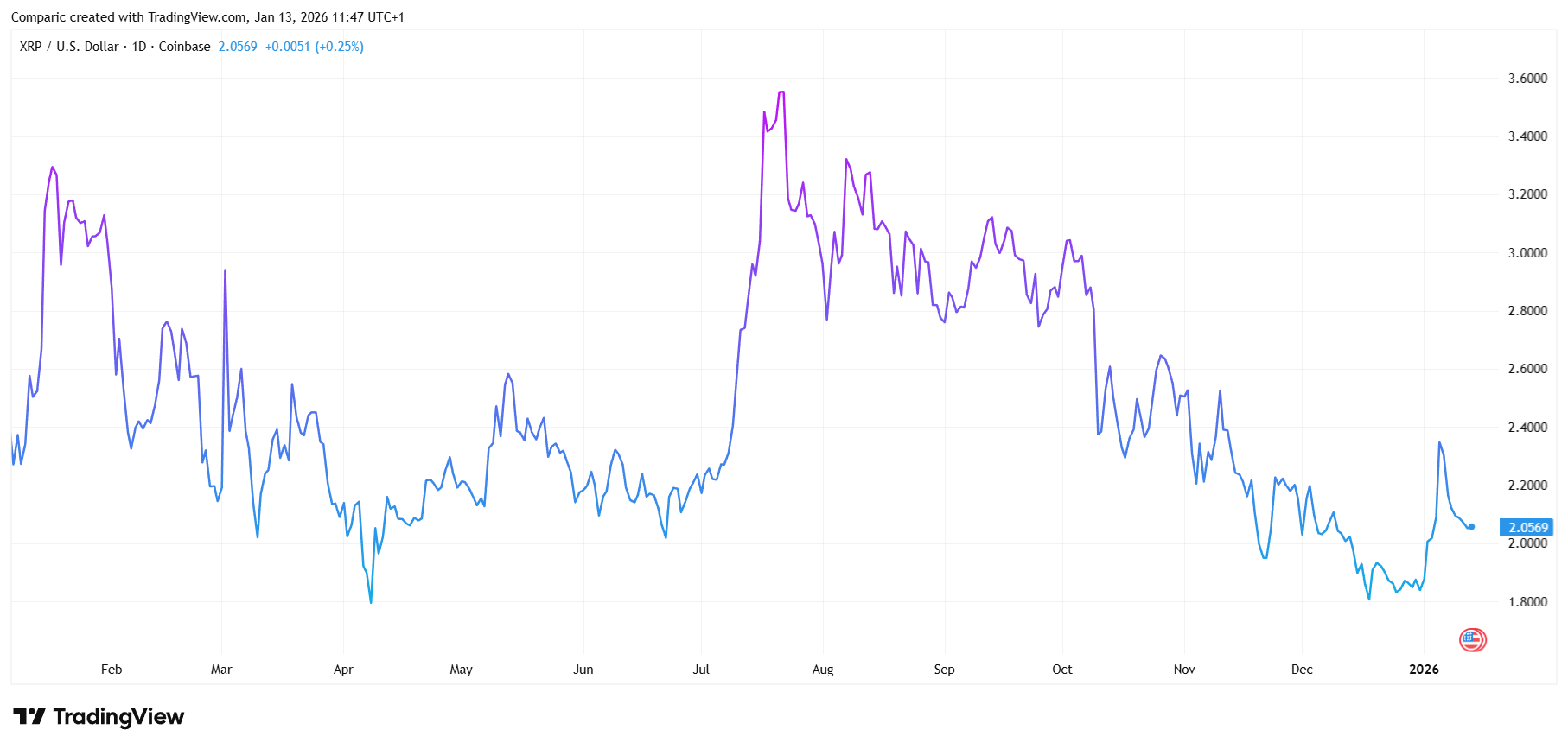

XRP trades at $2.058 on Tuesday, January 13, 2026, facing its seventh consecutive session of declines, the worst losing streak in two months. The cryptocurrency has fallen 13% from its $2.357 peak reached on January 6, when CNBC called it "the hottest crypto trade of the year" with analysts predicting $8 targets for 2026.

Now XRP moves near a critical $2.00 support after rejecting the 200-day EMA at $2.56 for the third time, a pattern that has consistently preceded multi-week corrections.

According to my technical analysis, XRP has broken below the 50-day EMA at $2.07, signaling a deeper correction is unfolding. The immediate target is the round $2.00 level, followed by November lows around $1.90, December lows at $1.80, April minimums at $1.61, and an ultimate bearish target of $1.25, representing potential 40% decline from current levels.

Why XRP Price Is Going Down? Seven-Session Losing Streak

Although XRP prices rose 0.31% during today's session, Tuesday, January 13, 2026, and are defending the $2.05 level, they have behind them a series of seven consecutive declining sessions, the worst such sequence in two months.

The depreciation follows after XRP entered 2026 strongly, rising five consecutive sessions from $1.84 to $2.357 on January 6, testing nine-week highs. Just one week ago, I reported XRP "crushed Bitcoin and Ethereum returns" with 25% January gains and bullish $8 predictions.

However, the cryptocurrency met stronger supply resistance at the 200-day exponential moving average around $2.56, the third rejection at this critical level in recent months.

- How Low Can XRP Go? Death Cross XRP Price Prediction Signals 50% Drop Risk

- This XRP Price Prediction From Ex-Goldman Analyst Eyes $1,000 by 2030

- Why XRP Is Going Down? Price Falls Today To $1.90 On Year-End Selloff

XRP Technical Analysis: 40% Downside Risk

As shown by my technical analysis, we are falling below the 50 EMA at $2.02, as a result of which a correction is about to unfold. The breakdown of this key support signals momentum has shifted decisively bearish.

Key technical levels:

- Current price: $2.058 (down 13% from January 6 peak)

- 50 EMA: $2.07 (broken - now resistance)

- 200 EMA: $2.33 (rejected third time)

- Target 1: $2.00 (psychological support)

- Target 2: $1.90 (November lows)

- Target 3: $1.80 (December lows)

- Target 4: $1.61 (April minimums - year low)

- Target 5: $1.25 (October Flash Crash - 40% decline)

The first short-term target is obviously the round level of $2.00. MEXC notes "$2.00 has acted as a formidable barrier that has capped rallies in previous cycles". Losing $2.00 opens the door to $1.90 and $1.80 December lows.

The next two medium-term decline levels are $1.61, matching the year low, and my ultimate target level is $1.25 per XRP, the flash crash low from October 10. As a result, from current levels, XRP could fall by as much as 40%.

CFD brokers like Axi recently expanded offerings to over 150 crypto perpetual contracts, enabling retail traders to access leveraged exposure to tokens, including XRP.

Crypto Market Sentiment Weighs on XRP

Broader crypto market weakness explains much of XRP's decline. "Crypto markets are trading sideways and sentiment is quite low. BTC Price action has been stuck in the $84,000-$95,000 range," explains James Harris, CEO of Tesseract Group.

The lack of speculative interest shows in declining metrics. "With speculative spirits very low, there is less interest in trading the markets and exchange volumes remain at lower levels," Harris notes. This reduced activity means fewer opportunities to exploit, consequently reducing demand for leverage .

"So borrowing rates are lower, with lenders having to drop rates to find borrowing demand," visible in both OTC lending markets and across DeFi platforms.

Despite Federal Reserve rate cuts, three in 2025 with two more expected in 2026 bringing rates to around 3.25%, the anticipated boost to risk assets hasn't arrived. "It is hoped that with this lower 'risk free rate' crypto markets will begin to look more attractive and encourage bullish, risk taking behaviour," Harris observes. "This hasn't materialised yet though."

Technical indicators confirm the bearish sentiment Harris describes. Hexn.io shows 70% Bearish reading on XRP with Fear & Greed Index at 26 (Fear), well below the 41 level Harris cites for broader crypto markets. XRP had only 43% green days over the last week with 0.69% price volatility .

For real-time XRP technical updates follow me on X (Twitter) @ChmielDk. I provide moving average analysis, support/resistance levels, and crypto sentiment insights.

XRP Price Analysis, FAQ

Why is XRP falling today?

XRP fell seven consecutive sessions from $2.357 (January 6) to $2.058 (January 13), worst streak since November 2025. According to my technical analysis, XRP rejected 200 EMA at $2.56 for the third time and broke below 50 EMA at $2.02, signaling correction with $2.00 support critical.

What is XRP price today?

XRP trades at $2.058 on January 13, 2026, down 13% from $2.357 peak reached January 6. Price defending $2.00 psychological support after rejecting 200-day moving average resistance for third time in recent months.

How low can XRP go?

According to my technical analysis, XRP targets: $2.00 (immediate), $1.90 (November lows), $1.80 (December lows), $1.61 (April minimums), and $1.25 (October Flash Crash, 40% decline from current). Break below $2.00 activates deeper correction toward $1.80-$1.90 zone.