Publicly listed Polish fintech XTB (WSE: XTB) has added French PEA (Plan d'Épargne en Actions) accounts to its investment platform, marking another step in the company's strategy to attract long-term investors across European markets.

The move follows similar launches of tax-advantaged accounts in Poland and the United Kingdom last year, as the company works to strengthen its position among more passive retail investors.

XTB Expands Long-Term Investment Offerings with French PEA Accounts

PEA accounts, which numbered over 7 million active accounts in France by the end of 2023, offer tax benefits for investments in stocks and ETFs that allocate capital to companies within the European Union and European Economic Area.

"We aim to provide our clients with an investment application where their money can work in multiple ways, both short and long-term," said Omar Arnaout, CEO of XTB. "Investment accounts offering tax benefits are often chosen as the most beneficial option when beginning an investment journey."

XTB's PEA offering will maintain the company's standard commission structure, allowing investors to trade stocks and ETFs without fees up to a monthly trading volume of €100,000. The company positions this as a competitive advantage in the French retail investor market.

In France, this direction could be particularly favorable for XTB, as the number of active CFD traders there is relatively low—fewer than 30,000. Given the country's size and population, this is a rather modest figure. By comparison, in Poland—XTB’s home country—117,000 people actively traded CFDs.

Attracting new, more long-term investors is clearly paying off. As reported by FinanceMagnates.com, XTB’s trading volume tripled the record levels seen during the COVID-19 pandemic on April 7, when Trump’s tariff volatility swept through global markets.

XTB's European Passive Expansion Strategy

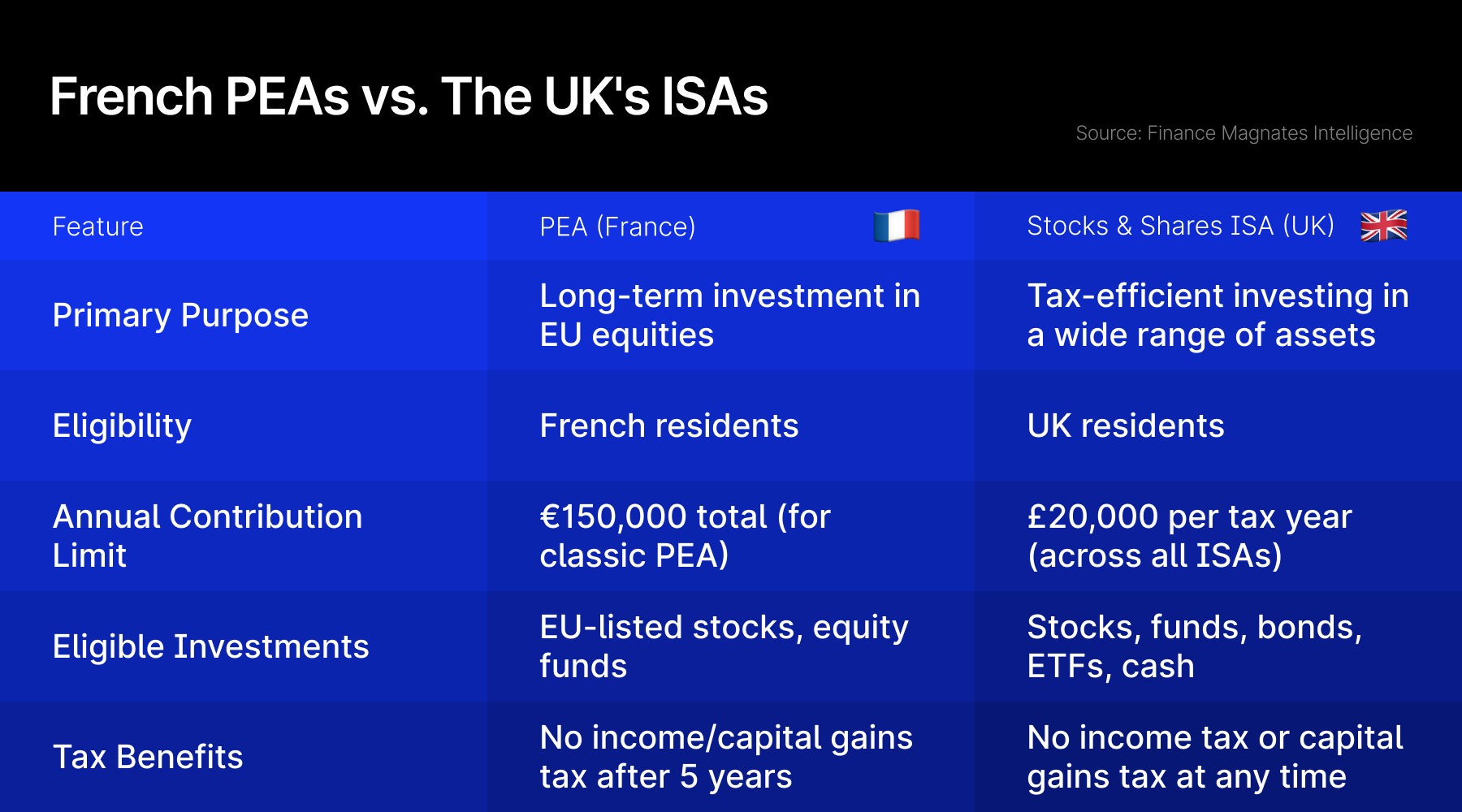

This latest product launch continues XTB's pattern of introducing tax-advantaged investment accounts across key European markets. The company previously launched IKE (Individual Retirement Accounts) in Poland and ISA (Individual Savings Accounts) in the United Kingdom, capturing market share in the long-term investment segment.

“After Poland and the United Kingdom, we have chosen France, where PEA accounts are highly popular,” added XTB’s CEO. “I believe that with this new offering, we will be able to strengthen our competitive position and significantly scale our business in this country.”

The expansion comes as European retail investors increasingly seek tax-efficient vehicles for building long-term wealth, particularly in uncertain economic conditions.

The introduction of long-term investment accounts also represents the latest development in XTB's product strategy. The company is working on enhancing its eWallet offering with additional currencies and benefits for multi-currency card users, while simultaneously developing options trading and physical cryptocurrency trading capabilities.

Founded in 2004, XTB currently serves nearly 1.5 million clients globally through its online investment platform and mobile application. In 2024, the company acquired 500,000 new customers, with revenues increasing by 16% to nearly 1.9 billion PLN.