Lately, when it comes to the state of crypto regulation and integration with the traditional financial system, all eyes have been on the US, the EU, and parts of Asia.

In the US, it’s been a turbulent situation with regulatory bodies and some politicians behaving hostile to crypto, while BlackRock, which is filing an ETF application, has opened up the possibility of a more welcoming environment. In the EU, MiCA has been approved, creating the impression of a continent moving quickly towards crypto acceptance and looking to set a global standard. Additionally, Asia, Hong Kong and Singapore are often mentioned as potential crypto hubs, while Japan, too, appears to be taking an open-minded approach.

Another region of particular interest, though, is the UK, which now – post-Brexit – is operating independently of the EU and has an opportunity to maneuver swiftly and on its terms. As in the EU and Asia, the UK appears to be largely accepting of the crypto industry, interested in positioning itself there advantageously. On top of that, there have been several recent developments that indicate the direction to come.

The Financial Services and Markets Act

It was announced on Thursday that the Financial Services and Markets Bill had passed Royal Assent. This is the final stage in which it will now be legal as a new Act. This is significant because it includes cryptocurrencies and stablecoins within its remit, and thus, crypto is now treated as a regulated financial activity.

This doesn’t tell us exactly how regulators will treat crypto currently, but it does mean that crypto is regarded as a significant sector and that the path is clear to officially get to grips with the industry as has been taking place in the EU. And, for a suggestion of the attitude of those in charge, we can look to this week’s UK government press release, which states:

“The Act is central to the Government’s vision to grow the economy and create an open, sustainable, and technologically advanced financial services sector.”

And it also specifically describes how the Act

“establishes ‘sandboxes’ that can facilitate the use of new technologies such as blockchain in financial markets.”

As a further indicator of where the UK might be heading, we have the words of the Economic Secretary to the Treasury, Andrew Griffith. He has listed what can be expected from the new law and summarized how the Act would enable regulation to support the safe adoption of crypto assets.

11. Promotes the use of new technology in financial services, enabling the regulation of cryptoassets to support safe adoption, and establishing ‘sandboxes’ that can facilitate the use of new technologies such as blockchain in financial markets.

— Andrew Griffith MP (@griffitha) June 29, 2023

BoE and the Digital Pound

Earlier this month, in an online event titled 'Demystifying the Digital Pound', the Head of Future Technology at the Bank of England, William Lovell, made several statements around a proposed retail CBDC in the UK, explaining a model by which the BoE can operate an underlying ledger. At the same time, new mechanisms called Payment Infrastructure Service Providers (PISPs), which may come to be operated by both banks and technology companies, “provide people with wallets that allow them to access their CBDC and other features.”

Lovell also suggested controls on CBDC holdings, with limits dependent on income, to mitigate against the possibility of bank runs. However, it’s worth remembering that these kinds of proposals run directly counter to the core aims around which Bitcoin was developed, with its creator (or creators) focused on decentralized networks, direct control of one’s assets, and the creation of a fixed supply currency that is decoupled from central banks.

Currently, Bitcoin, other cryptocurrencies, and CBDCs are often spoken of together under the broad umbrella of blockchain technology, but the reality is that they are not all aligned and that Bitcoin was designed as an alternative to fiat systems, whether digital or physical.

Andreesen Horowitz to Move to London

We’ve likewise seen real signs of a shift towards the UK as a place to do crypto business, with the VC firm Andreessen Horowitz, also known as a16z (heavily focused on Web3 development), earlier this month announcing that it would be opening its first business premises outside of the United States in London.

Chris Dixon, a General Partner at a16z, spoke at the time of having had a “productive dialogue” with British Prime Minister Rishi Sunak. He also had “constructive conversations” with the Treasury, policymakers, and the Financial Conduct Authority, stating, with reference to crypto, that:

“The UK is ahead of the curve and instituting policies that will eventually become a global standard.”

And, talking about the a16z move, Prime Minister Sunak enthused that:

“We must embrace new innovations like Web3, powered by blockchain technology, which will enable start-ups to flourish here and grow the economy.”

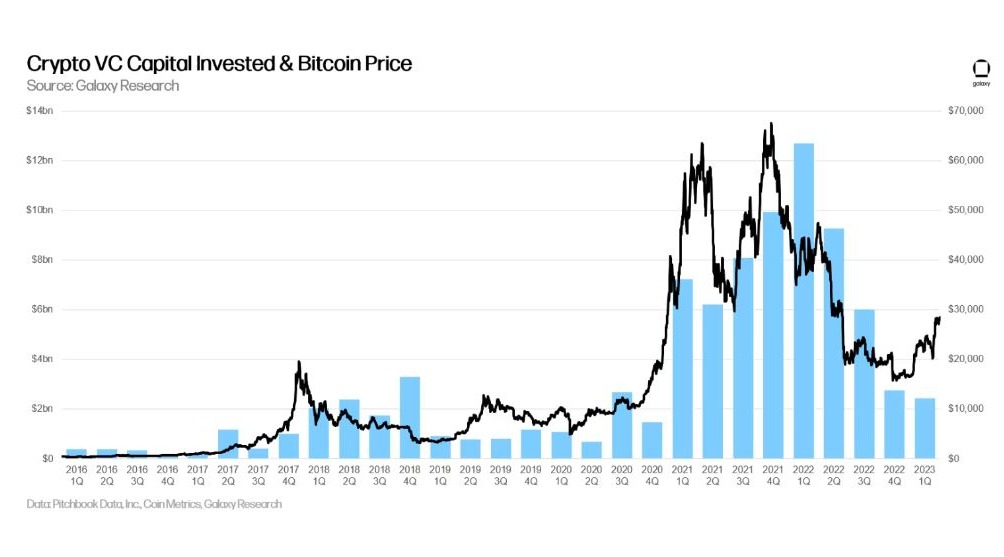

While overall VC investment in crypto has declined this year, charts indicate a correlation with the price of Bitcoin, and it wouldn't be unexpected if improved crypto market sentiment led to a revival of inflow to VC capital.

Binance Deregisters Amid Wider Controversies

Last month, moving in the opposite direction, saw the major crypto exchange , Binance’s UK subsidiary, Binance Markets Limited, deregistering from the Financial Conduct Authority (FCA). However, over the course of this year, Binance has withdrawn from Cyprus and Holland. Moreover, it has been ordered to cease offering crypto services in Belgium due to an alleged violation of that country’s Financial Services and Markets Authority prohibitions.

Presently, Binance is battling securities-related legal action from the SEC in the US, while facing an investigation from the authorities in France. Regarding the UK situation, the exchange has explained that the permissions withdrawn from the UK were unused. Yet, the FCA has said that Binance “can no longer provide regulated activity and products in the UK.”

Returning to the broader crypto landscape in the UK, there is uncertainty about how exactly the details might pan out. Also, there is a growing sense of willingness to recognize and integrate an expanding sector, which has proven extremely resilient.

Financial Services and Markets Act enables regulation to adopt crypto. Furthermore, the VC firm, a16z is moving to London, while Binance exits the UK, and the BoE looks to CBDCs.