Blockchain analyst defioasis.eth released data showing that roughly 70% of Polymarket's 1.7 million trading addresses have recorded realized losses, mirroring the loss rates long documented among retail CFD traders in traditional markets.

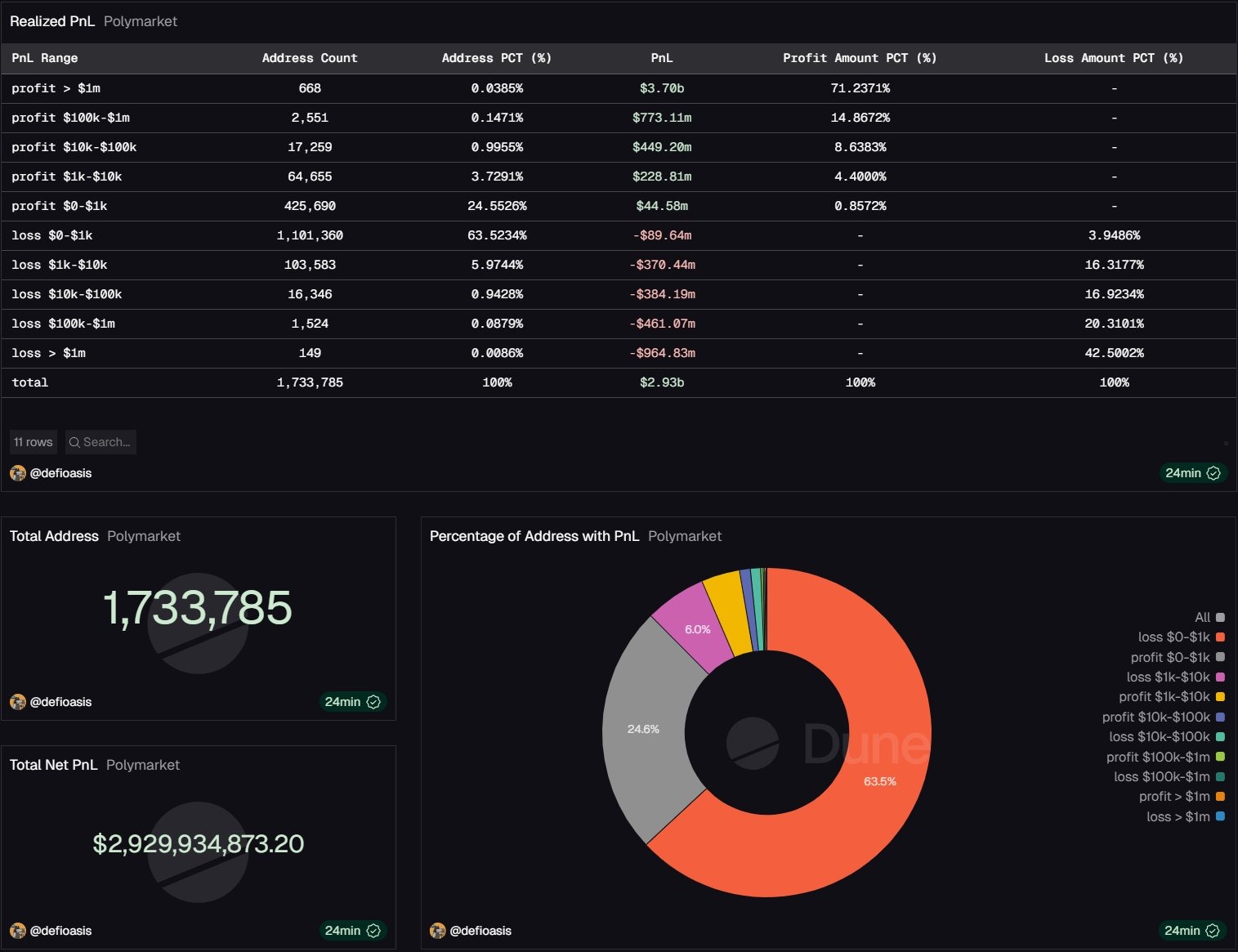

The analysis examined realized profit and loss across Polymarket's entire trading history through December 28, covering 1,733,785 unique addresses. Only 30% of participants have managed to lock in profits, while the remaining 70% sit in negative territory.

Extreme Profit Concentration Echoes Traditional Markets

The data reveals a winner-takes-all dynamic virtually identical to CFD trading platforms. Fewer than 0.04% of all Polymarket addresses captured over 70% of total realized profits, accumulating roughly 3.7 billion dollars in gains. This concentration ratio closely parallels what regulators observe in leveraged retail trading , where European brokers report 62% to 82% of accounts losing money.

Most profitable Polymarket users earned modest amounts. Addresses with realized profits between zero and 1,000 dollars represent 24.56% of all participants but captured just 0.86% of total gains. Earning more than 1,000 dollars requires breaking into the top 4.9% of all addresses.

The model appears to be proving itself. Polymarket is currently eyeing a valuation of about $15 billion, and together with Kalshi, its largest competitor, the two platforms generated nearly $7.5 billion in combined trading volume in October alone, driven mainly by sports-related contracts (or, to put it plainly, betting).

These figures are likely to keep rising. Polymarket has received the green light to return to the U.S. after its platform was blocked in 2022 and has just launched an application dedicated specifically to the U.S. market.

Small Losses Common, But Catastrophic Failures Exist

Over 1.1 million addresses, representing 63.5% of all participants, recorded realized losses between zero and 1,000 dollars. However, 149 addresses each lost more than 1 million dollars, demonstrating that while most users lose small amounts, the platform can deliver severe losses to unlucky or unsophisticated participants.

- Crypto.com's Plan to Trade Against Users Puts "No House" Model Under Scrutiny

- Ethereum’s Vitalik Buterin Defends Prediction Markets, Calling Them ‘Healthier’ Than Stocks

- Why Prediction Markets Could Kill Retail Trading Apps' Golden Goose? “A Churned User Is Worth Zero”

The methodology tracks total sale proceeds plus redemption amounts minus purchase costs, excluding unrealized gains or losses on open positions.

Defioasis.eth acknowledged limitations in the approach, noting that “the actual data can only be used as reference, pure on-chain data calculations have certain limitations, and may not have filtered out some official unlabeled contracts.”

When questioned about the 3.7 billion dollar profit figure by other analysts, defioasis.eth defended the calculation by comparing it to similar platforms: “Actually, it's not exaggerated at all, Pump Fun's Net PnL at that historical retrospective point was 3.8 billion.”

Markets Change, Retail Losses Don't

The similarity between Polymarket's 70% loss rate and the 70–80% failure rates mandated for disclosure by ESMA -regulated CFD brokers highlights a persistent reality: regardless of asset class or market structure, retail participants consistently subsidize more sophisticated players.

Whether trading currency pairs, stocks via CFDs, or political outcomes on blockchain prediction markets, roughly seven in ten retail accounts end up losing money. We can see that also in the booming retail prop trading industry.

“Whether it's prediction markets or Meme, there seems to be no difference for us retail investors,” added the analyst.

He also highlighted that Polymarket has become another venue where information asymmetry and automated market makers dominate, with one commenter describing it as “a new meat grinder” where “cognitive gaps, information gaps, insider manipulation make it normal for newcomers to find it difficult to profit.”

The analyst agreed with this assessment, noting that automated trading bots and sophisticated market makers turn casual participation into an expensive education.