Bitcoin (BTC) price shattered its previous all-time high over the weekend, climbing above $125,700 as crypto markets rallied to a record $4.24 trillion in total market capitalization. The surge comes as investors pile into digital assets ahead of an expected Federal Reserve interest rate cut later this month, with spot Bitcoin ETFs recording their second-largest weekly inflow ever.

The world's largest cryptocurrency by market value peaked at $125,736 on Sunday before settling today (Monday, 6 October 2025) around $124,100, marking roughly an 11% gain over the past seven days.

Bitcoin price analysis shows the digital asset trading up 1% in the last 24 hours, extending a winning streak that now spans six consecutive sessions. The previous record of $124,474 was set in mid-August before summer consolidation kept prices rangebound through September.

Why Bitcoin Price Is Going Up? ETF Inflows Signal Institutional Appetite

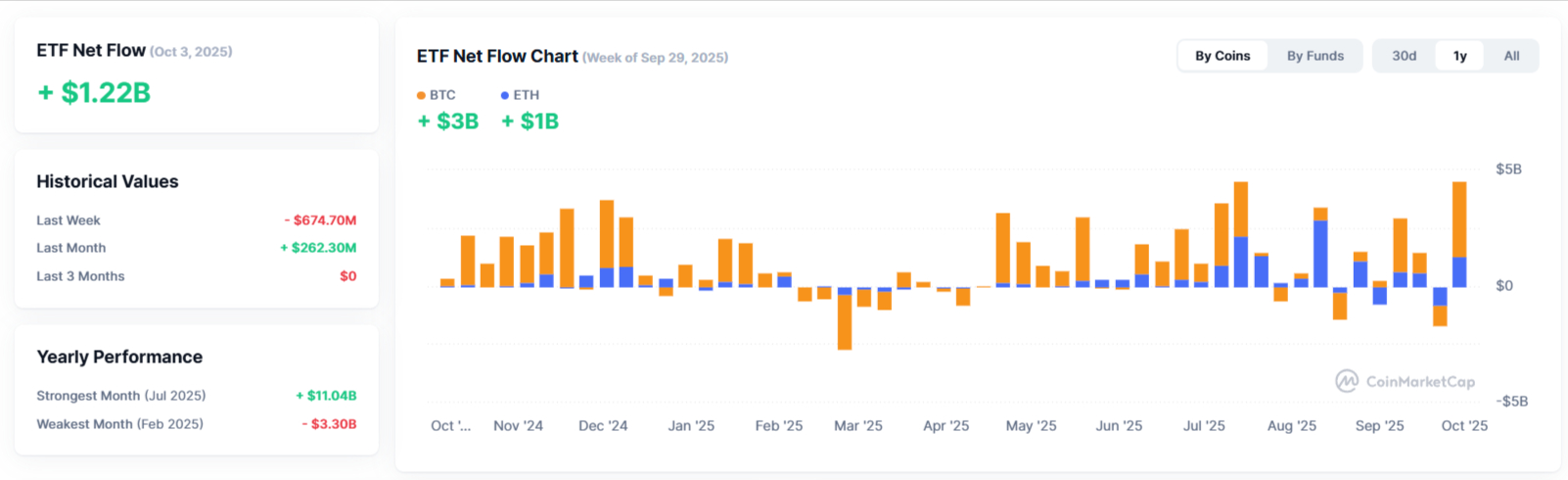

Spot BRC exchange-traded funds attracted $3.24 billion in net inflows last week, the second-highest week since their January 2024 launch. BlackRock's iShares Bitcoin Trust led the charge with $1.8 billion, while Fidelity's FBTC brought in $692 million. The institutional buying spree reversed the prior week's $902 million in outflows and brought four-week cumulative inflows close to $4 billion.

"Crypto markets rally to all-time high as investors increase Fed interest rate cut bets," said Simon Peters, crypto analyst at eToro. "Spot bitcoin ETFs saw $3.24 billion in net inflows last week, the second-largest week of inflows ever, helping propel the OG cryptoasset's price to a new-all-time high."

Markets are now pricing in a 98% probability of a 25-basis-point rate reduction at the Federal Reserve's October 29 meeting. Weaker-than-expected employment data fueled speculation that policymakers will continue easing monetary conditions, with the ongoing government shutdown preventing release of September's official nonfarm payrolls report. ADP private sector figures showed a surprising 32,000 job decrease where analysts anticipated a 50,000 increase.

Bitcoin Price Today: Current Market Snapshot

Metric | Value | Change (7 Days) |

Bitcoin Price | $124,100 | +11% |

Total Crypto Market Cap | $4.24 Trillion | +8.2% |

Bitcoin Market Cap | $2.47 Trillion | +10.8% |

Ethereum Price | $4,564 | +7.5% |

XRP Price | $3.00 | +4.9% |

Stablecoin Market Cap | $300+ Billion | +47% YTD |

6 Key Reasons Why Bitcoin Price Is Surging

Key factors driving the Bitcoin price surge include:

- Federal Reserve rate cut expectations reaching 98% probability for October 29 meeting

- Weakening U.S. dollar down 30% against Bitcoin year-to-date

- Government shutdown creating political uncertainty and fiscal concerns

- Record stablecoin market capitalization crossing $300 billion milestone

- Institutional adoption accelerating through treasury allocations and ETF vehicles

- Historical October performance patterns supporting bullish sentiment

Technical Resistance Tests Bitcoin Rally

Bitcoin price prediction models identify several key technical levels as the cryptocurrency tests resistance near its summer highs. According to my technical analysis, The zone between $124,000 and $125,700 has created a supply cluster that Bitcoin failed to decisively break through on Sunday, with the daily candle showing a long upper wick that suggests potential technical rejection.

"Bitcoin extended its rally over the weekend, pushing to new record highs above $125K before paring gains slightly," explained Joel Kruger, crypto analyst and strategist at LMAX Group. "The move has been underpinned by strong inflows into U.S. spot ETFs and a growing perception of Bitcoin as a hedge against political and fiscal uncertainty."

If profit-taking emerges, several support zones could stabilize prices. The first sits around $120,000, matching July's peak. Below that, the 50-day exponential moving average at $115,184 represents the next cushion, followed by early August lows near $112,000.

The September floor around $108,000-$109,000 aligns with the 200-day exponential moving average at $107,400, forming a critical support band. The psychological $100,000 level marks the ultimate line separating technical correction from potential trend reversal.

Bitcoin Technical Levels

Level Type | Price | Significance |

Current ATH | $125,708 | Sunday peak on Binance |

Previous ATH | $124,474 | August 14, 2025 record |

Current Price | $124,100 | Monday trading level |

First Support | $120,000 | July 2025 highs |

50-Day EMA | $115,184 | Short-term trend indicator |

Second Support | $112,000 | Early August 2025 lows |

Third Support | $108,000-$109,000 | September floor zone |

200-Day EMA | $107,400 | Long-term trend line |

Critical Support | $100,000 | Psychological six-figure level |

Altcoins, Including Ethereum and XRP, Join the Broad "Uptober" Rally

Ethereum climbed above $4,564, gaining 7.5% over seven days as the second-largest cryptocurrency benefits from similar liquidity dynamics. XRP hovered near the psychologically significant $3 level with nearly 5% weekly gains, while other major altcoins posted solid returns. The stablecoin market crossed the $300 billion milestone for the first time, reflecting 47% year-to-date growth and signaling deepening integration between crypto markets and traditional finance.

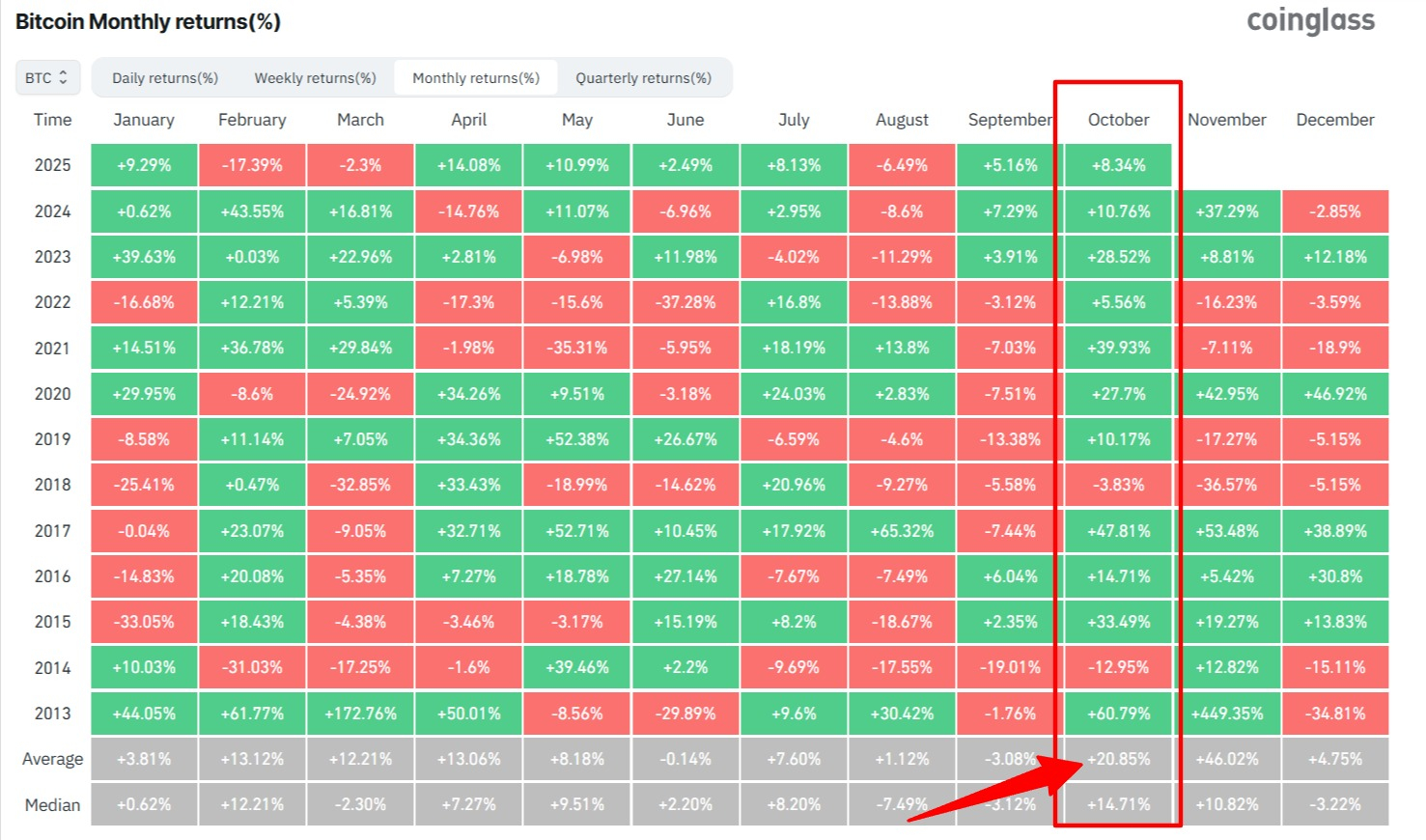

"With us now entering October, dubbed 'Uptober' in the crypto community as it has historically been a month where crypto markets have performed strongly, and with the current sentiment in the markets being risk-on due to anticipating further interest rate cuts, there is every chance we could see the rally continue," Peters noted.

Historical data supports October optimism. Bitcoin has averaged 22% gains during the month across its history, with positive performance in 10 of the past 13 Octobers since 2013. The fourth quarter traditionally delivers Bitcoin's strongest seasonal returns, averaging 80% gains, while December alone typically adds 21%. The cryptocurrency has only declined during two Octobers, in 2014 and 2018, both during bear market cycles.

Bitcoin Historical October Performance

Year | October Return | December Return | Q4 Total Return |

Average | +22% | +21% | +80% |

2024 | +28% | +18% | +94% |

2023 | +29% | +12% | +88% |

2021 | +40% | -19% | +61% |

2020 | +28% | +47% | +171% |

Decline Years | 2014, 2018 only | 2013, 2018, 2022 | Bear cycles |

Political Uncertainty Drives Debasement Trade

Growing fiscal concerns across major economies are accelerating what analysts call a "debasement trade," as investors rotate away from major currencies into perceived stores of value. The dollar has weakened roughly 30% against Bitcoin this year, while the yen tumbled Monday following Japan's leadership transition. The euro faces fresh political headwinds from France.

"The political situations across these countries give you a reason to buy gold and Bitcoin as debasement hedges," said Chris Weston, head of research for Pepperstone Group. "It's become a big momentum trade."

JPMorgan analysts noted "the familiar pattern of dollar debasement against alternative reserve assets amid Washington dysfunction," pointing to broad-based precious metals rallies similar to those following the global financial crisis. Gold reached fresh record highs above $3,900 on Monday, while silver approached its all-time peak.

Bitcoin Price Predictions: Market Outlook Hinges On Fed Path

Kruger identified key risks including disappointment on the Federal Reserve policy path, escalation of U.S. political standoffs, and new regulatory pressures from European or Washington policymakers. Near-term, traders are monitoring whether Bitcoin can establish support above $120,000 and whether Ethereum sustains momentum above $4,500.

"Technically speaking, Bitcoin’s latest breakout opens the door for a push through $140k in the days ahead, which should also translate to fresh record highs in the price of ETH," Kruger added.

The broader cryptocurrency market remains in risk-on mode as October trading kicks into gear. With institutional adoption deepening through ETFs and corporate treasury allocations, Bitcoin's integration with traditional finance provides durability to inflows while heightening sensitivity to sudden policy shifts. Regulatory developments from European authorities and potential U.S. oversight changes represent wildcards that could reshape sentiment quickly.

You may also like to read my other articles with Bitcoin and crypto price predictions:

- Why Crypto Is Up Today? BTC Price Sees Biggest Rally Since June as XRP, Ethereum and Dogecoin Follow

- Bitcoin Price Prediction 2025: Why BTC Price Is Going Up Today

- This Bitcoin Price Prediction Suggests BTC Will Hit $200K in 2025

Bitcoin Price Analysis FAQ

What is the price prediction for Bitcoin in 2025?

Most analysts expect Bitcoin to reach between $150,000 and $200,000 by year-end 2025. Wall Street institutions including Standard Chartered ($200,000), JPMorgan ($165,000), and Bernstein ($200,000) have issued bullish targets based on continued ETF inflows and institutional adoption.

How much will 1 Bitcoin be worth in 2030?

Yes, Bitcoin is widely predicted to reach between $300,000 and $1.5 million by 2030. ARK Invest projects a base case of $710,000, while more conservative estimates from Changelly suggest around $872,000, with bearish scenarios starting at $300,000.

Is Bitcoin expected to reach $200,000?

Yes, Bitcoin is expected to reach $200,000 by the end of 2025 according to Standard Chartered's forecast. The bank's head of digital assets research Geoffrey Kendrick reaffirmed this target based on projected ETF inflows of at least $20 billion by year-end.

Will Bitcoin reach $150,000 in 2025?

Yes, Bitcoin is likely to reach $150,000 in 2025 according to multiple analysts including Tom Lee of Fundstrat Global Advisors and Marshall Beard of Gemini Exchange. The Wall Street consensus average sits at $156,000 for year-end 2025, making $150,000 a conservative milestone.