FX brokerage is a lucrative business, so it is no surprise that there are always potential market entrants assessing the best way of gaining a foothold in key trading jurisdictions. For these entities, a key consideration is whether to acquire an existing FX broker license or apply for a new one.

How to Get a FX/CFDs Brokerage License?

One obvious disadvantage of the latter approach is the legal complexity Amirani Azaladze, CEO of Forex Brokers License explained. However, he also acknowledged that buying an existing license without active currency operations may not be a suitable decision.

“The transfer process and regulatory approval take the same time as obtaining a new licence and the cost of the existing licence is often significantly higher, sometimes up to three times more than obtaining a new one,” Azaladze stated.

In many jurisdictions, it is becoming increasingly difficult to open a new FX/CFD brokerage as regulators are clamping down on the industry. That is the view of Chris Rowe, the Director of Financial Technology Consultancy Services, who said the buy-or-apply decision should be determined by what is required to set up a new licenced brokerage, and the applicant's business model.

“If you are an existing regulated brokerage you may be happy to wait for the full application to be made as you are already making money elsewhere,” he said. “If you work for a brokerage and are looking to move your existing client base onto your own company, waiting nine months for [an] FCA application to go through may not work.”

According to Rowe, there is an increasing demand from clients to purchase existing brokerages rather than apply for a new licence in the major FX jurisdictions.

Timeframe for Receive a New License is Lengthy

Emily Faye Helmer, the Head of partnerships at Clearsky Network said that the timeframe for establishing a license has significantly increased in the past 2-3 years due to enhanced AML policies.

“Furthermore, in certain jurisdictions regulators aren’t eager to issue new licences," she added. "Instead of waiting 10 months or longer with no guarantee of actually obtaining the licence, the purchaser of an existing licence can enjoy a much friendlier timeframe of 3-4 months until completion of ownership transfer.”

Clearsky Network operates a marketplace that brings together the buy and sell side of these transactions where the purchaser of a licenced company is informed of all the relevant requirements to take control of the company. The main disadvantage of purchasing an existing licence is that it usually carry a business history that must be carefully examined by the purchaser.

“This is done by conducting due diligence on the existing licence's financial reports, accounts and clientele to make sure company being purchasing is clear of sanctions, fines, or debts,” added Helmer.

Money Matters

Capital requirements will vary based on the type of licence and jurisdiction. High call and transparent regulators like CySEC, FCA and ASIC have the highest requirements based on whether a licence is STP, a market maker or if the company has other services except trading Azaladze mentioned.

“Based on MIFID standards, minimum capital starts from €135,000 for non-market maker brokers,” he observed. “In Mauritius, the capital requirement for market maker brokers is approximately $21,800. In Vanuatu, it is approximately $42,000 and for a Seychelles FSA international securities dealer the minimum level of liquid capital is around $37,000.”

Traders favour leverage over consumer protection and the major jurisdictions offer significantly lower leverage than their offshore equivalent so it can seem less desirable than an offshore licence. However, there is significant prestige in having an ASIC , CySEC or FCA licence.

“Where your clients are based may also influence what the best licence is in terms of marketing prestige,” said Rowe. “Southeast and Far East Asia favour ASIC and FCA, whereas the Middle East prefers CySEC. In terms of offshore licences, Mauritius, Seychelles and Bahamas seem to be the most sought after, and South Africa also seems to be gaining popularity if you are looking to target the African continent.”

Firms that either provide advice on, or arrange retail investment products for consumers, reported revenue earned in 2022 had increased by 3% to £5.5 billion compared to 2021. #FCAData #RetailInvestment https://t.co/LLdlXHdPh9

— Financial Conduct Authority (@TheFCA) August 3, 2023

Onshore vs Offshore

The main difference between offshore jurisdictions like Mauritius, Seychelles, Vanuatu, and Labuan compared to onshore jurisdictions such as EU countries, the UK, Australia and Canada from a licensing framework perspective is that for onshore jurisdictions the framework with respect to AML and KYC requirements from the ultimate beneficial owner is much more enhanced, noted Helmer.

“For example, the FCA requires the ultimate beneficial owner to disclose a much higher and more comprehensive amount of supporting documentation on the source of their funds, financial stability, and background in the FX industry than the FSA, the regulatory body in Mauritius,” she said.

Licensing costs vary widely depending on the jurisdiction. For example, the FCA requires applying brokers to have a manned office in the UK and directors and regulated positions to be covered.

“The broker will also need to engage with a compliance specialist company in order to have any chance of the new application being approved,” Rowe commented. “All this for an application process that typically takes nine months and has no guarantee that the licence will be issued at the end of it.”

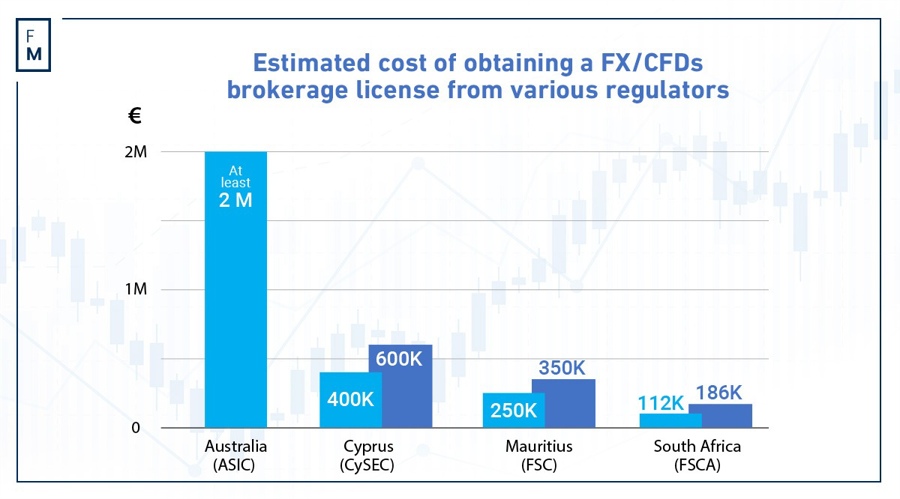

For those looking to acquire an existing licence in the UK, a 150K (STP only) licence can cost up to £1 million and a 750K (market making) licence more than seven figures. “ASIC licences tend to be more expensive and prospective buyers should budget at least €2 million for a market making licence,” Rowe stated.

“CySEC is cheaper than ASIC or FCA equivalents at €400,000-€600,000 and if you go offshore the cost comes down again with Mauritius licences typically selling for €250,000-€350,000. South Africa is cheaper still at approximately $120,000-$200,000.”

A spokesperson for the FCA observed that it has a pre-application support service for overseas wholesale firms and their advisers wishing to expand into the UK and that firms wishing to request a pre-application meeting can do so on its website.

In a recent interview with Finance Magnates, Dr George Theocharides, the Chairman of CySEC explained that there are many reasons why someone with a licence which has some value might wish to sell it. “For us, a new application triggers a robust process to ensure that the entity can meet its obligations under the law and contribute to strong investor protections,” he declared.

The process includes stringent due diligence on the owners, which can take months. Any changes to the organisational structure or business model are also carefully examined.