Several prominent cryptocurrency executives remain confident that Bitcoin (BTC) Price will hit $250,000 by year-end, but Galaxy Digital CEO Mike Novogratz isn't convinced.

"The end of the year is only two and a half months away," Novogratz told CNBC on Wednesday, adding that "there would have to be a heck of a lot of crazy stuff to really get that kind of momentum.”

Let’s check the current Bitcoin price predictions for 2025 and beyond and what other experts say about the crypto market.

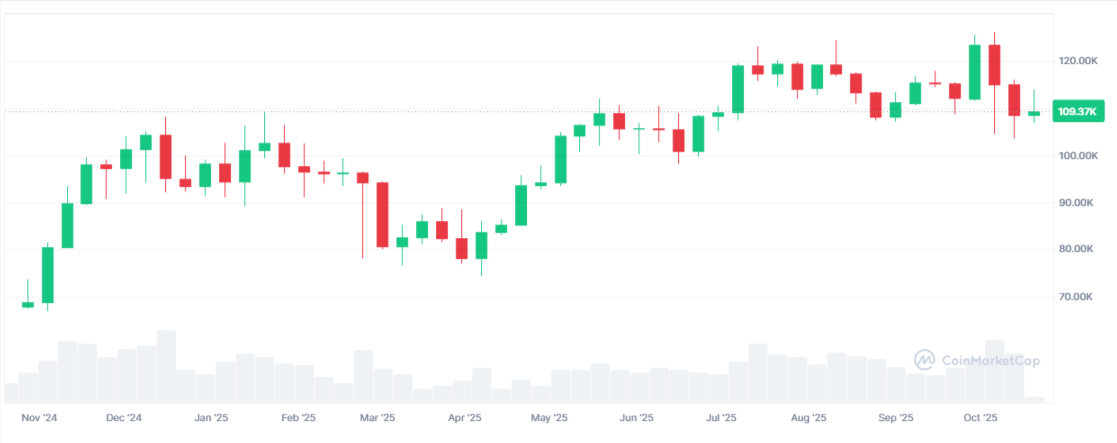

Bitcoin Price Surges Today

At the time of publication, Bitcoin trades at $109,672, rebounding 2% from the important support. However, it means, the oldest cryptocurrency would need to surge approximately 128% within the next 10 weeks to reach the ambitious $250,000 target that analysts including Tom Lee, Arthur Hayes, and Tim Draper have maintained throughout 2025.

With that in mind, Novogratz expects a rebound toward the end of the year. However, he admits it is likely to be modest. How much of a recovery does he anticipate? I take a closer look at that later in this article.

Bitcoin Key Metrics | Current Data (Oct 23, 2025) |

Current Price | $109,672 |

All-Time High | $125,761 (Oct 6) |

Monthly Performance | -3.5% |

Target for $250K | +128% needed |

Time Remaining | 10 weeks |

Novogratz Forecasts Bitcoin Should Hold $100K, Range to $125K Most Likely

Novogratz, whose Galaxy Digital serves major institutional cryptocurrency clients, offered a more measured outlook than the $250,000 bulls.

"I do think we should hold 100, you know, 100 or somewhere close to that should be the downside," he stated during the CNBC interview. "And on the upside, you know, you don't really accelerate until you take out 125."

According to my technical analysis, Bitcoin currently trades between critical support at $100,000, a psychological level first broken in December 2024 shortly after Donald Trump's reelection, and resistance at $125,000, representing the all-time high reached on October 5. Bitcoin came close to retesting the $100,000 floor following Trump's announcement of 100% tariffs on China, which caused the market to tumble on October 10 to $102,000.

"So the most likely outlook is we're rangy between 100 and 120 or 125, unless we take out the top side," Novogratz explained. The Galaxy CEO identified only two potential catalysts that could push Bitcoin through the all-time high level again before year-end: Trump moving to influence the Federal Reserve "prematurely" or the crypto market structure bill, known as the CLARITY Act, passing this year. "Those are the two kinds of catalysts I see," he said.

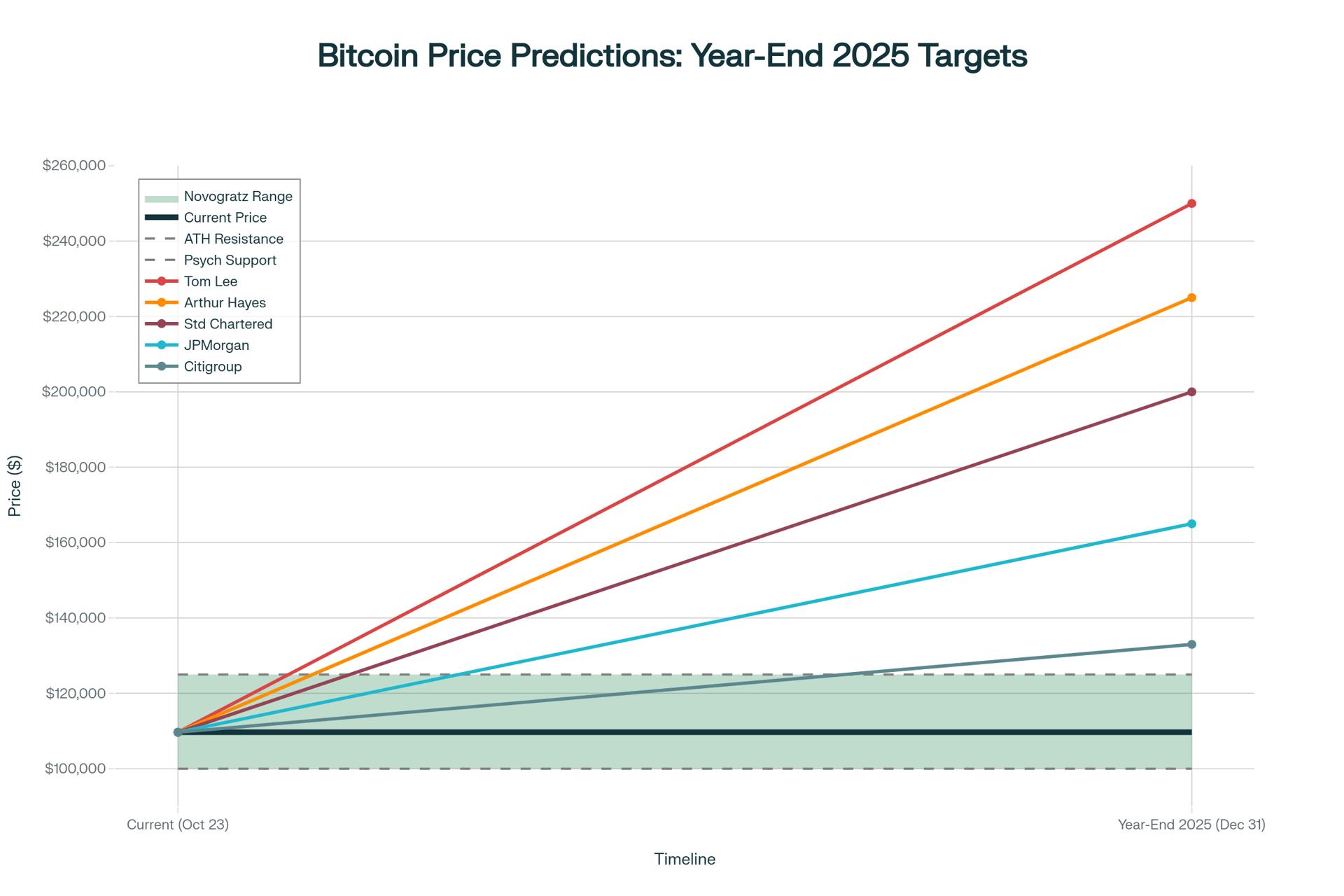

How High Can Bitcoin Go? Tom Lee and Arthur Hayes Maintain $250K Conviction

Despite Novogratz's caution, several high-profile analysts continue doubling down on their $250,000 predictions. Speaking on the Bankless podcast earlier this month, Fundstrat co-founder Tom Lee and BitMEX co-founder Arthur Hayes said they remain confident Bitcoin can hit between $200,000 and $250,000 by year-end, a prediction they've stuck with for most of this year.

Lee believes current conditions make it "highly probable" that Bitcoin will reach $250,000, citing the halving cycle, institutional adoption acceleration, and the incoming U.S. government's pro-Bitcoin stance as key drivers.

Hayes, during his visit to Korea last month, told WEEKLY BIZ: "By year-end, Bitcoin's price rally will continue and silence various controversies." The BitMEX co-founder currently forecasts Bitcoin reaching around $250,000, arguing that "Bitcoin's price is heavily influenced by global liquidity.

You may also read my previous articles about Bitcoin and crypto price predictions:

- Why Gold Price Is Falling the Most Since 2020? The Crash Is Dragging Bitcoin Down Too

- The New Bitcoin Price Prediction From This Expert Warns of 40% BTC Crash to Just $70K

- How High Can Bitcoin Go? New BTC Price Predictions Point to $200K in 2025 and $1M Long Term

Bitcoin Price Prediction: Other Analysts Forecast $250K Within 12 Months

Beyond Lee and Hayes, other prominent figures maintain bullish long-term outlooks even if they acknowledge the aggressive timeline. Venture capitalist Tim Draper recently stated that Bitcoin "will top $250,000 in 12 months," extending his forecast horizon slightly beyond the year-end target.

Veteran trader Peter Brandt, known for accurate market calls, indicated on October 22 that Bitcoin "has a chance to hit $250,000," though he emphasized speaking from a "standpoint of possibilities rather than probabilities or certainties". Brandt projected that BTC could ascend to $250,000 "influenced by the macroeconomic narratives he contemplates," though he cautioned the cryptocurrency might also experience sideways movement or downward trends.

Cardano founder Charles Hoskinson echoed similar sentiment back in April, suggesting that increasing interest from major tech companies like Microsoft could propel Bitcoin to "unprecedented heights".

Year-End Price Matters Less Than Long-Term Trajectory

Some analysts argue that focusing excessively on Bitcoin's year-end price misses the broader picture. Bitcoin analyst PlanC stated on September 5: "Anyone who thinks Bitcoin has to peak in Q4 of this year does not understand statistics or probability".

This perspective emphasizes that Bitcoin's four-year halving cycle doesn't require the cryptocurrency to peak in any specific quarter, and that long-term accumulation matters more than short-term price targets.

Novogratz acknowledged Bitcoin's inherent volatility during the CNBC interview, noting: "Listen I mean keep things in perspective. Bitcoin is still a 50 vol asset. And so, and crypto is like a 60-70 vol asset class. And so, you're to expect big moves in these markets." When pressed on whether Bitcoin could fall below $100,000, the Galaxy CEO responded: "I don't think it will just given the buyers we see and where people seem to care."

Bitcoin Price Forecast Comparison Table: Bulls vs Realists

Analyst/Institution | Price Target | Timeline | Gain Required | Key Rationale |

Tom Lee (Fundstrat) | $250,000 | Year-end 2025 | +128% | Halving cycle, institutional adoption, U.S. strategic reserve possibility |

Arthur Hayes (BitMEX) | $200,000-$250,000 | Year-end 2025 | +82% to +128% | Global liquidity surge, fiat debasement, fixed supply narrative |

Tim Draper (Venture Capital) | $250,000 | Within 12 months | +128% | Long-term adoption trajectory, digital scarcity |

Mike Novogratz (Galaxy) | $100,000-$125,000 | Near-term range | -9% to +14% | Realistic consolidation post-deleveraging, needs catalysts for breakout |

Standard Chartered | $200,000 | 2025 | +82% | Institutional flows, regulatory clarity |

JPMorgan | $165,000 | Year-end 2025 | +50% | ETF adoption, traditional finance integration |

Citigroup | $133,000 | Year-end 2025 | +21% | Conservative institutional estimate |

Peter Brandt | $250,000 | Possibility | +128% | Technical analysis, acknowledges uncertainty |

Bitcoin Price Analysis, FAQ

Will Bitcoin hit $250,000 in 2025?

Galaxy Digital CEO Mike Novogratz says reaching $250,000 by year-end would require "a heck of a lot of crazy stuff" with only 10 weeks remaining, making $100,000-$125,000 range "most likely outlook," though bulls like Tom Lee, Arthur Hayes, and Tim Draper maintain $250,000 conviction citing institutional adoption, halving cycle, Fed rate cuts, and potential CLARITY Act passage as catalysts.

How high can Bitcoin go by year-end?

Novogratz expects Bitcoin to trade "rangy between 100 and 120 or 125" absent major catalysts, noting "you don't really accelerate until you take out 125" (all-time high), with potential upside to $150,000+ if CLARITY Act passes or Trump influences Fed policy, while downside support "should hold 100 or somewhere close to that".

What could drive Bitcoin to $250K?

Key catalysts include CLARITY Act regulatory clarity passage ("give crypto a real jolt to the upside" per Novogratz), Trump Fed intervention targeting year-end timeline, continued rate cuts (96.7% probability October 29), U.S. strategic Bitcoin reserve adoption legitimizing asset class, global fiat debasement with governments "printing massive amounts of money" driving inflation hedge demand, and MicroStrategy-style corporate treasury adoption trend.

Is $250,000 Bitcoin realistic?

Yes, but not this year. Bitcoin needs 128% surge in 10 weeks to reach $250,000 from current $109,672, with institutional forecasts ranging from Citigroup's $133,000 to Standard Chartered's $200,000, while crypto-native analysts Lee and Hayes maintain $250,000 conviction based on halving cycle (historically producing 10x-20x gains 18 months post-event), though Novogratz's realistic $100K-$125K range reflects consolidation following recent deleveraging that "takes few weeks and sometimes months for markets to heal".