Tiger Brokers Appoints New CEO in Singapore

Tiger Brokers (Singapore) has announced the appointment of Ian Leong as its new CEO. Leong, who previously served as the Business Development Director for the retail part of the company, has replaced the former CEO Eng Thiam Choon. He brings a wealth of experience from his previous roles in the financial industry, including as the CEO of uSMART Singapore and the Head of Dealing at Phillip Securities.

Dong Ming, the Vice President and Co-Founder of Tiger Brokers Group, expressed his enthusiasm for Leong's appointment. "Leong's strategic vision aligns perfectly with our commitment to growing our presence in Singapore and expanding throughout Southeast Asia."

The CFO, Henry Toh welcomed Leong, highlighting his established track record and alignment with the company's long-term goals.

FCA Censures London Capital & Finance

The Financial Conduct Authority (FCA ) has censured London Capital & Finance (LCF) for misleading financial promotions of minibonds. The FCA did not impose a financial penalty due to LCF's insolvency. The promotions led to many investors, some of whom were vulnerable, investing in high-risk products.

"LCF's use of financial promotion led to bondholders, many of whom were vulnerable, investing in unsuitable, high-risk products," Therese Chambers, the Joint Executive Director of Enforcement and Market Oversight at the FCA, commented. "We recognize our censure will not provide solace to those investors who lost out. But it is important we set out what went wrong at LCF and how their promotions misled people into parting with their money."

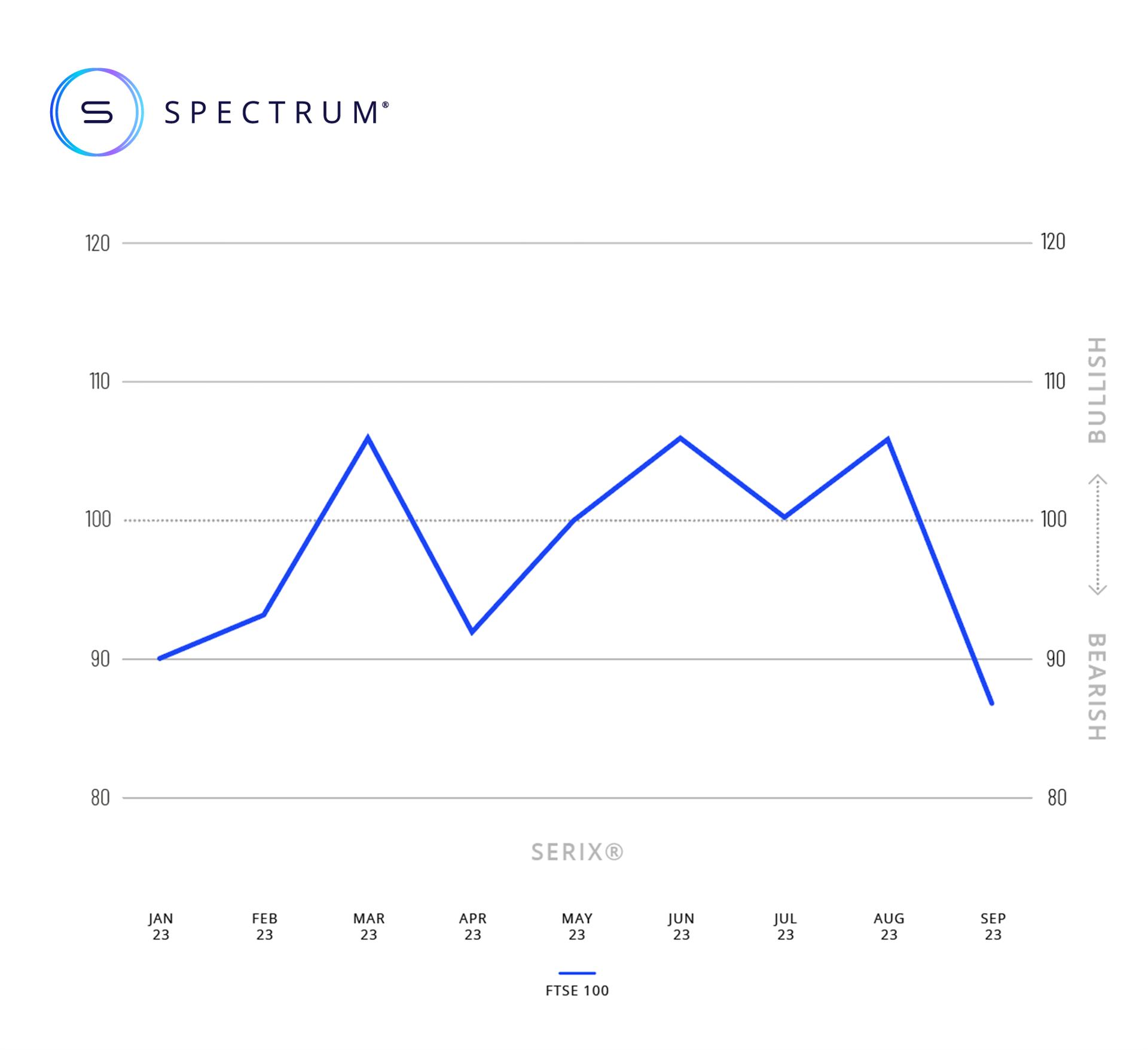

European Retail Investors Bearish on UK Equities

Spectrum Markets has released its SERIX sentiment data for September, revealing a significant drop in European retail investor sentiment towards the FTSE 100 index. The index fell to 87 points, indicating a bearish outlook. The decline is attributed to a range of challenging macroeconomic factors affecting the UK, including Brexit, Covid-19, and an energy crisis.

Michael Hall, the Head of Distribution at Spectrum, explained that the Bank of England's decision to hold interest rates at 5.25% reflected the current market uncertainty. He also noted that investors are closely watching key economic data to gauge what might happen next.

Consob Orders Blackout of Unauthorized Financial Websites

Italy's financial regulatory authority, Consob, has ordered the blackout of five new websites offering financial services without proper authorization. This action is part of a broader initiative that has seen 950 websites blacked out since July 2019.

The move aims to protect consumers from fraudulent financial intermediaries and is based on powers granted to Consob under the "Growth Decree" law. The blacked-out websites include "Global News," "Cryptonoid Ltd," "Alphascrypto," "Afex Market," and "Tradeontop Limited."

BlackRock Invests in German Fintech Upvest

BlackRock has acquired a minority stake in Berlin-based fintech Upvest, following a 30 million euros funding round. The investment aims to help BlackRock reach first-time investors in Europe through Upvest's digital wealth management platform. The platform allows investors to access a variety of asset classes, including ETFs, with as little as one euro.

The move is part of BlackRock's broader strategy to transform itself into a one-stop-shop for investors, offering a range of services including tech, data, analytics, and financial markets advice.

SFC Takes Action against IPO Sponsor Failures

Hong Kong's Securities and Futures Commission (SFC) has banned Ivan Chan Chuk Cheung, a former responsible officer of Changjiang Corporate Finance, from the industry for seven years. The ban results from Cheung's failure to adequately supervise five listing applications. The SFC emphasized the need for strict adherence to industry standards and cited Cheung's otherwise clean disciplinary record as a mitigating factor.

The SFC has launched a consultation on market-sounding guidelines, aiming to provide clarity on regulatory expectations and assist intermediaries in compliance. The guidelines focus on the governance and internal control procedures to prevent misuse and leakage of non-public information.

Deutsche Bank Collaborates with Kodex AI

Deutsche Bank has invested in Kodex AI, a Berlin-based startup specializing in AI-powered solutions for the financial industry. The investment follows a collaboration that began earlier this year as part of Deutsche Bank's Entrepreneur in Residence program. Kodex AI's solution is designed to extract and analyze data from financial documents and is specifically trained for the financial industry.

"Kodex AI developed a solution that addresses the specific needs of a highly regulated industry and has the potential to significantly enhance the efficiency of how financial data is being extracted and analyzed," Gil Perez, Deutsche Bank's Chief Innovation Officer, commented.

OKX Hires New Head of Compliance

The crypto exchange OKX has announced that Neil Grant has become its Head of Compliance for the EMEA region. Previously, he served as the Compliance Officer at Crypto Facilities and Chief Compliance Officer at B2C2 and Global Prime Partners.

"I’m happy to share that I’m starting a new position as Head of Compliance EMEA at OKX,” Grant commented on his LinkedIn profile.

Grant’s professional career in finance started at CMC Markets, where he served as a Business Analyst for two years, from 2022.