This series examines the best practices for retention and Acquisition in the retail FX space. It is sponsored by All Sherpa, a data intelligence & behavioral science company serving dozens of retail brokerages worldwide. Today we'll focus on redeposits.

Looking at the figures of our clients in the retail FX space, we can’t help wonder how some brokers still fail to grasp how crucial retention is for their business. Indeed, brokers thrive on their ability to acquire and convert, but increasing average lifespan of existing clients is no less important. In many cases, it’s nothing short of a make-it-or-break-it task.

When retention desks are killing it, lifetime value reaches 10X the initial deposit. On the other hand, we’ve seen businesses fail because they were unable to generate redeposits or increase trading volumes. It might be the struggle with

It might be the struggle with acquisition that sucks up all the broker’s resources and attention. But in most cases, we attribute such blunders to frustration with the zero-sum game between brokers and clients, which makes management skeptic and even cynical about improving client experience.

We’ve seen businesses fail because they were unable to generate redeposits or increase trading volumes

[gptAdvertisement]

Even when retention efforts are in place, too often enormous and undiscerning investments are poured to sales teams using high-pressure tactics, or generic retention software. More than any other shortcoming, these two methods completely ignore the most important drover of success: the traders’ emotions.

We know for a fact there are more honest and profitable ways for brokers to build retention business. In fact, we were able to achieve an increase of 30% in volumes and deposits by introducing surprisingly minor changes in the product or messaging. Let’s go over them one by one.

Trader Emotions drive the Numbers

To be successful in driving redeposit rates, brokers need to tap into the psyche of the trader has likely lost their money, but is still willing to redeposit and trade again. What motivate traders to redeposit? and why haven’t my redeposit rates moved after all my A/B tests? (hint: the answer is NOT the dream of ‘earning big’ that drove their first deposit).

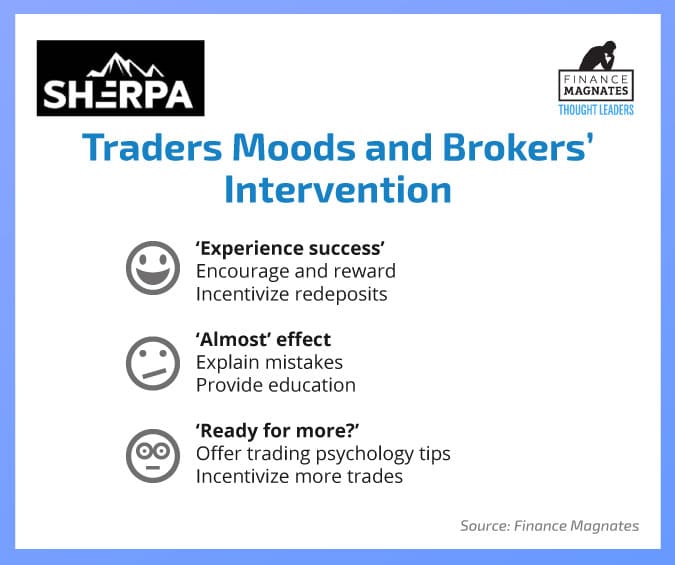

To redeposit, traders need to be emotionally reassured and clear that they are better positioned to realize their trading dreams. The desired emotions you want to encourage are the following:

‘Experience success’

They have experienced some successful trading themselves. This first-hand experience of successful trading leaves an indelible mark on the client. This successful experience - even if they haven’t cashed out - is far more powerful than any testimony or high-pressure sales call. And when stirred, it spurs traders to redeposit.

For example, when a client has made three large, successful trades or has clients doubled their balance through a series of successful trades, they will redeposit - even if they lose their capital because they have experienced success and believe they have the skills to recreate that success.

‘Almost!’ effect

Even if not successful, clients who can identify their mistakes are more confident in their abilities to trade again. It is important to help the client understand that this failure has made him closer to achieving better results next time round.

This can be achieved through timely insights and tips about their trading that help them to understand what will lead them to success. Such a motivation can be reached through a combination of data and behavioral science.

For example, “Regret Theory” applies clearly when brokers notice untypically small size trades that turned to be successful. This is an opportunity to educate clients about overcoming their hesitation that prevented them from securing more significant profits.

Brokers can guide clients to avoid the most common irrational behavior

Practically speaking, brokers can guide clients to avoid the most common irrational behavior like running losing trades for too long, and in doing so, build the client trust for redeposits. We’ve worked with brokers that have successfully built redeposit rates by simple in-app prompts that guide clients away from common mistakes.

Using real-time messaging, brokers can make clients aware of common trading pitfalls, help clients understand where they have made mistakes so that they can feel better positioned to be successful for their next trades – creating the ‘Almost!’ effect.

Unlike off-platform webinars and videos, in-platform tips tend to build confidence and ability that motivate redeposit. Framing these emotional states and help traders act upon them is necessary, but hardly enough. In order to deliver consistent success, brokers must have two additional keys in mind all across their interaction with clients.

Help clients succeed

Though counter-intuitive to brokers who may be looking at maximizing immediate profitability, brokers can help their traders succeed and develop a longer, more profitable relationships with their clients.

Practically speaking, this means reducing spreads and commissions at times in order to help traders get the full potential from their trades. This should obviously be done wisely, cherry-picking the timing and parameters for starting and stopping helping clients in order to empower traders, motivating them to continue with standard brokerage terms.

Guide, don’t teach

Traders want immediate feedback on specific trades. As grown adults, they appreciate experienced, objective guidance and are reluctant to sit through theoretical videos, webinars or ebooks. Traders need to know when they’ve done well and when they have made mistakes. More importantly, traders need tips and tools to help them improve for next time.

There are many irrational behaviors (from simple ones - running losses, stopping profitable trades, to more advanced errors like anchoring, overconfidence, etc) that can be counteracted in real-time by providing short educational snippets.

In the end, this pattern of adding discipline can bring traders to develop and implement a well-thought-out trading strategy that they are inclined to stick to – even across redeposits.

Knowing the emotional drivers behind the numbers is a proven game changer in the broker-trader relationship

Bottom Line

Anna Becker, CEO, AllSherpa

True, redeposits boil down to numbers and ROI. But knowing the emotional drivers behind the numbers is a proven game changer in the broker-trader relationship, which affects directly redeposits and lifetime value. Our clients are amazed to witness how small, yet carefully chosen interventions can change client’s trading experience and set them up for a longer term trading approach.

The science and art of retention will eventually impact, for better or worse, both your brokerage and your clients’ success. So make sure to have the expertise and experience to apply the lessons to your business.

This article has been written by Anna Becker, CEO of All Sherpa. Learn more about how data intelligence and behavioral science can drive redeposits.