Over the past 24 hours, Bitcoin (BTC) price has dropped nearly 3%, briefly testing the $80,000 level. While the cryptocurrency rebounded from this psychological support on Monday, it had just experienced a 6.4% drop on Sunday—one of the steepest declines this year and its lowest daily close since November 2024.

Why is Bitcoin going down and closing at four-month lows? According to experts, the decline is linked to market volatility triggered by an executive order signed by President Donald Trump, which mandates the creation of a strategic cryptocurrency reserve in the U.S., including Bitcoin.

Bitcoin Price Today Is Going Down. Why?

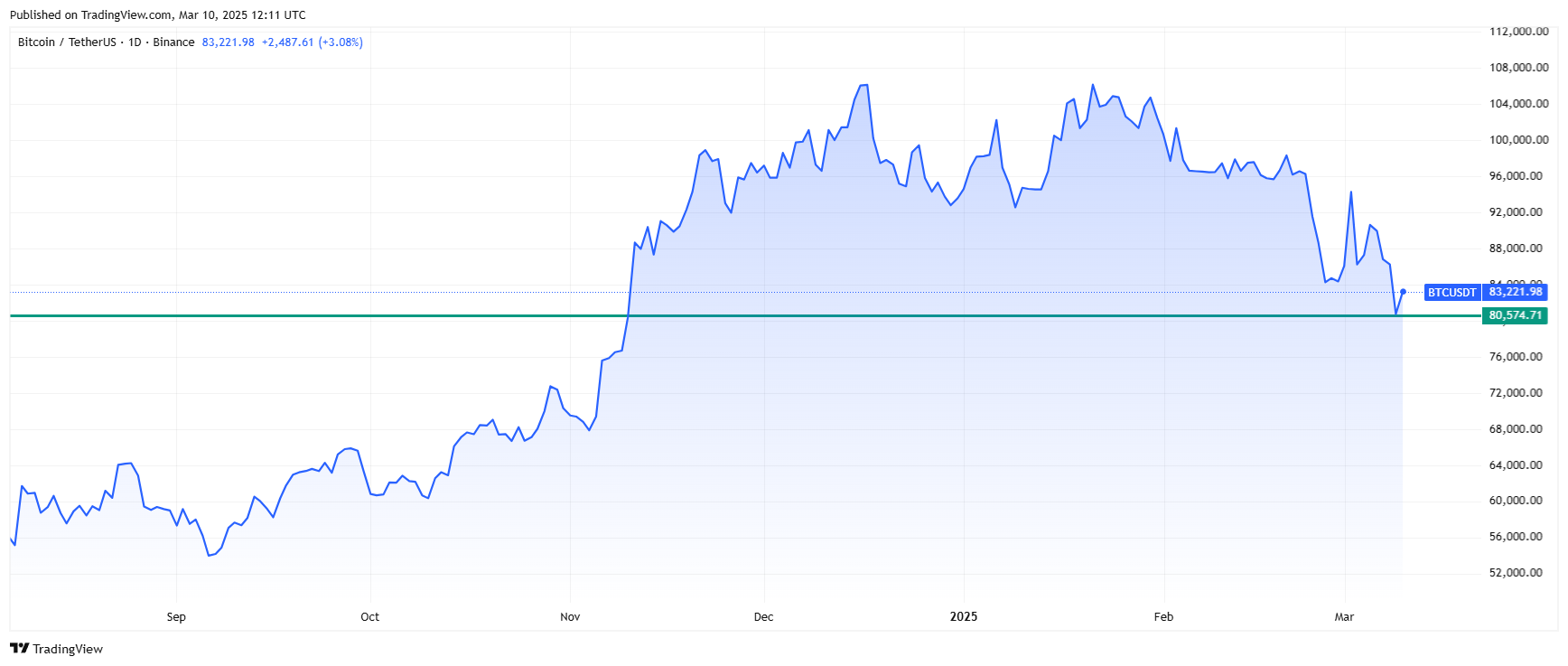

As of today (Monday), March 10, 2025, Bitcoin has been testing the $80,000 level for the second consecutive day. While at the time of writing, its price is rebounding 3.4% to $83,455, it remains down nearly 3% on a 24-hour basis.

This decline follows a sharp drop on Sunday, when BTC fell by over 6%, marking one of the worst sessions of the year. It also recorded its lowest daily close since November 2024, making it the weakest level in more than four months.

One major catalyst for Bitcoin’s recent slump is the market’s reaction to an executive order signed by President Donald Trump last week. The order established a U.S. strategic Bitcoin reserve, utilizing cryptocurrencies seized in criminal and civil forfeiture cases.

While this move initially sparked optimism, the lack of a bold commitment to purchase significant amounts of Bitcoin—such as 100,000 or 200,000 coins—left investors underwhelmed. Prices slid as traders expressed disappointment over what they perceived as a conservative approach.

Bitcoin Holds (Again) at $80K – BTC/USDT Technical Analysis

My technical analysis suggests that the $80,000 level is a critical support for buyers, having successfully halted declines for the second time in the past two weeks. After four consecutive days of BTC depreciation, this level has triggered a reversal and a corrective rebound of over $3,000.

However, BTC/USDT remains under bearish pressure, far from the consolidation near its all-time high (ATH) that was observed between November and late February. In my view, a break above the $90,000–$92,000 zone, which marks the lower boundary of that consolidation range, would signal that bulls have regained full control.

If the $80K support fails, the next target would be the October highs around $72,000. However, I see a more significant support level at the September and early November peaks, near $67,000. In my opinion, this is the ultimate line in the sand that will determine whether bulls or bears take dominance in the market.

Bitcoin Price Drops in “Textbook Correction”

Beyond policy announcements, Bitcoin’s price action reflects broader market dynamics. Analysts at 10x Research described this as a “textbook correction,” pointing out that roughly 70% of the selling pressure came from investors who entered the market within the last three months. This wave of panic selling by newer participants has amplified the decline.

Buy The Dip? Or Stay Fully Cashed Up?

— 10x Research (@10x_Research) March 10, 2025

Bitcoin's Textbook correction is fully playing out...

👇1-11) Bitcoin follows the price projection outlined in our ‘Bitcoin: Textbook Correction?’ report on February 25. The support structure collapsed once Bitcoin fell below the critical… pic.twitter.com/bHZ7whPSzF

Arthur Hayes, co-founder of BitMEX and CIO of Maelstrom, warned that Bitcoin could soon retest the $78,000 level. “If that support fails, $75,000 is next,” he posted on X, highlighting significant open interest in Bitcoin options at the $70,000 to $75,000 range. A drop to these levels, he cautioned, could trigger a “violent” sell-off as derivatives traders adjust their positions.

An ugly start to the week. Looks like $BTC will retest $78k. If it fails, $75k is next in the crosshairs. There are a lot of options OI struck $70-$75k, if we get into that range it will be violent. pic.twitter.com/q4cq0rthGJ

— Arthur Hayes (@CryptoHayes) March 9, 2025

The crypto market doesn’t operate in a vacuum, and macroeconomic factors are also at play. This week, the U.S. is set to release two critical inflation reports that could sway Federal Reserve policy. Persistent inflation might prompt tighter monetary measures, potentially dampening risk assets like Bitcoin.

Meanwhile, trade tensions are heating up, with Canada imposing retaliatory tariffs in response to U.S. policies under Trump. Mark Carney, Canada’s newly elected Liberal Party leader and former central banker, vowed to challenge American trade moves, adding uncertainty to global markets.

Bitcoin News and Price, FAQ

Why Is Bitcoin Falling Now?

Bitcoin’s recent price drop is mainly linked to market reactions following President Donald Trump’s executive order to establish a U.S. strategic Bitcoin reserve. Instead of committing to large-scale government purchases of Bitcoin, the reserve will be funded using assets seized in criminal and civil forfeiture cases.

Will BTC Rise Again?

The future trajectory of Bitcoin remains uncertain and is influenced by multiple factors, including government policies, investor sentiment, and broader economic conditions. While some analysts believe Bitcoin will recover in the long term due to increasing institutional adoption and its role as a store of value, others warn that without strong buying pressure, Bitcoin may remain under bearish influence. A key resistance level to watch is the $90,000–$92,000 range, which could signal a return to bullish momentum. On the downside, if the $80,000 support level fails, Bitcoin could test lower levels around $75,000 or even $70,000.

What If You Invested $1,000 in Bitcoin 10 Years Ago?

If you had invested $1,000 in Bitcoin ten years ago, in March 2015, your investment would have significantly increased in value. At that time, Bitcoin’s price ranged from approximately $177 to $465, with an average of about $300. A $1,000 investment would have bought around 3.33 BTC. At the current price of about $82,308 per Bitcoin, that investment would now be worth approximately $274,000. This highlights Bitcoin’s historical potential for high returns despite its volatility.

Is Bitcoin Going Down Because of Trump?

Yes, to some extent. The recent drop in Bitcoin’s price has been partially attributed to investor disappointment over President Trump’s executive order regarding a strategic Bitcoin reserve. While the order initially sparked optimism, the lack of a bold commitment to purchasing significant amounts of Bitcoin left traders underwhelmed. This led to selling pressure and price declines. However, Bitcoin’s movement is also influenced by broader market dynamics, such as profit-taking, macroeconomic concerns, and technical levels being tested in the market.