XTB doesn't see limits to how fast it can grow, even after adding more clients last year than it accumulated in its first 20 years of operation.

Omar Arnaout, the broker's chief executive, told Polish financial daily Parkiet that bringing in two million new accounts annually “is completely realistic” within a few years. The Warsaw-listed company pulled in 864,000 clients during 2025, a 73 percent jump that pushed its total base past 2.16 million.

“It took us 20 years to have a million clients,” Arnaout said in the interview published this week. “In 2025, we acquired over 860,000 clients. So in one year we did practically what took 20 years.”

When asked where the ceiling is for client acquisition growth, Arnaout was blunt: “We still don't see that ceiling.”

XTB reported record fourth-quarter revenue of 610.1 million złoty ($173 million) and net profit of 180.5 million złoty in preliminary results released last month. For the full year, the company posted 644 million złoty in net profit, falling short of the billion-złoty threshold that analysts have floated as the next psychological milestone.

Flat Markets Masked Client Growth Impact

Arnaout blamed sideways price action across most assets for keeping results below what the expanding client base could have delivered. He said 2025 stood out for how many instruments traded in tight ranges, limiting the volatility that typically drives trading volume at contracts-for-difference brokers like XTB.

“If conditions had been favorable, I think that billion really would have been broken,” the CEO told Parkiet. The number of active clients climbed 70 percent during the year, reaching 1.19 million, but many of those traders sat on the sidelines when markets stalled.

- XTB Trading Volumes Jump 76% as Poland's Bull Market Roars

- Multi Asset Broker XTB Launches American Style Options Under CySEC Supervision

XTB added 117,000 clients in the first 28 days of January alone, according to company disclosures. Arnaout wouldn't discuss specific monthly performance but said his personal goal for 2026 includes crossing the billion-złoty profit mark. The company has publicly committed to signing up one million new clients this year, which would work out to roughly 250,000 per quarter at minimum.

“That's the minimum,” Arnaout said. “Our aspirations are definitely bigger.”

Crypto License Opens New Revenue Stream

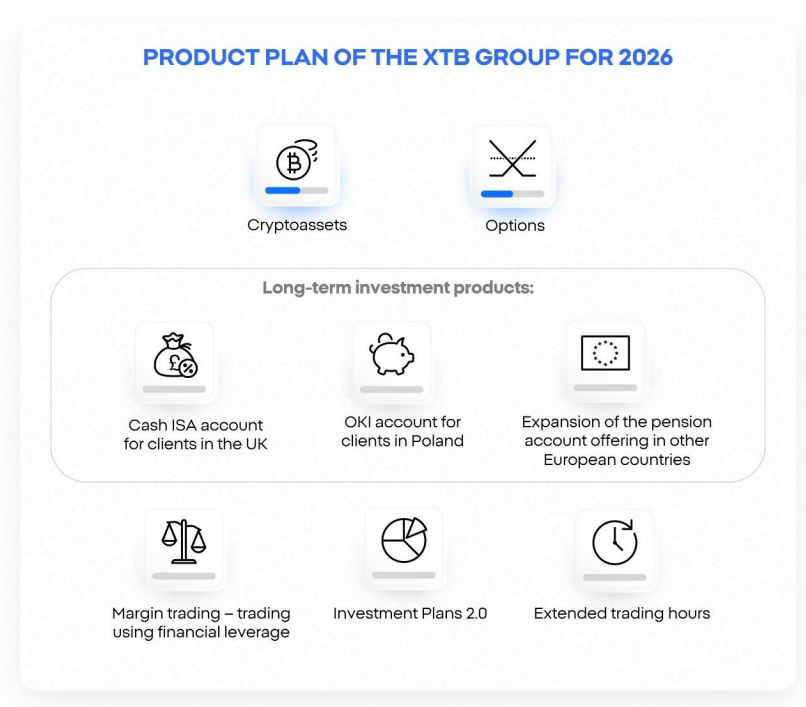

The broker secured approval from Cyprus regulators in December to offer spot cryptocurrency trading under the EU's Markets in Crypto-Assets framework. That authorization came after months of legislative gridlock in Poland, where President Karol Nawrocki vetoed crypto legislation that parliament had passed.

Arnaout sees crypto as an entirely separate market from the stock and CFD traders XTB already serves. Poland has more than two million brokerage accounts but an estimated three million people who own cryptocurrencies , he noted. Unlike the broker's zero-commission stock and ETF products, crypto and options will carry transaction fees.

“If we add cryptocurrencies to the offer, we're entering an entirely new business, we're starting a completely different competitive battle,” Arnaout explained. “That's a completely new client base, so I don't see that ceiling.”

XTB plans to launch spot crypto trading in Cyprus first, then roll out to other markets once it clears regulatory hurdles in each jurisdiction. The company is waiting to see how Poland's legislative process plays out but won't delay indefinitely. Arnaout said XTB will make a decision by the second quarter, or third quarter at the latest, on how to proceed.

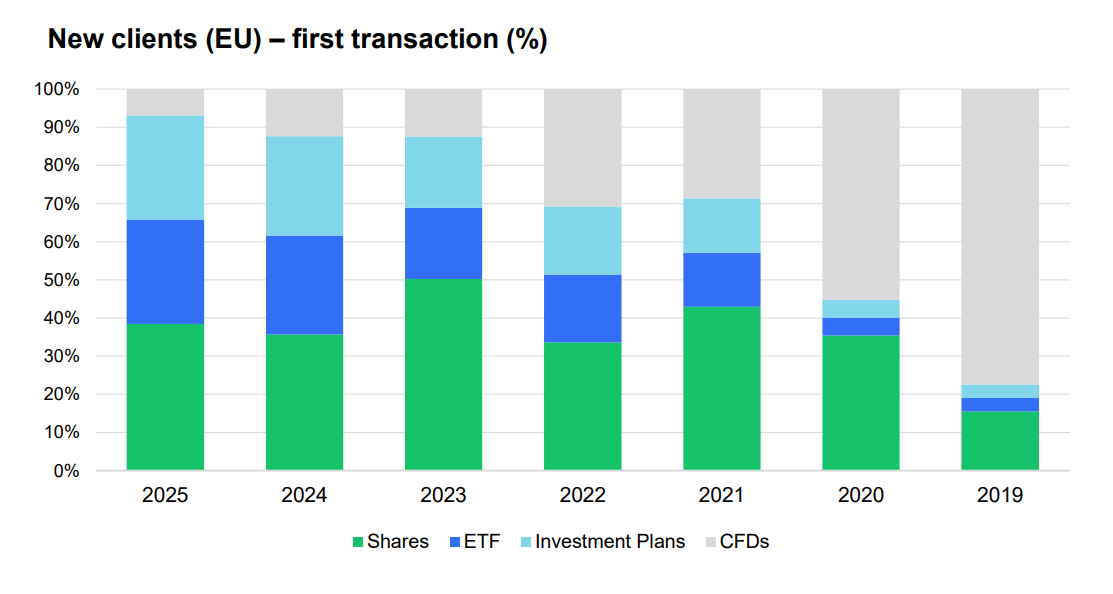

The crypto push fits into Arnaout's broader vision of building what he described last year as a “super app” that handles everything from investing to payments. That strategy has already reshaped the company's customer mix, with only 7 percent of new clients now choosing CFDs as their first transaction, down from 80 percent in 2019.

Options Already Live in Cyprus

The broker began offering options trading to Cypriot clients late last year and expects to extend the service to at least one other European branch during the first quarter of 2026. Like crypto, options represent a fee-generating product that could reduce XTB's dependence on CFD spreads for revenue.

“If the client base grows dynamically and interest in CFDs is maintained, that will positively impact our business,” Arnaout said. But he acknowledged that XTB's stock and ETF products, along with interest paid on idle cash, don't yet produce meaningful income because the user base remains too small. Crypto and options could change that math by adding paid services to the platform.

The company also announced plans last week to introduce margin lending for stock purchases and extend trading hours to 24 hours a day, five days a week. Those announcements sent XTB shares up 12 percent in the biggest single-day jump since 2021, even as full-year profit dropped 25 percent.

Competition Heats Up in Polish Market

Poland continues to drive a disproportionate share of XTB's growth, even as the broker operates across multiple countries. Brand recognition has reached a point where XTB is often the first choice for Polish investors opening new accounts, Arnaout said.

But rivals are circling. German fintech Trade Republic entered Poland last year, launching a direct challenge to XTB's market leadership. ING Bank Securities, the country's fourth-largest brokerage, is preparing its own offensive with tax-sheltered retirement accounts and expanded foreign market access.

“I would like to be able to say that we will have much greater diversification, but at this pace of business development in Poland, it still seems unrealistic for now, although foreign branches are also developing very quickly,” Arnaout told Parkiet.

The CEO said XTB won't sacrifice profitability to chase expansion in 2026. Marketing budgets will stay aggressive because becoming Europe's largest retail broker requires sustained ad spending, but other costs face tighter controls.

Headcount is budgeted to rise just one percent this year, the slowest pace in company history, though total personnel expenses will climb about 16 to 17 percent due to raises and other compensation adjustments.

“Approaching the budget for this year, for the first time we were very cautious,” Arnaout said. “If I'm talking about my goals, I would like to exceed that billion złoty profit this year.”

Client assets held at XTB reached approximately 10.8 billion euros by the end of 2025. The average cost to acquire each new account held steady at 700 złoty for the full year and 600 złoty in the fourth quarter.