Several contracts for differences (CFD) brokers last week were either forced to halt gold trading or imposed strict margin conditions following the sharp gold rally. The reason was one-sided, skewed exposure from their internalised trades.

Although the double-digit dip on Friday helped these brokers rebalance their books, the past few days have clearly exposed flaws in their risk management.

“The Risk of Running Out of Cash”

“Gold used to be treated much like an FX instrument, albeit a more volatile one,” said Tom Higgins, CEO at Gold-i. “However, recent XAUUSD volatility means gold now needs to be managed more like a high-volatility asset, closer to a digital asset than to FX, with far greater emphasis on A-booking than was historically the case.”

He further pointed out that the central issue from a risk perspective “is balance-sheet protection,” explaining: “If gold moves strongly in one direction and a broker is heavily B-booked, the risk is no longer just P&L volatility, but also the risk of running out of cash.”

These circumstances force brokers to tighten exposure limits on gold, hedge more frequently, and therefore make A-booking far more common than before.

Interestingly, ‘Rogue Trader’ Nick Leeson, whose actions brought down Barings Bank, on CFD brokers’ risk management, also pointed out the risks to CFD brokers when they get themselves involved in one-sided positions.

According to Higgins, around 40 per cent of gold flow was A-booked in 2023–2024, but that number has now jumped to “probably” 80 per cent.

However, he stressed that brokers are not abandoning B-booking altogether, as “it can still be highly profitable, but only if it is applied selectively.”

Read more: Gold Trading Rises to 90% of Total Volumes, but Liquidity Is Not a Concern for CFD Brokers

Most retail brokers cover the trade first and then give the client the fill. If there is slippage, clients receive the slipped price, meaning brokers are always giving clients the best price available at the time. Issues can arise if the broker fills the client first and then attempts to hedge seconds later; by then, price movements can create significant losses.

“Delayed hedging is particularly risky for volatile instruments like gold, and is not something that most retail brokers or LPs do in this industry,” Higgins continued.

- Bullion, Billions, and the Blockchain: Tether Scores $5B From Gold Rally

- Wall Street's $6,000 Gold Price Targets May Be Setting a Retail Trap, Warns Scope Markets EU CEO

- Gold Dominates Trading at Axi as Volatility And Record XAU Price Drive CFD Volumes

“The Rally Exposed Existing Risk Management Problems”

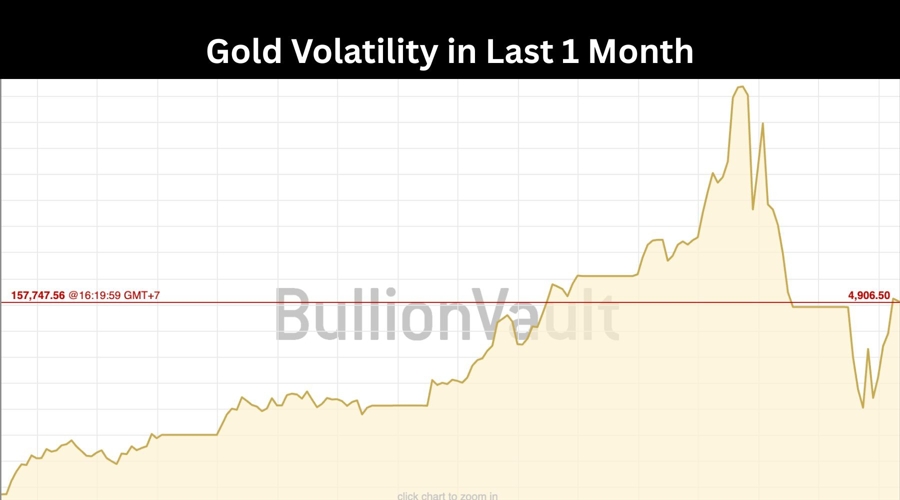

Gold has rallied about 30 per cent since the beginning of January 2025, reaching a peak of about $5,600. Although the gold price corrected sharply on Friday, the one-sided rally in the safe-haven metal has created chaos among CFD brokers.

Several industry insiders also pointed out on social media that the gold rally has pushed many B-book-heavy brokers close to bankruptcy.

"The gold rally has been in place for nearly six months, during which brokers should have adjusted their risk management frameworks," said Menelaos Menelaou, Co-CEO at XM. "However, January was characterised by sharp, dislocated price moves, particularly around market opens, which created abnormal trading conditions."

He elaborated that XM was able to execute trades efficiently even during sharp spikes in activity with its "substantial server capacity."

"Its large and diversified trading volumes across multiple asset classes allowed risk management frameworks to dynamically manage sudden changes in net exposure," Menelaou added. "Products are priced according to inherent risk, creating buffers to withstand sporadic adverse market conditions."

“The rally didn’t create new problems; it exposed existing ones,” said Domantas Mocevicius, Co-Founder and Managing Director at Hedgx. “Brokers without clearly defined risk policies, exposure limits, and escalation procedures struggled to respond in a consistent way. In some cases, decisions were reactive rather than rule-based, leading to delayed hedging, over-concentration, or inconsistent execution.”

Related: “CFD Brokers Don’t Really Understand Risk Management” - ‘Rogue Trader’ Nick Leeson

The gold rally pushed traders worldwide towards the yellow metal. On Rostro, volumes in gold futures contracts or spot instruments ranged between 50 per cent and 90 per cent, depending on geography, last year.

Data from Finance Magnates Intelligence shows that CFDs on metals accounted for more than 60 per cent of global broker volumes in the first half of 2025. Nearly 80 per cent of that came from gold contracts.

Gold-i also revealed that it has seen a 74 per cent increase in gold trading over the past couple of years. Recently, Australia-headquartered CFD broker Axi also said that gold became its dominant trading instrument.

Higgins further noted that retail positioning on gold has become “increasingly one-directional,” adding that “it is similar to Bitcoin in that many people just buy and hold it.”

“Sustained, one-way positioning pushes brokers towards higher levels of A-booking,” he added.

However, the move from B-book to A-book becomes difficult during periods of strong one-way volatility when the risk management framework is poorly structured.

“Brokers with modern execution hubs can dynamically reroute flow at multiple levels: by account, account group, symbol, symbol group, or volume threshold,” Mocevicius added. “This allows partial or full A-book routing in real time, often with adjusted mark-ups or reduced internalisation limits.”

“However, brokers relying on static configurations or manual intervention typically cannot react quickly enough. In fast-moving markets like gold, delays of even minutes can materially impact P&L. The ability to shift exposure quickly is therefore a structural capability, not an operational afterthought.”

Liquidity Providers’ Biggest Challenge – Handling Toxic Flow

One immediate response from brokers during periods of volatility is to tighten trading conditions. In mid-January, US-based futures exchange operator CME Group switched to a new margin calculation system for precious metals futures, moving away from fixed dollar amounts to percentage-based requirements following a continued rally in both gold and silver.

Brokers, meanwhile, usually raise margin requirements.

“The tightening of trading rules is primarily liquidity-driven rather than discretionary,” added the Hedgx Managing Director. “During volatile periods, many liquidity providers increased margin requirements, reduced leverage, widened spreads, or discouraged metals flow due to balance-sheet and risk concerns. As metals liquidity becomes more expensive and selective, brokers are effectively forced to mirror these conditions downstream.”

“From a technical standpoint, tightening leverage, increasing margin, or adjusting trading parameters is often the only viable way for brokers to stay aligned with LP risk limits and avoid holding unmanageable exposure.”

The XM co-CEO added: "A-book brokers, which hedge client flow directly with liquidity providers (LPs), were most exposed to the deterioration in institutional trading conditions. LPs widened spreads, increased margin requirements, and reduced leverage, while institutional counterparties typically do not benefit from negative balance protection. As a result, pure A-book brokers likely faced higher capital requirements or were forced to re-establish hedges at significantly higher costs. Against this backdrop, Friday’s price correction was broadly neutral for A-book brokers, as LP trading conditions remained restrictive."

"B-book brokers retain more flexibility, as a smaller share of flow is routed to LPs. The impact of the correction depended on broker-specific factors, including net gold exposure, the degree of hedging already in place, whether positions were net long or short, and the capital available to absorb adverse price movements."

Higgins pointed out that prime brokers also tighten conditions for smaller brokers in volatile markets. In addition, volatile markets make liquidity providers concerned about toxic flows, which arise when short-term traders take advantage of rapid price moves before positions can be hedged.

“Liquidity providers may respond by widening spreads, increasing margin requirements, or even cutting off feeds if toxic flow continues,” he concluded.