Dogecoin, often called DOGE, started as a joke cryptocurrency in 2013. Fast forward to today, it is one of the most popular digital assets, with a massive community of supporters and strong market influence. With the 2024 U.S. presidential election stirring excitement and Elon Musk’s growing involvement, many wonder, “Will Dogecoin go up?”

In this article, we dive deep into Dogecoin price predictions for 2024, 2025, 2026, and beyond, analyze its historical price trends, and discuss whether DOGE could reach new all-time highs by 2030. This comprehensive guide includes technical analysis, predictions, and potential scenarios for Dogecoin’s future value.

Dogecoin Overview: A Brief History

Dogecoin is a cryptocurrency created by Billy Markus and Jackson Palmer as a parody of Bitcoin. What started as a lighthearted project has grown into a serious investment option with a loyal community.

Key Milestones in Dogecoin’s History

- 2013: Dogecoin launched as a meme-based cryptocurrency.

- 2021: Dogecoin’s price skyrocketed to its all-time high of $0.73 due to social media buzz and Elon Musk's tweets.

- 2024: Dogecoin’s value surged by over 350% following Donald Trump’s 2024 election win and Elon Musk’s appointment to lead a government agency called DOGE.

Dogecoin Price History: From Creation to Today

This week, Dogecoin's price reached multi-month highs, testing $0.4386 on Binance on November 12, 2024—the highest in over three years. Since the beginning of the year, DOGE's price has increased by nearly 300%.

If you want to learn more about: “Why Dogecoin price is surging” in the last weeks, you can check this article.

Dogecoin's Historical Price Analysis

- Early Years: Dogecoin remained below $0.01 for much of its history.

- 2021 Surge: DOGE reached its all-time high of $0.73, driven by celebrity endorsements and meme culture.

- 2024 Recovery: After a bearish period, Dogecoin’s current price in November 2024 is $0.35, reflecting renewed interest.

Year | Price Range | Key Events |

2021 | $0.05–$0.73 | All-time high fueled by Elon Musk’s tweets. |

2022–2023 | $0.05–$0.10 | Decline due to market-wide corrections. |

2024 | $0.10–$0.44 | Boost from Trump’s win and Musk’s influence. |

After a very calm 2023 and a bearish 2022, during which DOGE lost nearly 60% of its value, 2024 is bringing highly dynamic growth. While these gains are nowhere near the speculative frenzy of 2021, which saw a 3,500% surge, they still outperform most of the major cryptocurrencies.

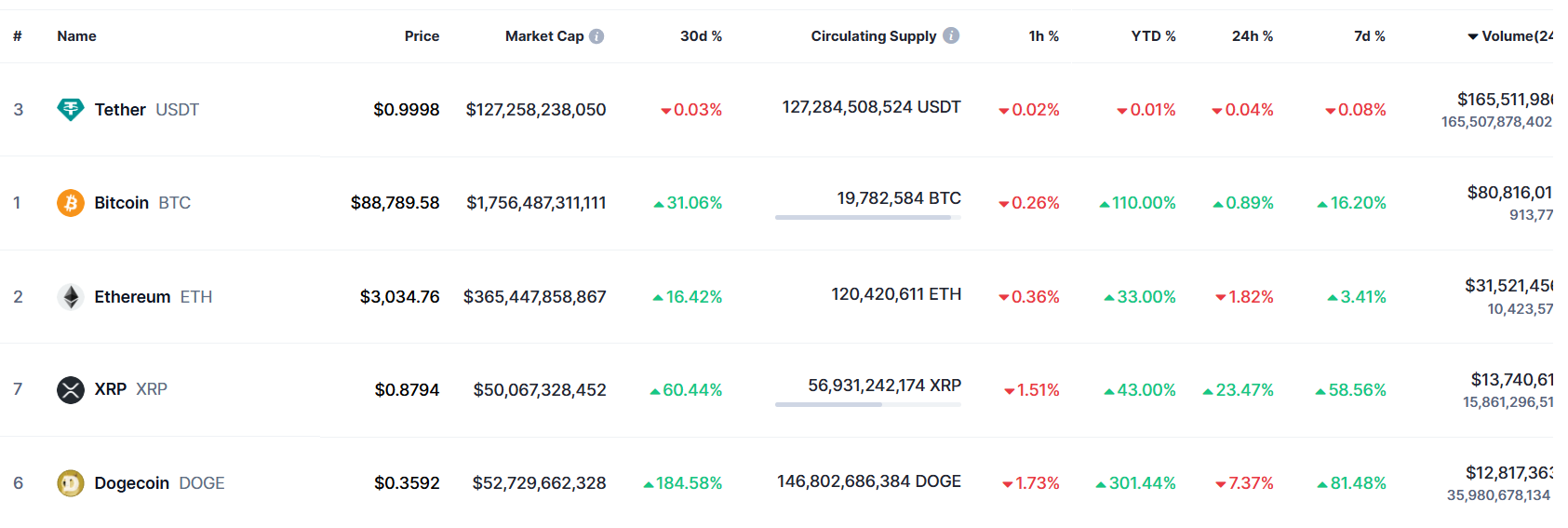

Currently, Dogecoin is one of the biggest cryptocurrencies by market cap (6th) and by daily volumes (5th):

Dogecoin Price Prediction 2024

Factors Driving Dogecoin’s Price in 2024

- Donald Trump’s 2024 Election Win: His administration’s pro-crypto stance could boost Dogecoin.

- Elon Musk’s Role: Musk’s appointment as co-chair of the government’s DOGE agency has already driven investor optimism.

- Market Trends: Renewed interest in meme coins and altcoins is likely to sustain DOGE’s momentum.

“DOGE has been an outstanding charting market following classical charting principles,” claims Peter Brand, the veteran trader from Wall Street. “I am going to follow up in a few hours with a comparison chart that will blow your mind (as long as I remember to do so at age 78).”

DOGE $DOGE has been an outstanding charting market following classical charting principles

— Peter Brandt (@PeterLBrandt) November 13, 2024

I am going to follow up in a few hours with a comparison chart that will blow your mind (as long as I remember to do so at age 78) pic.twitter.com/xKuLflPgea

Doge Price Prediction Table for 2024

Month | Minimum Price of Dogecoin | Maximum Future Price | Average Price |

Q1 2024 | $0.25 | $0.35 | $0.30 |

Q2 2024 | $0.30 | $0.45 | $0.37 |

Q4 2024 | $0.40 | $0.60 | $0.50 |

By the end of 2024, Dogecoin’s price is expected to reach around $0.60, barring major market disruptions. However, there are people with much more positive projections:

$doge will hit $4.20 easily this cycle

— Coochie Fiend (@Coochie_Fiend_) November 6, 2024

And I’m not even joking

Research “Golden Bull”#dogecoin pic.twitter.com/l0CGK5GK4i

Dogecoin Price Predictions for 2025–2030

2025 Price Prediction

The price of DOGE may experience steady growth in 2025. Adoption by merchants and partnerships with payment processors like PayPal could drive the price higher. Analysts predict that the DOGE price could reach a maximum of $0.85 by the end of 2025.

2026 Price Prediction

By 2026, Dogecoin’s price may increase with technological advancements. Its minimum price is expected to hover around $0.50, while its maximum price could reach $1.00. Find out more about the newest DOGE price predictions for 2026 here.

2030 Price Prediction

Dogecoin’s long-term price target depends on broader adoption and market trends. If Dogecoin reaches its potential as a widely accepted digital currency, it could surpass $1.50 by 2030.

Year | Minimum Price | Maximum Price | Average Price |

2025 | $0.50 | $0.85 | $0.70 |

2026 | $0.50 | $1.00 | $0.75 |

2030 | $1.00 | $1.50 | $1.25 |

Why Dogecoin Could Reach All-Time Highs Again

1. Elon Musk’s Influence

Elon Musk’s ongoing support has played a pivotal role in Dogecoin’s growth. His involvement in the DOGE government agency and frequent mentions on social media keep Dogecoin in the spotlight.

Elon Musk on D.O.G.E:

— DogeDesigner (@cb_doge) November 13, 2024

"I think we can reduce the annual federal budget by atleast $2 trillion per year. Your tax money is being wasted and the Department of Government Efficiency is going to fix that."

pic.twitter.com/KWtqEl8xEl

2. Market Sentiment

The Dogecoin community remains one of the most active and loyal in the cryptocurrency space. This enthusiasm often drives up prices during bull runs.

3. Adoption and Use Cases

- Merchants Accepting DOGE: Companies like Tesla already accept Dogecoin for certain purchases.

- Future Partnerships: New partnerships with financial services or e-commerce platforms could increase demand.

4. Broader Market Trends

Dogecoin often follows the price action of larger cryptocurrencies like Bitcoin and Ethereum. A strong crypto market could push Dogecoin toward new all-time highs.

Experts are also highlighting technical analysis. On the DOGE chart, a “golden cross” has just occurred, where two long-term moving averages have crossed.

“The majority here don't seem to understand the implication of this golden cross that just occurred on DOGE,” pseudonymous analyst Mikybull, commented. “Last cycle, dogecoin rallied almost 7,000% after the golden cross.”

The majority here don't seem to understand the implication of this golden cross that just occurred on $DOGE.

— Mikybull 🐂Crypto (@MikybullCrypto) November 12, 2024

Last cycle, dogecoin rallied almost 7,000% after the golden cross. pic.twitter.com/K0vBRQGrSs

Should You Invest in Dogecoin Today?

Risks of Investing in Dogecoin

- Volatility: Dogecoin’s price can swing significantly within days.

- Lack of Utility: Unlike Ethereum, Dogecoin does not have smart contract functionality.

- Regulatory Uncertainty: Increased regulations could impact the cryptocurrency market.

Rewards of Investing in Dogecoin

- Potential Growth: If Dogecoin continues to gain mainstream acceptance, its price could skyrocket.

- Community Support: A loyal community helps maintain its relevance.

- Low Entry Point: Dogecoin is affordable compared to major cryptocurrencies, making it accessible to new investors.

What $100 in Dogecoin Today Could Be Worth

- 2024: $100 invested today could grow to $150–$200 if prices rise as predicted.

- 2030: If Dogecoin hits $1.50, that same $100 investment could be worth $375 or more.

Conclusion: The Future of Dogecoin (2024–2030)

Dogecoin’s future depends on several factors, including market trends, technological developments, and adoption rates. While price predictions for 2024–2030 suggest significant growth potential, the coin remains volatile and speculative.

Investors should monitor key events like the 2024 U.S. presidential administration, technological updates, and overall market sentiment. Whether you’re considering buying Dogecoin for the short term or the long term, always do your research and diversify your portfolio.

Dogecoin might just surprise us again, and who knows? By 2030, we might all be looking back and thinking, “I should have bought more DOGE when it was under $1.”

Dogecoin price prediction, FAQ

What is the Dogecoin prediction for 2025?

For 2025, analysts offer varying predictions with a wide range of potential outcomes. Changelly projects a conservative range between $0.29 and $0.34, while Coinpedia presents a more optimistic forecast between $0.62 and $1.07. CryptoNewsZ suggests a moderate outlook with a maximum value of $0.39 and a minimum of $0.25. The variance in predictions reflects the market's uncertainty, though most analysts agree on an upward trajectory from current levels.

Is Dogecoin going to be big?

Dogecoin has already established itself as a significant player in the cryptocurrency market, currently ranking sixth with a market cap of $52.29 billion. The cryptocurrency's future growth potential is supported by several key factors, including increased merchant adoption, technical developments like the DRC-20 tokens implementation, and growing institutional interest. The completion of projects like GigaWallet and RadioDoge, along with enhanced network capabilities, suggests a continued expansion of its ecosystem.

What is the prediction for DOGE in 2040?

Long-term predictions for 2040 show significant variation. Coinjournal projects an ambitious price target of around $4.70, while Coincodex provides a more conservative range from $0.170 to $2.62. Changelly's prediction suggests a range between $123.48 and $146.04, though such extreme projections should be viewed with caution. These long-term forecasts factor in various growth scenarios, including historical ROI patterns and potential market evolution.

Will DOGE ever reach $1?

The possibility of Dogecoin reaching $1 appears feasible based on several factors. Currently trading at $0.35622, DOGE would need approximately a 180% increase to reach this milestone. Technical analysts, including Dj Anas and Master Kenobi, suggest this target could be achievable even by year-end, citing Fibonacci levels and market patterns. However, this would require Dogecoin to achieve a market capitalization of approximately $144 billion, making it the third-largest cryptocurrency. While challenging, this target isn't impossible given DOGE's previous all-time high of $0.74 and current market momentum.