For many years, crypto has been fended off accusations of being a solution in search of a problem. Another way of putting it is that product-market fit is an issue, or that crypto needs a killer app. It’s worth distinguishing here also between bitcoin and the rest of crypto. Bitcoin can claim a category of its own as a digital store of value, but when it comes to the rest of the blockchain environment, a wide variety of potential use cases are on the table but still unproven.

Stablecoins have perhaps the clearest case for immediate utility, and then there’s the tokenization of real world assets, the use of NFTs in gaming, entertainment and as a medium for digital art, and there’s also DeFi as an alternative financial environment (although then there are still questions as to what specific value DeFi tokens are actually tethered to).

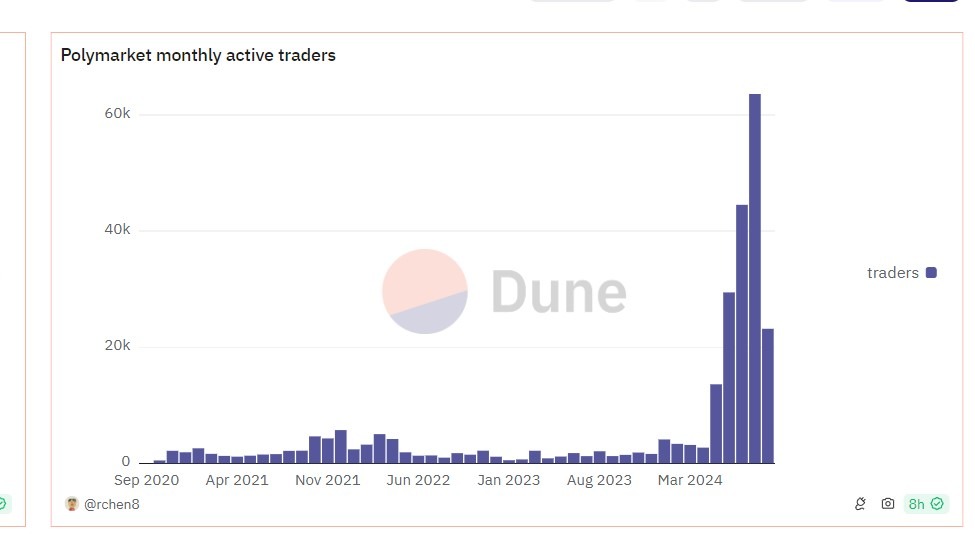

However, regarding practical utility, this year has been marked by the emergence into the mainstream of the decentralized prediction market Polymarket, which increasingly looks like it may be turning into crypto’s first potentially killer app, or is at least gaining recognition as a decentralized platform that makes clear sense to users outside of the crypto bubble.

What Is Polymarket?

Founded in 2020 and built on Polygon, Polymarket is a blockchain-based prediction market that utilizes the stablecoin USDC for trading. There’s no way you can use the product without crypto and it doesn’t require KYC, meaning it’s a legitimately crypto-native platform, and it is–by nature of the gambling on current affairs that it facilitates–closely in touch with real world events, appealing, and easily understood.

Odds Republicans win back the Senate are up to 75%. pic.twitter.com/WQtrzzAZA7

— Polymarket (@Polymarket) September 5, 2024

It should be noted that political betting goes back centuries, while the first online prediction market was the still-in-operation Iowa Electronic Markets, which launched back in 1988. Also, Polymarket is not the first ever crypto-powered prediction market: Augur and Gnosis are both decentralized prediction market developments that were started before Polymarket launched.

However, Polymarket is the first decentralized prediction market that has picked up a lot of mainstream attention while it gains in volume and users. As we’re in a US election year, there is a huge amount of interest in public opinion on the presidential candidates, and it’s become commonplace to see Polymarket’s latest political trading stats cited in order to get a handle on voting intentions.

This also ties back in with the recent prominence of crypto as a political issue in America. Analysis shows that this year, the crypto industry has–by a substantial margin–been the leading corporate sector when it comes to political donations, funding pro-crypto candidates in primary races through non-partisan, crypto-dedicated super PACs.

And at the same time, Donald Trump has grabbed headlines by making multiple strongly pro-crypto campaign pledges, while this week it was reported that the Kamala Harris campaign is able to receive crypto donations through a PAC called Future Forward (and the Trump campaign, meanwhile, directly accepts donations made in crypto).

Against this crypto-tilted backdrop then, what better way to get a handle on public opinion than through Polymarket, a platform that is deeply embedded in the very crypto world now being openly supported by one candidate, and cautiously paid attention to by the other?

Polymarket, Memecoins and Financial Nihilism

Another crypto trend that has emerged over the past year or so is speculation on memecoins. These are tokens that have no utility, and which–through novel platforms such as Pump.fun and various copycats–can be rolled out very quickly for the purposes, essentially, of rapid-fire gambling.

What the memecoin niche has in common with Polymarket is the tendency towards a betting mentality, but where they differ is that memecoins haven’t gained mainstream traction and aren't immediately intuitive, whereas Polymarket makes instant sense to anyone with an interest not only in betting or finance, but also in news and current affairs.

Or in other words, Polymarket has product-market fit, whereas memecoins come across as an eccentric novelty, and also at times as requiring insider knowledge in order to be profitable, whereas on Polymarket, knowledge of current affairs is the more useful commodity.

BOOM. We now have @Polymarket election data on @TheTerminal pic.twitter.com/kMpxlFTURx

— Joe Weisenthal (@TheStalwart) August 29, 2024

This all relates also to a thesis that was circulating around the crypto space earlier this year–when memecoin flipping was at its peak–suggesting that we’re in an era of financial nihilism. This reading of the market argues that participants–particularly at the younger end of the scale–have lost confidence in the ability of traditional assets to deliver meaningful returns, and would prefer to roll the dice on alternative assets; an attitude that, when taken to extremes, arrives at memecoins, out on the furthest fringes of the crypto world.

Ultimately though, not everyone is a financial nihilist, memecoins have limited appeal, and though Polymarket overlaps to an extent into memecoin territory, it is also entirely compatible with a more conventional approach to both finance and entertainment.

Finally, one curiosity when it comes to Polymarket is that within the crypto arena–where almost every new product and protocol has a native token through which traders can speculate on its success–Polymarket has never issued any such token. This means one question you can’t take a financial position on is whether or not Polymarket itself will continue to grow, despite the odds on that looking increasingly positive.