If you’re an institutional investor with an interest in bitcoin, but you are either restricted from or simply hesitant about buying the digital currency directly, then what are your options? Looking at recent events, it appears that an alternative path by which you can increase your exposure to bitcoin, without actually holding any bitcoin, is by increasing your exposure to MicroStrategy instead.

Why Is MicroStrategy Synonymous With Bitcoin?

Back in August 2020, the Co-Founder and then-CEO of MicroStrategy, Michael Saylor, signaled through the company’s first purchase of $250 million worth of bitcoin that he was taking the cryptocurrency seriously. For Saylor, not only was bitcoin a deeply important financial innovation, but it had become the most efficient and effective means of storing wealth.

And, this wasn’t to be a partial move, as Saylor then decisively went about the task of making bitcoin the primary treasury reserve asset at MicroStrategy. Thus, since 2020, the company has acquired 140,000 BTC at an average cost of $29,803 per coin.

Furthermore, Saylor has become one of the most prominent public advocates for bitcoin, its utility, and the conviction that it will, in time, become the strongest asset in existence.

In this capacity, Michael Saylor has delivered countless interviews on platforms, ranging from crypto-native niche podcasts to mainstream channels, such as CNBC and Fox News. Additionally, he changed his position within MicroStrategy, becoming the Executive Chairman in August 2022, and announcing at the time that he would “be able to focus more on our bitcoin acquisition strategy and related bitcoin advocacy initiatives.”

MicroStrategy’s latest bitcoin acquisition came at the beginning of this month, with an announcement that it had purchased another 1,045 coins, at an average price of $28,016 per coin.

MicroStrategy has acquired an additional 1,045 #bitcoin for ~ $29.3M at an average price of $28,016 per bitcoin. As of 4/4/2023 @MicroStrategy holds 140,000 bitcoin acquired for ~$4.17 billion at an average price of $29,803 per bitcoin. $MSTR https://t.co/IBufTxalnv

— Michael Saylor⚡️ (@saylor) April 5, 2023

Institutions Increase Exposure to MicroStrategy

As MicroStrategy is now well known for its bitcoin holdings, and Michael Saylor has taken on a role involving bitcoin advocacy, any increases in institutional ownership of MicroStrategy shares are notable as possible indicators of wider interest in bitcoin.

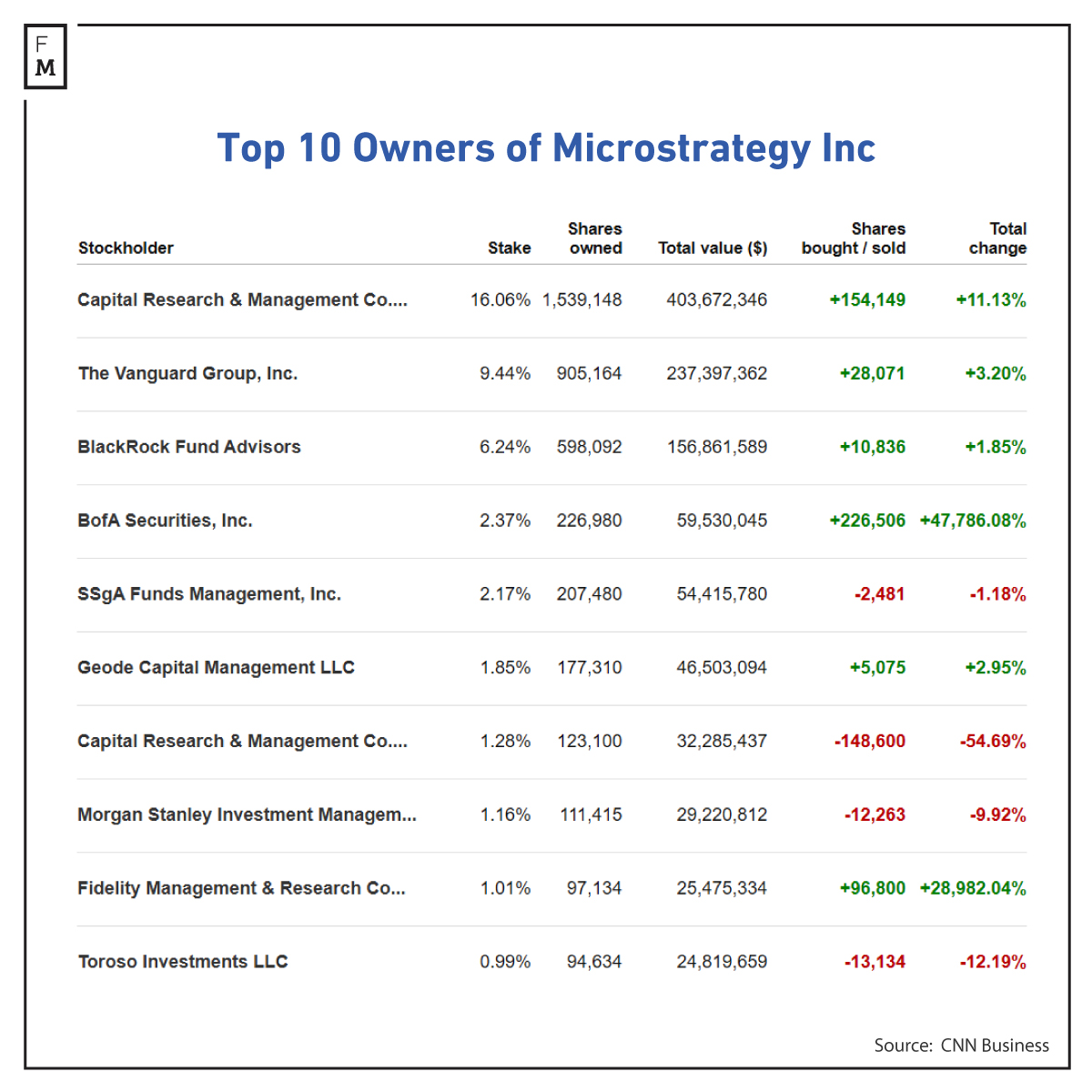

Year-to-date reports show that in Q1 of this year, institutional ownership of MicroStrategy shares increased 121%, and that figure includes some sudden increases in exposure by major entities, with the biggest purchases coming from Bank of America, which increased its holdings by almost $60 million, followed by Capital Group and Fidelity Investments.

Bank of America is now the fourth largest MicroStrategy shareholder, behind Capital, Vanguard and BlackRock, with Vanguard and BlackRock also increasing their holdings.

MicroStrategy as a Bitcoin Proxy

As observed, MicroStrategy has, seemingly deliberately, become synonymous with bitcoin, and now holds an amount approaching 0.7% of the total bitcoin that can ever exist (the future total supply is capped at 21 million).

With no spot bitcoin ETF currently approved in the US, if a large entity is interested in the leading cryptocurrency but wants to avoid directly buying and taking custody with all the logistical complications and attention that would involve, then it would be logical to explore other routes towards gaining exposure. And, buying shares in MicroStrategy presents an easily executable, indirect option. Simply put, exposure to MicroStrategy equates to exposure to bitcoin.

What’s more, these increases in exposure to MicroStrategy and its digital treasury came immediately after the crypto bear market appears to have bottomed out. Moving on from 2022's downward bleed, which culminated in the collapse of FTX, the new year has subsequently brought what looks like a change in bitcoin’s trend structure on the price charts, and the digital currency has hugely outperformed other asset classes since the beginning of 2023.

It appears, then, that at this juncture in bitcoin’s history, when the asset’s presence has come to look solidly resilient but American regulatory bodies are still reluctant to fully open the doors, MicroStrategy is acting as a temporary bitcoin proxy and functioning almost as a makeshift bitcoin ETF.

On top of that, it’s notable that this should be occurring, along with a rally in bitcoin’s price to volley it back over $30,000, during a period US authorities have been taking explicit aim at crypto platforms, such as Coinbase, Kraken and Binance, and after crypto-friendly banks Silvergate Bank, Silicon Valley Bank, and Signature Bank ran into fatal problems.

Veteran bitcoin advocates will tell you that none of these events is a reflection on the value of bitcoin itself, but rather, are the result of other cryptocurrencies being classifiable as unregistered securities, or, in some cases, due to mismanagement at particular crypto companies, exchanges, and banks.

On the other hand, bitcoin (as distinct from crypto, or the crypto industry) continues to operate reliably, as it has since its inception. And, it seems now that institutions may be not only picking up on that message but looking to act on it through whichever avenues currently happen to be the most expedient.