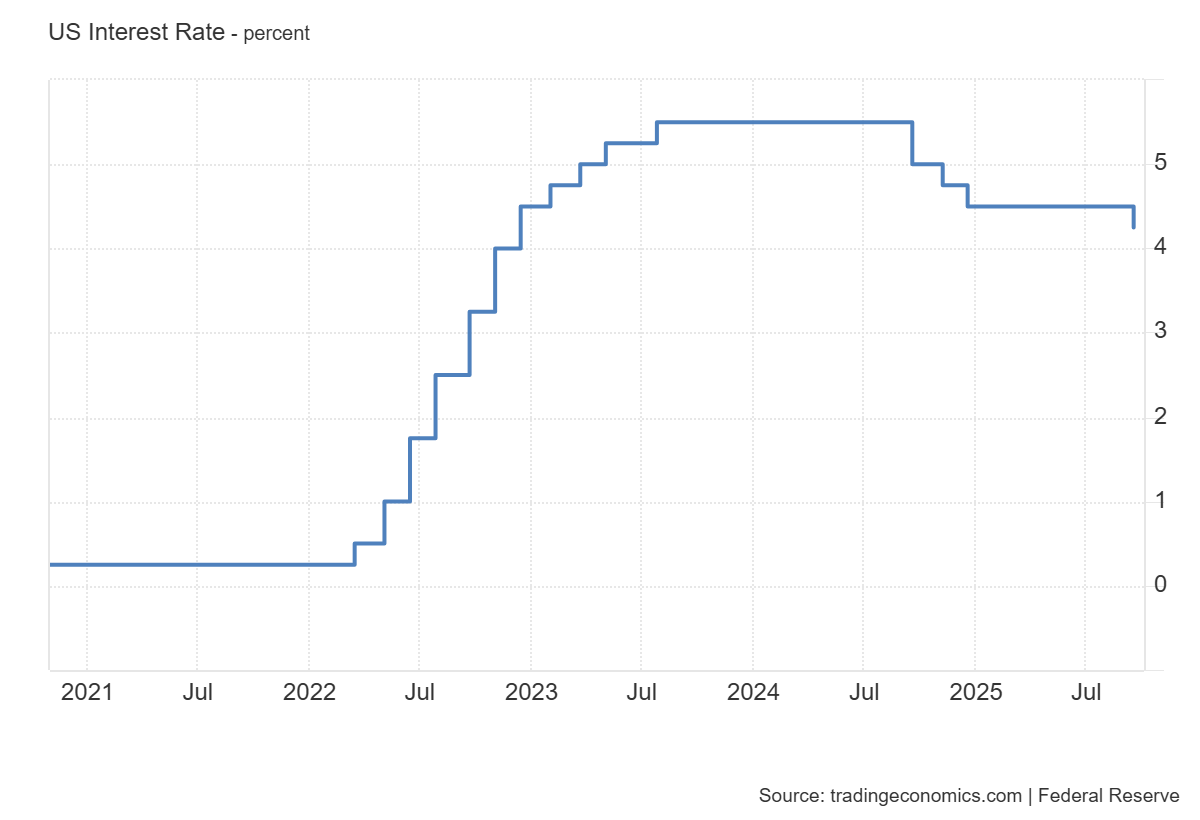

The cryptocurrency market experienced significant momentum on September 17, 2025, as digital assets surged following the Federal Reserve's (Fed) decision to cut interest rates by 25 basis points.

This marked the Fed's first rate reduction of the year, lowering the benchmark rate to a range of 4.00% to 4.25%. XRP emerged as one of the standout performers, demonstrating why crypto is going up today with notable gains across major tokens.

Why Is XRP Price Surging? Fed Decision Triggers Crypto Market Response

The Federal Open Market Committee's (FOMC) unanimous decision to reduce rates by a quarter percentage point immediately impacted cryptocurrency markets. Fed Chairman Jerome Powell characterized the move as a "risk management" decision, acknowledging that job gains have slowed and unemployment has edged higher. The central bank's dovish stance, although projected, signals growing concern over economic momentum, creating favorable conditions for risk assets like cryptocurrencies.

Vijay Valecha, Chief Investment Officer at Century Financial, noted the economic context: "Chairman Powell acknowledged that a slowdown in consumer spending was weighing on economic growth. The U.S. economy grew at 1.5% in H1'2025, down from 2.5% in H1'2024".

XRP jumped by more than 1.5% on Wednesday, closing the day at $3.08 and marking intraday highs at almost $3.11. The payments-focused cryptocurrency demonstrated strong resilience during the Fed announcement, trading nearly 3% higher and looking to build upside momentum. Today (Thursday), 18 September 2025, XRP is changing hands at $3.06, falling modestly by 0.6% as markets digest the rate decision implications.

Rate Cut Implications for Digital Assets

Kathleen Brooks, XTB analyst, provided crucial insight into the Fed's forward guidance: "The Fed has cut interest rates by 25bps as expected and also reduced its forecast for interest rates in 2025. The Dot Plot shows that the median estimate for rates this year has been revised down to 3.625% from 3.875% in June". She emphasized that "the forecasts for further out the curve have been left unchanged, and the terminal rate was also unchanged at 3%, signaling a 5 more rate cuts in this cycle".

September has historically been a weak month for XRP (as well as for cryptocurrencies), which I pointed out in this analysis. However, 2025 defies that trend, with the cryptocurrency already up 11 percent.

This dovish trajectory particularly benefits cryptocurrencies , as Josip Rupena, Founder and CEO of Milo, explained: "When it comes to crypto, rate cuts are equally important. Lower rates tend to benefit what we call 'risk-on' assets, which include digital assets and equities. When borrowing costs go down and liquidity improves, investors often feel more comfortable putting capital into these categories".

Technical Analysis Reveals XRP Price Bullish Potential

My technical analysis shows the Federal Reserve meeting positively influenced the broader cryptocurrency market, which gained during Wednesday's session despite declines in equity markets including major Wall Street indices. Both markets typically move in tandem during similar macroeconomic events, but this time they moved in opposite directions.

XRP prices rose by one and a half percent following Powell's comments, representing the strongest strengthening in a week. From a technical perspective, little has changed as XRP continues to move within consolidation around the $3 level and support zone, reinforced by the 50-day exponential moving average and 38.2% Fibonacci retracement at the third level, plus horizontal support established by summer results at the $2.90 level.

You may also like: Latest XRP Price Prediction Points to 55% Rally After Bullish Flag Breakout

Local peaks on September 13 at $3.13 serve as local resistance that may block short-term bull runs heading toward August peaks around the $3.30 level. The ultimate resistance zone extends from $3.60 to $3.66 - this year's peaks. Additional support levels, though I don't expect XRP to decline significantly in the short to medium term, are located around $2.80 covering August and September minimums and 50% Fibonacci retracement, as well as at $2.66 coinciding with May peaks.

The next support level is at $2.60 where the 61.8% Fibonacci retracement and 200-day EMA run. We're missing about 17% to reach these downward levels, though I would consider this entire decline a technical correction and an opportunity to buy at more attractive prices. Only a break below would mean bears are gaining advantage, and XRP could decline more significantly, even toward $2, or June lows.

Spot ETFs for XRP Fuel Optimism

The cryptocurrency surge coincides with significant institutional developments for XRP. REX-Osprey launched the first U.S.-listed spot ETFs for XRP and DOGE on September 18 under tickers XRPR and DOJE. These products mark the first time American brokerage accounts have access to XRP-focused ETFs, expanding beyond Bitcoin and Ether dominance in the ETF landscape.

Launching Tomorrow: REX-Osprey™ XRP ETF, $XRPR, & REX-Osprey™ DOGE ETF, $DOJE.

— REX Shares (@REXShares) September 17, 2025

The first U.S.-listed ETFs offering spot exposure to $XRP and $DOGE go live tomorrow, offering investors a way to access these digital assets through an ETF structure.

Brought to you by… pic.twitter.com/NbyQqEs1YQ

CME Group announced plans to introduce options on XRP and SOL futures on October 13, pending regulatory review. The exchange cited strong growth in newer altcoin futures, with SOL futures logging over 540,000 contracts traded since March ($22.3 billion notional), while XRP futures introduced in May have seen more than 370,000 contracts ($16.2 billion notional).

Broader Crypto Market Performance: Bitcoin, Solana and Dogecoin Are Up

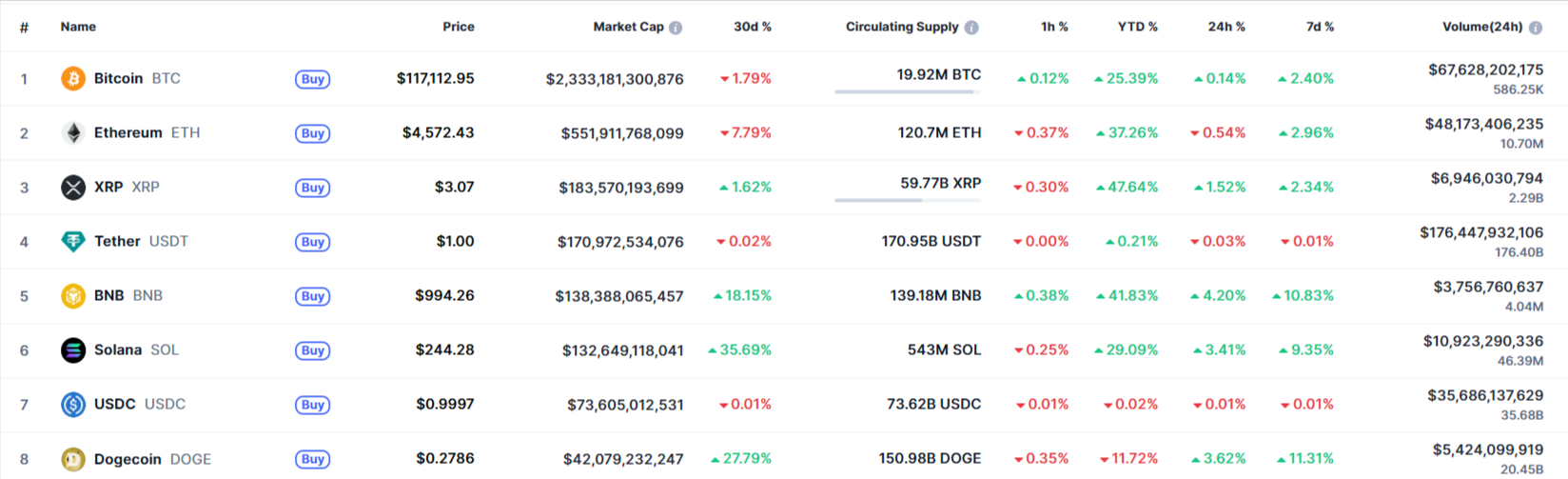

The global crypto market cap rose 2% to $4.2 trillion on Thursday, lifted by Bitcoin's steady climb toward $118,000. Bitcoin traded 1% higher at $117,426, while Ethereum experienced a 2.8% increase to $4,609. The measured gains reflected investors weighing the central bank's cautious tone on future policy moves.

Matt Mena, crypto research strategist at 21Shares, noted the Fed's openness to accelerate easing pace creates an asymmetric setup for Bitcoin: "The dots leaned more dovish, signaling the Fed is open to accelerating the pace of easing if conditions demand it".

He predicted Bitcoin could set an all-time high above $124,000 by end of October, with Ether topping the $5,000 psychological barrier.

XRP Price FAQ

Are the Federal Reserves going to use XRP?

No, there is no indication that the Federal Reserve will use XRP. The Federal Reserve operates its own payment systems and is developing a Central Bank Digital Currency (CBDC) separate from existing cryptocurrencies like XRP. While XRP's technology focuses on cross-border payments and financial institutions, the Fed maintains its independence in monetary policy and payment infrastructure decisions.

Will XRP reach $10 dollars?

Yes, however, XRP reaching $10 would require significant market developments and adoption. Based on current technical analysis, XRP faces immediate resistance at $3.13 and ultimate resistance between $3.60-$3.66. For XRP to reach $10, it would need to overcome multiple resistance levels and achieve substantial institutional adoption or regulatory clarity.

Is XRP a good buy?

Yes, but XRP investment decisions should be based on individual risk tolerance and market analysis. Current technical analysis shows XRP consolidating around $3 with support at $2.90 and the 50-day exponential moving average. Recent positive developments include the first U.S. XRP ETF launch and upcoming CME options trading. However, cryptocurrency investments carry significant volatility and risk. The Fed's dovish monetary policy may benefit risk assets like XRP, but investors should consider support levels at $2.60-$2.80 and potential downside risks.