The stock index that includes the largest domestic companies has plummeted to over two-year lows, and the currency has weakened to its lowest point in seven years. These are the market repercussions of the unexpected terrorist attack from Hamas on Israeli civilians that occurred this weekend. The Bank of Israel has initiated the sale of $45 billion in foreign currency reserves to manage the situation and curb the depreciation of the shekel (ILS).

Largest Fluctuation in Israeli Currency in 20 Years

The central bank in Israel has taken unprecedented measures to counter one of the most potent bouts of currency volatility that the shekel has experienced in the past two decades. Despite pumping billions of dollars into the market, the bank has not halted the steep currency depreciation following the initiation of a terrorist attack by Hamas from Gaza that led the Israeli government to announce it was at war.

Before the market opened this week, the institution issued a statement informing that it would sell up to $30 billion in reserves to support the shekel and extend an additional $15 billion through a swap mechanism. However, the market panic has not been contained, and on 9 October, the ILS lost nearly 2.7% against the U.S. dollar, reaching its lowest levels since 2016.

However, the Bank of Israel has expressed confidence in its actions and stated that an emergency interest rate hike is not needed for the time being. Indeed, intervention in the open market has allowed the reversal, or at least the halt, of further sell-offs.

⚠️BREAKING:

— Investing.com (@Investingcom) October 9, 2023

*BANK OF ISRAEL ANNOUNCES PROGRAM TO SELL $30 BILLION DOLLARS IN FX TO SUPPORT SHEKEL

*BANK OF ISRAEL: TO PROVIDE NECESSARY LIQUIDITY FOR MARKETS pic.twitter.com/BNqByKeXIJ

The USD/ILS currency pair stabilized at the beginning of the week at 3.9842 and has since dropped to 3.9535. Although the difference is minor, the central bank has managed to maintain the rate above seven-year lows.

"However, the Israeli currency has been in decline for some time due to social unrest caused by government judicial reform. It has lost 10% against the dollar since the beginning of the year," Łukasz Klufczyński, the Chief Economist at InstaForex, commented for Finance Magnates.

Moreover, speculators are reluctant to test the institution and short the ILS. The bank has amassed nearly $200 billion in reserves and has a substantial cash buffer to extinguish any speculative sell-off attempts.

"An equivalent selling of US dollars should not have any meaningful impact on Israel's solvency metrics. Israeli authorities have solid experience of intervention in the FX market," Murat Toprak, the Strategist at HSBC Holdings Plc, commented in a note this week.

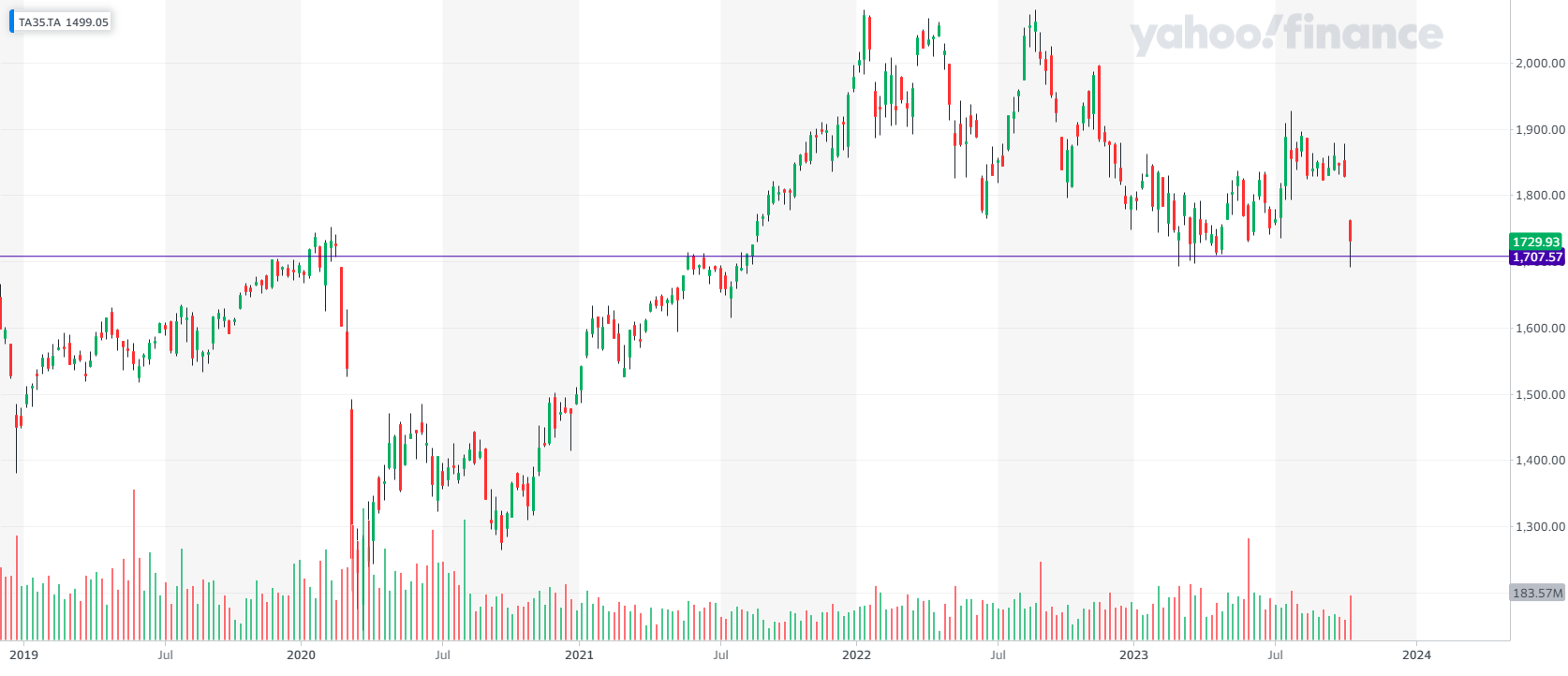

TASE's Largest Companies Index at 2021 Levels

The strong depreciation has not spared the Tel Aviv Stock Exchange (TASE). The index comprising the 35 largest Israeli companies slid during this week's opening to a level of 1692.26, hitting lows from February of the current year. It temporarily deepened its losses to 1689.98 a day later, testing the lowest levels since August 2021.

Ultimately, this year's February lows are serving as a barrier against further sell-offs, allowing TA 35 some room for an upward correction. This does not change the fact that the benchmark is still down by nearly 6%.

"If in the past the reaction in the markets was for a day or two at most, it is likely that this time we will see the local markets having difficulty recovering quickly," Ori Greenfeld, the Chief Strategist at Psagot Investment House, commented for The Times of Israel.

Greenfeld argues that the war will negatively impact Israel's global image, which has already suffered due to judicial reform. In his opinion, this could lead to a long-term weakening of local financial markets.

Significant declines were also recorded in the TA 90 index, which is comprised of the 90 companies with the largest market capitalizations on the TASE that are not included in the TA 35. However, its declines were limited to lows from June and stopped at a level of 1785.08.

"As for the old stock market saying 'buy on the sound of cannons', defense companies, in particular, reacted with growth. These changes affected the overall market capitalization of companies in the defense sector, which increased by $15 billion, reaching about $500 billion," explained Klufczyński.

As the Israel-Gaza conflict unravels, the cyber unit of Israel Police's Lahav 433 is now concentrating on disabling the channels through which Hamas receives financial support. The cyber unit has received backing from the National Headquarters for Economic Combating Terrorism at the Ministry of Defense, the General Security Service, and other intelligence agencies, according to the local media outlet 0404. As it turns out, cryptocurrencies became an important factor in financing the war against Israel.

How International Markets Reacted

The terrorist attack by Hamas on Israeli civilians has not gone unnoticed by international markets. During Monday's opening, the price of WTI crude oil rose by 4.35% to a level of $87.20 per barrel. Investors began fleeing to safe havens, benefiting gold, among other assets. It is currently rebounding from six-month lows, costing almost $1,900 per ounce.

Risk aversion has also aided "safe haven" currencies, including the Japanese yen, which has moved away from lows that could trigger intervention by the Bank of Japan, and the Swiss franc, which has been gaining against the dollar for the eighth session in a row.

"The market's initial reaction to the situation in the Middle East was textbook economics. We saw a sudden risk-off move, meaning stocks were losing while assets considered safe havens, particularly sensitive to potential conflict escalation, started to gain. Precious metals and oil were the usual winners in such situations," Klufczyński added.

Interestingly, the war in the Middle East has not triggered a capital outflow towards the dollar. The DXY index, which measures the strength of the USD against a basket of currencies, has been losing ground since the beginning of the week. Although it is still up 2% for the year, its daily chart now shows a series of consecutive bearish candles.