A retail trader from United States agreed to pay more than $357,000 to settle charges that he manipulated options prices through a scheme involving fake orders, federal regulators announced this week.

California Trader Pays $357K to Settle Options Spoofing Case

Ryan Cole, who lives in Florida, used a technique called “spoofing” to artificially move prices on thinly traded options while working at an unnamed financial firm, the Securities and Exchange Commission (SEC) said. The practice netted him roughly $234,000 in profits before he was caught and fired.

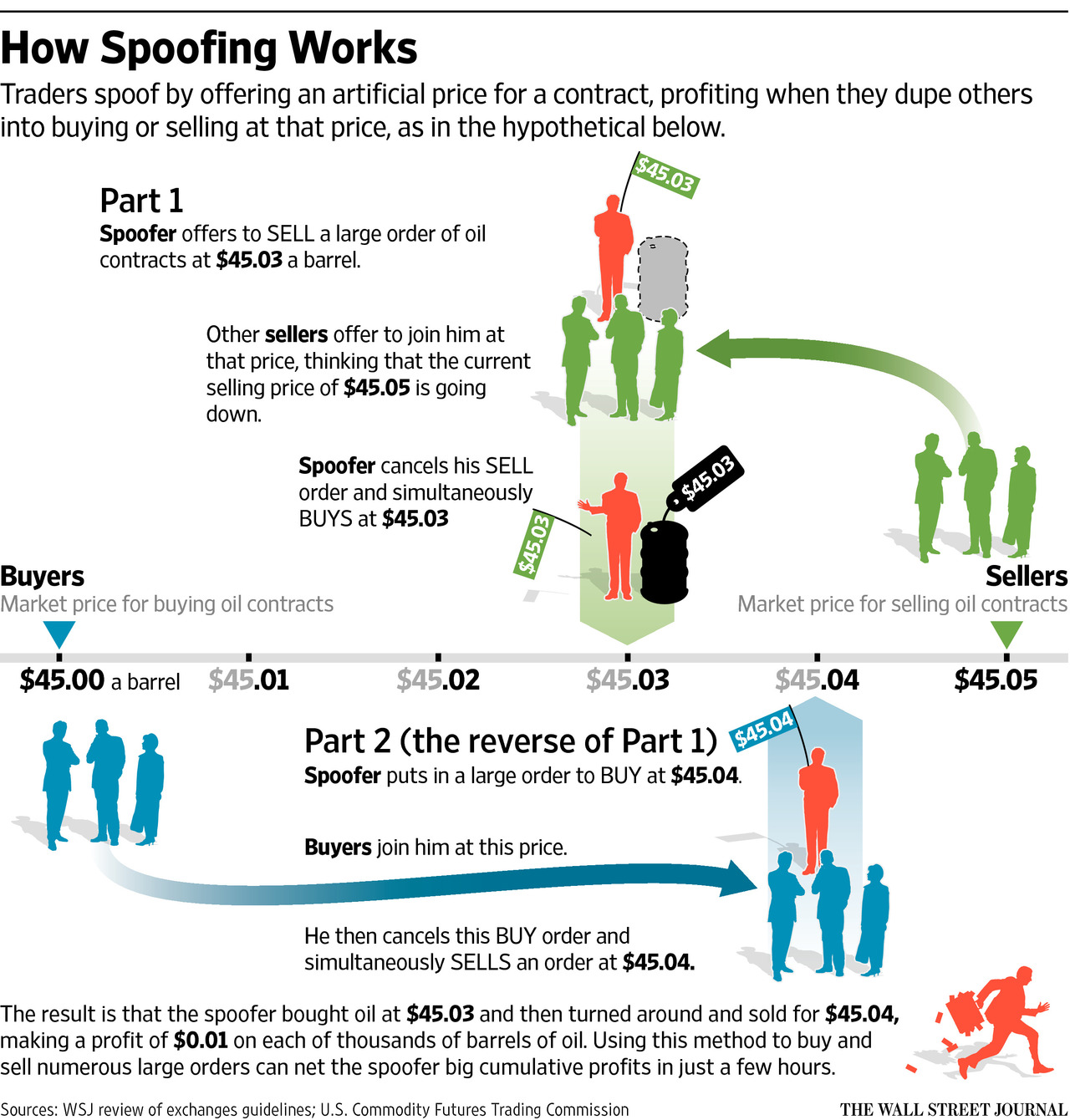

The scheme worked by placing fake orders that he never intended to execute, creating the appearance of demand or supply that would push prices in his favor. Cole would then quickly place real trades at the manipulated prices before canceling the fake orders, according to the SEC complaint filed in federal court in California's Eastern District.

Cole made his spoofing more sophisticated by spreading fake orders across multiple related options series rather than focusing on just one contract. He used complex multi-leg orders that would execute immediately or be canceled, timing them carefully with his spoof orders to maximize the manipulation's impact.

In 2020, another trader was ordered by the SEC to pay more than $200,000 in penalties for spoofing.

Five-Year Trading Ban

When his employer started asking questions about unusual trading patterns, Cole allegedly lied to cover his tracks. The firm eventually terminated him, though the SEC didn't identify which company employed him during the scheme.

“Cole took steps to conceal his spoofing scheme from the firm by providing false and misleading responses to questions posed about his trading,” the SEC said in its complaint.

The settlement requires Cole to pay back his $234,803 in profits plus $52,656 in interest, along with a $70,441 civil penalty. He also faces a five-year trading ban that prevents him from opening or maintaining brokerage accounts in his name, his family members' names, or through companies he controls without notifying brokers about his violations.

Cole agreed to the settlement without admitting or denying wrongdoing, which is standard practice in SEC enforcement cases. The deal still requires approval from a federal judge.

Spoofing Fines Also Hit Major Players

Spoofing became illegal under the 2010 Dodd-Frank Act, though regulators have struggled to catch sophisticated practitioners who can carry out the scheme in milliseconds using algorithmic trading. The practice undermines market integrity by creating a false impression of supply and demand.

The SEC penalizes not only individuals but also large institutions for spoofing. Last year, TD Securities was fined $6.5 million for failing to supervise its head trader. In 2023, BofA Securities paid $24 million for more than 700 instances of the illegal practice.

The largest spoofing fine to date was issued in 2019 to Tower Research, which was ordered to pay $67 million. According to the CFTC, another U.S. regulator, the firm had earned nearly $33 million from the practice.