Tesla shares (NASDAQ: TSLA) tumbled nearly 7% Monday after CEO Elon Musk announced plans to launch a new political party, reigniting tensions with President Donald Trump and raising fresh concerns about the billionaire's focus on his electric vehicle company.

Tesla Shares Plummet as Musk's Political Party Plans Spark Trump Feud

The stock decline wiped more than $68 billion from Tesla's market capitalization, with shares falling to $293.94. Short sellers capitalized on the drop, pocketing roughly $1.4 billion in profits as investors fled the stock.

Musk revealed Saturday that he's forming the “America Party,” saying it would target “just 2 or 3 Senate seats and 8 to 10 House districts” to serve as a deciding vote on legislation. The Tesla chief argued this approach would be “enough to serve as the deciding vote on contentious laws, ensuring that they serve the true will of the people.”

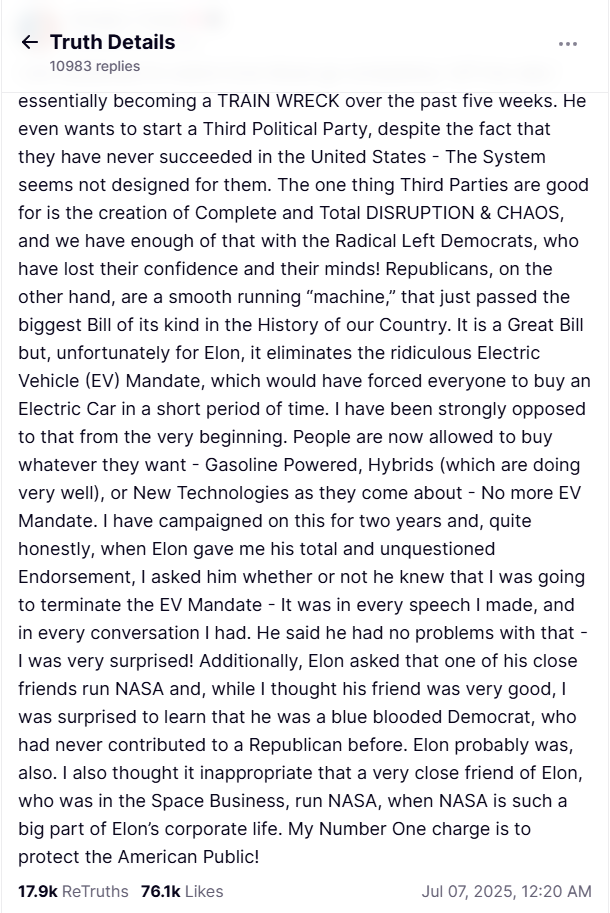

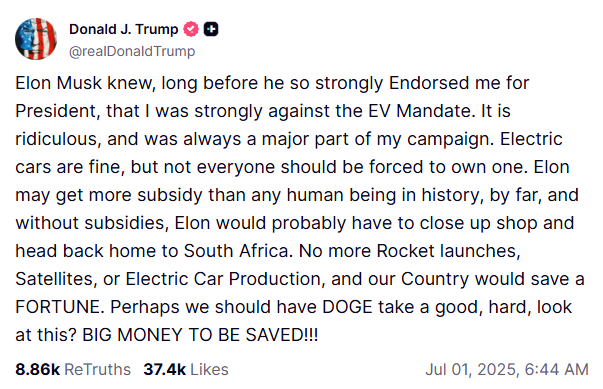

The announcement drew swift criticism from Trump, who called Musk's political ambitions “ridiculous” and said the Tesla boss had gone “completely off the rails.” Writing on Truth Social Sunday, Trump added that third parties “have never succeeded in the United States” and only create “Complete and Total DISRUPTION & CHAOS.”

This adds to the ongoing conflict between Trump and Musk, which FinanceMagnates.com covered last week when Tesla shares dropped more than 5% to similar levels. At that time, the former president suggested that the Department of Government Efficiency should investigate Musk’s subsidies.

Why Is Tesla Share Price Falling? Investor Fatigue Over Political Distractions

Wall Street analysts say Tesla shareholders are growing tired of Musk's political involvement, which they view as a distraction from the company's core business challenges.

“Very simply Musk diving deeper into politics and now trying to take on the Beltway establishment is exactly the opposite direction that Tesla investors/shareholders want him to take during this crucial period for the Tesla story,” said Dan Ives, global head of technology research at Wedbush Securities.

Ives noted that while Musk's core supporters remain loyal, “there is broader sense of exhaustion from many Tesla investors that Musk keeps heading down the political track.”

The latest political drama comes as Tesla faces mounting business pressures. The company reported a 14% year-over-year decline in car deliveries for the second quarter, missing analyst expectations. Tesla also posted its first annual sales decline as a public company, dropping about 1% compared to the previous year.

Trump-Musk Relationship Sours

The relationship between Trump and Musk has deteriorated significantly since Musk's stint leading the Department of Government Efficiency earlier this year. The two began clashing publicly in June over Trump's tax and spending legislation, which Musk criticized as fiscally irresponsible.

“When it comes to bankrupting our country with waste & graft, we live in a one-party system, not a democracy,” Musk wrote on X Saturday. “Today, the America Party is formed to give you back your freedom.”

The America Party is needed to fight the Republican/Democrat Uniparty https://t.co/fEqDuddOoI

— Elon Musk (@elonmusk) July 6, 2025

Musk stepped down from his government role in May, initially boosting Tesla's stock as investors hoped he would refocus on his companies. However, his renewed political activity has sent shares tumbling again.

Broader Market Impact

Neil Wilson, a strategist at Saxo Markets, said investors worry about two key issues: potential cuts to EV subsidies if Trump retaliates against Musk, and concerns that the CEO appears “distracted” from Tesla's business.

“Investors had cheered Musk stepping back from frontline politics but are now worried he's going to (be) sucked back in and take his eye off Tesla,” Wilson wrote.

Tesla's stock volatility reflects the company's broader challenges. The automaker is losing ground to Chinese competitor BYD, which is poised to overtake Tesla as the world's largest EV maker by annual sales. Tesla also faces intensifying competition in China, its key international market.

The company's shares have lost more than 21% this year and are down over a third from their December highs, when investors initially cheered the prospect of a Trump-Musk alliance benefiting Tesla's business.

However, technical analysis and Tesla shares price predictions suggest that bullish momentum main remain.

Tesla Shares Technical Analysis and Price Prediction for 2025

My technical analysis suggests that Tesla’s share price, after falling nearly 7%, has paused at the lower boundary of a consolidation range that has been forming for over two months. This support zone sits around the $290 level. The decline also marks a renewed drop below the 200-day exponential moving average (200 EMA) and a test of medium-term lows. So far, however, the price has consistently bounced strongly from this level. Will it be the same this time? Time will tell.

If Tesla wants to relieve some of the pressure, a return to the upper half of this sideways range would be necessary. This would mean breaking through the resistance zone between $320 and $325, which could pave the way for a move toward the upper band, local highs near $360. A breakdown below the $290 and $280 levels, however, would invalidate this bullish scenario and open the door to a retest of the consolidation range formed near the March–April lows. That would significantly raise the risk of a decline toward $220.

From a longer-term perspective, Fibonacci extensions suggest that Tesla's stock could rise substantially in the coming months, potentially reaching as high as $520, an increase of about 70% and equivalent to the 161.8% Fibonacci extension based on the previous uptrend. For me to even consider such a scenario, however, the price would first need to break above the $360 level, which marks the highest point since late May.

These reflections based on technical analysis are not entirely isolated. Analyst recommendations and forecasts from major financial institutions also point to significantly higher levels in the medium to long term. For example, Wedbush assumes the price could rise to $650, while Mizuho Securities sees potential for a move to $515.

Tesla Stock FAQ: Why Shares Keep Falling and 2025 Outlook

Why are Tesla shares falling?

Tesla shares are declining due to multiple interconnected factors that have created a perfect storm for the stock: Elon Musk's renewed political involvement, particularly his announcement of forming the “America Party,” has spooked investors who want him focused on Tesla's business challenges. The public feud with President Trump has added volatility, with Trump calling Musk “completely off the rails.”

Why does Tesla keep going down?

The persistent decline reflects structural challenges beyond short-term volatility: There's growing exhaustion among Tesla shareholders regarding Musk's political activities. As Wedbush analyst Dan Ives noted, “Musk diving deeper into politics and now trying to take on the Beltway establishment is exactly the opposite direction that Tesla investors/shareholders want him to take.” Institutional holdings have dropped to 48.74%, indicating that professional money managers are reducing their Tesla positions.

Is Tesla stock predicted to go up?

Analyst opinions are sharply divided, reflecting the uncertainty surrounding Tesla's future: Of 35–47 analysts covering Tesla, the consensus is a “Hold” rating, with roughly equal numbers recommending “Buy” and “Sell.” The median one-year price target is $291.31, implying minimal upside from current levels. Some analysts remain optimistic, with Benchmark raising its price target to $475 following the Robotaxi launch. Cathie Wood projects Tesla could reach $2,600 over the next five years.

What will be the Tesla stock price in 2025?

Price predictions for 2025 vary significantly based on different methodologies and assumptions: Wall Street median target: $291.31 (slight downside from current levels), CoinCodex forecast: $329.51 by August 2025 (12.10% upside), 24/7 Wall St. target: $352.99 (19.65% upside potential). The consensus suggests Tesla's 2025 performance will largely depend on whether the company can refocus on its core business while navigating competitive pressures and resolving the political distractions that have weighed on investor confidence.