There will come a day when I don’t need a bank. Or maybe, just maybe, that day is already here.

The evolution of Bitcoin and Blockchain technology over the past few years alone has been vast (and impressive). From wallets and exchanges to payment systems, casinos, and even crypto-loans – a plethora of blockchain-powered services have sprung up to serve consumers and market participants.

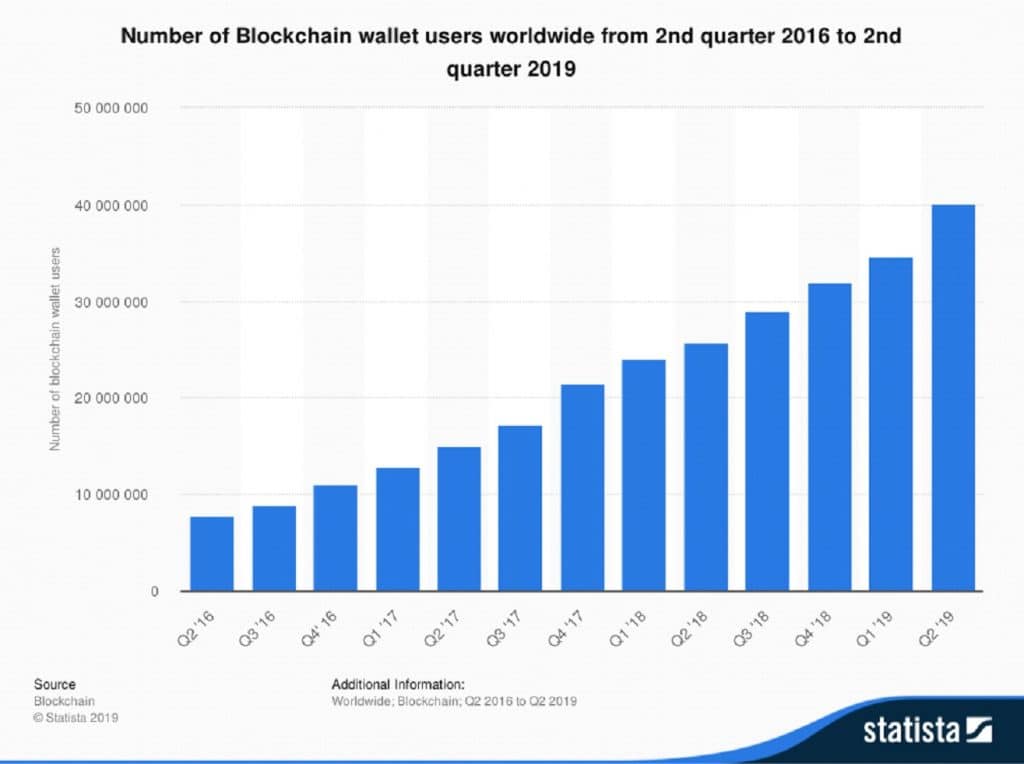

According to market and consumer data provider Statista, the number of blockchain wallet users grew from 10 million in 2016 to over 40 million in June this year – that’s a growth rate of over 400%.

Number of Blockchain wallet users worldwide from 2nd quarter of 2016 to 2nd quarter of 2019

The center of gravity in the blockchain universe has been Bitcoin, a decentralized digital currency without a central bank or even a single administrator. The cryptocurrency can be sent from user to user on a peer-to-peer bitcoin network without the need for intermediaries.

It’s not surprising that Bitcoin’s ascent has attracted wrath from banks, the traditional intermediaries of the financial and capital markets.

However, Bitcoin has been frowned upon by banks for many other reasons.

As Bitcoin’s popularity continues to grow at an impressive rate, so does the risk it poses to the traditional banking system. In 2017, JPMorgan’s CEO Jamie Dimon labeled Bitcoin as a “fraud” and even went as far as threatening JPMorgan staff with the sack if they traded it themselves. His contempt for the virtual currency didn’t stop there with the banker also calling it “stupid” and “far too dangerous.”

As vindication of Dimon’s comments, both JP Morgan and another top-tier US bank, Bank of America, both listed Cryptocurrencies among the risk factors that could impact competitiveness and reduce revenues and profits, just two years later.

JPMorgan Chase isn’t the only bank to have qualms with Bitcoin. Other banks such as RBC Royal Bank, Regions Financial Corporation, Santander, PNC Bank, TD Bank, Citi, Bank of America, and even Capital One have also been reported blocking Coinbase purchases.

Coinbase is possibly the most renowned cryptocurrency wallet/exchange to date with an astounding 30 million users. To put this into context, RBC Royal Bank of Canada has approximately 16 million clients and has been operating in Canada for over 150 years – a country with a population of just 37 million.

Not only does Coinbase wield a continually growing user base, but it is also expanding with payment systems like PayPal while making progress towards obtaining its own banking license. The firm's partnership with PayPal has started the process of cutting banks out of the equation, and this trend of bank redundancy is only likely to accelerate given the trajectory so far.

The monopoly

The prime reason why banks are worried about blockchain technology is the fact that innovative fintech products threaten the monopoly banks currently operate on a global level. Moreover, blockchains are fuelling industry-wide change, while banks are absolutely terrified of changing given their largesse and cumbersome operations.

The banking system has always seemed very simple and traditional. We trust banks to store our money and facilitate spending. Their ‘bread and butter’ is paying interest on deposits and charging fees for lending to borrowers. This simple banking model has underpinned modern society for hundreds of years.

Until recently, there has been a dearth of alternative money or payment processing providers. Other companies or individuals have struggled to break up the banking monopoly because its roots run deep, and its influence is all-encompassing. The companies applying for a banking license will know exactly how difficult it is to obtain a seat at the table.

However, cryptocurrencies have opened a new world of banking which is allowing end-users (you and me) to store our own money securely. Fintech innovations such as peer-to-peer networks, distributed ledger technology (DLT) and Bitcoin have leveled the playing field and empowered almost anyone to become a bank.

I can now rely on my fingerprint, retinal scan, or even more complex security measures such as cold storage wallets to store my own money. I don’t have to pay monthly fees, and my money isn’t benefitting someone else, it’s just mine.

This area is where banks are simply not needed, and I’m certain they are starting to notice.

Let the battle commence

Even though cryptocurrencies are on a resolute march forward while chipping away at the banking monopoly, let’s not be so naïve as to think that banks are not taking action.

Despite the fact there are a growing number of reports of banks blocking cryptocurrency purchases, many of these exact same banks are simultaneously investing in both cryptocurrency and blockchain start-ups. Maybe Dimon’s words are merely a bid to distract people and to prevent a stampede into cryptocurrencies?

In May 2019, Coindesk reported that JPMorgan is continuing to develop its own “JPM Coin,” using a private version of the Ethereum blockchain called Quorum. Quorum is also set to be the first distributed ledger platform available through the Microsoft Azure Blockchain Service.

Santander (another bank allegedly blocking Coinbase purchases) recently invested in Coinbase-backed token issuance protocol Securitize.

In parallel, RBC Royal Bank – a bank that makes it very clear they do not allow their credit cards to be used for cryptocurrency transactions – has been working on a blockchain-based payment system with JPMorgan and is a self-admitted supporter of Ripple.

Bank of America is busy chasing a patent for its own cryptocurrency wallet.

These are only a few of the examples of how banks are scrambling to get involved in an industry that is rapidly advancing without them. The fact that blockchains are built on open-source principles has meant anyone and everyone can now create their own blockchain projects, wallets, or even exchanges.

Technological advancements have left plenty of room for innovation and creative thinkers to create the next best thing.

To the over-enthused and the uninformed alike, it’s an easy bandwagon to jump on – to hate the banks because they control our money. To hate the government because they don’t understand the role of taxes. But the reality is that banks aren’t the enemy and we’re likely to need them.

As more companies like Coinbase emerge, we find ourselves facing less and less of a reason to use a bank. But this merely represents competition and not a revolution. The actions and investments being taken by banks are a clear sign that they now realize that Bitcoin is a vibrant competitor and not just a funky internet trend.

Blockchain-based businesses are on the rise, and it will not be long before companies are providing fiat-backed debit/credit cards to allow consumers to do our daily grocery shopping with our own cryptocurrency wallets.

Clearly, banks aren’t heckling fintech companies while sitting on the sidelines. They are well and truly in the game, and they’re in it to win it.

So maybe, just maybe, in tomorrow’s world, we will all become our very own bank.