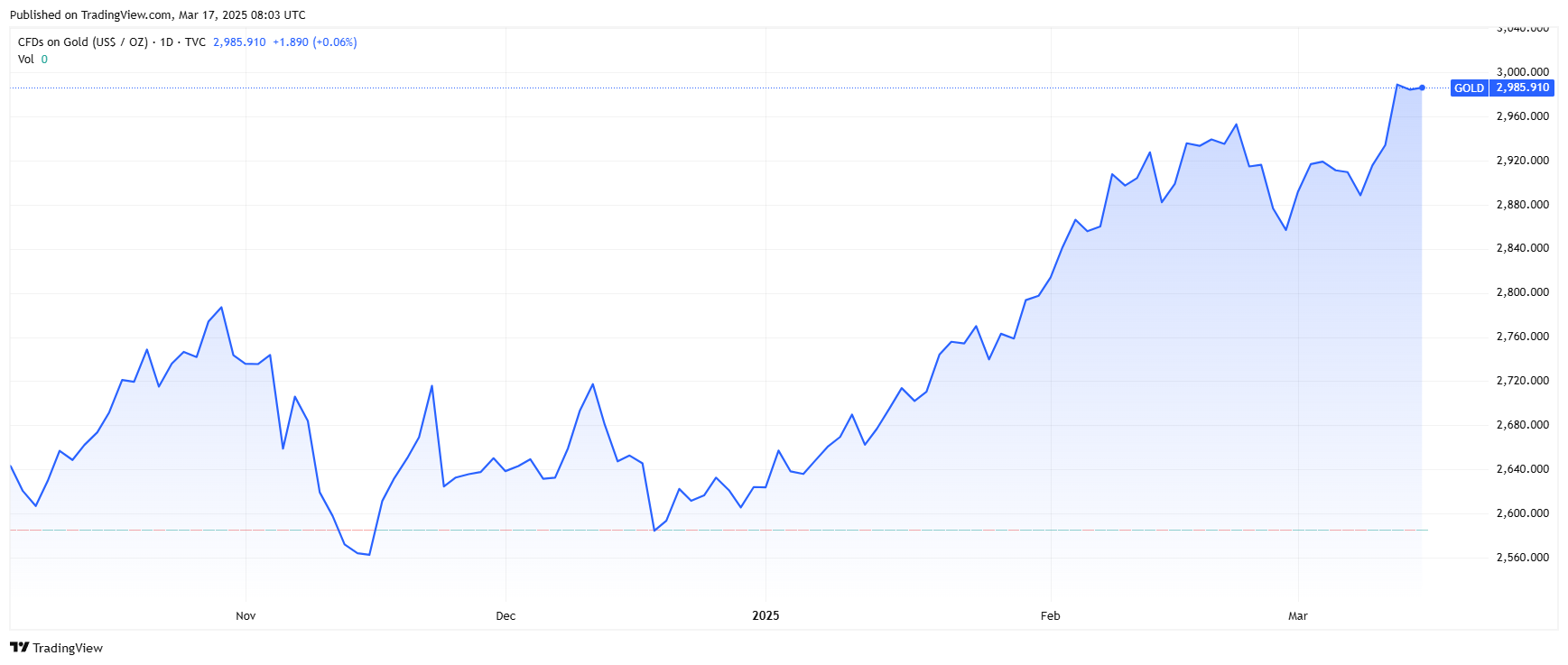

Gold has always held a unique position in the global economy, often seen as a safe-haven asset during times of uncertainty. As of Monday, March 17, 2025, the precious metal has been making headlines, recently breaking through the $3,000 per ounce milestone for the first time.

This historic rally has sparked curiosity about why gold is going up and what its price might look like by the end of 2025. Let’s dive into the key factors driving this surge and explore expert predictions for gold’s future value based on the latest data.

Why Gold Price Is Increasing? $3,000 Reached

Last Friday, the price of gold set a new record on global markets, surpassing the psychological threshold of $3,000. Although this level was not permanently breached and, as of Monday, an ounce of gold is trading at $2,985, investors remain optimistic that, given the current geopolitical and economic uncertainty, gold has plenty of room for further gains.

So far, gold investors have little reason for concern. The precious metal initially surged 27% in 2024 and is now up nearly 14%. While these returns may not match those of cryptocurrencies, they are certainly impressive within traditional markets—especially when compared to the stock market. The S&P 500 gained about 23% last year but is currently down more than 4% in 2025.

“Central banks worldwide have been stockpiling gold at an unprecedented pace,” the Gold-Silver Ratio analytical team commented. “Since 2022, following the freezing of Russian assets, emerging market central banks have ramped up purchases to diversify reserves away from U.S. Treasuries. In December 2024 alone, demand surged, with institutions adding significant tonnage to their holdings.”

More importantly, market experts believe gold is just getting started. They anticipate its price could climb another 35%, reaching the $4,000 mark.

Gold Price Prediction 2025: Gold to Hit $4,000

Jeffrey Gundlach, CEO and Chief Investment Officer of DoubleLine Capital, has forecasted gold prices will reach $4,000 per ounce, extending his bullish stance on the precious metal that recently crossed the $3,000 milestone for the first time.

Gold’s going to reach $4,000, recession probability at 60%, says Gundlachhttps://t.co/40sYZ8PmZh

— David Lee (@DavidLe76335983) March 16, 2025

"Gold continues its bull market that we've been talking about really now for a couple of years ever since gold was down to $1,800," Gundlach stated during an investor call this week. "I'd be so bold to say I think gold will make it to $4,000. I'm not sure that'll happen this year, but I feel like that's the measured move anticipated by the long consolidation at around $1,800 on gold."

The investment manager, often referred to as the "bond king," pointed to central banks' accelerating gold purchases as a key driver behind the rally, describing their buying pattern as following a "very sharp, steep trajectory" that he expects to continue. Gundlach suggested this trend reflects recognition of gold as a "storehouse of value that's more outside the financial system, which seems to be in a state of flux."

Gold Price Prediction Table

The stronger U.S. dollar or fewer rate cuts could pull prices down (e.g., Goldman Sachs notes a possible dip to $3,060).

Source | Predicted Gold Price (End of 2025) | Key Notes |

Goldman Sachs | $3,100 - $3,300 | Base case at $3,100, with $3,300 possible if geopolitical risks or U.S. debt concerns rise. |

UBS | $3,000 | Raised from $2,850, driven by rate cuts and investor demand. |

BullionVault Users | $3,070 | Average from 1,440+ respondents, reflecting private investor optimism. |

Coin Price Forecast | $3,286 | Aggressive outlook, with potential to hit $3,873 by end of 2026. |

J.P. Morgan | $3,000 | Near $3,000, tempered by possible slowdown in central bank buying. |

World Gold Council | $2,900 - $3,100 | Range based on QaurumSM analysis, with modest upside if conditions hold. |

Gold price prediction table, updated March 17th, 2025.

Why Gold Will Go Up?

Beyond his gold forecast, Gundlach shared insights on broader market trends, noting that European stocks are beginning to outperform U.S. equities amid the dollar's downtrend. DoubleLine initiated investments in European markets around 2021, a position that initially proved challenging but now shows "a lot of momentum," according to Gundlach.

The fund manager also addressed the vulnerability of the "Magnificent Seven" tech stocks that have dominated market gains in recent years. "Every sector is always vulnerable and we're starting to obviously see that," he remarked.

On the economic front, Gundlach assigned a 60% probability of a U.S. recession this year—a significantly more pessimistic outlook than most Wall Street institutions, which generally don't anticipate an outright contraction. He also expressed strong support for Elon Musk's Department of Government Efficiency initiative aimed at federal spending cuts, stating it's "the only way that we can try to get our fiscal house in order."

The above factors are expected to create ideal conditions for capital to flow into "safe havens." Precious metals are considered one of the most important among them.

Gold Technical Analysis: How High Can Gold Go?

When an asset is at all-time highs, as is the case with gold, predicting future prices using technical analysis becomes challenging.

However, we can use indicators that attempt to project future movements, such as trend-based Fibonacci extensions. Measuring the range of the most recent uptrend, which began from December lows below $2,600, and the correction at the end of February, helps estimate gold’s potential direction.

The most commonly observed target in this scenario is the 161.8% Fibonacci extension, which is considered a key level for the ongoing uptrend. Based on current calculations, this level is slightly above $3,400—at the upper end of Goldman Sachs' forecasts but still well below Gundlach’s projections.

What about the downside? What happens if the bulls fail to break the $3,000 mark? In that case, the key support level, in my view, would be $2,955—the February highs. The next two significant support levels are last month’s lows at $2,855 and the October peak at $2,791. A drop below this level would make me question whether buyers still hold the upper hand.

Gold Price, FAQ

How Much Gold Will Be Worth in 2025?

Jeffrey Gundlach (DoubleLine Capital) predicts gold could reach $4,000 per ounce, though he’s unsure if this will occur within 2025. Goldman Sachs forecasts a range of $3,100 to $3,300, with $3,100 as their base case. UBS predicts $3,000, recently raised from $2,850.

Is Gold Predicted to Go Up or Down?

Gold is predominantly predicted to go up in 2025. Your article highlights a historic rally, with gold already up 14% in 2025 after a 27% surge in 2024. Key drivers include: geopolitical and economic uncertainty, central banks’ accelerating gold purchases and overall market optimism.

What Will Gold Be Worth in the Next 10 Years?

If Gundlach’s $4,000 target is reached by late 2025 or 2026, and the bull market persists, gold could see steady growth driven by inflation, central bank buying, and economic instability. Coin Price Forecast’s aggressive outlook suggests $3,873 by 2026, implying a potential trajectory toward $4,500–$5,000 by 2035 if the 5–7% annual growth trend continues.

How Much Will Gold Be Worth in 2030?

Gold could reach $4,800–$5,200 by 2030. More conservative estimates (e.g., World Gold Council’s $3,100 max for 2025) might see gold at $3,700–$4,000 by 2030 if growth slows.