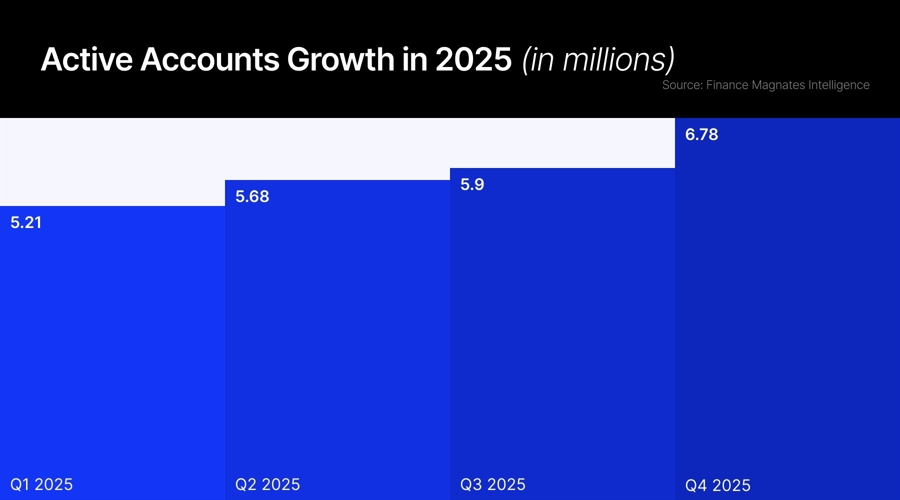

CFD accounts surge past 6 million

The CFD market ended 2025 on a high note, posting stronger-than-expected results in the final quarter. Instead of the usual year-end slowdown, the industry saw a surge in activity.

According to the latest Finance Magnates Intelligence Report for Q4 2025, active accounts jumped to 6.79 million from 5.92 million in the previous quarter, a sharp 14.6% increase.

This growth is notable because the fourth quarter typically brings reduced trading as many firms and clients scale back during the holiday season.

- Weekly Roundup: Octa Entity to Launch New Broker; XTB’s CFD Era Fades

- Weekly Recap – MFF Founder Breaks Silence: “We Were Blindsided”; Is the Retail-Institutional Gap Narrowing?

- Weekly Recap: Ripple-LMAX Pact Brings Stablecoins Closer to Mainstream; Will London’s IPOs Rebound?

India raises trading tax

When policy tightens its grip, does the market adapt, or slip through its fingers? Well, India’s stock markets tumbled on Sunday after the government increased tax on derivatives trading.

The government’s move is expected to dent trading volumes in the local derivatives market as investors weigh the higher costs of participation. The new rates have sparked speculation that Indian traders may shift toward contracts for difference, which remain unregulated and exempt from such levies.

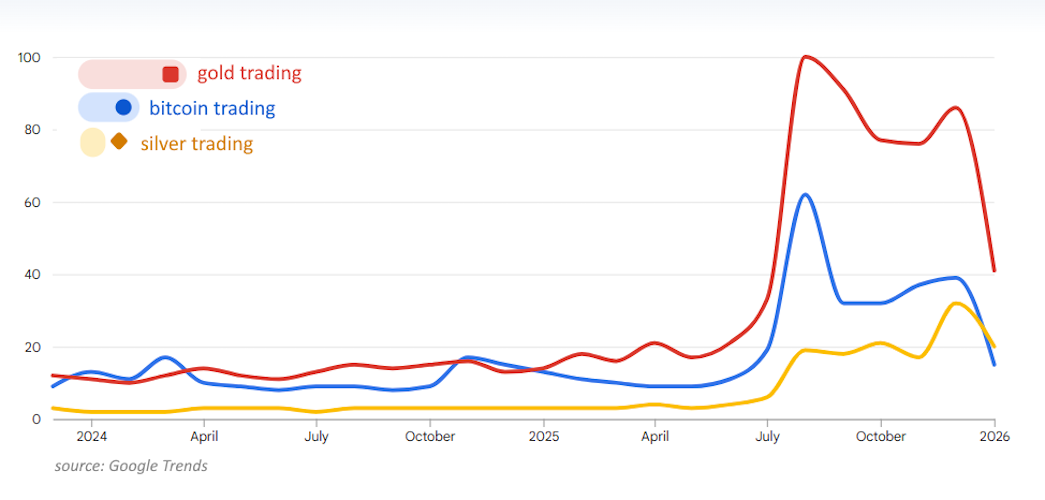

Gold volatility shifts broker risk to balance sheets

Meanwhile, the recent swings in gold prices have putsignificant pressure on CFD brokers. Several brokers were recently forced to suspend gold trading or tighten margin requirements after a sharp rally in gold prices created heavily one-sided exposure in their internalized books.

However, a double-digit drop in gold on Friday eased some of that pressure. It allowed brokers to rebalance positions. Still, the volatility exposed weaknesses in how some firms manage market risk.

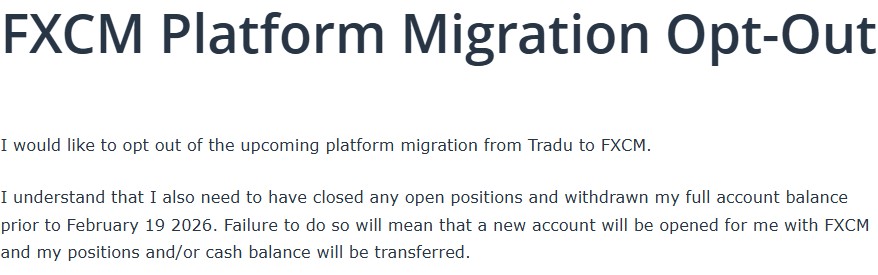

Tradu starts client shift to FXCM

However, for Tradu, the challenges go beyond recent market pressures. The 2023-launched brand is now moving its CFD clients to sister company FXCM as part of a broader restructuring.

The shift follows recent cost-cutting measures, including staff reductions and the rebranding of parts of its European business under the Stratos Markets name.

Plus500 launches US prediction markets

In the prediction markets space, Plus500 introduced prediction markets for its United States retail clients, expanding its product suite to include event contracts in partnership with locally regulated Kalshi.

The launch follows Plus500’s recent move to become the clearing partner for CME and FanDuel’s event-based contracts platform, highlighting its growing involvement in this emerging asset class.

According to the broker, prediction markets are gaining traction among both retail and institutional investors as a transparent, regulated avenue for speculating on real-world outcomes.

Is Interactive Brokers’ Peterffy Backing a Prediction-Markets Startup?

Elsewhere, Lumina Markets, a new venture, begun recruiting marketing and legal professionals as it prepares to launch a prediction-markets platform. Job listings posted on LinkedIn last week describe the startup as being “backed by a billionaire pioneer of electronic trading.”

As reported by Business Insider, the listings were uploaded by an employee of Interactive Brokers, the brokerage founded by Thomas Peterffy.

Additional corporate records reviewed by Business Insider indicate that Lumina Markets was incorporated by an in-house lawyer at Interactive Brokers, with its CEO also being an attorney who has previously worked closely with both the firm and Peterffy.

Why brokers are rushing into prediction markets

Last year, established financial firms, from retail brokers to major exchange operators, accelerated their entry into prediction markets.

Industry research shows trading volumes surged from about $9 billion in 2024 to roughly $40 billion in 2025, with forecasts suggesting the sector could approach $1 trillion in annual volume by the end of the decade.

Find event contracts across economics and sports in our Prediction Markets Hub.

— Robinhood (@RobinhoodApp) July 3, 2025

Newest to the hub, check out tennis in the app now. pic.twitter.com/X2pz1PskdN

Retail brokers have prioritized distribution and accessibility over product innovation. Robinhood led the shift with its Prediction Markets Hub, launched in March 2025, embedding event contracts directly in its main trading app.

UK mid-caps reverse dividend trend

After years of market shifts and changing investor sentiment, the balance between large- and mid-cap stocks in the UK has started to look very different. UK mid-cap stocks have struggled in recent years, hurt by weak confidence in the domestic economy and investors’ growing appetite for large-cap and global shares.

Traditionally, mid-caps were known for strong growth potential but offered smaller dividends. That trend has flipped, for the first time since the early 2000s, many mid-cap companies are now cheaper than large caps and paying out noticeably higher dividends.

MFF CEO promises updates for traders awaiting payouts

After more than two years of limited updates, MyForexFunds CEO Murtuza Kazmi spoke publicly about the firm’s ongoinglegal dispute with the U.S. CFTC. He addressed the 2023 account freezes that halted operations and shared insights into the company’s efforts to resolve the case and eventually resume business.

Earlier, in an exclusive interview with Finance Magnates, Kazmi discussed the difficulties MyForexFunds faced after the CFTC imposed an asset freeze in August 2023.

Dubai fails to dethrone Cyprus as CFD job hub

Meanwhile, the world’s 50 largest online brokers currently list more than 1,400 open positions worldwide, with Cyprus accounting for the highest share of hiring activity at 22.8% of all vacancies, according to new data from marketing consultancy FYI.

Christian Görgen, a marketing consultant at FYI.LTD, said most available roles are located in Cyprus, followed by the UAE, Malaysia, and India, based on his analysis of nearly 1,000 job descriptions across the brokerage sector.

Singapore goes almost cash-free

In the payment space, Singapore is boosting its global payments hub as digital wallets, real-time transfers, and regulated stablecoins move toward mainstream adoption.

Titled Payments’ State of Play 2026, the report traces Singapore’s payments evolution from a focus on domestic infrastructure to scaling cross-border capabilities.

Despite this trend, Singapore’s financial institutions remain cautious and selective toward Web3 businesses, maintaining strict compliance and licensing standards despite the sector’s growth.