Strong growth in prop trading revenues among non-bank liquidity providers has highlighted the potential impact of market expansion on CFD brokers.

Data from Crisil Coalition Greenwich indicates that on average, less than half of non-bank liquidity provider revenues come from market making activities – with prop trading accounting for an increasing proportion of revenue growth.

CFD Brokers Are Losing Business to Prop Firms

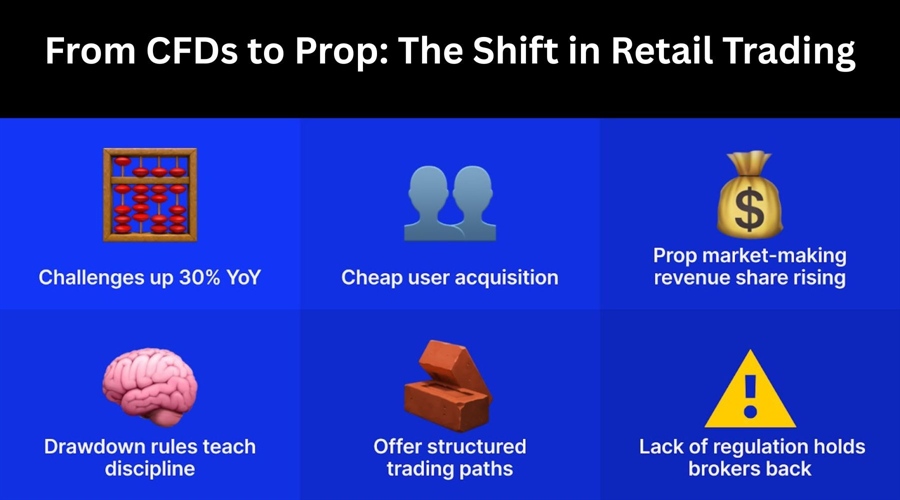

One of the interesting questions raised by this acceleration in prop trading revenues is its effect on CFD brokers. In addition to anecdotal evidence in the market to suggest that CFD brokers are losing business to prop firms, Charles Finkelstein, CEO and founder of Upside Funding says his firm’s analysis suggests the number of challenges sold is rising by around 30% per annum.

“An argument a trader may make when deciding between the two options is that prop firms have rules and CFD brokers do not, which is completely valid,” he says. “Prop firms may also take a percentage of the profit, but rules don't have to be the bad guy. The investment banking framework for its prop traders has very similar rules, such as drawdowns. In our opinion, staying within the drawdown limits of a prop firm teaches the trader the most important rule – to preserve your capital at all costs.”

Oliver Olejar, COO of Lux Trading Firm, is confident that CFD brokers have already lost a lot of retail traders to prop firms and that there will be more brokers offering some kind of prop account as they see prop firms get bigger than many retail brokers.

In the world of trading, the relationship between CFD brokers and proprietary trading firms is often seen as competitive. However, the reality is perhaps more complementary with prop firms providing a structured pathway for traders to leverage substantial capital, while CFD brokers cater to a broader spectrum of trading needs.

“We view coexistence with CFD brokers as beneficial,” says Simone Nateri, Chief Operating Officer at City Traders Imperium. “It diversifies the financial landscape, enriching the trading community as a whole. Moving forward, the emergence of prop firms within established CFD brokerages could further this synergy, creating a richer, more diverse trading ecosystem.”

Siju Daniel, Chief Commercial Officer at ATFX, takes a similarly nuanced view, suggesting there is plenty of room for brokers and props to co-exist. “Entering the prop space depends on the broker’s models and risk appetite,” he says. “It is likely that more brokers will join the prop market but with the regulatory uncertainty it is understandable why larger companies would hesitate to jump in.”

Brokers Joining Props

Larger CFD brokers will be motivated to open prop trading arms, suggests Saul Lokier, CEO of The5ers. “Prop firms have an easier and cheaper way to acquire users than brokers, so it makes sense for brokers to open prop arms under their offshore licences to acquire more users,” he says.

“We have already seen some major players roll out funding programmes and tap into this booming market and I think there will be more to come,” says Fintokei co-founder, David Varga. “However, prop trading business comes with its own risks and challenges, which are different to the brokerage industry, so it will be interesting to watch how some other experienced players handle these risks and challenges as well as whether they would bring any actual innovations to the market.”

The CFD broker space is saturated and highly competitive and success often depends on having deep pockets to spend on marketing.

“While I think some smaller brokers may follow in the footsteps of Blueberry Markets and launch their own prop firms, I still believe annual gross revenue across the prop trading industry is relatively insignificant when spread across the massive number of CFD brokers operating globally,” observes David Dombrowsky, CEO & founder FX2 Funding.

MetaQuotes Dominates

FinanceMagnates.com has reported extensively on MetaQuotes’ decision to start issuing licences to prop firms again after its regulatory crackdown in February 2024 recalibrated the market. So what do our interviewees make of this move?

“It is incredibly significant because our analysis suggests around 55% of the online trading community globally has MetaQuotes as its favoured trading platform,” says Finkelstein. “As a prop firm you want your traders to be as comfortable as possible when trading, so this could only be seen as revenue generative.”

Dombrowsky says his firm expects to be licensing its own MetaQuotes platform by the end of April and while he is not convinced it will automatically attract more traders, he believes it will definitely add credibility and strengthen brand equity – important considerations in a crowded space.

According to Nateri, MetaQuotes’ decision to reissue licenses to proprietary trading firms is a pivotal moment for the industry and reflects a strategic response to evolving market dynamics, where a surge in new proprietary trading firms and the adoption of alternative platforms like cTrader and TradeLocker have begun to diversify the landscape.

“These platforms have gained traction among traders looking for modern features and enhanced user experiences, posing a potential long-term threat to MetaQuotes’ dominance in the trading platform market,” she says.

“By re-engaging with prop firms, MetaQuotes is not only broadening its own market reach but also reinforcing its position in a rapidly changing industry,” adds Nateri. “Ultimately, this decision is likely driven by the need to stay ahead in a market where technological adaptability and innovation are key. It is a proactive approach to counteract the shift towards newer trading platforms and to maintain a leading edge in the proprietary trading sector.”

Varga agrees that this is significant news for prop firms and potentially a threat to other platform providers but doesn’t think that it would be a huge change for the industry.

“For smaller, up-and-coming prop firms that pivoted or struggled during the ban the change is welcome, albeit arguably a bit late,” he says. “The industry has moved on and prop firms face many other obstacles, which is why I don’t expect many new firms to be coming to the scene, with or without the MetaTrader platform.”