It seems Saxo not only maintained its strong profitability from first half of 2010 but has actually grown way beyond industry averages. If public brokers like FXCM and Gain reported earnings higher by 16-23% Saxo has managed to actually triple its net profit. Not only that, but between the pages you can find that Saxo has managed to sign Barclays as a White Label partner. Barclays will join the likes of Citi and even Microsoft who already lease Saxo's solution. It seems Saxo, who was going through some rough patch back in 2009, has completely rebounded, rebranded and all but positioned itself as the banks' retail Forex platform of choice.

In terms of net income Saxo and FXCM have reported more or less same number - ~$120 million. Gain reported around $34 million (adjusted).

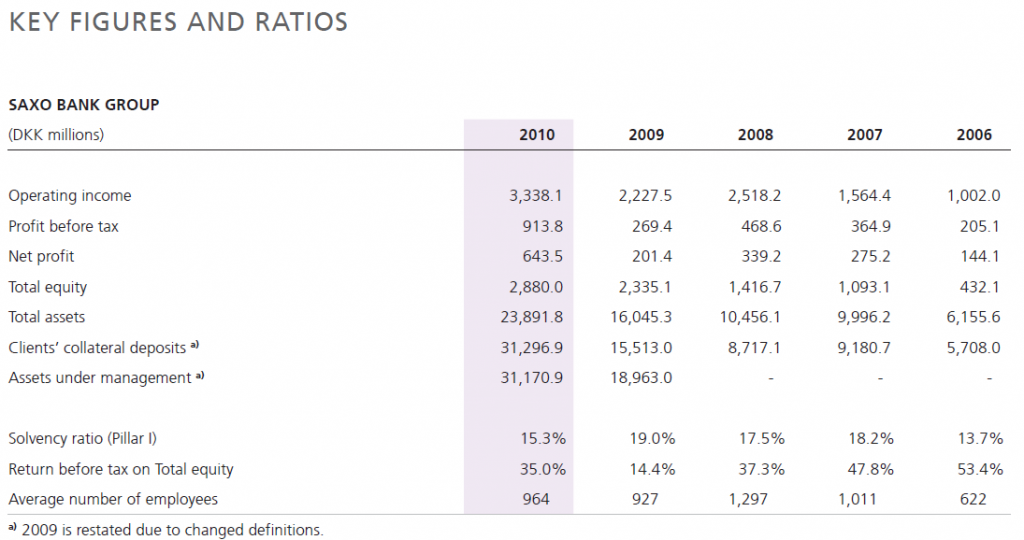

- With net profit of DKK 644 million, the trading and investment specialist today announced its best full-year results ever.

- Operating income reached DKK 3.3 billion for the Group in 2010, compared to DKK 2.2 billion in 2009. This 50% year-on-year rise in operating income can be attributed to larger client numbers, increased deposits and high trading activity in the first half of the year.

- Total costs for the year increased by DKK 0.5 billion to DKK 2.4 billion for the Group, an increase of 24% from the previous year. Saxo Bank continued to invest in geographical expansion, product and platform developments, systems upgrades and new business. Despite these investments, profit before tax increased by more than three times to DKK 914 million.

- Total assets increased during the year – from DKK 16.0 billion in 2009 to DKK 23.9 billion in 2010. The increase is due to a growth in client’s cash deposits as well as acquisitions by Saxo Bank such as the acquisition of E*Trades Nordic activities and Broerup Sparekasse.

- Clients’ collateral deposits related to the online trading business in Saxo Bank more than doubled to DKK 31.3 billion as at 31 December 2010. Excluding Saxo-Etrade Bank, which was acquired during the year, the growth was DKK 5.6 billion, equivalent to 36%. In addition, by means of organic growth in Sirius, Capital Four and Global Evolution, Saxo Asset Management grew its assets under management from approximately DKK 19.0 billion to more than DKK 31.2 billion as at 31 December 2010.

The founders and CEOs of Saxo Bank, Kim Fournais and Lars Seier Christensen, said in a joint statement:

“Since autumn 2008, Saxo Bank has been implementing a transformation plan with the aim of maintaining growth while simultaneously ensuring profitability and efficiency. The external events following the financial crisis and the performance posted in 2010 prove that our initiatives are steering the Bank on the right track. We consider this year’s results very satisfactory.

“Saxo Bank will continue to focus on maintaining its technological advantage in the financial industry and will open more local sales offices through acquisitions or as green field start-ups with a view to improving client sales and service”.

As at 31 December 2010, the solvency ratio for the Group was 15.3%.

Here is something you can find within the pages regarding the Barclays deal:

“Over the past several years Saxo Bank has gained industry recognition for its online trading platforms, multi-product offering, prices and services. This year, the Bank was especially recognised for its White Label business. Saxo Bank was awarded the top spot by subscribers of Profit & Loss, a monthly business magazine, and was also voted ‘Best Re-Labelling Platform 2010’. Saxo Bank was also chosen as ‘Best White Label Solution Provider’ at the World Finance Foreign Exchange Awards 2010, acknowledging the Bank’s long-established programme of investment and innovation within its White Label business”.

“Saxo Bank reached a major milestone in developing the institutional business in December 2010, when Barclays Stockbrokers Limited entered into an agreement with Saxo Bank, whereby the Bank will produce and tailor an international equities offering that caters for clients of Barclays Stockbrokers. Another important step was reached when Saxo Bank entered into an agreement with Microsoft to design and tailor-make a Trading Platform , MSN Trader. MSN Trader, which is featured on Microsoft’s MSN Money website in the UK, was launched in November. Microsoft and Saxo Bank intend to expand the cooperation, with other MSN regions expected to follow in 2011.”

However, early February 2011 Barclays launched a Saxo Bank white labeled platform to supply their UK client base with an International Equities solution. The solution, which goes under the name “International Trader”, encompasses over 9,000 equities, 21 major global exchanges in 13 international markets and the Equities research solution. The release is marketed widely in the UK marketplace as well as to Barclays’ existing UK clients base, and has already seen considerable client pick up and.

For more information on the offering place click the link: https://www.stockbrokers.barclays.co.uk/?category=whatweoffer&usecase=landing61

Click the link below to see full Saxo Bank's 2010 financial report.

// <