Tesla stock (NASDAQ: TSLA) has always been a thrill ride for investors, but as of March 11, 2025, that ride has taken a stomach-churning plunge. After a euphoric 91% surge following the U.S. presidential election in November 2024, driven by hopes that CEO Elon Musk’s alliance with President Donald Trump would propel the electric vehicle (EV) giant to new heights, TSLA has cratered.

The stock dropped over 15% in a single day on Monday, its worst decline since September 2020, wiping out more than $700 billion in market value from its December 2024 peak. Today, TSLA price sits 53% below that high, leaving investors scrambling to understand why Tesla stock is down and what it means for their portfolios.

Tesla Stock Price Today: Analyzing Recent Performance

As of today (Tuesday), March 11, 2025, Tesla stock is trading at $222.15, reflecting a decrease of $40.52 (15.4%) from the previous close. Moreover, it's hard to find a similar one-day drop on the chart in recent months, or even years. A comparable depreciation last occurred 4.5 years ago, when markets feared the global COVID-19 pandemic.

The TSLA price decline in 2025 ties to classic financial theory—supply, demand, and sentiment. Declining EV sales signal weaker revenue growth, while Musk’s role in Trump’s Department of Government Efficiency (DOGE) has sparked brand backlash, denting demand.

Add rising competition and a broader tech sector sell-off, and you’ve got a recipe for volatility. Historically, Tesla’s stock has been hypersensitive to Musk’s actions—think his 2018 “funding secured” tweet that sent shares soaring, then crashing. Today’s Elon Musk politics factor is just the latest chapter.

Why Tesla Stock Is Down Today? 4 Main Reasons

Elon Musk, known for his charismatic yet often controversial personality, has recently escalated his involvement in politics, openly endorsing candidates, critiquing government policies, and engaging in political debates through social media. Investors generally prefer corporate leaders to remain politically neutral to prevent unnecessary brand damage or regulatory backlash. Musk’s recent political commentary, however, has amplified Tesla’s exposure to reputational risks.

So, why is Tesla stock down in 2025? Four key drivers stand out:

- Slowing EV Demand and Competition: Tesla’s global sales dropped 1% in 2024, its first annual decline in over a decade, and 2025 isn’t looking better. In Europe, registrations fell 45% in January, with Germany seeing a 76% plunge. Meanwhile, China’s BYD is gaining ground with cheaper EVs and advanced self-driving tech, threatening Tesla’s dominance.

- Musk’s Political Pivot: Since joining Trump’s administration as DOGE co-leader, Musk has been a lightning rod. His push for government layoffs and far-right endorsements—like Germany’s AfD party—have sparked protests, vandalism at Tesla stores, and boycotts. A Strategic Vision survey shows Tesla’s appeal to U.S. car shoppers dropped from 22% in 2022 to 7% in 2024, a trend likely worsened by Musk-Trump administration ties.

- Market Sentiment and Overvaluation: After TSLA’s post-election rally pushed its market cap above $1.5 trillion, analysts warned of a bubble. With profit margins shrinking from price cuts and no new models since the Cybertruck, investors are rethinking Tesla’s sky-high valuation amid a tech stock rout.

- Stock market investors' fear: in just one day, the entire Nasdaq 100 index lost $1.1 trillion in value, driven by a strong sell-off of technology companies. Although Tesla was one of the leaders in the decline, Amazon (-2.4%), Meta (-4.4%), Alphabet (-4.6%), Microsoft (3.3%), and Netflix (2.7%) also experienced significant losses. The entire Nasdaq 100 slid by 3.8%, while the S&P 500 fell by 2.7%.

Data backs this up: Tesla’s automotive revenue fell 8% year-over-year in Q4 2024, and UBS predicts a 5% delivery decline in 2025—contrasting with Wall Street’s earlier 12% growth hopes. The Tesla stock drop reflects a recalibration of expectations.

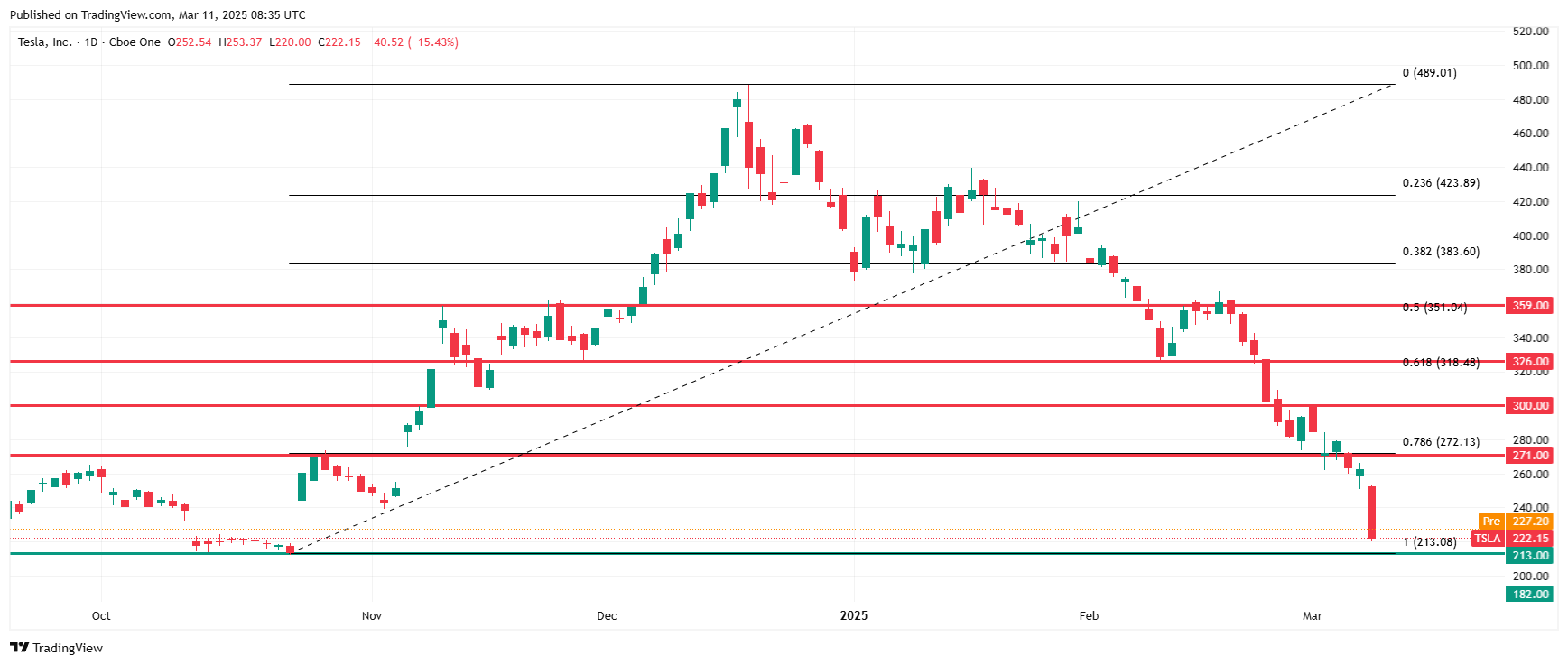

Tesla Technical Analysis

Since my last technical analysis, Tesla's price has broken through one of the key support levels at $271, which will now serve as a crucial resistance level. At the same time, it's only about a year away from testing another important level for bulls, namely $182, which marks the August 2024 lows. In my opinion, this level should provide temporary relief and a technical rebound.

However, if the fundamentals remain unfavorable and investor sentiment negative, I don't rule out a continuation of the decline all the way to $138, where the April 2024 lows are located.

Technical condition improvement could only occur when the price returns above the $271 level. Bulls will only properly return to the chart above the $351–359 zone, which is marked by local resistance combined with a 50% retracement of the uptrend from October and December 2024.

Support ($) | Resistance ($) |

213 – October lows | 271 – July highs, key resistance in the past |

182 – August 2024 lows | 300 – Psychological level & 200 EMA |

138 – April 2024 lows | 326 – Local lows from November and February |

359 – Tested in November and February |

Recent Pepperstone data reveals Tesla’s stock price has seen sharp swings lately. Over the past year, after-hours trading has outshone regular sessions, capturing 97% of gains outside normal market hours, making it a hotter spot for profits.

Tesla Stock Price Prediction 2025 and 2030

As the company grapples with its steepest Tesla stock drop since 2020, analysts are split on where TSLA is headed for the rest of 2025 and into the long term. Here’s a snapshot of the latest forecasts as of March 11, 2025:

- JPMorgan: Targets $135, a bearish call implying a 40% slide from today’s $222 close. They point to slumping EV sales and Musk’s political distractions as key risks.

- Ross Gerber (Gerber Kawasaki): Sees a potential 50% drop, citing an overstretched valuation, delays in Full Self-Driving (FSD), and Elon Musk politics pulling focus from Tesla’s core.

- ARK Invest: Stays wildly bullish with a $3,000 target, banking on Tesla’s autonomous ride-hailing dreams becoming reality by late 2025.

- Morningstar: Pegs TSLA at $250, arguing the stock’s current price—despite the TSLA price decline—still overestimates its near-term earnings power.

- Consensus Range: Analysts’ average spans $300–$528, reflecting uncertainty tied to production hiccups, electric vehicle market trends, and Musk’s Trump administration role.

Even amid the gloom, some see glimmers of hope for Tesla stock in 2025. Potential game-changers include a budget-friendly EV slated for 2026, breakthroughs in FSD that could unlock new revenue streams, and Tesla’s energy division—think solar panels and Megapack batteries—gaining traction as a diversification play.

Peering further out, Tesla stock price predictions for 2030 paint a broad picture:

- Goldman Sachs: Forecasts $1,200, expecting robust growth if Tesla holds its EV crown.

- Morgan Stanley: Predicts $850, a tempered outlook based on steady but unspectacular gains.

- ARK Invest: Doubles down with $2,500, betting big on autonomy and global scale.

The catch? Tesla’s long-term fate hinges on outpacing rivals like BYD and Volkswagen in a crowded EV arena—a challenge made tougher by today’s Tesla investor concerns over brand damage and leadership focus.

Should You Buy Tesla Stock Now?

The TSLA price decline stems from a brutal mix: sales dipping 1% in 2024 (with worse expected in 2025), fierce competition, and Elon Musk politics—particularly his DOGE role—stoking boycotts and protests. Macro pressures, like a tech sector sell-off and recession jitters, haven’t helped. Yet, Tesla’s knack for defying odds keeps optimists in the game, especially with autonomy and energy innovations on the horizon.

For investors eyeing TSLA today, it’s a risk-reward tightrope. Short-term pain is real—UBS projects a 5% delivery drop in 2025—but the Tesla stock 2025 outlook could brighten if Musk refocuses and new models hit the road.

Looking to 2030, the bulls see a titan reborn; the bears, a has-been. To decide, track Tesla stock charts, monitor electric vehicle market trends, and weigh analyst takes against your own goals.

- Why Tesla stock is down: Weak demand, rivals gaining ground, and Musk’s political spotlight are hammering TSLA.

- The broader market’s retreat—think Nasdaq’s 10% dip—has magnified the Tesla stock drop.

- Analysts are divided on 2025, but long-term bets still see upside if Tesla innovates.

- Stay sharp: Use data, not hype, to navigate this TSLA price decline and position yourself for what’s next.

Tesla Stock News, FAQ

What is causing Tesla stock price to go down?

The Tesla stock drop isn’t a one-off—it’s a pile-up of woes. Global EV sales dipped 1% in 2024, with Europe crashing 45% and China sliding too, signaling demand trouble. Competition’s heating up—BYD’s cheaper, tech-savvy EVs are stealing share, while legacy automakers pile in. Profit margins are thinning, dropping to the mid-teens in Q4 2024 after price cuts failed to spark volume.

When will Tesla stock price recover?

Pinpointing a TSLA rebound is tricky, but catalysts could turn the tide. A successful robotaxi debut—slated for mid-2025—could reignite growth if it delivers. New models, like a budget EV, might lift sales, especially if Tesla hits its 25% auto growth goal. Margins need to climb back too, and Musk refocusing on Tesla over Musk-Trump administration duties could calm Tesla investor concerns.

How much has Tesla stock price dropped in 2025?

The Tesla stock 2025 story is brutal: TSLA has tumbled roughly 25% year-to-date, lagging far behind its “Magnificent 7” tech peers. From its December 2024 peak, the TSLA price decline clocks in at 53%, a staggering fall from grace after a 91% post-election spike. This isn’t just a dip—it’s the Tesla stock drop of the decade, rivaling its 2020 plunge.

What is the Tesla stock price prediction for 2025?

Analysts are all over the map on Tesla stock 2025. JPMorgan’s bearish $135 target warns of a 40% further slide, citing sales woes and Musk’s distractions. Ross Gerber predicts a 50% haircut, hammering the same risks plus FSD delays.

Why is Tesla stock down today?

Today’s Tesla stock drop—March 11, 2025—packs a punch: a 15% single-day nosedive, the worst since 2020. Blame slowing sales (down 76% in Germany alone), Musk’s Trump administration gig sparking protests, and a Q4 2024 earnings miss that exposed shrinking margins. Rivals like BYD are nipping at Tesla’s heels, and with the stock breaking key support levels, panic selling kicked in.

Is Tesla stock a good buy at current prices?

With the TSLA price decline slashing its value 53% from December 2024’s peak, cautious investors might hesitate—its forward P/E still hovers above 100x, lofty for a company facing a projected 5% delivery drop in 2025 (per UBS). Shrinking sales and Tesla investor concerns over brand backlash tied to Elon Musk politics add to the unease.