Bitcoin (BTC) during Thursday's November 27, 2025 Thanksgiving session costs $91,503, rising 1.14% and has behind it a test of session maximums around $91,925, the intraday high recorded during today's trading. This is a continuation of strong gains this week, with Bitcoin rebounding 12% from last Friday's devastating drop to $80,600, its lowest level since April and a seven-month low.

Although this corrective bounce has been going on for several sessions, in my view this remains only a bull trap left by bears and the price still has a chance to continue the declines observed since early October when Bitcoin achieved an all-time high above $126,000 toward my ultimate target around $74,000, this year's minimums.

In this article I analyze Bitcoin’s price during Thanksgiving and review two updated BTC price forecasts from Tom Lee and Cathie Wood.

Why Bitcoin Is Surging Today on Thanksgiving?

Why is Bitcoin going up today on Thanksgiving? The rally is primarily driven by a surge in Federal Reserve rate cut expectations for December, with odds jumping from below 44% just a week ago to 85% currently according to market pricing. After lingering below $90,000 for nearly a week, Bitcoin managed to rise above that threshold on Wednesday and continues gaining ground Thursday.

According to market analysis, Bitcoin rebounded as investors recognized it had become extremely oversold, with the Relative Strength Index (RSI) bottoming at 23, a level historically associated with macro bottoms. The Crypto Fear and Greed Index tumbled to the lowest point this year, and it's common for Bitcoin to rebound whenever it moves to the extreme fear zone.

Additionally, institutional money is returning. ETF inflow data has shown positive movement for two consecutive days, with major players like BlackRock and Fidelity re-entering the scene. Nearly a billion dollars worth of liquidations have reset over-leveraged long positions, clearing the path for a technical bounce.

However, in the short-term, Bitcoin still may fall.

Follow me on X for more up-to-date analysis and forecasts on major cryptocurrencies and other financial instruments.

Bitcoin Technical Analysis: Bull Trap at $92K-$94K Resistance

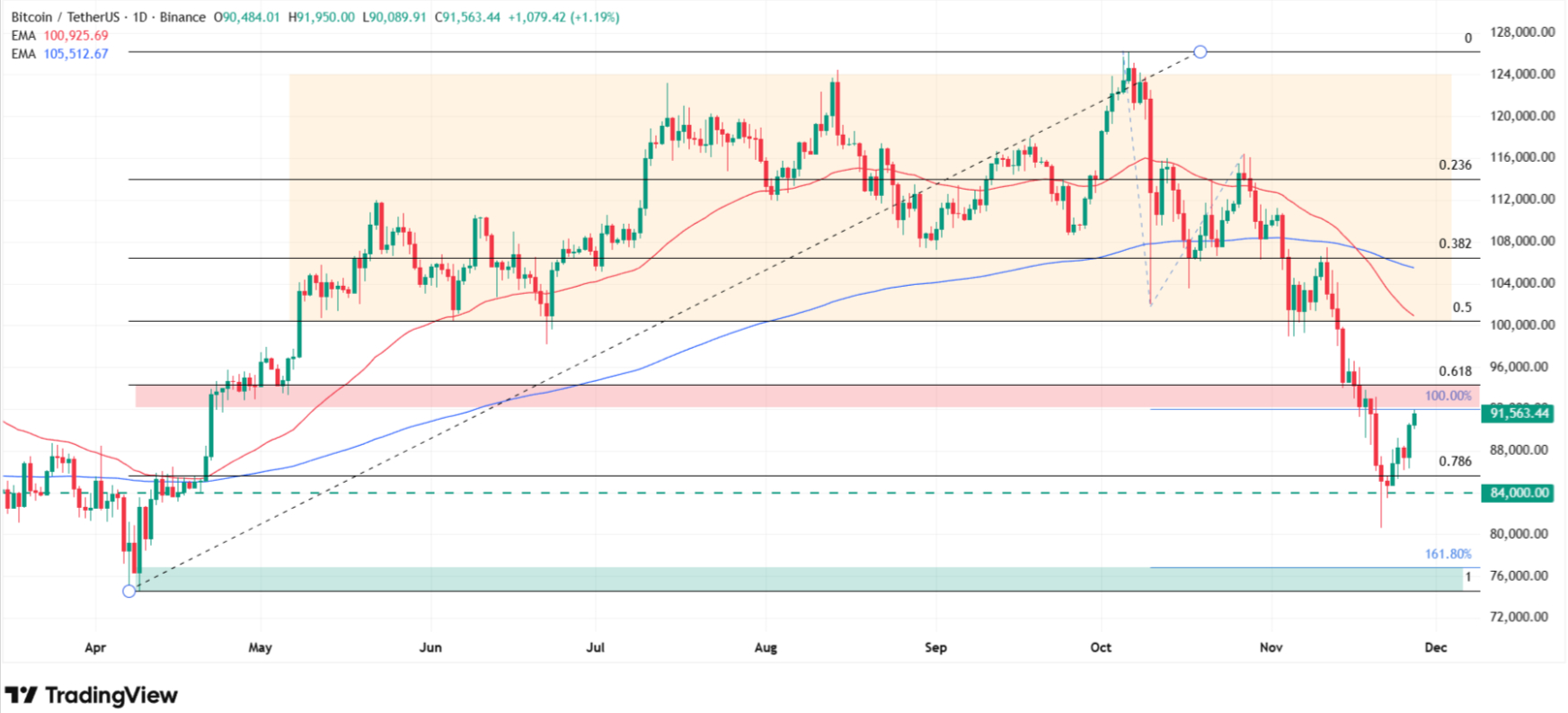

We still find ourselves below the main resistance zone marked by the 100% Fibonacci extension and 61.8% Fibonacci retracement around $92,000 and $94,000 levels, a zone that constituted local support at the turn of April and May. Current real-time data confirms Bitcoin is trading at $91,503 with a day high of $91,925, approaching but not yet breaking this critical resistance.

As long as we remain below this level, I maintain my bearish narrative and price forecast toward $74,000 from which Bitcoin will then bounce and return in the medium term to higher levels than the current all-time high, ultimately entering a price discovery phase.

According to my technical analysis framework, I will abandon my narrative if within this correction there's a breakout of the current resistance and its test from the other side as new support according to the polarity reversal principle, which would allow gaining greater confidence and increase buying pressure.

Bitcoin Critical Technical Levels

Key Level | Price | Technical Significance |

Current Price | $91,503 | Thursday Thanksgiving, +1.14% |

Day High | $91,925 | Session maximum, approaching resistance |

Day Low | $90,068 | Thursday support test |

My Resistance Zone | $92,000-$94,000 | 100% Fibo + 61.8% retracement, April-May support |

Iliya Kalchev, dispatch analyst at digital asset platform Nexo, shares a similar view, telling Cointelegraph that "cryptocurrency markets will continue lacking conviction until Bitcoin can reclaim the $92,000 level, which may 'open the door to a broader recovery if macro conditions align.'"

It's worth remembering that at this moment officially the trend on the Bitcoin chart is bearish, as evidenced by moving below the 200-day exponential moving average (200 EMA) which currently sits at $109,985, a full 17% above the current price. Moreover, a strong sell signal was recently formed in the form of a death cross, though historical data shows such patterns have often preceded Bitcoin doubling within six months during previous cycles.

Bitcoin Price Predictions

Tom Lee Cuts $250K Bitcoin Call to "Above $100K"

Tom Lee, the chair of Fundstrat and a long-time advocate for Bitcoin, shared with CNBC on Wednesday that he has revised his Bitcoin year-end target down from $250,000 to a figure "above $100,000," suggesting it may only "possibly" retest its all-time high of $125,100 (updated data shows $126,296) achieved in October.

"I believe it's still quite probable that Bitcoin will exceed $100,000 before the year concludes, and it might even reach a new peak," Lee stated during the interview. This appears to be the first time Lee has publicly softened his $250,000 year-end Bitcoin price target, which he initially floated earlier in 2024.

TOM LEE JUST SAID LIVE ON CNBC THAT #BITCOIN IS STILL GOING OVER $126,000 IN THE NEXT 35 DAYS

— Vivek Sen (@Vivek4real_) November 26, 2025

TIGHTEN YOUR SEATBELTS 🚀 pic.twitter.com/89aGN6S9fb

That being said, Lee emphasized that some of Bitcoin's strongest days may still lie ahead before the end of 2025. "I still think some of those best days are going to happen before year-end," he said, with 35 days remaining until the end of 2025.

Cathie Wood: ARK's $1.5M Bitcoin Bull Case Unchanged

Despite the recent crypto market correction and Bitcoin's 20%+ November decline, Cathie Wood and ARK Invest's bullish long-term price target remains unchanged. Earlier in April, ARK Invest predicted a 2030 Bitcoin price target of $1.5 million in the company's "bull case," and a $300,000 price target in the "bear case."

"The stablecoins have accelerated, taking some of the role away from Bitcoin that we expected, but the gold price appreciation has been far greater than we expected," explained Wood during a Monday webinar. "So net, our bull price, which most people focus on, really hasn't changed."

In this recent webinar, I discuss why the liquidity squeeze that has hit #AI and #crypto will reverse in the next few weeks, something the markets seemed to buy, and why AI is not in a bubble. The 123% increase noted below was in Palantir’s US commercial business last qtr.

— Cathie Wood (@CathieDWood) November 26, 2025

Watch… https://t.co/GdBZtEQcxM

Wood and ARK Invest point to improving market conditions driven by increasing liquidity, which has already returned $70 billion into markets since the end of the US government shutdown, with another $300 billion expected to return over the next five to six weeks as the Treasury General Account normalizes.

Bear Market or Bull Trap?

Not all analysts share the optimism of Lee and Wood. Analyst Valdrin Tahiri from CCN noted in a recent report that "the breakdown suggests the end of Bitcoin's bullish cycle, indicating the onset of a bear market." According to Tahiri, Bitcoin's current trajectory could see it trading at $73,000 and $57,000 by the end of 2026 and 2027, respectively.

Glassnode added in its weekly report that "realized losses have climbed to levels comparable to previous cycle lows and that the short-term holder profit and loss ratio has collapsed, underscoring how little buying momentum remains." The combined data might imply that the uptick in prices may be masking deeper liquidity stress, and "until liquidity returns and demand strengthens, any further upside may prove temporary rather than a turning point."

In my agreement with the current forecast, I expect the conclusion of the current correction ultimately at a bottom in this declining cycle around $76,000-$74,000, then a return to a clearer long-term uptrend. Please remember that at this moment officially the trend on Bitcoin's chart is bearish, as evidenced by moving below the 200-day EMA, and moreover, a strong sell signal was recently formed in the form of the death cross.

Before you leave, please also check my previous articles on price predictions:

- Gold Is Surging And This New Gold Price Prediction Targets 35% Upside Above $5,500

- This New Dogecoin Price Prediction Shows 40% Crash Risk to $0.095 And DOGE Death Cross

- Ethereum Tracks Bitcoin as ETH Price Prediction Signals Further 60% Drop to April Lows

Bitcoin Price Analysis, FAQ

What is Bitcoin price prediction for 2025?

Bitcoin at $91,503 Thursday Thanksgiving with conflicting expert views. Tom Lee revised year-end target from $250K to "above $100K," calling it "still quite probable" with "best days" ahead in 35 remaining days but only "possibly" reaching October ATH $126,296.

Why is Bitcoin surging today Thanksgiving?

Bitcoin surging to $91,503 (+1.14%) Thanksgiving due to Fed rate cut odds jumping to 85% from 44% week ago (December meeting), 12% bounce from Friday $80,600 seven-month low as extreme oversold (RSI 23), hammer candle bullish reversal pattern and $1B liquidation clearing over-leveraged longs.

Will Bitcoin reach $100,000 by year-end?

Tom Lee says "still quite probable" Bitcoin exceeds $100K before year-end with 35 days remaining, emphasizing Bitcoin makes move in just 10 days annually (2024's top 10 days: +52%, remaining 355 days: -15% average).

Is Bitcoin in bull trap?

Yes. Bitcoin at $91,503 testing $92K-$94K resistance zone (100% Fibonacci extension + 61.8% retracement, former April-May support) represents bull trap before continued decline toward $74,421 yearly low.