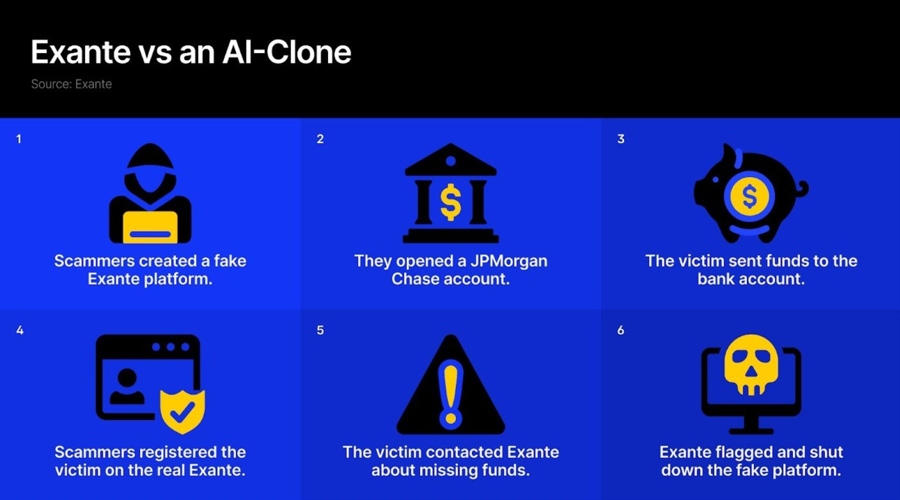

Scammers have become so sophisticated that even traditional bank accounts are within their reach. In one such case, scammers opened a JPMorgan Chase bank account and scammed at least one victim in the United States through a clone of Exante, a brokerage firm that does not even offer services in that country. The victim transferred the funds to the scammers via that JPMorgan Chase account, according to the (real) Exante.

“They managed to open real accounts with JPMorgan Chase using a US address and also opened a few crypto wallets,” Natalia Taft, Head of Compliance at Exante, told Financemagnates.com. “They set up these channels to collect money from their victims.”

Financemagnates.com also verified that the routing and account number belong to a JP Morgan Chase account.

Obtaining a Bank Account

This shows how sophisticated scammers have become. Although it remains unknown how they have opened the JPMorgan Chase account, it must be pointed out that generative artificial intelligence (AI) has become a tool for many fraudsters. Many people on social media have pointed out how easy it is to now create fake passport images using ChatGPT’s latest image generation capabilities, one of the most widely used AI tools.

Inspired by linkedin post, I decided to take a look myself at how well Chatgpt-4o handles generating passports - in short, not bad.

— Paul Kuryłowicz (@wh01s7) April 3, 2025

Image-based solutions have been bypassed for a long time, in many different ways. Now they are screwed.

🧵👇 pic.twitter.com/f736cPxAfd

Taft was certain that they used AI tools in the development of the clone platform.

Exante did not report the incident to JPMorgan Chase as they do not have a presence in the US and does not bank with JP Morgan in anyway. Financemagnates.com reached out to JPMorgan Chase, who wrote: “We’re looking into this.”

“They’ve done a very good job,” Taft said about the clone website interface. “You need some AI tools to copy and create it quickly. That’s because, for them, it’s a speed game. They have to hit as many victims as possible before being taken down.”

Taft further explained that the scammers even “replicated the trading board” of Exante. Although the fake website mentioned Exante’s Cyprus address, it targeted US clients. The real Exante does not offer trading services to US clients.

After receiving deposits from the victim, the scammers even registered the victim on the real Exante platform. When an Exante account manager contacted the new client (a scam victim), they asked about the money lost on the fake Exante platform. Although it remains unclear why the scammers registered the victim on real Exante, Taft guesses, “it's a way for them to turn the victims our way, so that they come complain to us and request their money back from us, while the scammers make a disappearance act with the money originally sent.”

“We looked for other recent examples of similar scams in the United States,” Taft continued, “and we found quite a few. This leads us to believe that it was not an isolated case.”

“Next-gen AI scams against financial services providers are an industry-wide concern", she added. "Having recently worked with US authorities to shut such a scam down, Exante is proactively seeking to raise awareness and show how the industry can take action to protect clients and partners.”

AI Is a Great Tool for Scammers, and Regulators Know It

Regulators have also started actively paying attention to AI-related scams. The US Commodity Futures Trading Commission (CFTC) also issued an advisory stating that “AI is making it increasingly easier for fraudsters to create convincing scams.”

The regulator found that scammers are using AI to create fake images, voices, videos, live-streamed video chats, social media profiles, and websites made to look like real financial trading platforms.

Although using fake celebrity images to promote scams is not new, AI tools have made it easier. The fake endorsements also look more real. There are tools that can generate deepfake videos using the faces and voices of celebrities and even politicians to lure victims.

“Fraudsters can use new technologies to hide their identities, not only in photos used on social media, but also in video chats that change their facial features and voices,” said CFTC's Office of Customer Education and Outreach (OCEO) Director, Melanie Devoe. “Telling what’s real from fake can be hard. The best defence is to never give money to people you only meet online.”

The CFTC is not the only agency warning about AI in scams. The Securities and Exchange Commission (SEC), the North American Securities Administrators Association (NASAA), and the Financial Industry Regulatory Authority (FINRA) also issued a joint warning about a rise in investment frauds involving AI and other new technologies. “Individual investors should know that bad actors are using the growing popularity and complexity of AI to lure victims into scams,” the warning said.

Last December, the Federal Bureau of Investigation (FBI) also warned the public about criminals using generative AI on a large scale. “Generative AI reduces the time and effort criminals must spend to trick their targets,” the FBI said, supporting Taft’s observations. Exante also filed a formal complaint with the FBI. Since the fraudsters were offering products under the oversight of the SEC and CFTC, Exante’s compliance team filed complaints with both agencies, as well as the State of New York and FinCEN.

However, according to CFTC's Commissioner Kristin Johnson, the regulators “have not yet fully explored the potential for AI to address cyberthreats and AI-driven fraud.” She further elaborated that a survey in among financial market participants revealed the cyberthreat actors benefit from lower barriers to entry, increasingly sophisticated automation, and decreasing time-to-exploit.

“Firms face cyberthreats from actors including opportunistic fraudsters with access to advanced AI tools to sophisticated nation-state hackers who deploy targeted attacks,” Johnson added. “Generative AI may enable sophisticated actors to execute more convincing phishing campaigns. Deepfakes and similar campaigns may be more difficult to identify... As a result, time-to-exploit is shrinking and the overall risk level to financial organizations is climbing.”

Deepfakes are a convincing way to manipulate video into something it’s not. Find out more this Sunday on Full Measure #deepfake #niccage pic.twitter.com/zYtVUGR4Nv

— Full Measure News (@FullMeasureNews) June 1, 2019

Scammers Are Organised and Running Large-Scale Operations

The scale of scam operations using deepfakes and AI tools can be seen in a recent investigation by the Organised Crime and Corruption Reporting Project (OCCRP), Swedish Television (SVT), and 30 other media partners. They uncovered two boiler room operations—one run from call centres in Georgia and the other active in Bulgaria, Cyprus, and Spain, but controlled from Israel.

The Georgian operation took $35.3 million from over 6,000 people between May 2022 and February 2025. The Israeli/European operation took at least $247 million from nearly 27,000 victims between January 2021 and December 2024.

The investigation also found that one of the fake crypto-trading websites used by the scammers was AdmiralsFX, which copied the branding of Admirals, a real forex and CFDs broker.

US regulators have also warned that unregistered online investment platforms—and unlicensed individuals or firms—are promoting AI trading systems with false claims like: “Our proprietary AI trading system can’t lose!” or “Use AI to Pick Guaranteed Stock Winners!”

“In reality, these scammers are running investment schemes using the popularity of AI,” the SEC and the other agencies noted.

The sophisticated nature of the AI-powered investment scams also became prominent in the latest Spanish police bust, which arrested six people for being a part of a scam that stole over $20 million from at least 208 victims. Scammers used deepfake ads featuring well-known public figures, claiming high returns on crypto investments. At times, they pretended to be financial advisers or showed fake romantic interest to trick victims.

🚩Detenidas seis personas por estafar más de 19 millones de euros usando #inteligenciaartificial

— Policía Nacional (@policia) April 7, 2025

🔴Engañaban a las víctimas a través de anuncios manipulados con #IA para que realizaran inversiones con #criptomonedas en productos supuestamente muy rentables pic.twitter.com/rMrdgBpOYz

“Victims were not selected randomly; instead, algorithms selected those whose profiles matched the cybercriminals’ searches,” Spanish police said. “Once they selected their victims, they placed advertising campaigns on the websites or social networks they used, offering them cryptocurrency investments with high returns and zero risk of asset loss—investments that, obviously, turned out to be a scam.”