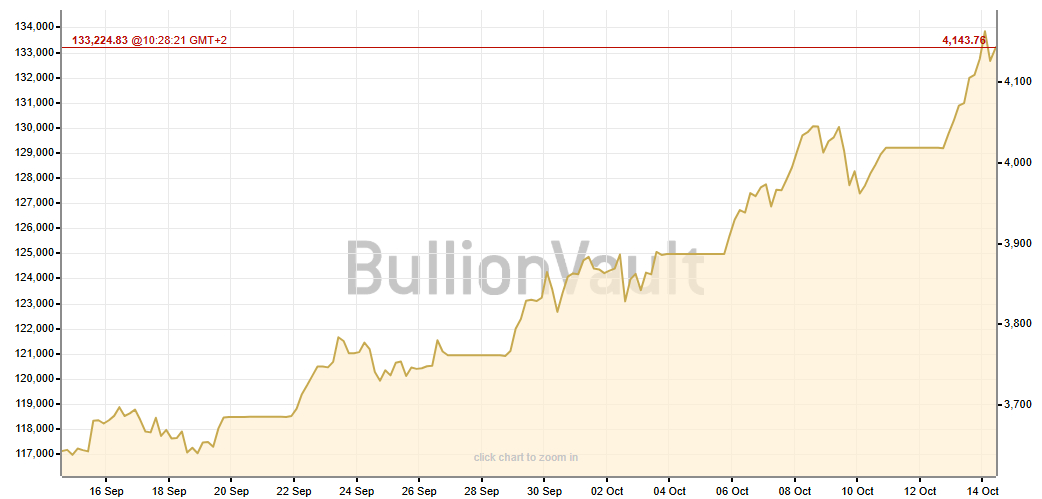

Gold shattered records today (Tuesday), October 14, 2025, reaching $4,179.48 per ounce as investors rushed into safe-haven assets amid escalating US-China trade tensions and mounting expectations for Federal Reserve rate cuts. Bank of America responded by lifting its 2026 gold price prediction to $5,000, the one of the most bullish prediction among major financial institutions.

Gold Record-Breaking Rally Accelerates Today

Spot gold surged 1.7% intraday on Tuesday, breaking above $4,100 for the first time in history just 36 days after crossing $3,500. December futures climbed 1.9% to $4,185.50, while the yellow metal has now posted eight consecutive weekly gains. Year-to-date performance stands at an extraordinary 57%, marking gold's strongest annual showing since 1979.

And why is the price of gold going up today? The rally gained momentum after President Trump threatened a "massive increase" of tariffs on China, promising 100% tariffs on Chinese imports effective November 1. China retaliated with new port fees on US vessels and tighter rare earth export controls, sending nervous investors scrambling for protection. Silver joined the precious metals surge, hitting an all-time high of $53.60 per ounce.

- Gold Breaks $4K for First Time Amid Geopolitical Tensions and Central Bank Demand

- Silver Smashes Through Four-Decade Ceiling as Gold Rockets Past $4,000

- Bybit Pushes Gold Tokenization Through Blockchain TON Integration

How High Can Gold Price Go? Technical Analysis Points to $4,300-$4,470 Range

My technical analysis of gold's chart reveals immediate intraday resistance at $4,170 per ounce, with critical support levels identified at $4,059 (October 8 highs) and $3,944 (local lows from October 9-10 sessions). The psychologically significant $4,000 level will also serve as crucial support during any corrective pullback.

Applying Fibonacci extensions to the current trend structure suggests initial upside targets above $4,300 per ounce, with the 161.8% extension landing near $4,470, closely aligning with Standard Chartered's $4,488 forecast for 2026.

These technical projections from my technical analysis, however, sit approximately $500 below the ambitious $5,000 targets from Goldman Sachs and Bank of America.

Bank of America's Ambitious Gold Price Prediction: $5,000 Target

Bank of America became the second major institution to project gold at $5,000 per ounce for 2026, with an average price forecast of $4,400. The bank's metals team emphasized that "the White House's unorthodox policy framework should remain supportive for gold given fiscal deficits, rising debt, intentions to reduce the current account deficit/capital inflows, along with a push to cut rates with inflation around 3%".

While acknowledging the possibility of a near-term correction, BofA maintains that sustained investment demand could drive further gains. The bank calculates that a 14% increase in investment demand, similar to 2025's pattern, would be sufficient to propel gold to the $5,000 milestone.

Societe Generale echoed this bullish sentiment, also forecasting $5,000 by end-2026, while Goldman Sachs raised its December 2026 target to $4,900.

Carsten Menke of Julius Baer said he maintains a positive outlook for both gold and silver, noting that any signs of speculative fatigue “should not cause a correction, but rather a short-term and temporary setback,” since the overall fundamentals remain supportive. He added that the key forces behind the record rally, slower U.S. growth, lower interest rates, and a weaker dollar, are still in place.

Gold Price Prediction Table

Institution | 2025 Average Forecast | 2026 Average Forecast | Price Target | Date Updated |

Bank of America | — | $4,400/oz | $5,000/oz by end 2026 | October 13, 2025 |

Societe Generale | — | — | $5,000/oz by end 2026 | October 13, 2025 |

Goldman Sachs | $3,400/oz | $4,525/oz | $4,900/oz by Dec 2026 | October 7, 2025 |

Standard Chartered | — | $4,488/oz | — | October 13, 2025 |

Deutsche Bank | $3,291/oz | $4,000/oz | $4,300/oz by Q4 2026 | September 17, 2025 |

UBS | $3,800/oz by end 2025 | $3,900/oz by mid-2026 | $4,200/oz in coming months | September 12, 2025 |

Commerzbank | $3,600/oz | $3,800/oz | — | September 2025 |

Citigroup | $3,800/oz (3-month target) | $4,300/oz by Q4 2026 | — | September 2025 |

HSBC | $3,355/oz | $3,950/oz | $3,600/oz avg in 2027 | October 3, 2025 |

J.P. Morgan | $3,675/oz by Q4 | $4,100/oz by Q3 2026 | $4,000/oz by Q2 2026 | August 10, 2025 |

ANZ | $3,338/oz | $3,845/oz | — | September 10, 2025 |

Why Gold Is Surging? 4 Main Reasons

Federal Reserve Rate Cut Expectations Fuel Momentum

Markets assign a 97% chance that the Federal Reserve will cut rates by 25 basis points at its October 28–29 meeting, according to CME FedWatch data. Another cut in December would lower the federal funds rate to 3.75%–4%. Lower yields reduce the opportunity cost of holding gold, boosting its appeal versus interest-bearing assets.

Massive ETF Inflows Signal Institutional Conviction

Gold-backed ETFs have attracted $64 billion year-to-date, with a record $17.3 billion in September alone, the largest monthly inflow on record. North American funds accounted for most of the activity, with daily trading averaging $6.5 billion.

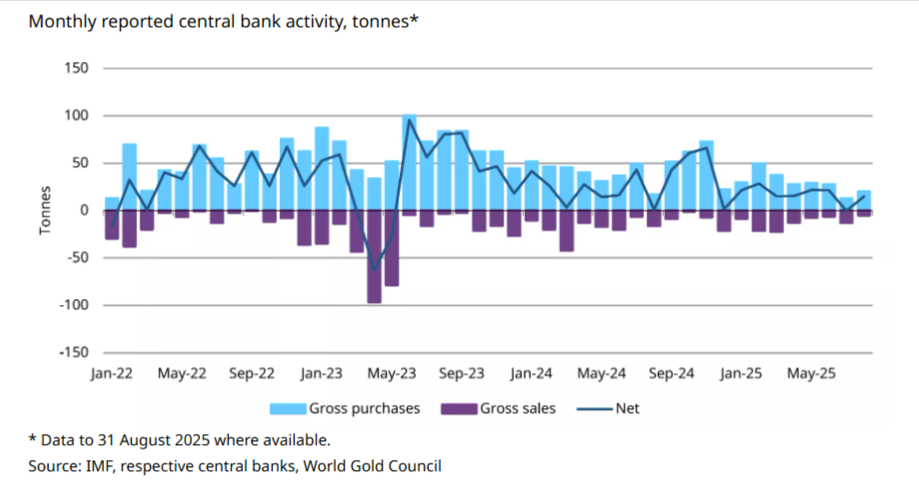

Central Banks Continue De-Dollarization Push

Official sector purchases remain a key driver. Goldman Sachs expects central banks to buy 80 metric tons monthly in 2025 and 70 tons in 2026, led by emerging markets diversifying from US Treasuries, now at their lowest holdings since 2013.

Multiple Catalysts Converge

Trump’s renewed tariff threats, a weaker dollar, the government shutdown, and inflation near 3% are combining to sustain gold’s momentum. Treasury Secretary Scott Bessent warned the shutdown could slow growth but remains hopeful for US–China talks later this month.

Gold trading volumes jumped 34% in September to $388 billion daily, setting 13 new record highs. COMEX volumes rose 58%, and Shanghai activity climbed 84%.

Gold Price Analysis FAQ

Why is gold pice at record high?

Gold reached record highs due to Federal Reserve rate cut expectations (97% probability for October meeting), escalating US-China trade tensions with 100% tariff threats, massive ETF inflows exceeding $64 billion year-to-date, central bank diversification away from US dollars, and safe-haven demand amid economic uncertainty.

Will gold continue rising?

Yes. Major institutions expect further gains, with Bank of America forecasting $5,000 by 2026, Goldman Sachs predicting $4,900, and technical analysis suggesting targets of $4,300-$4,470 in the near term, though short-term corrections remain possible[user].

What is gold price prediction for 2025-2026?

Bank of America projects $5,000 per ounce in 2026 (average $4,400), Goldman Sachs forecasts $4,900 by December 2026, Standard Chartered expects $4,488 average for 2026, while Wheaton Precious Metals CEO predicts $5,000 within one year and potentially $10,000 by 2030.

Should I buy gold now?

Yes, you should, however, gold investments carry volatility risks despite current momentum. Prices have surged 57% year-to-date and may experience near-term technical corrections toward $4,000 support levels before resuming upward trajectory toward institutional price targets, requiring careful consideration of individual risk tolerance and portfolio diversification goals.