The Australian Securities and Investments Commission (ASIC) has released today its submission to the government's 2014 Financial System Inquiry revealing that regulator is looking to enhance its punishing powers and to bring it more inline with its international counterparts as ASIC sees it.

In the 273 page long submission ASIC called for reforms that include the Australian government granting it new powers such as those of the CFTC, SEC and NFA in the US to improve its ability to regulate companies conduct especially in areas it sees as high risk including high frequency trading, dark Liquidity and speculative trading. ASIC requested tighter standards for financial advisers, new mechanisms to manage systemic risk, tougher penalties and the introduction of a user-pays system to fund its activities.

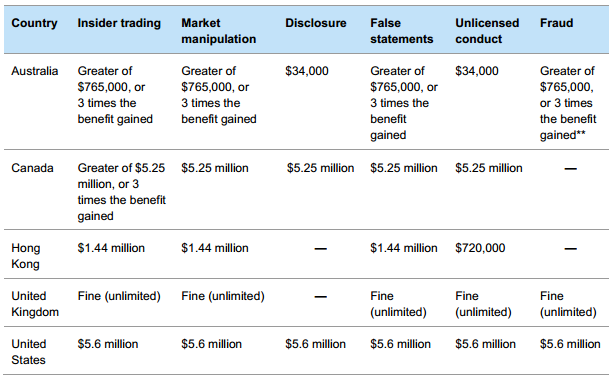

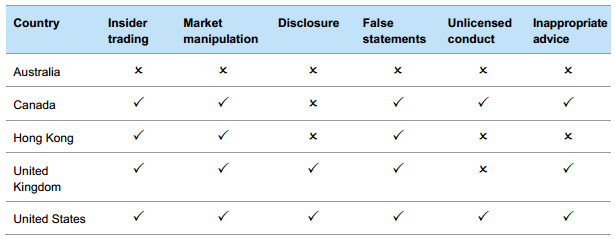

To make the point that other international jurisdictions give more powers to their regulators, ASIC compared the ability to require the removal of financial benefit that arises from wrongdoing in selected markets around the world with this chart:

Current Roles of ASIC In The Australian Economy

ASIC serves the functions of several regulatory bodies elsewhere in the world, with at least a couple of them relating to the retail FX trading industry. As the financial services regulator, it has responsibility for investor and consumer protection. ASIC administer the Australian financial services (AFS) licensing regime and monitor financial services businesses to ensure that they operate efficiently, honestly and fairly

As the markets regulator, ASIC assess how effectively financial markets are complying with their legal obligations and advises the government about authorising new markets. On 1 August 2010, it assumed responsibility for the supervision of trading on Australia’s domestic licensed equity, derivatives and futures markets. ASIC also promotes financial literacy, to ensure investors can have greater confidence when buying financial services, and are able to make sensible and informed financial decisions.

Writing about the issue of globalisation ASIC notes that encouraging the development of further cross-border activity and integration of international markets could deliver significant economic benefits to Australian markets, providers, investors and financial consumers. The area where the most immediate potential benefits lie is in the Asian region. Already, efforts to achieve recognition by US and EU authorities of Australia’s regulatory regime for over-the-counter (OTC) derivatives have enabled Australian businesses to avoid substantial compliance costs.

At the same time, the result of the increased breadth and strength of international standard-setting is that ASIC has needed to introduce, or at least consider introducing, Regulation over areas that were not previously regulated. ASIC fears that failure to keep pace with relevant international regulatory standards could lead to the risk of Australia’s regulatory system not being assessed as adequately equivalent, and entry to markets being closed off to their market participants.

"Retail Financial Markets Need More Intensive Regulation"

ASIC’s states that its experience with regulation, including during the global financial crisis, indicates that financial products and services require more intensive regulation than other products, especially in retail markets. According to the report, Financial products and services represent extreme examples where the performance and quality of the good is not apparent even after purchase. This means that assessing quality is very difficult. They are intangible and often complex.

The regulator explains that the nature of many financial products, such as the timing mismatch between purchase and identifying a problem with a product, means that consumer behavioural biases are more likely to lead to flawed consumer decision making. And if things go wrong for investors and financial consumers, the consequences can be more severe than for most other purchases; they may lose their home, their retirement savings, or suffer extreme financial hardship.

In the view of ASIC, these factors represent one of the reasons why in almost all jurisdictions there are specific regulators for investor and financial consumer protection. Relying solely on generic ‘after the event’ laws will not address many of the problems outlined above, the government is warned in the report.

The regulator writes that disclosure is not the best tool to fix market failure as economic research in behavioural economics, as well as its own experience of regulating retail financial markets, indicates that investors and consumers are prone to behavioural biases that mean decision making is often not instrumentally rational. This undermines the effectiveness of disclosure as a regulatory tool. Importantly, these behavioural biases are significant and systematic, rather than random and trivial.

There is potential, therefore according to ASIC, to improve the regulatory design with a better understanding of consumer behaviour and decision making. This will require a "more flexible regulatory toolkit to target market-improving actions." It also means that there are opportunities to reduce costs to industry by removing ineffective regulation.

List Of Regulatory Reforms ASIC Is Recommending

ASIC is proposing several reforms with the overall aim of ensuring that it can "more effectively contribute to a financial system that meets the needs of Australian households and businesses into the future." If adopted by the government these reforms can have major effects on the regulatory environment in Australia for brokers, and they include:

Requiring ASIC to consider a competition objective- Requiring the regulator to formally consider the effect of its decision making on competition would drive a greater focus on the long-term benefits for the end users of the financial system. While ASIC would not be a competition regulator, it would help ensure that ASIC’s approach to regulation considered market-wide effects more explicitly.

Ensuring the system better meets the needs of the retirement phase- As the Australian population ages, there is a need for better products to help people manage their retirement savings during the retirement phase. There is also a greater need for good quality retirement advice. Options should be explored to encourage product providers to increase the choice of products available that cater to the retirement phase, to increase consumer demand for these products, and to improve the quality of advice.

Lifting standards in financial advice- With compulsory retirement savings, there is a critical need for accessible and sound financial advice. ASIC has proposed a package of reforms that include a consistent minimum competency standard for advisers, a comprehensive national register of advisers, and the ability for the regulator to ban managers of advice businesses that cause consumers major harm.

Strategic participation in global financial markets- More efficient cross-border financial activity would create significant economic benefits for Australian markets, businesses and consumers. Encouraging the development of ‘passporting’ arrangements across the Asian markets, and more broadly, will facilitate the integration of the Australian financial system into global markets.

Managing systemic risk -A mechanism is required to allow financial regulators to monitor for the emergence of systemic risk in entities or sectors outside the current boundary of prudential regulation, and to bring them within that boundary if necessary.

Improving conduct through a more flexible regulatory toolkit- Better policy design, including a more flexible regulatory toolkit, can ensure better market outcomes with less cost for industry. This could be accompanied by a reduction in some current disclosure requirements that are less effective.

Penalties that provide the incentive for better conduct -Effective and credible enforcement of the laws governing the finance sector is critical to the level of trust and confidence in the system. Without effective enforcement, non-compliant firms can capture market share at the expense of compliant firms. A review of penalties under ASIC-administered legislation would help establish whether such penalties currently provide the right incentives for better market behaviour.

A better funding model for ASIC- A user pays (cost recovery) funding model that better reflects the costs associated with market regulation can drive economic efficiencies and can also provide better incentives for industries to improve their own standards and practices.

To prove the point that it needs more "incentivising" penalties ASIC compared the fines in selected markets around the world with this chart: (in AUD)