A wave of unauthorized cryptocurrency tokens exploiting the name of Chinese AI sensation DeepSeek has emerged on multiple blockchain networks, with one fraudulent token briefly reaching a market capitalization of $48 million despite explicit warnings from the company.

This is happening as DeepSeek has triggered significant panic on Wall Street, dragging cryptocurrencies down as well. Bitcoin (BTC) briefly dropped below $100,000, while XRP tested monthly lows. Let's take a closer look at why crypto is going down.

Fake DeepSeek Token Hits $48 Million Market Cap as AI Hype Fuels Surge

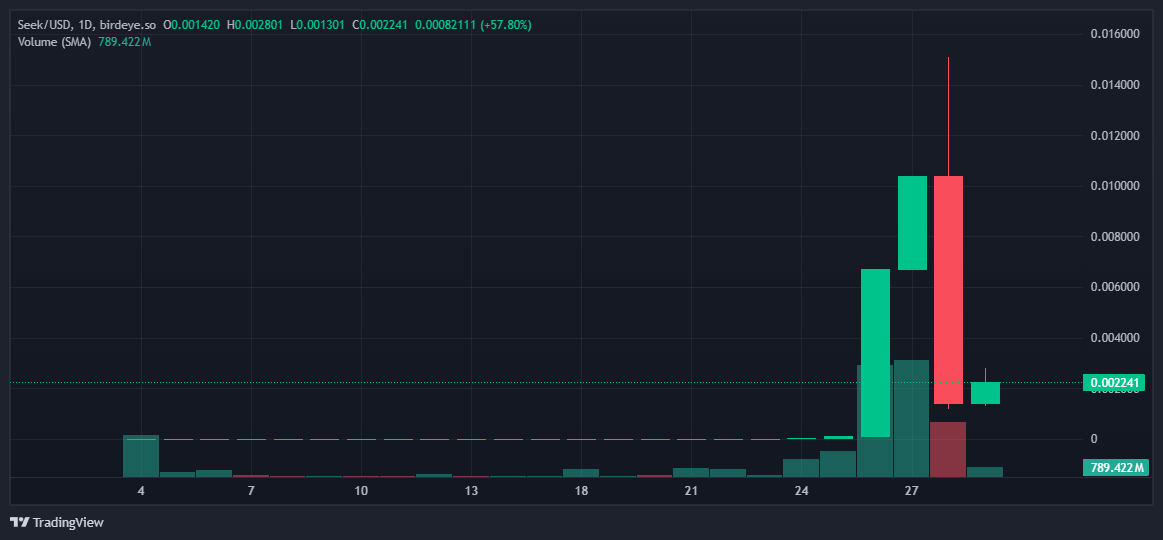

The primary impostor token, launched on the Solana blockchain earlier this month, generated approximately $150 million in trading volume and attracted over 22,000 wallet holders, according to data from Solana token tracker Birdeye. DeepSeek has explicitly denied any connection to cryptocurrency projects and warned users about potential scams.

The scam's timing coincided with DeepSeek's meteoric rise to prominence in the artificial intelligence sector, where its cost-effective AI model has challenged industry giants. The fraudulent token's creators attempted to legitimize their offering by creating false associations with DeepSeek's official social media presence and website.

A second unauthorized DeepSeek token also gained significant traction, reaching a $13 million market cap with $28.5 million in trading volume before declining to $8.6 million. These incidents are part of a broader trend of scammers exploiting popular technology trends in cryptocurrency markets.

"DeepSeek will accelerate AI development both in the US and overseas, denying hegemony over AI," commented Paul Howard, Director at Wincent. "There is little impact for trading, anything an LLM could offer has already been available for a while, and a lower cost base will do little to influence the way institutional players interact with the crypto market, which is at the amplified risk end of the stock market."

Why Is Crypto Going Down?

Bitcoin's price recently dipped below $100,000, reaching an 11-day low, amid a broader selloff in technology stocks. This downturn was triggered by DeepSeek's announcement of more affordable AI models, which intensified competition in the tech sector and led to significant declines in tech equities.

At the beginning of this week, Bitcoin dropped to just under $98,000, testing the 50-day exponential moving average. All major altcoins followed suit: Ethereum (ETH) tested the psychological support level of $3,000, while XRP formed a long lower wick, dipping to $3.05.

The Nasdaq 100, heavily weighted with technology companies, experienced notable losses, reflecting investor concerns over DeepSeek's potential impact on established tech firms.

The cryptocurrency market, particularly Bitcoin, has shown a strong correlation with technology stocks, especially during periods of market stress. As tech stocks declined, Bitcoin's value also dropped, highlighting its sensitivity to shifts in investor sentiment within the tech industry.

However, by Wednesday, January 29, 2025, the market appears to be stabilizing. Bitcoin is currently rebounding by 1.3%, testing the $102,630 level. Moreover, analysts are still being highly positive, some of them even predicting, that Bitcoin price this year may reach $200K mark.

From Fake TRUMP to Fake DEEPSEEK Tokens

The phenomenon has been amplified by recent legitimate crypto initiatives, including former President Donald Trump's official meme coin launch, which may have inadvertently legitimized similar schemes. Blockaid reported that "Trump"-branded token scams doubled from 3,300 to 6,800 daily following the official launch.

Major decentralized finance platforms have implemented protective measures, with companies like Uniswap and DexScreener partnering with security firms to filter out fraudulent tokens. However, the decentralized nature of blockchain technology makes it challenging to completely prevent such scams.

As of press time, the primary fake DeepSeek token's volume had decreased to $2 million, though thousands of wallets still hold the unauthorized asset. The incident serves as a stark reminder of the risks in cryptocurrency markets, particularly during periods of intense speculation around emerging technologies.

To prevent any potential harm, we reiterate that @deepseek_ai is our sole official account on Twitter/X.

— DeepSeek (@deepseek_ai) January 28, 2025

Any accounts:

- representing us

- using identical avatars

- using similar names

are impersonations.

Please stay vigilant to avoid being misled!

Why is Silicon Valley Afraid of DeepSeek?

Silicon Valley is concerned about DeepSeek because the Chinese startup has disrupted the AI landscape by offering advanced models at a fraction of the cost. Unlike U.S. firms that rely on high-end hardware, DeepSeek has leveraged widely available Nvidia H800 chips to develop AI models that are reportedly 50 times cheaper to operate than OpenAI’s.

This cost-efficiency, combined with an open-source approach, has raised concerns among U.S. tech leaders about China’s growing influence in AI. DeepSeek’s rapid rise, underscored by its AI assistant surpassing ChatGPT in downloads, signals a shift in the global AI race. Furthermore, the Chinese government’s support for DeepSeek highlights AI as a strategic industry, intensifying geopolitical tensions and fueling fears in Silicon Valley about maintaining dominance in AI innovation.

"Similar to the headlines we saw around quantum computing several months ago, both software and hardware will continue to advance, reduce cost, and increase access," Howard added. "Moreover, in the medium term for crypto, pay attention to macro and tech numbers due out this week as to influencing the majors, whilst we see a continued pullback in the pricing of AI tokens the last 7 days not necessarily correlated with DeepSeek news itself."

Deepseek engineers getting a $5K bonus after wiping out $1 trillion in the market pic.twitter.com/OjjKIokDwx

— naiive (@naiivememe) January 28, 2025

Why is Crypto Going Down? FAQ

Why Is the Crypto Market Falling?

The cryptocurrency market is currently experiencing a downturn due to a combination of factors, including broader sell-offs in technology stocks and the impact of fraudulent token schemes. The recent surge and collapse of unauthorized DeepSeek-branded tokens have contributed to heightened volatility, shaking investor confidence.

Additionally, DeepSeek’s disruption of the AI sector has triggered concerns on Wall Street, leading to declines in tech stocks, which have historically correlated with Bitcoin and other cryptocurrencies. As a result, Bitcoin briefly fell below $100,000, while major altcoins like Ethereum and XRP also tested key support levels.

Will Crypto Rise Again in 2025?

Despite the recent downturn, analysts remain optimistic about the long-term outlook for cryptocurrency in 2025. Bitcoin has already shown signs of recovery, rebounding to over $102,000. Some analysts predict that Bitcoin could reach $200,000 by the end of the year, supported by institutional adoption, potential regulatory clarity, and continued demand for decentralized assets. However, market volatility remains a key factor, and investors should remain cautious about speculative trends and potential scams.