Prediction markets are drawing a new class of active traders who treat event contracts less like wagers and more like another screen on the trading desk. From geopolitics and tariffs to crypto price paths, contract prices are increasingly used as live probability signals that update as narratives shift.

“You're seeing more systematic strategies, more cross-venue monitoring, and a growing need for infrastructure that lets people see and execute across markets in one place,” Edward Ridgely, co-founder of Stand, told FinanceMagnates.com.

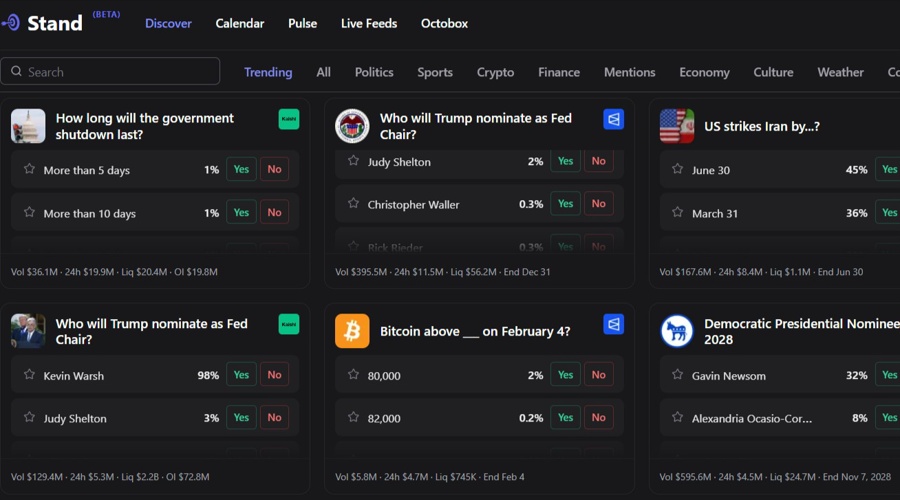

His terminal is approaching $200 million in annualized trading volume after adding Kalshi alongside Polymarket, giving traders access to the two largest prediction-market venues through a single interface.

Stand Adds Kalshi Integration as Platform Volume Nears $200M

Stand targets what it calls “pro-tail” users, traders who execute frequently and prioritize workflow over a consumer interface. The platform consolidates order books from multiple venues, adds automation features like stop orders and pegged orders, and allows batch execution across markets.

Major crypto and fintech firms are already moving to capture that flow. Crypto.com recently spun out a standalone prediction markets platform after a 40x growth surge, joining Coinbase and Backpack in bundling event contracts alongside other trading products.

- The Wallet Is the New Battleground for Prediction Markets, Bitget Wallet Report Argues

- Prediction Markets Scale Up as Volumes Surge, But Regulation and Liquidity Remain Key Constraints

- Kalshi CEO: Prediction Markets Could Spawn New Job Category Like Instagram Creators and Uber Drivers

“Traders are increasingly using prediction markets the way they use other markets, to price uncertainty, express views quickly, and react as information changes,” Ridgely added.

For exchanges pushing deeper into traditional finance, prediction markets are the latest frontier after adding CFDs and tokenized stocks in 2025.

Systematic Traders Hunt Arbitrage Across Venues

As volumes climb, liquidity is fragmenting across multiple platforms. A recent FinanceMagnates.com feature highlighted how Wall Street quants are moving into prediction markets to hunt for arbitrage rather than place directional bets, using playbooks borrowed from equities and derivatives.

That backdrop is where Stand sits. Similar themes can now be priced simultaneously across multiple platforms, opening up relative-value trades when implied probabilities diverge.

“What's changed is the behavior,” Stands co-founded said.

Multi-Exchange Tools Target “Pro-Tail” Desks

Stand is one of several terminals competing for "pro-tail” users, active traders who want execution speed, automation and data, rather than a consumer-first app. The direct competitos, Verso is limited to U.S. users, while Betmoar has no Kalshi integration and often sits as a skin on top of existing Polymarket accounts.

“On Stand, users actually deposit funds,” Ridgely told FinanceMagnates.com. That setup, he argues, allows the platform to automate trades in ways that simple account connectors cannot. “We provide pro-tail users a cadre of automations that would not be possible if we simply allowed users to connect their Polymarket or Kalshi accounts.”

The terminal offers stop orders, pegged orders, copy trading and batch order placement, as well as tools to manage multiple existing orders at once. Through a feature called Octobox, traders can monitor and trade up to eight markets on a single screen and receive alerts when large participants enter or exit a market.

“Traders can trade up to 10x more, much faster, and in secure manner through Stand,” Ridgely said.

Volumes Grow, But Liquidity and Oversight Lag

Despite rapid growth, prediction markets still face structural constraints. Monthly volumes across major platforms have topped $13 billion, yet regulation and liquidity remain key bottlenecks. The Financial Times has warned that insider risk and thin order books remain unresolved even as more capital arrives.

Platforms are betting that deeper participation will change that profile. Kalshi CEO Tarek Mansour has argued that professional prediction market traders could evolve into a new job category, akin to Instagram creators or Uber drivers, as the venue targets $100 billion in annual trading volume. Stand’s move to bridge Kalshi and Polymarket is one attempt to make that activity easier to scale.

For some desks, prediction markets now sit alongside traditional risk monitors. Russia–Ukraine contracts are watched next to oil inputs, while macro and policy-linked markets, including tariff outcomes, help calibrate event risk and positioning.

Regulators Weigh Similarities to Binary Options

The regulatory picture remains uneven across jurisdictions. Some authorities compare prediction markets to binary options, which have been heavily restricted or banned after losses among retail clients. ASIC, for instance, found that 80% of retail customers lost money trading binary options, prompting tough restrictions.

“Regulation is critical and we need more clarity to protect users,” Ridgely told FinanceMagnates.com. “However, prediction markets have been around for a long time and even before them, retail users were making trades in their communities around elections, entertainment awards, and sports events. The reality is this behavior is not new. It will be better served with regulatory oversight and clear guardrails to protect retail and prevent the bad actors.”

In the U.S., the policy debate is playing out case by case. Kalshi is fighting a court ban in Massachusetts that threatens its sports contracts, even as sector-wide fees hit record levels. Tennessee regulators have ordered Kalshi, Polymarket and Crypto.com to shut down prediction market operations in the state, return customer funds and cancel all open positions by the end of January.

Ridgely sees reasons for cautious optimism. “Overall, the path is clearing under the current White House administration but there's still uncertainty,” he told FinanceMagnates.com. “You can see that optimism from Coinbase, Robinhood, and SIG all entering the foray. These are multi-billion dollar companies that would not jeopardize their standing if they didn't think there was a real opportunity in a regulatory compliant industry.”

Stand Positions Itself Outside the U.S.

To navigate the evolving rulebook, Stand operates outside the U.S. and adheres to Polymarket and Kalshi’s terms, including geo-blocking restricted regions. Ridgely said most of the terminal’s users are in Europe and Asia, where traders are looking to plug prediction contracts into broader macro and event-driven strategies.

For now, prediction markets sit at an awkward intersection of finance, gambling and information markets. Infrastructure providers such as Stand are betting that, with clearer guardrails and deeper liquidity, event contracts will settle closer to the trading tools used in other markets than to retail betting apps.