Ethereum (ETH) price has tested the psychological $3,000 level, deepening medium-term lows and falling to the lowest levels in over 4 months. And although the ETH price is rising today (Monday), November 17, 2025, rebounding over 3.46% to trade at $3,199.35, my Ethereum forecasts remain bearish.

The cryptocurrency faces a potentially catastrophic 60% decline scenario as extreme fear grips the market and technical signals flash warning signs of deeper correction ahead. Let’s check together why Ethereum is falling with other crypto and what the ETH/USDT technical chart hides.

Follow me on X for more up-to-date analysis and forecasts on major cryptocurrencies and other financial instruments.

Why Crypto Is Going Down? Extreme Fear Dominates as Bitcoin Crashes Below $94,000

Bitcoin (BTC) briefly fell below $94,000 for the first time since May 6 on Sunday, triggering a cascade across the entire cryptocurrency market, including Ethereum. Analysts pointed to intensifying fear among traders and flagged possible downside risks as sentiment stayed locked in extreme fear territory. As I wrote in my previous Bitcoin price analysis, the oldest cryptocurrency may fall another 30% from the current levels.

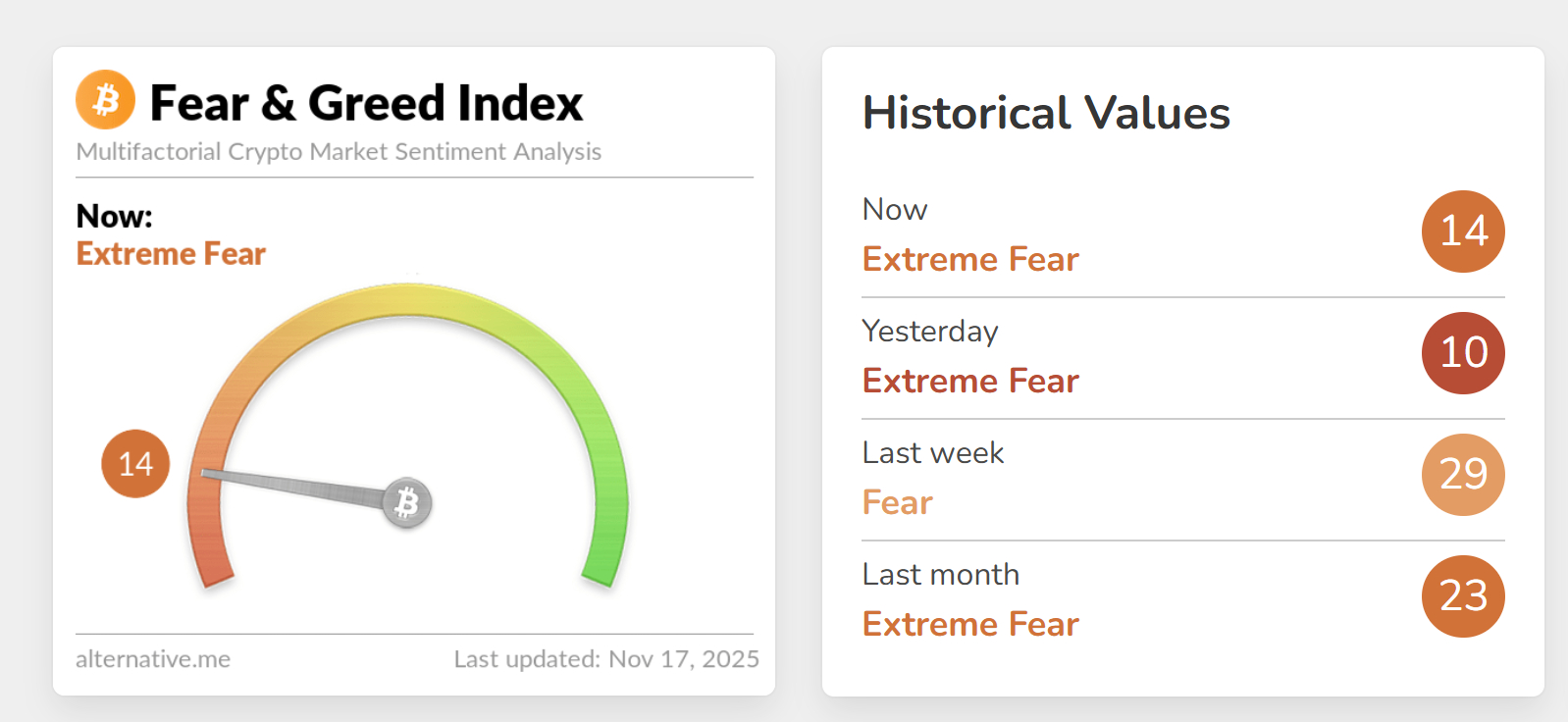

The Crypto Fear & Greed Index stood at 10, firmly in its extreme fear band, after already sitting at the same level on Saturday.

This represents one of the most severe sentiment readings in 2025, reflecting widespread panic as the crypto market experienced a $19 billion liquidation event.

"Volatility has not been limited to equity markets – economic uncertainty and the recent tech sector sell-offs have had a direct and immediate impact on the price of Bitcoin,” Hina Sattar Joshi, Director at TP ICAP Digital Assets, explained. “After the summer's exuberance, this month, the cryptocurrency experienced a $19 billion liquidation and continued the most sustained declines in price since Donald Trump's inauguration."

Ethereum has underperformed Bitcoin during this selloff, declining from its August year high of $4,955.90 to current levels around $3,199.35, a decline approaching 40% from peak levels. This underperformance signals particular weakness in the altcoin leader as institutional and retail participants alike reduce exposure to digital assets amid deteriorating market conditions.

Why Ethereum Is Falling Today? Death Cross Formation Imminent

According to my technical analysis, from this year's highs, ETH has corrected so strongly that, from a standard market perspective, it would mean entering a downtrend with double force. Moreover, since the beginning of the month we've been moving below the 200 EMA, which for me is a binary separation between bull trend and bear trend.

We'll soon see a death cross formation on the chart as the 50 EMA is rapidly approaching the crossover of the 200 EMA, which will be a strong sell signal for me. Ethereum's 50-day moving average currently sits at $3,892.98 while the 200-day moving average is at $3,467.40, a narrowing gap that suggests the crossover could occur within days. The last time such a crossover occurred was at the beginning of the year in February, when ETH subsequently fell 50% to the April lows.

"This time, the signal comes at a moment when liquidity is only starting to stabilize, December rate-cut odds have fallen from near-certainty to ~50%, and market risks remain unresolved, including Tom Lee's warnings about two major market makers facing financial deficits,” said Lacie Zhang, Research Analyst at Bitget Wallet. “With institutional flows gradually returning, traders should approach this cross with caution: it can reinforce a risk-off structure, favoring defensive positioning, hedging through derivatives, or disciplined spot accumulation."

How Low Can Ethereum Go? -60% Ethereum Price Prediction

How low could Ethereum fall? According to my ETH price forecasts, if current psychological support doesn't hold, then price will head toward the support zone determined by local highs from May and June this year around $2,700-$2,750, additionally strengthened by the 61.8% Fibonacci retracement.

The next target is $2,150, the June lows coinciding with the intraday minimum on February 3 and the lows from August 2024. This level represents a 33% decline from current $3,199 prices and would mark a significant psychological breakdown for Ethereum holders who accumulated during the summer rally.

The ultimate level of decline for me is the zone between $1,500 (September 2023 lows) and $1,370 (April 2025 minimums). If Ethereum were heading in that direction, it could lose almost 60% from current levels. This catastrophic scenario would take ETH back to year-low territory at $1,383.26, essentially erasing all gains achieved since the spring bottom.

- Ethereum Inches Toward 2021 High as Tokenized Stocks and ETFs Outpace Bitcoin Inflows

- New Ethereum Price Prediction Targets $17K by 2026. Could ETH Gain as Much as 350%?

- The Newest Ethereum Price Prediction Shows ETH Could Hit $15K in 2025

Institutional Outflows and Macro Headwinds Are Not Helping

Linh Tran, Market Analyst at XS.com, emphasized that the selling pressure extends beyond retail panic: "Bitcoin fell below the USD 93,000 mark this weekend, which is the lowest level in nearly six months. This decline marks one of the strongest corrections since the beginning of the year. It also reflects a shift in overall market sentiment from the risk-on optimism at the beginning of Q4 to a more cautious and defensive risk-off tone."

Tran continued: "From the peak near USD 125,000 in early October, Bitcoin has lost nearly 25% of its value, showing that the current selling pressure does not come only from retail investors but also from institutional flows, which are highly sensitive to macroeconomic signals."

The $19 billion Bitcoin liquidation event described by Hina Joshi represents forced selling that cascaded across all digital assets. When Bitcoin experiences such massive liquidations, altcoins like Ethereum typically suffer amplified losses as leveraged positions unwind and traders flee to cash or stablecoins for safety.

What Would Invalidate Ethereum Bearish Scenario?

What would need to happen for me to start looking at the ETH/USD chart bullishly again? First of all, we would need to return above the grid of 50 and 200 EMAs, simultaneously at the 38.2% Fibonacci retracement. In my opinion, this would open the way to looking again at a test of this year's historical highs, and earlier a return to the round level of $4,000.

Technically, Ethereum would need to reclaim the $3,600-$3,900 zone decisively, ideally on strong volume, to negate the death cross signal before it fully forms. This would require approximately 12-22% gains from current $3,199 levels—a significant move that would necessitate major positive catalysts.

Potential catalysts for reversal include:

- Aggressive Fed easing: If December rate cut materializes and guidance signals continued easing into 2026

- Ethereum network upgrades: The upcoming Fusaka upgrade delivering performance improvements

- Institutional ETF inflows: Resumption of flows into Ethereum ETFs after recent outflows

- Bitcoin stabilization: BTC holding above $90,000 and reclaiming $100,000 psychological level

- Liquidity injection: Resolution of market maker concerns and return of risk appetite

Ethereum Price Analysis, FAQ

Why is Ethereum going down?

Ethereum is declining due to multiple converging factors: the imminent death cross formation (50 EMA approaching crossover below 200 EMA), Crypto Fear & Greed Index at 10 (Extreme Fear), and the $19 billion Bitcoin liquidation event triggering cascade selling across altcoins.

Why is crypto going down?

The cryptocurrency market is experiencing one of its strongest corrections since the beginning of 2025, driven by a $19 billion Bitcoin liquidation event, extreme fear sentiment (Fear & Greed Index at 10), and a shift from Q4 risk-on optimism to defensive positioning.

How low can Ethereum go?

According to my ETH price forecasts, Ethereum faces a potential 60% decline from current levels around $3,199 to the ultimate downside zone between $1,370-$1,500 matching April 2025 and September 2023 lows.

How much will Ethereum be worth in 2025?

If the imminent death cross confirms (50 EMA crossing below 200 EMA) and $3,000 support fails, my forecast shows Ethereum could decline through multiple levels: first to $2,700-$2,750 (May/June local highs strengthened by 61.8% Fibonacci retracement), then $2,150 (June lows coinciding with February intraday minimum), and ultimately to $1,370-$1,500 matching April 2025 lows and September 2023 levels.