Gold price is trading at $4,191 per ounce today (Tuesday) December 9, 2025, holding near the elevated levels that defined 2025's historic rally. After surging 61% this year with over 50 all-time highs, the fourth strongest annual return since 1971, gold now faces a critical question: what will 2026 bring?

According to the World Gold Council's (WGC) newly released Gold Outlook 2026 report, the answer depends on whether US President Donald Trump's reflation policies succeed. In the organization's most bearish scenario, gold price could crash between 5% and 20% from current $4,200 baseline levels, potentially dropping to a range of $3,360 to $3,990 per ounce.

In this article I am checking the newest gold price prediction to try to answer the question: How low can gold go in 2026?

Gold Price Outlook And Four 2026 Scenarios: From +30% Rally to -20% Crash

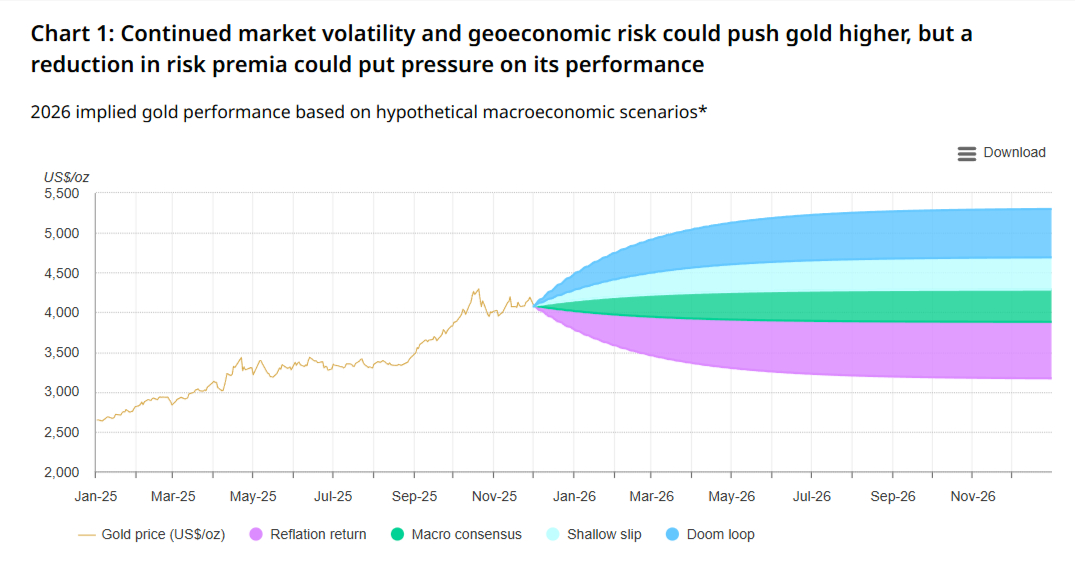

The World Gold Council doesn't offer a single prediction for 2026. Instead, the team headed by Juan Carlos Artigas, Regional CEO (Americas) and Global Head of Research at the WGC, presents four distinct macroeconomic scenarios in the organization's Gold Outlook 2026 report, each with dramatically different implications for gold prices.

"Looking to 2026, the outlook is shaped by ongoing geoeconomic uncertainty," the report states. "The gold price broadly reflects macroeconomic consensus expectations and may remain rangebound if current conditions persist. However, taking cues from this year, 2026 will likely continue to surprise."

The Four 2026 Gold Scenarios

Scenario | Gold Performance | Key Drivers | Probability |

Macro Consensus | -5% to +5% (rangebound) | Stable growth 2.7-2.8%, Fed cuts 75 bps, USD edges higher | Baseline expectation |

Shallow Slip | +5% to +15% | Growth slows, Fed cuts 120+ bps, weaker USD, risk-off | Moderately bullish |

Doom Loop | +15% to +30% | Severe downturn, aggressive Fed cuts 175+ bps, flight to safety | Very bullish |

Reflation Return | -5% to -20% | Trump policies succeed, Fed holds/hikes, yields rise, USD surges | Most bearish |

The baseline "Macro Consensus" scenario assumes current market expectations play out: global GDP growth remains around 2.7-2.8% in real terms, the Fed delivers approximately 75 basis points of additional rate cuts, and the US dollar edges modestly higher. Under these conditions, gold would trade rangebound between -5% and +5% from current levels, essentially sideways action.

However, the WGC emphasizes that "the macroeconomy rarely follows the path that market consensus dictates." This is where the more extreme scenarios come into play.

Why Gold Will Crash? The "Reflation Return" Scenario

The most bearish outlook for gold in 2026 centers on what the World Gold Council calls the "Reflation Return" scenario, a situation where President Trump's fiscal and industrial policies spark stronger-than-expected economic growth.

"On the flip side, there's also a possibility that the policies set by the Trump administration succeed, resulting in stronger-than-expected growth linked to fiscal induced support," according to Juan Carlos Artigas and the WGC research team in the Gold Outlook 2026 report.

The Reflation Mechanics

The scenario unfolds in a cascading series of economic developments. "Under these conditions, reflation likely takes hold, pushing activity higher and lifting global growth toward a firmer trajectory," the report explains.

As economic momentum builds, inflation becomes the critical concern. "As inflation pressures mount, the Fed would be forced to hold or even hike rates in 2026. This, in turn, would push long-term yields higher and strengthen the US dollar," Artigas notes.

The impact on gold becomes mechanical at this point. "The rise in yields and a firmer currency increase the opportunity cost of holding gold and draw capital back toward US assets," the report states. Improving economic sentiment would also "fuel a broad risk-on rotation" away from safe-haven assets like gold and into equities .

Using the WGC's November 2025 baseline of approximately $4,200 per ounce, this translates to a price range of:

- -5% decline: $3,990 per ounce

- -10% decline: $3,780 per ounce

- -15% decline: $3,570 per ounce

- -20% decline: $3,360 per ounce

The report specifically identifies gold ETF outflows as a key transmission mechanism. "Gold ETF holdings could see sustained outflows as investors rotate into equities and higher-yielding assets. Their magnitude would be a function of the reduction in gold's risk-induced premium, which has been a mainstay since the invasion of Ukraine in 2022."

The WGC concludes that "the combination of higher opportunity costs, risk-on sentiment, and negative price momentum could create challenging conditions for gold, reinforcing this as the most bearish scenario in our outlook."

Gold Price Prediction 2026 And $3,300-$3,440 Support Zone

As visible on my technical analysis chart, the WGC projection aligns remarkably well with my independently identified support zone between just under $3,300 per ounce and over $3,440 per ounce, these are the maximums from the first part of this year drawn from April to August 2025.

This technical validation is significant. The World Gold Council's fundamental analysis of macroeconomic scenarios pointing to $3,360-$3,990 under reflation conditions corresponds almost precisely with my chart-based support levels at $3,300-$3,440 where gold established multiple highs during the spring and summer months before the autumn breakout to all-time highs.

Even such a strong correction wouldn't mean tragedy for the gold market from my perspective, but only a healthy technical correction and an opportunity to buy back at more attractive prices. Although this would mean going below the 200-day exponential moving average (200 EMA), if gold began to gradually decline, the 200 EMA would also find itself at the height of this zone or below it, so the uptrend would theoretically be maintained.

This is a critical technical point: A decline to $3,300-$3,440 represents a retest of previous resistance-turned-support, not a breakdown of the multi-year bull trend. As long as the 200 EMA descends to meet price at this support zone, the technical structure of higher lows and higher highs remains intact.

Gold Technical Levels Under Reflation Scenario

Level | Price | Technical Significance |

Current Price | $4,191 | Dec 9, 2025, near 2025 highs |

November Baseline | ~$4,200 | WGC projection reference point |

-5% Decline | $3,990 | Upper end of reflation correction |

-10% Decline | $3,780 | Mid-range correction scenario |

-15% Decline | $3,570 | Deeper correction level |

-20% Decline | $3,360 | Maximum WGC reflation downside |

My Support Zone | $3,300-$3,440 | April-August 2025 maximums, key technical base |

200 EMA (projected) | ~$3,300-$3,400 | Would descend to support on gradual decline |

The alignment between the WGC's $3,360 maximum downside and my $3,300-$3,440 support zone provides dual confirmation, fundamental scenario analysis and technical chart structure both pointing to the same price region as the likely floor under bearish conditions.

Read also my other gold-related article:

- Gold Is Surging And This New Gold Price Prediction Targets 35% Upside Above $5,500

- Why Gold Is Surging? New 20% Gold Price Prediction as Metal Rises for a 5th Straight Session

Bullish Gold Price Forecasts

Even though the World Gold Council outlines a bearish “Reflation Return” path with a possible 20% pullback, some of the biggest banks on Wall Street still see gold significantly higher into 2026.

- Goldman Sachs: One of the most aggressive bulls on Wall Street, Goldman Sachs projects gold could surge to $5,055 per ounce by late 2026. Their analysts cite "strong Western ETF inflows" and "continued central bank buying" as primary drivers. They also note that risks are skewed to the upside, as private sector diversification into the relatively small gold market could push prices even higher than their models predict.

- Bank of America: BofA has raised its forecast, targeting $5,000 per ounce by the end of 2026. While they acknowledge the possibility of short-term corrections, they emphasize that a 10-15% increase in investment demand could easily elevate prices to this level.

- J.P. Morgan: Taking a longer-term view, J.P. Morgan sees gold averaging $5,055 by Q4 2026. They have also issued a conviction call for a multi-year bull market, with a target of $6,000 per ounce by 2028.

- UBS: While slightly more conservative, UBS maintains a bullish stance with a baseline target of $4,200 in the near term. However, they outline a plausible upside scenario where intensifying geopolitical risks could push the metal to $4,700 by Q1 2026.

- ING: Analysts at ING see fundamental factors pointing to further upside, forecasting prices to average $4,100 in early 2026 with limited downside risk.

- Saxo Bank's $10,000 Scenario: In a "black swan " prediction, Saxo Bank warns that a breakthrough in quantum computing could disrupt traditional digital finance and crypto, potentially sending gold rocketing to $10,000 per ounce as the ultimate "no-password" safe haven. Alternatively, they suggest a "Golden Yuan" scenario where China backs its currency with gold could push prices to $6,000+.

Gold Price Analysis, FAQ

How low can gold go in 2026?

According to World Gold Council's Gold Outlook 2026 report, gold could decline 5-20% from ~$4,200 November baseline to $3,360-$3,990 range under "Reflation Return" scenario if Trump policies succeed sparking reflation. As visible on my technical analysis, this aligns with my support zone $3,300-$3,440 (April-August 2025 maximums).

Why will gold crash?

WGC's "Reflation Return" scenario projects gold crash if Trump administration policies succeed creating fiscal-induced growth. "Under these conditions, reflation likely takes hold, pushing activity higher. As inflation pressures mount, Fed would be forced to hold or even hike rates in 2026, which would push long-term yields higher and strengthen US dollar," per Juan Carlos Artigas.

Will gold fall to $3,300?

Possible under WGC's "Reflation Return" scenario projecting -20% maximum decline to $3,360 from $4,200 baseline. As visible on my technical chart, WGC projection aligns with my support zone $3,300-$3,440 (April-August 2025 maximums where 200 EMA would descend on gradual decline).

Is gold crash coming?

Not necessarily/ WGC presents four equal scenarios for 2026. "Reflation Return" crash scenario (-5% to -20%) requires Trump policies succeeding, reflation, Fed holds/hikes, yields +20bp+, USD materially stronger, risk-on rotation. But "Shallow Slip" (+5% to +15%) occurs if growth slows/Fed cuts more, while "Doom Loop" (+15% to +30%) happens in severe downturn.