Bitcoin (BTC) price could surge 25% from current levels to reach a new all-time high of $135,000 by the end of the third quarter, according to a fresh price forecast from global bank Standard Chartered that challenges traditional market patterns.

How High Can Bitcoin Go? New BTC Price Prediction from Standard Chartered

The British multinational bank's digital asset research head Geoff Kendrick released the bullish projection last week, arguing that Bitcoin has broken free from historical post-halving price declines due to unprecedented institutional demand through exchange-traded funds and corporate treasury purchases.

Bitcoin currently trades around $109,000, meaning the $135,000 target would represent a roughly 2% gain over the next two months. Standard Chartered goes even further, predicting Bitcoin will break $200,000 by year-end before ultimately reaching $500,000 per coin by 2028.

“Thanks to increased investor flows, we believe BTC has moved beyond the previous dynamic whereby prices fell 18 months after a ‘halving’ cycle,” Kendrick said in the Wednesday report. The analyst noted that traditional halving patterns would have suggested price declines in September or October 2025.

You may also like: Bitcoin Sets Record Close in June, With July BTC Price Predictions Target $115K

Breaking the Halving Cycle Pattern

Bitcoin's halving events occur approximately every four years, cutting mining rewards in half and historically triggering both price spikes and subsequent corrections. The most recent halving happened in April 2024, and previous cycles in 2016 and 2020 led to Bitcoin prices falling about 18 months afterward.

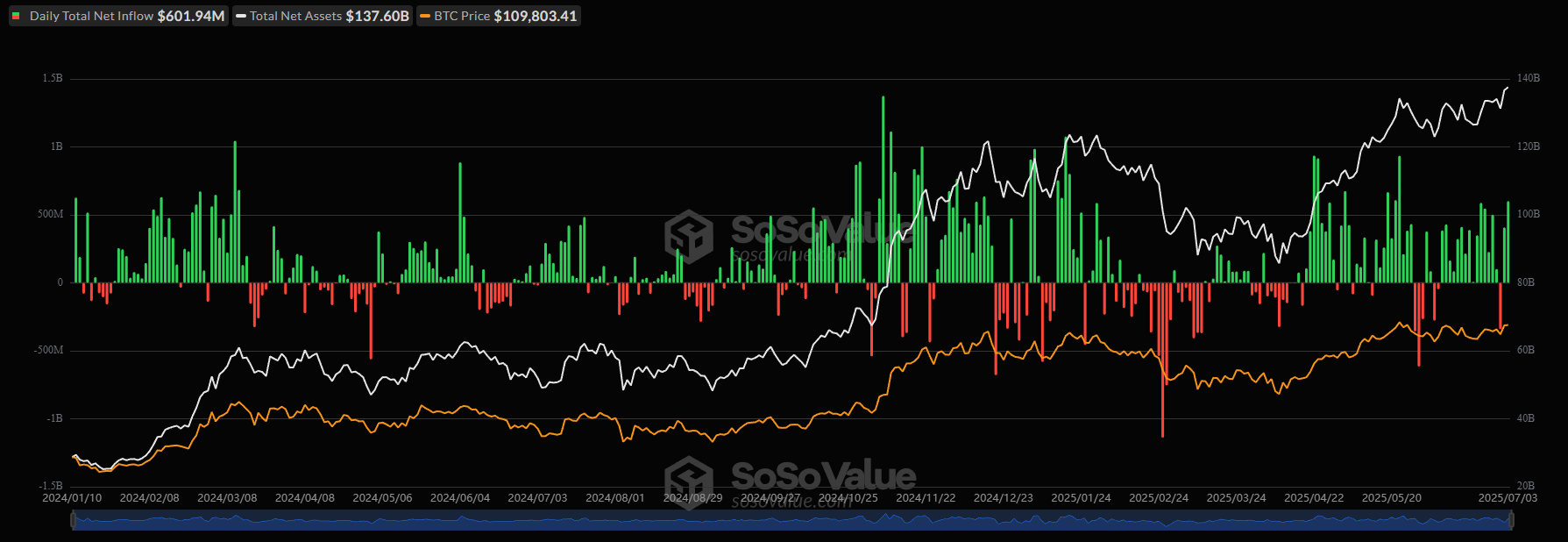

However, Kendrick argues this cycle will play out differently because of two major factors that weren't present during earlier halvings: massive ETF inflows and corporate Bitcoin buying for treasury purposes.

“We expect prices to resume their uptrend, supported by continued strong ETF and Bitcoin treasury buying,” Kendrick wrote, emphasizing these drivers were absent in previous halving cycles.

The bank's analysis shows Bitcoin ETF flows and corporate treasury buying totaled 245,000 BTC in the second quarter alone. “We expect that level to be exceeded in both Q3 and Q4,” Kendrick added.

A similar Bitcoin price growth forecast was already presented in April by Titan of Crypto, a popular analyst from X.

Mixed Signals from Recent ETF Activity

The optimistic forecast comes as Bitcoin ETF flows recently turned negative after a strong 15-day run. U.S. spot Bitcoin ETFs posted $342.3 million in outflows last Tuesday, marking their first outflows since June 6 and representing 7% of the total $4.8 billion inflows seen during the previous two-week streak.

Despite the recent outflow, Standard Chartered maintains that institutional demand remains the key driver separating this cycle from previous ones. The bank acknowledges prices could still be “somewhat choppy” in late Q3 and early Q4 due to lingering concerns about historical correction patterns.

Bitcoin Price Predictions for 2025 and 2028

The cryptocurrency market has attracted significant attention from major financial institutions, with numerous Wall Street firms and industry analysts releasing increasingly bullish Bitcoin price forecasts. These predictions span both near-term targets for 2025 and longer-term projections extending into 2028 and beyond.

Standard Chartered maintains one of the most aggressive mainstream forecasts, with the bank's digital assets research team projecting Bitcoin could reach $200,000 by year-end 2025.

VanEck, a prominent asset management firm, has outlined what they call a “dual-peak cycle” scenario for 2025. Their research team expects Bitcoin to potentially hit approximately $180,000 during a first-half rally, followed by a mid-year correction, before potentially establishing new highs in the latter part of 2025.

The Finder.com expert panel, which surveys over 50 cryptocurrency analysts and industry figures, has produced an average forecast of $161,000 for Bitcoin by the end of 2025. This consensus figure represents the collective wisdom of diverse market participants and provides a middle-ground estimate among the various predictions.

Bitcoin Price Prediction Table

Institution/Source | 2025 Target | Long-Term Projection |

Standard Chartered | $200,000 by end of 2025 | $500,000 by 2028 |

VanEck | $180,000 peak (dual-cycle scenario) | Next cycle >$400,000 |

ARK Invest | Bullish trajectory (no specific target) | $1.2M base case by 2030; $2.4M bull case |

Finder.com Expert Panel | $161,000 (average forecast) | $405,000 by 2030 |

Looking further ahead, price projections become even more ambitious. Standard Chartered has outlined a multi-year trajectory toward $500,000 by 2028, representing their view of Bitcoin's potential as institutional adoption accelerates and macroeconomic factors continue supporting alternative assets.

ARK Invest, led by Cathie Wood, has published some of the most bullish long-term forecasts in the industry. Their base case scenario projects Bitcoin reaching $1.2 million by 2030, with a bull case extending to $2.4 million. Even their bear case scenario anticipates Bitcoin reaching approximately $500,000 by the decade's end.

VanEck, while not providing specific 2030 targets, expects Bitcoin to achieve new highs beyond 2025, with some projections suggesting the next cycle could push prices above $400,000.

Why Bitcoin May Not Reach New ATH? Experts Weigh In

Not everyone shares Standard Chartered's aggressive timeline, though many agree on Bitcoin's long-term potential.

Kirill Kretov from CoinPanel expressed caution about the near-term projections: “While Bitcoin reaching $135K or even $200K by year-end is possible, especially in a thin, sentiment-driven market, I would remain cautious about taking such projections at face value.”

Kretov's on-chain research shows “larger players are actively accumulating BTC in the $100K–$110K range, while liquidity continues to be withdrawn from actively transacting wallets.” He sees near-term fluctuations between $95K and $115K as more realistic, calling the current environment “a structured accumulation phase” rather than trend-chasing.

For Bitcoin to move decisively higher, Kretov believes the market needs “clearer macroeconomic direction,” reduced volatility exploitation by large players, and “a flush of ‘dead weight’—long-standing holders hoping to exit on price strength.”

Paul Howard from Wincent offered a more optimistic but measured view: “To date, Geoff has consistently delivered more accurate price predictions than not.” Howard expects “tailwinds from fiat devaluation, and ETF activity will in all likelihood propel BTC to break $150k before year end.”

However, Howard expressed skepticism about the $200,000 target: “I will be surprised if prices touch $200k given this would arguably need around $1Tn additional market cap. I dont see where that money come from in the next 6 months but we do get there by 2027.”

Institutional Adoption Continues

The debate over Bitcoin's short-term trajectory occurs against a backdrop of continued institutional adoption. Howard noted “genuine institutional activity in digital assets spurred on by a more positive US regulatory environment,” though he warned that “the macro threat of tariffs could still spoil the recipe.”

Standard Chartered's forecast represents one of the most aggressive near-term Bitcoin predictions from a major traditional financial institution. The bank's confidence stems from its belief that ETF demand and corporate buying have fundamentally altered Bitcoin's market dynamics, potentially rendering historical price patterns obsolete.

Whether Bitcoin can achieve the predicted 25% jump to new highs this quarter will largely depend on sustained institutional demand and broader macroeconomic conditions. The cryptocurrency's ability to break free from traditional halving cycle patterns could reshape how investors approach Bitcoin's four-year cycles going forward.

Bitcoin News FAQ

What will BTC be worth in 2025?

Based on current institutional forecasts, Bitcoin is expected to reach $135,000 to $200,000 by the end of 2025, with most major financial institutions converging around six-figure targets. Key 2025 Price Predictions:

- Standard Chartered: $200,000 by year-end, with $135,000 expected by Q3

- VanEck: Peak around $180,000 in a dual-cycle scenario

- Finder.com Expert Panel: $161,000 average forecast

- Current trajectory: Bitcoin needs approximately 25% growth to reach the $135,000 Q3 target

The bullish outlook stems from unprecedented ETF inflows and corporate treasury adoption that weren't present in previous Bitcoin cycles. Standard Chartered argues these factors have broken traditional post-halving correction patterns, potentially eliminating the 18-month price declines that historically followed halving events.

How much will 1 Bitcoin be worth in 2030?

Long-term Bitcoin projections for 2030 range from $405,000 to $2.4 million, depending on adoption scenarios and market conditions. ARK Invest provides the most detailed 2030 analysis, with their base case of $1.2 million per Bitcoin assuming continued institutional adoption and Bitcoin's evolution as “digital gold 2.0.” Their bull case scenario of $2.4 million factors in accelerated corporate treasury adoption and potential sovereign wealth fund allocations.

How high can Bitcoin go realistically?

Bitcoin's realistic long-term potential depends on its role in the global financial system, but institutional analysis suggests $500,000 to $1.2 million represents achievable targets based on current adoption trends.