A few years ago, heading offshore was seen - even in the often less than scrupulous retail trading industry - as an indicator of dubious business practices on the part of a broker.

But with more jurisdictions opening up to brokers and new regulations pushing them away from Europe, heading offshore is a more reasonable step for a business to take than it was two or three years ago.

Before looking at what benefits one can accrue from heading to the Bahamas or Belize, it’s worth defining what we mean by ‘offshore.’ Australia’s shores are, for instance, far away from the hawk-eyed regulators over at the European Securities and Markets Authority - but the Land Down Under is certainly not an ‘offshore’ jurisdiction.

For our purposes, the best way to define ‘offshore’ is something like, ‘a jurisdiction that is not a traditional center of financial services activity and which has far fewer regulatory strictures.’

Obviously, this is not a catch-all definition as not all offshore locations are the same. Some jurisdictions, for instance, have no regulations and minimal financial services activity. Conversely, some are small hubs for the financial services industry and have developed a solid set of laws to govern retail trading firms.

Tax benefits

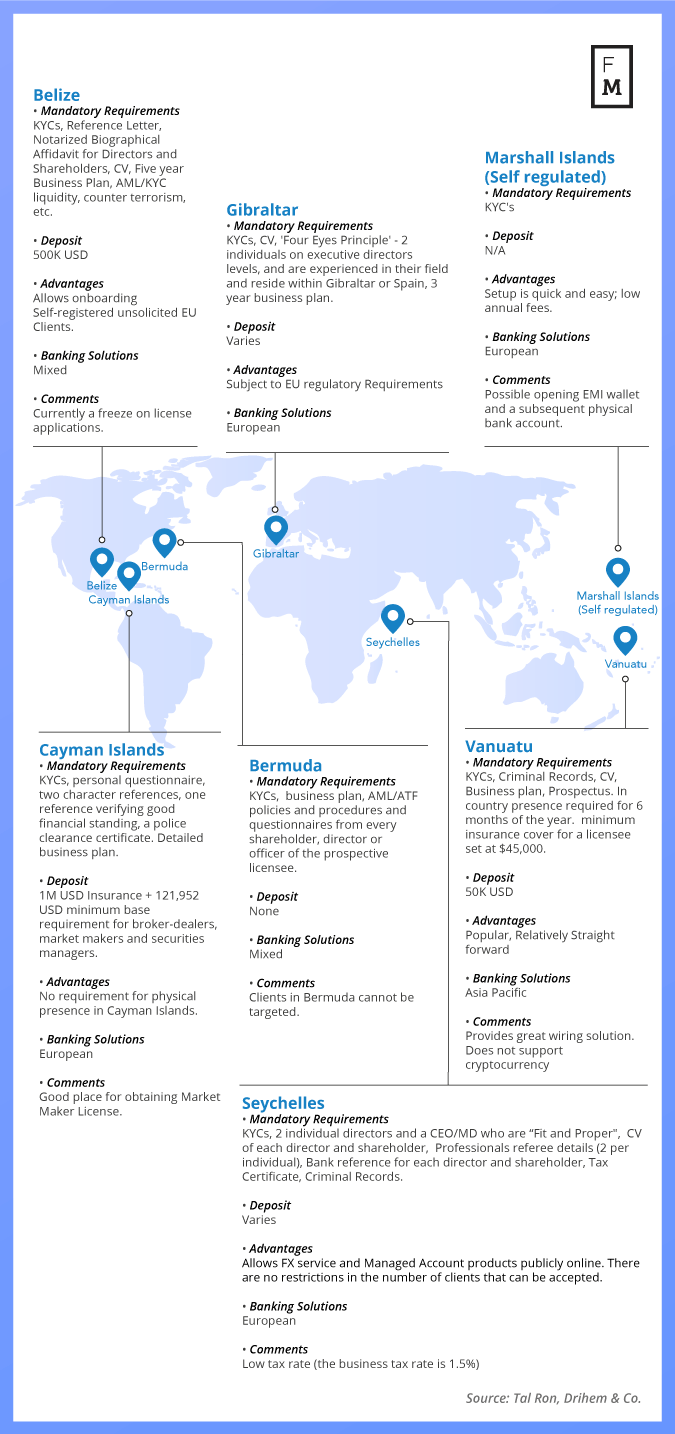

A broker’s decision to head to one of these jurisdictions will be guided by a number of factors. That could include tax benefits, setup costs, regulations and access to banking facilities. Another major consideration is experience.

Tal Itzhak Ron, Chairman and CEO, Tal Ron, Drihem & Co

“There is no right or wrong choice when going offshore as there's no one-size-fits-all solution for brokers,” said Tal Itzhak Ron, Chairman and CEO at legal firm Tal Ron, Drihem & Co. “New brokers or high caliber brokerage dissidents who wish to rejuvenate the financial industry and embark on a journey of their own, normally possess the know-how but they lack the financial capacity of the large players. So going offshore is the only way for them to break into the industry.”

Until recently, the favorite offshore destination for brokers was Vanuatu, a small country in the south Pacific Ocean where some people worship Prince Philip, the Queen of England’s husband, as a God.

The reason for that was simple - it was incredibly cheap to set up a brokerage there. Until the summer of 2017, capital requirements for firms operating on the island were set at only $2,000.

To give some idea of how minuscule an amount this is, the equivalent number for the US is $20 million. And in the wake of ESMA’s regulatory changes, European brokerages effectively need over 730,000 euros ($827,000) to be operational.

Offshore clampdowns

Vanuatu’s rules meant that an astonishing 500 foreign exchange brokers were licensed in the south Pacific nation by 2017. But unfortunately for the often mysteriously anonymous set of companies heading to the country, in the summer of that year, local regulators clamped down on the industry.

“Constant pressure from international bodies and major regulators, meant the Vanuatu Financial Services Commission had to come up with newly drafted and extensive dealers in securities and AML laws,” said David Woliner, Head of Financial Regulation at Nir

David Woliner, Head of Financial Regulation at Nir Porat & Co. Law Firm

Porat & Co. Law Firm. “That means there is now a much more complex and highly detailed licensing process and a $50,000 capital requirement. That’s still one of the lowest requirements amongst offshore jurisdictions but far away from the previous $2,000.”

Those rules didn’t wipe out the trading industry in Vanuatu entirely, but there are now approximately 140 brokers registered in the country, a more than 70 percent reduction compared to when the capital requirements were lower.

And that number could be about to shrink further. This week, regulators in Vanuatu made further changes to laws, including stricter auditing requirements, insurance coverage and a requirement that company directors stay for six months of the year in the country.

Vanuatu is not the only offshore jurisdiction to tighten the screws on the retail trading industry. Before the small country became a hotspot for brokers, Belize was the industry’s ‘go to’ offshore jurisdiction.

Prior to 2016, the South American nation had capital requirements of $100,000 and a required annual payment to the local regulator, the International Financial Services Commission (IFSC), of $5,000.

Once again, pressure from financial authorities in different countries pushed the IFSC to make changes to its rules. Firms must now have $500,000 to get started and pay $25,000 a year to the regulator. The IFSC has also put a freeze on new license applications for over a year and seems likely to keep it in place for the foreseeable future.

More regulations, more legitimacy

The changes in Belize and Vanuatu are in many ways a reflection of the growing regulatory scrutiny that the retail trading industry is facing across the world.

In Europe, which was previously the home of most respectable brokers, regulation has pushed many of the smaller players to look for offshore licensing. In turn, growing offshore regulations, perhaps for the better, have hit the most cheaply run, and often least savory, brokers in the market.

That has left us with a situation in which going offshore is, because of European regulations, understandable and, as there are now some solid regulations in those jurisdictions, not simply evidence that your company is run by a bunch of hucksters.

Having said that, just looking at Vanuatu and Belize illustrates the differences that exist amongst offshore jurisdictions - a company that can afford to pay $500,000 is likely to be more established and more legitimate than one that only has to fork up $50,000.

Consequently, it seems plausible that in the next couple of years we might start to see a mirroring of Europe, with brokers registered in some offshore jurisdictions being seen as trustworthy and others as more likely to offer inferior service.

ESMA pushes, offshore pulls

Established firms are already opening offices in these places. For instance, in the middle of last year, ActivTrades opened an office in the Bahamas. FxPro did the same, citing regulation in Europe as its reason for getting a regulatory license in the country.

Similarly, AvaTrade has had an office in the British Virgin Islands for several years. Gain Capital has had a regulatory license from the Cayman Islands for over a decade and eToro, Alpari, ForexTime, and XM are all regulated in Belize.

For now, firms that were smart enough to get an Australian license before ESMA’s rules went into effect are less likely to get an offshore license. The reason for that is fairly straightforward - the Australian Securities and Investments Commission (ASIC) is a respected regulator, and it still permits high Leverage trading.

But, if ASIC does clamp down on leverage as ESMA has, then we could start to see a real boom in the offshore market. In fact, if that does occur, it could make ‘onshore’ locations suitable only for big market players, such as IG Group or Plus500, and offshore locations the home for smaller firms.