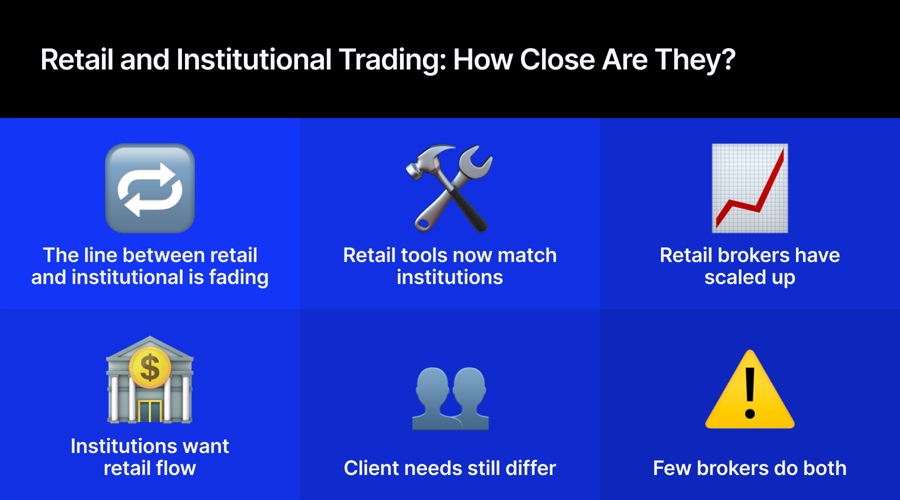

The distinction between retail and institutional trading may be less clear than ever, but it is far from certain that the future of brokerage lies in firms effectively servicing both market segments.

"The Cross-Pollination Is Creating a More Robust Ecosystem"

During the panel discussion entitled ‘Art of the Dealer, Risk Management and Industry Education’ at the Finance Magnates London Summit, Chariton Christou, co-founder and CEO of Boltzam Research, made the point that retail dealers increasingly have access to tools and concepts once reserved for institutions.

This has encouraged many retail brokers to develop their own systems and infrastructure to better support such business. According to David Morrison, senior market analyst at Trade Nation, the level of both client and technology sophistication has increased dramatically.

Retail brokerages have scaled up technology, research, and execution capabilities, enabling them to service high-frequency traders, family offices, and even smaller institutions, says Ross Maxwell, global strategy and operations lead at VT Markets.

“Likewise, traditional institutional brokers and global investment banks are paying greater attention to sophisticated retail and active traders,” he adds. “Advances in fintech and API-based trading have further blurred the lines between retail and institutional offerings. Scale, technology, and regulatory compliance now carry more weight, driving brokers to diversify client bases and revenue streams.”

As margins compress across global markets, retail and institutional players are incentivised to standardise technology, share infrastructure, and scale volumes. While differences remain in terms of latency sensitivity, balance sheet usage, and customisation, the core trading technology has largely converged.

Retail brokers are becoming more advanced and are naturally moving up to service small-to-medium institutions and professional traders who demand institutional-grade reliability, while institutional players are rethinking their approaches to be more user-focused, similar to the retail world, agrees LMAX Global Managing Director Andreas Wigström.

“Overall, the cross-pollination is creating a more robust ecosystem,” he says. “For the institutional broker, this means a larger, more diverse pool of participants and liquidity, which ultimately drives better price discovery and market depth for everyone.”

- New Year, New UK? Can Britain’s IPO Market Finally Turn

- Does the Kraken–Deutsche Börse Deal Simplify Crypto, or Complicate It Further?

- As the Year Turns: A Market Reckoning for 2025

AI Will Blur Lines

Wigström believes the wider use of AI will further blur the line between retail and institutional trading technology. This view is shared by Christopher Gregory, GTN’s CEO for Europe, who notes that execution algorithms, consolidated market data feeds, and client-facing execution analytics are now common across both segments.

“Evidence from industry reports and trade commentary indicates retail platforms are expanding product scope and considering listed derivatives and institutional clients, while incumbents are responding with broader distribution strategies,” he adds.

Dan Moczulski, UK Managing Director at eToro, acknowledges that over time certain tools move from institutional markets into retail. However, he also points to the importance of clear definitions when discussing customer segments.

For example, his firm would not say it operates in institutional markets, particularly where high-net-worth accounts are offered a retail white-glove service rather than being classed as institutional.

“There is also a distinction within what is often described as institutional business,” explains Moczulski.

“One type involves reselling liquidity to other retail brokers, and I can see retail brokers moving into this space, as it is effectively the same activity, just higher up the chain. What might be classed as ‘traditional’ institutional business, such as hedge funds and family offices, is very different. Most retail brokers cannot service those clients without significantly changing their practices, balance sheets, infrastructure, and strategies.”

The Challenge? "Each Market Demands Full Dedication and Specialised Solutions"

While this trend is popular in theory, effective execution is extremely challenging. Only a few companies have successfully managed to offer both types of services, and such cases remain the exception rather than the rule.

That is the view of Filip Kaczmarzyk, Head of Trading and XTB board member, who says the markets are fundamentally different, from client onboarding processes through to the technical infrastructure required.

“Each market demands full dedication and specialised solutions,” he adds. “It is not possible to treat one as a side task while focusing on the other.”

When asked whether he could see a future where a higher percentage of brokers service both retail and institutional clients, Morrison observes that as retail brokers extend their offering to B2B, the institutional space has seen increased volumes flowing from the retail sector and wants to capture part of that growth.

“They see it as a potential growth area and will look to adjust and expand their product offering and services to try to meet retail needs,” he says.

Regulatory alignment and transparency requirements are narrowing the gap between retail and institutional market access, particularly in equities, derivatives, and FX. From a demand perspective, retail investors are becoming more sophisticated, while smaller institutions seek cost-efficient, multi-asset solutions, creating overlap in service needs.

“This trend will favour brokers with strong compliance frameworks and solid capital positions, as conflicts of interest and best execution standards will face closer scrutiny,” says Maxwell. “While brokers will face challenges servicing both client types, those able to combine institutional-grade infrastructure with retail interfaces are well placed to attract a broader and more diverse client base over the long term.”

Doing so profitably will require clear product, risk, and compliance separation. While equities are relatively straightforward instruments, the process of making advanced capabilities available to retail clients is extending into more complex asset classes, such as fixed income and exchange-traded derivatives, to make them accessible and easier for retail investors to understand.

Wigström accepts that it is difficult to cater to B2B and B2C clients at the same time. However, he adds that brokers with strong technology and local expertise within a global strategy can successfully bridge that gap.

Moczulski, however, cautions that much of what is labelled institutional business is still retail at its core, simply aggregated.

“There is only so much of that business to go around, and it cannot be endlessly recycled,” he adds. “When brokers reach a certain scale, they also tend to use banks for core services rather than other brokers. For that reason, while there may be overlap, it is not inevitable that more brokers will successfully service both retail and true institutional business.”

Kaczmarzyk goes further, suggesting that the trend is moving towards specialisation rather than dual service models. He believes brokers need to be fully committed and focused on either retail or institutional clients.