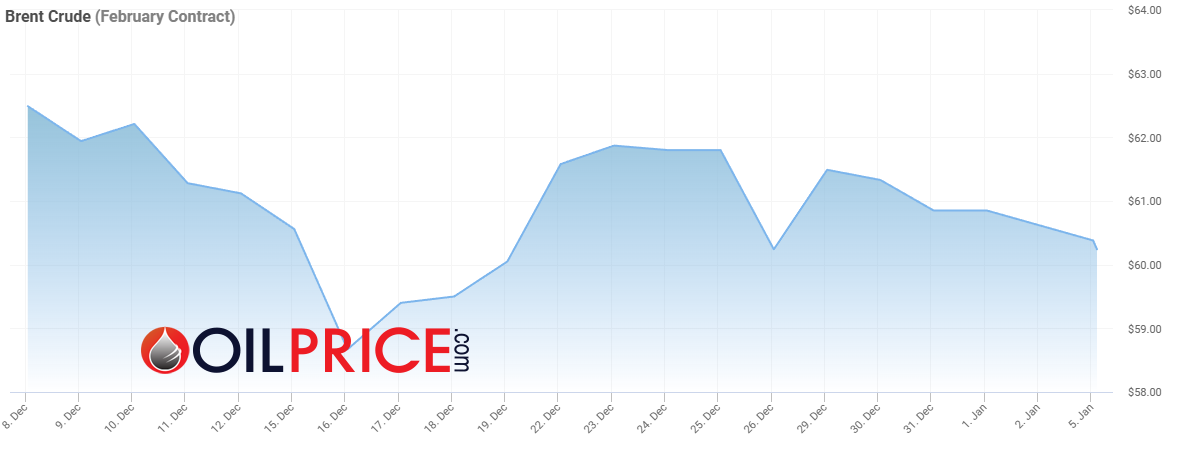

Oil markets opened Monday, 5 January 2025, trading in negative territory, with Brent crude falling 0.4% to $60.54 per barrel and West Texas Intermediate (WTI) dropping 0.5% to $57.04. Traders assessed the implications of the United States' dramatic weekend operation that resulted in the capture of Venezuelan President Nicolás Maduro.

The muted market reaction reflects a fundamental disconnect between political headlines and near-term supply realities in an already oversupplied global oil market. The market, however, fell while precious metals rebounded.

As a result, I am looking for answers to why oil is falling. I review the latest oil price predictions and conduct a technical analysis of crude oil charts, drawing on my more than 10 years of experience as an analyst and trader.

Why Are Oil Prices Falling Today?

Due to the dramatic geopolitical developments in Venezuela over the weekend, oil prices slipped lower as markets confronted a more complex reality than simple supply disruption narratives suggest.

President Donald Trump announced the US would maintain its embargo on Venezuelan oil in full effect, while simultaneously stating that American companies are prepared to return and invest in the country's struggling oil sector.

Nicolas Maduro had his chance — until he didn’t.

— The White House (@WhiteHouse) January 4, 2026

The Trump Admin will always defend American citizens against all threats, foreign and domestic. 🇺🇸🦅 pic.twitter.com/eov3GbBXf4

The bearish price action stems from several converging factors:

- Massive oversupply: Global oil supplies currently exceed demand by approximately 3.85 million barrels per day, representing nearly 4% of worldwide consumption

- Unchanged forecasts: Goldman Sachs maintained its 2026 price forecasts at $56 for Brent and $52 for WTI, signaling limited immediate impact

- OPEC+ inaction: The cartel decided to maintain current output levels, effectively acknowledging its limited ability to support prices

Kyle Rodda, senior market analyst at Capital.com in Melbourne, explained that "the implications are limited in the short-term and relatively contained to the energy complex." The market's tepid response underscores how Venezuela's production has already been constrained for years due to mismanagement, sanctions, and deteriorated infrastructure.

Trading crude oil, including Brent and WTI, is available through many CFD brokers, which provide exposure to this market via derivative instruments.

Venezuela's Oil Recovery: Years, Not Months

The Orinoco Challenge

Contrary to simplistic "war for oil" narratives circulating in international media, the path to meaningful Venezuelan production increases faces substantial obstacles. The country's Orinoco Belt contains heavy-to-extra-heavy crude that requires diluents, upgrading capacity, stable logistics, and massive reinvestment after years of decline.

Cyril Widdershoven, a geopolitical strategist specializing in energy markets, noted that "international media is reaching—again—for the most straightforward explanation of Washington's strike on Venezuela: 'war for oil.' It's a convenient narrative. It's also analytically weak."

He emphasized that "even under highly optimistic assumptions, meaningful incremental barrels take years, and truly transformative volumes take a decade+."

Production Timeline Projections

Timeframe | Production Target | Current Level |

Current (2026) | 800,000 bpd | Baseline |

2-Year Scenario | 1.3-1.4 million bpd | +62-75% |

10-Year Optimistic | 2.5 million bpd | +212% |

Historical Peak (1970s) | 3.5 million bpd | Reference |

JPMorgan analysts project Venezuela could raise oil production to 1.3-1.4 million barrels per day within two years, potentially reaching 2.5 million bpd over the next decade. However, this optimistic scenario depends on political stability, clear governance frameworks, and billions in capital investment that oil majors are hesitant to commit without regulatory certainty.

The Investment Dilemma

The White House has reportedly told US oil executives including ExxonMobil and ConocoPhillips that they would need to front investment capital themselves to rebuild Venezuela's oil industry as a precondition for recovering debts from past expropriations. ConocoPhillips alone seeks to recover some $12 billion from the Chavez-era nationalization of its Venezuela assets, while Exxon Mobil filed international arbitration cases trying to recover $1.65 billion.

This is absolutely insane:

— The Kobeissi Letter (@KobeissiLetter) January 3, 2026

Venezuela currently has 303 billion barrels of crude oil reserves, which Trump says the US now controls.

Oil prices are trading at ~$57/barrel, making Venezuela's total reserves worth $17.3 TRILLION.

Even if the US sells this oil for HALF of the…

Oil Price Predictions

Downside Risks Dominate 2026 Outlook

Multiple forecasts point to sustained pressure on oil prices throughout 2026. The US Energy Information Administration projects Brent at $55 per barrel for Q1 2026 persisting through the year, while bear case scenarios suggest prices could dip below $50 mid-year if oversupply pressures intensify.

JPMorgan analysts estimate a $4 per barrel downside to 2030 oil prices in a scenario where Venezuelan crude production rises to 2 million bpd.

Helal Naeem, country manager at OneRoyal, observed that "markets do not price headlines. They price scenarios," adding that the smart money is watching whether oil exports are actually disrupted, how sanctions evolve, and whether there's a clear political roadmap or power vacuum in Caracas.

Technical Analysis: Support Levels Under Pressure

Current Chart Setup

According to my technical analysis, Brent crude's chart shows little change in the overall bearish structure. The commodity is trading below $61 per barrel but remains within a critical support zone established by early 2025 lows and tested in the first half of December in the $60-59 range, coinciding with the lowest levels in five years since January 2021.

What I see on the Brent chart currently:

- Moving averages: The shorter 50-period exponential moving average serves as dynamic resistance, creating the upper boundary of a regression channel

- Immediate resistance: $63.70 per barrel, aligning with local lows from June

- Secondary resistance: $65.50 converging with the 200 EMA

- Major resistance zones: $70 and $72, marked by 2023 lows and second-half 2024 lows

Downside Targets

If current support fails to hold, the next significant level lies at $50 per barrel, corresponding to the lows from the turn of 2018-2019. At current prices, drawing further upside ranges seems unjustified given that oil appears more likely to decline than appreciate.

- Why Silver Is Falling With Gold and Why Robert Kiyosaki Predicts a $200 Price by 2026

- Oil is pushed down as OPEC+ raises production

- Gold Retreats After Record High, Silver Falls but Gains in Tokenized Markets

Commodities Markets React: Gold and Silver Surge

While oil prices declined, precious metals rallied strongly on Monday as safe-haven demand returned following the weekend's geopolitical shock.

Monday's Commodity Performance:

- Gold: +1.0% to $4,420 per ounce

- Silver: +3.5% to $75.32 per ounce

- Platinum: +3.26% to $2,214 per ounce

- Palladium: +2.41% to $1,657 per ounce

- Copper: +2.86% to $5.85 per pound

Kyle Rodda noted that "we are definitely seeing a response in precious metals though and that's the market front-running governments and upping their exposure to non-dollar (and non-fiat) alternatives."

Precious Metals' Remarkable 2025 Run

Silver extended its remarkable run that saw the white metal reach an all-time high of $83.62 earlier in the week. Both platinum and palladium posted record-breaking performances in 2025, with platinum surging 127% and palladium gaining 76%, its best showing in 15 years.

Copper traded around $5.85 per pound, up on the day but still below its July 2025 all-time high of $5.94. Industrial metals are receiving support from persistent supply constraints and demand expectations, though economic concerns continue weighing on sentiment.

Market Implications: Political Risk Premium Returns

The Venezuelan situation reintroduces political risk premiums that had been largely absent from commodity markets during the extended period of oversupply. However, this premium manifests differently across asset classes. Oil markets are treating the development as a potential long-term supply addition that could depress prices, while precious metals are responding to the geopolitical uncertainty itself.

Cyril Widdershoven emphasized that "the real market impact is not immediate relief but a risk premium, legal uncertainty, sanctions whiplash, trade-flow distortions, and higher friction for tankers, insurers, and refiners."

He added that "governance and licensing durability will decide whether Venezuela's 'oil prize' ever becomes investable again."

Regional Instability Concerns

Trump raised the possibility of further US military interventions in Latin America on Sunday, suggesting Colombia and Mexico could face military action if they do not reduce the flow of illicit drugs to the United States. These threats add another layer of regional instability that markets will need to monitor, particularly given the potential impacts on energy infrastructure and trade flows.

Venezuelan interim government officials, led by acting president Delcy Rodríguez, initially denounced Maduro's capture as a kidnapping before striking a more conciliatory tone. Rodríguez extended an invitation to the US government to work together on a cooperation agenda, though Secretary of State Marco Rubio said Washington would watch her actions more than her rhetoric.

The entire world is talking about Venezuela’s oil.

— Shanaka Anslem Perera ⚡ (@shanaka86) January 4, 2026

Nobody is talking about the gold.

161 metric tons.

$22.5 billion at today’s prices.

The largest gold reserves in Latin America.

Every $100 gold rises, these holdings gain $518 million.

And that’s just what’s in the vaults.… pic.twitter.com/CylZRSSj1y

Oil Prices and Venezuela Impact, FAQ

Why are oil prices going down today?

Oil prices fell on Monday despite Venezuela's political upheaval because global markets are already oversupplied by nearly 4 million barrels per day. Traders recognize that meaningful Venezuelan production increases will take years, not months, to materialize due to infrastructure damage and the need for billions in new investment.

Why is oil stock going up when crude prices fall?

While crude prices declined Monday, some oil stocks may rise on expectations of long-term opportunities in Venezuela. Major oil companies like ExxonMobil and ConocoPhillips could potentially recover billions in debts and gain access to massive reserves if they invest in rebuilding Venezuela's production capacity.

Will oil prices rise in 2026?

Most analysts expect oil prices to remain under pressure throughout 2026. Goldman Sachs forecasts Brent at $56 per barrel, while JPMorgan warns that successful Venezuelan production recovery could add $4 per barrel in downside risk through 2030. The global oversupply situation suggests limited upside potential.

Why are gold and silver prices rising if oil is falling?

Gold and silver are rising as safe-haven assets in response to geopolitical uncertainty from the Venezuela situation. Investors are hedging against political risk and potential dollar weakness, with gold up over 1% and silver surging 3.5% on Monday. This divergence shows markets pricing different aspects of the same event.

What does Venezuela's situation mean for gas prices?

The immediate impact on gas prices is minimal because Venezuela's current production of around 800,000 barrels per day represents only 1% of global output. US sanctions remain in place, and any production increases would take years to materialize, limiting near-term effects at the pump.