As of April 1, 2025, Microsoft (NASDAQ: MSFT) stock has hit a 15-month low, sliding to $375.39. Yet, despite this stumble, Wall Street analysts remain optimistic, with 2025 price predictions still painting a bullish picture. So, what’s dragging Microsoft stock down today, and why are experts betting on a rebound?

Let’s break it down in plain terms: competition from Amazon and Google, regulatory pressures, tariff troubles, and a rough quarter for the broader market. By the end, you’ll have a clear picture of what’s happening—and what might lie ahead.

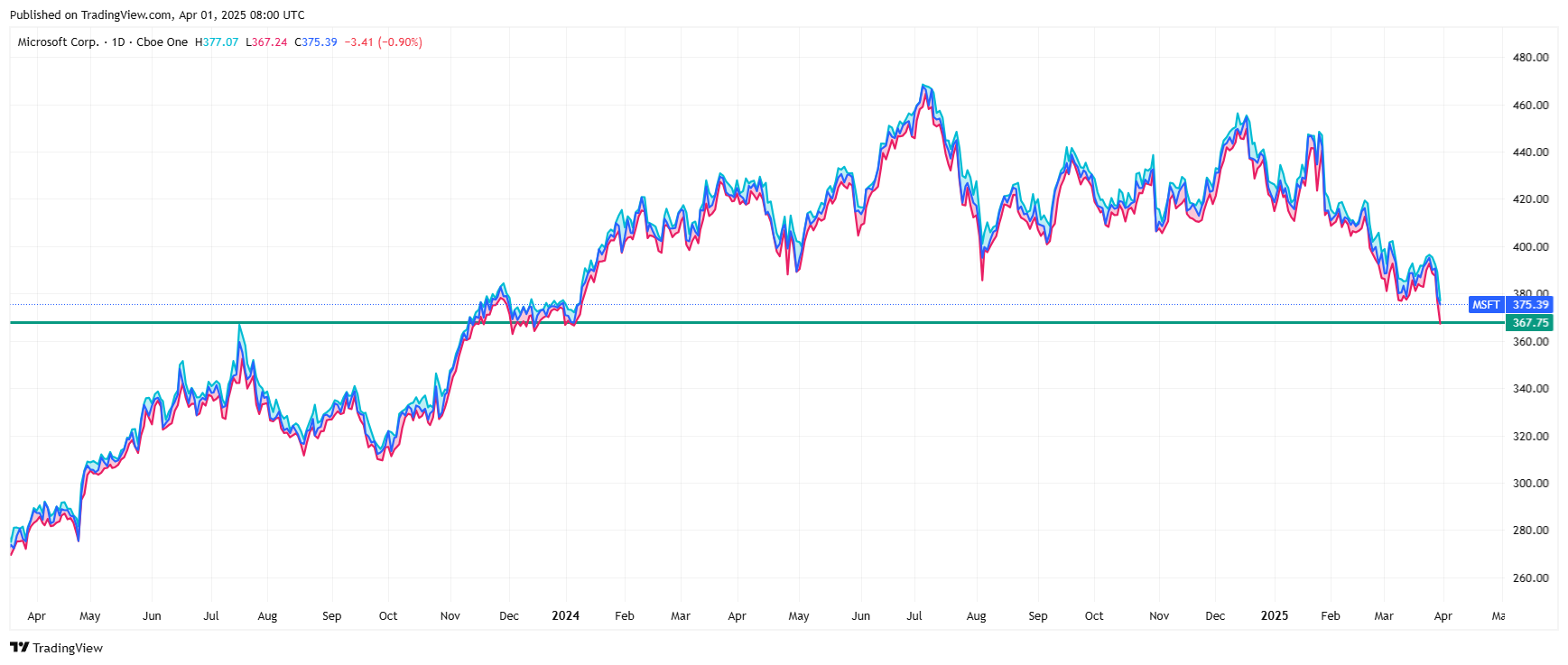

Microsoft Stock Price Tests January 2024 Lows

On Monday, March 31, 2025, Microsoft shares fell 0.9%, closing the final session of the first quarter at $375.39. At one point during the day, however, the stock dropped more sharply, reaching $367.24 and testing its lowest level since January 2024—a 15-month low.

Over the entire first quarter, Microsoft shares declined nearly 11%, continuing their retreat from the record highs of 2024. From a peak of nearly $470, the stock has now fallen more than 20%.

While it's little consolation for shareholders, Microsoft is not alone in its losses. Amazon dropped 1.28%, closing at $190.26 and hitting a six-month low. Meanwhile, the broader Nasdaq 100 index slid to its lowest level since September last year.

You may also like: Microsoft Hangs Up on Skype, Ending a Two-Decade Legacy in Favor of Teams

What’s driving the sell-off in Microsoft shares? Let’s take a closer look.

Why Is Microsoft Share Price Going Down? Key Drivers

Competition with Amazon and Google: A Cloud and AI Battle Royale

Microsoft’s Azure cloud platform is a crown jewel, but it’s locked in a fierce fight with Amazon Web Services (AWS) and Google Cloud. Azure’s revenue grew 31% in the fiscal second quarter of 2025 (ended December 31, 2024), but it missed Wall Street’s 31.8% expectation. Meanwhile, AWS continues to dominate with a larger market share, and Google Cloud is gaining ground with lower-cost AI offerings.

Amazon’s AWS benefits from its early-mover advantage and massive scale, while Google’s AI innovations—like cheaper models challenging Microsoft’s OpenAI partnership—threaten to undercut Azure’s pricing power. For retail investors, this means Microsoft’s hefty $87 billion capital expenditure (capex) in 2025—up 55% from last year—might not deliver the immediate returns Wall Street craves.

Provider | Market Share (2025 Est.) | Q1 2025 Revenue Growth | Key AI Offering |

Microsoft Azure | 21% | 32% | OpenAI-powered tools |

Amazon AWS | 30% | 18% | SageMaker AI |

Google Cloud | 13% | 34% | Vertex AI |

The worry? Microsoft is pouring cash into AI and cloud infrastructure, but Amazon and Google could steal the spotlight if they scale faster or cheaper.

Regulatory Impacts: Antitrust Shadows Loom Large

U.S. Federal Trade Commission (FTC) is probing Microsoft’s cybersecurity deals with the government, hinting at potential antitrust concerns over locking in customers. Globally, its $69 billion Activision Blizzard acquisition still faces scrutiny, even after closing in 2023. While the UK’s Competition and Markets Authority recently cleared Microsoft’s OpenAI partnership, the regulatory spotlight remains intense.

Regulatory hurdles could delay Microsoft’s growth plans—like expanding AI through Azure—or lead to fines that dent profits. It’s not a dealbreaker, but it’s enough to spook the market, contributing to the stock’s 15-month low.

Tariff Impacts: A New Trade Headache

Tariffs are back in the news, and Microsoft isn’t immune. In late 2024, President Trump proposed a 25% tariff on non-U.S.-made cars, set to kick in on April 2, 2025. While Microsoft doesn’t make cars, tariffs ripple through the economy. Higher costs for imported tech hardware—like chips powering Azure’s data centers—could squeeze margins. Plus, if trade tensions escalate, Microsoft’s global supply chain (think China-made components) might face disruptions.

Retail investors might wonder: how big is this hit? It’s not catastrophic yet, but with Microsoft spending billions on infrastructure, even small cost hikes add pressure. Analysts estimate tariffs could shave a few percentage points off profitability if they broaden beyond cars—a risk worth watching.

Others also liked: Why Meta Stock Is Down? Cathie Wood Sells The Magnificent 7 META Shares

A Bad Quarter for S&P 500, Nasdaq, and Wall Street

Zoom out, and Microsoft’s woes aren’t solo. The S&P 500 and Nasdaq are reeling from a tough Q1 2025. Stifel’s Barry Bannister predicts the S&P 500 could drop 26% to 4,700 by year-end after a 10% rally, citing overvaluation (21.4 times earnings vs. a 10-year average of 18). The Nasdaq, heavy with tech stocks like Microsoft, feels the heat too. Wall Street’s mood soured after mixed earnings, with Microsoft’s own Q2 cloud miss fueling the gloom.

After testing all-time highs in Q1 2025, the S&P 500 is now undergoing a sharper correction, falling 4.6% after six consecutive quarters of gains. Meanwhile, the tech-heavy Nasdaq has dropped nearly 9%, also retreating from its record highs.

$US $SPX #SP500

— Marco Olevano, CFA (@MarcoOlevano) April 1, 2025

A quarter to forget for the S&P 500. Despite eking out a 0.6% gain on Monday, the equity benchmark posted its worst period versus the rest of the world since 2009. BBG pic.twitter.com/5j5uEs6sgO

Microsoft Share Price Technical Analysis

According to my technical analysis, Microsoft's share price has broken below a key support zone that had held since early 2024, located between $385 and $390. The stock also slipped beneath the 2025 year-to-date lows from early March, signaling further weakness.

The current decline has paused near a support level identified around the July 2023 highs, at approximately $367. This area was tested heavily in December 2023 and early 2024, ultimately serving as a springboard for a stronger rebound.

Adding to the bearish outlook, Microsoft shares have remained trapped within a clearly defined downward regression channel for the past five months. This structure continues to pressure the price lower.

What does this mean? In my view, Microsoft has more room to fall than to rise at this point. I’ve identified the following key support levels to watch:

- $338.85 – corresponding to the September 2023 highs

- $309 – the lows tested in August and September 2023, which marked the beginning of Microsoft’s last significant rally

A move back above the resistance zone marked in red on the chart would invalidate the bearish scenario. If that happens, the first upside target would be the Q4 2024 lows, around $404, followed by the all-time high near $468. While this rebound seems unlikely for now, recent analyst forecasts suggest it cannot be completely ruled out.

Microsoft Stock Price Predictions for 2025 and Beyond

Despite the 15-month low, the outlook isn’t bleak. Here’s what experts are saying about Microsoft’s stock in 2025 and beyond, including the latest from Stifel and others:

- Stifel’s Take (March 6, 2025): Stifel cut its price target to $475 from $515, yet kept a “Buy” rating. Why the trim? Analysts see Microsoft’s $87 billion 2025 capex as a gamble—huge AI bets (like Azure’s $10 billion genAI run rate) need time to pay off. They expect double-digit growth long-term but warn the stock might stay “range-bound” until cloud revenue outpaces spending again.

- Piper Sandler (March 25, 2025): Piper Sandler holds an “Overweight” rating with a $520 target—31% above today’s price. They’re bullish on Azure’s momentum and Microsoft’s $100 billion-plus cash flows, per X posts. AI leadership keeps them confident.

- Morgan Stanley: Calling it a “Strong Buy,” Morgan Stanley sees Microsoft hitting $500 by late 2025. They highlight Office 365 and Teams anchoring steady revenue, even if cloud growth wobbles.

Analyst Firm | Price Target | Rating | Potential Upside |

Stifel | $475 | Buy | 20% |

Piper Sandler | $520 | Overweight | 31% |

Morgan Stanley | $500 | Strong Buy | 26% |

Consensus Average | $510 | Strong Buy | 29% |

Microsoft Share Price News FAQ

Why Did Microsoft Stock Go Down?

Microsoft stock dropped to a 15-month low of $375 by April 1, 2025, due to a mix of pressures. Azure’s cloud growth (31% in Q2 FY25) missed Wall Street’s lofty expectations, facing stiff competition from Amazon AWS and Google Cloud. Regulatory scrutiny over cybersecurity deals and the Activision Blizzard acquisition rattled investors.

Why Is Microsoft Declining?

Microsoft’s decline stems from short-term stumbles and broader economic woes. Regulatory headaches—like U.S. probes into government contracts—add uncertainty. Tariffs could hike costs for hardware powering Azure’s data centers, squeezing margins. Meanwhile, Wall Street’s tough quarter, with the S&P 500 overvalued at 21.4 times earnings, has soured sentiment. It’s not a collapse—just a lull amid big spending and market jitters.

Is Microsoft Expected to Rise?

Yes, analysts expect Microsoft to rise in 2025 despite its current dip. Stifel cut its target to $475 (19.6% upside from $396.89) but kept a “Buy” rating, while Piper Sandler ($520, 31% upside) and Morgan Stanley ($500, 26% upside) stay bullish. The consensus average of $510.03 signals a 28.5% climb, driven by Azure’s $10 billion AI revenue run rate and Microsoft’s strong cash flows.

Can Microsoft Stock Reach $1000?

Yes, reaching $1,000 is a long shot by 2025, but not impossible long-term. Current 2025 targets top out at $650 (per TipRanks’ high-end range), with CoinPriceForecast projecting $850–$1,000 by 2030 if AI and cloud dominance hold.

Why Is Microsoft Not in FAANG?

You might wonder: why isn’t Microsoft lumped with FAANG (Facebook, Amazon, Apple, Netflix, Google)? The term, coined in 2013 by Jim Cramer, spotlighted high-growth, consumer-facing tech stocks.

Microsoft, though a tech titan, didn’t fit the mold back then—it was seen as a legacy software giant, not a flashy growth story. Today, with Azure and AI, it rivals FAANG in innovation, but the label stuck to its original crew (now often FAANGM with Microsoft tacked on informally).