When it comes to launching new ventures, the past decade has shown that it takes more than a business plan and a good team to become successful. Although start-up capital is the most important factor at the beginning of a project, a healthy revenue model is, and remains, the key barometer long term.

Revenue models are rigorously tested during low volatility, during times of high competition or due to mandatory regulation. This is why it is imperative to be offering appropriate products, so as not to just survive the turbulent times, but, to emerge out of periods of volatility as a thriving winner.

A healthy revenue model – the profit engine of a venture – needs to be clear and understandable. Investors should be able to understand how customers are acquired, at what cost, and the associated revenue expectations resulting from client activity.

I call this Traffic 101.

All executives in financial services, especially those that comprise Management teams in brokerage firms, should understand what is a “funnel”, how clicks are converted to leads, how leads are eventually converted to clients, and how long various customers can be expected to use the trading platform provided by the broker – otherwise known as “LTV” or Life Time Value.

Nowadays, building attractive products and presenting them via aesthetically pleasing websites is simply not enough. Successful brokering requires a commercially viable pricing model that considers various caveats influencing customer acquisition.

By offering the right products at the right price, the broker can avoid a situation where continued marketing activity leads to gradually deteriorating company performance. By making all client offerings profitable, the broker can potentially exit the so-called “J-curve”, where operating costs remain higher than revenues, and focus on marketing instead.

For more practicality, we will review three industries that are interconnected and discuss customer acquisition. More specifically, we will discuss margin trading, fintech including crypto and Payments , as well as, gambling companies.

Margin Trading

When it comes to margin trading of financial instruments such as foreign exchange (forex), contracts for difference (CFDs) and spread betting, MetaTrader 4 continues to dominate the market with more than 70% of all the retail traders currently turning to the tried and tested platform.

The remaining 30%, if they are not trading on MetaTrader 5, are scattered amongst the thousands of retail brokers operating around the world and using a variety of proprietary or third-party platforms.

As a result of the many changes in the retail trading industry over the past decade, MetaTrader 4 acquisition costs are currently comparatively higher due to the dislocated journey of a customer. Brokers that streamline their back and front office systems, as well as integrating the required technical tools to ensure customers are on-boarded, serviced and engaged efficiently, tend to reduce costs and raise revenues over time.

Solid examples of such streamlining include the likes of PLUS500 which offers easier conversions since all client

Dr. Demetrios Zamboglou, COO of BABB

records are maintained in the same ecosystem, from back office to payments and eventually to trading.

The typical cost of acquiring a funded retail client is around US$1,000. However, client deposits could be lower than the acquisition amount. In such cases, the broker is effectively pursuing a negative revenue model which makes long-term success highly challenging.

Despite the probability, some brokers can still achieve positive returns by using an inverse revenue model, although this requires a frictionless customer journey, appealing incentives and a highly engaging platform.

Fintechs

In recent times, it has become quite apparent that launching a crypto company without the required caution or planning often results in devastating losses, as well as opening the door to other vulnerabilities such as cybersecurity and reputational damage.

When it comes to launching a crypto exchange, we need to understand that exchanges do not carry risk exposure which means all revenue is generated from commission fees. It’s a fallacy that exchanges only make money when traders are active. The problem here is that the behaviour of institutional traders and retail traders differs greatly. Moreover, following the bursting of the crypto bubble in 2018, exchange customer acquisition costs have climbed significantly higher.

Typically, a customer will cost around US$150 to acquire while generating an average revenue of US$50 in the exchange, even if operating a hybrid exchange/card provider model. However, card and inactivity fees are insufficient to make up for the higher acquisition cost, which means the model will still be negative in low volatility.

Of course, there are solutions, such as offering margin crypto products and acting as a Liquidity provider rather than an exchange, as just two examples. Other solutions include creating synthetic CFDs linked to cryptocurrency prices and managing risk in-house, similar to what Binance is doing indirectly. In this scenario, the cost of acquiring a new client falls closer to the 1:2 ratio most often seen in margin trading.

On the other hand, if you decide to become a challenger bank you will still have similar challenger acquisitions as crypto fintech projects, resulting to acquisitions close to US$100 -150, struggling to make fees of US$5-10 from transactions. But the idea here is the fact that a challenger bank is not a short-term plan.

A challenger bank project wants to attract as many accounts as possible to obtain an accurate evaluation of itself.

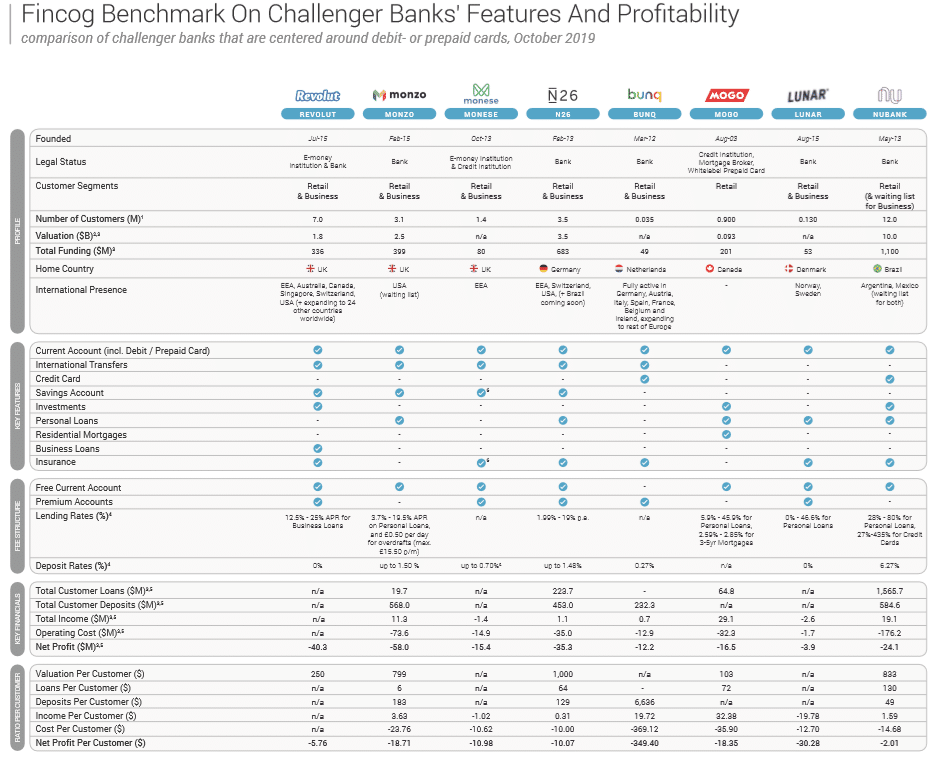

For example, Revolut’s active customers are valued at US$250, while Monzo values its customers nearer to US$800, based on a recent study.

source: https://s3-eu-west-1.amazonaws.com/fincog/fincog/files/20191005_Fincog_Challenger_Bank_Benchmark.pdf

As a rule of thumb, the more customers a bank has, the bigger the bank’s valuation will be – and challenger projects require surplus capital considering that banking licenses are expensive and time-consuming to obtain.

Therefore, challenger banks tend to remain “challenger only” for a while, offering services resembling those offered by Electronic Money Institutions (EMIs). Otherwise, challenger banks will fail to become operational until they secure a banking license.

Nevertheless, as soon as challenger banks become “banks”, they can offer their customers what some have referred to as “weapons of mass destruction” – credit products that facilitate lucrative revenues such as credit cards and overdrafts.

In modern times, we are also witnessing a growing trend in short term lending, whereby people borrow money for very small periods at exorbitant interest rates. This new financial industry niche has been fuelled by developments in financial technology (fintech) but has been described as nothing short of loan sharking by critics. A worthy note to remember here is that banks have access to near-zero interest rates from Central Banks, whilst operating in a highly protected industry and lending at higher rates to all other market participants.

Gambling

Finally, when it comes to customer acquisition for gambling products such as binary options and online casinos, the cost per customer is much lower, and can sometimes fall to as low as US$1 per funded account.

Of course, gambling companies have a different set of challenges, and industry dynamics greatly differ from those in retail trading – although some parallels do exist which brokers can emulate and improve their own operations.

Ideally, gambling providers should be targeting customers within domestic jurisdictions where banks allow them to carry out transactions. However, since gambling is classified as a risky product, funding gambling accounts is often prohibited by banks and e-money providers.

Frictionless deposits, high engagement, and optimised internal systems are essential for profitability, and ultimately, scalability. Without these factors secured, any (if not all) marketing spend deployed to attract more customers could prove to be counterproductive without improving revenue.

The margin for error in gaming is relatively small, which is why margin brokers and fintech companies have a lot to learn from gaming, including customer targeting, display and AdWords, landing page strategy, incentives and gamification.

In summary, when a retail broker thinks about which trading instrument it should launch next, the correct answer should be: “a profitable one”.

Dr. Demetrios Zamboglou, COO of BABB