The news of the tie-in of Twitter and eToro has made a splash in the tech space, indicating Musk's ambitions to create the "everything app". In the retail trading industry, many were curious about the nuts and bolts of the deal, which can be meaningful for pretty much every major broker and provider. The terms were famously not disclosed, but Finance Magnates sat down with eToro's UK Managing Director Dan Moczulski, to get a glimpse into its facets.

Asked whether any user data could be shared between the two platforms, Mr Moczulski stated, “No, nothing. It’s a marketing deal at the moment.”

And, on the subject of KYC checks, he explained: “What's not happening is, you click on Twitter, on $APPL, and suddenly, if you're not an eToro user, you get the ability to buy or sell Apple.

"Actually, you land on eToro, you see Apple prices, you see an Apple chart, but if you want to become an eToro client, you have to go through KYC the same as anybody else.”

Asked whether the integration was more similar to the relationship between an advertiser (eToro) and a media platform (Twitter), or more like an arrangement by which Twitter can take a share of the revenue from eToro, Moczulski replied, “It’s most definitely the former,” and confirmed that this kind of arrangement is straightforward with regulators, going on to explain, with regard to how the partnership might develop in the future.

“This is eToro using Twitter's infrastructure to market the services of eToro. Any other kind of speculation on the future motivations of Twitter is for them to decide.

"But who knows? Obviously, there's a line of communication that's been developed now, but certainly, at the moment, it's for us to help Twitter users find more information about stuff that they might be interested in.”

Twitter just scored a deal with eToro that takes the social media firm a little deeper into the world of finance. https://t.co/6kePDH7e2r

— FORTUNE (@FortuneMagazine) April 13, 2023

There has been speculation about the possibility of Elon Musk, at some point, moving to make an investment or purchase offer to eToro, to build out his proposed everything app, but Mr Moczulski made clear that this is simply guesswork on the part of commentators.

“[The partnership] has struck a chord with people who are making those kinds of predictions, but at the moment, these are just predictions. It's the early days of a marketing agreement, but I think we can assert that there's a real synergy between the person who uses fintwit, and the person who uses eToro".

Mr Moczulski elaborated that "This is why it all makes sense for us because there is that synergy with people that want breaking financial news and want to share breaking financial news. We really are built from the ground up as this social investing network. We encourage people to write about assets, we encourage people to engage with other users on the platform. You can see what other users invest in.”

eToro #CEO Yoni Assia told #CNBC the deal will help connect the two brands, adding that in recent years its users have increasingly turned to #Twitter to “educate themselves about the #markets.” pic.twitter.com/EYMDbQobNg

Mr. Moczulski also summarized why he believes that eToro is uniquely distinct from other platforms:

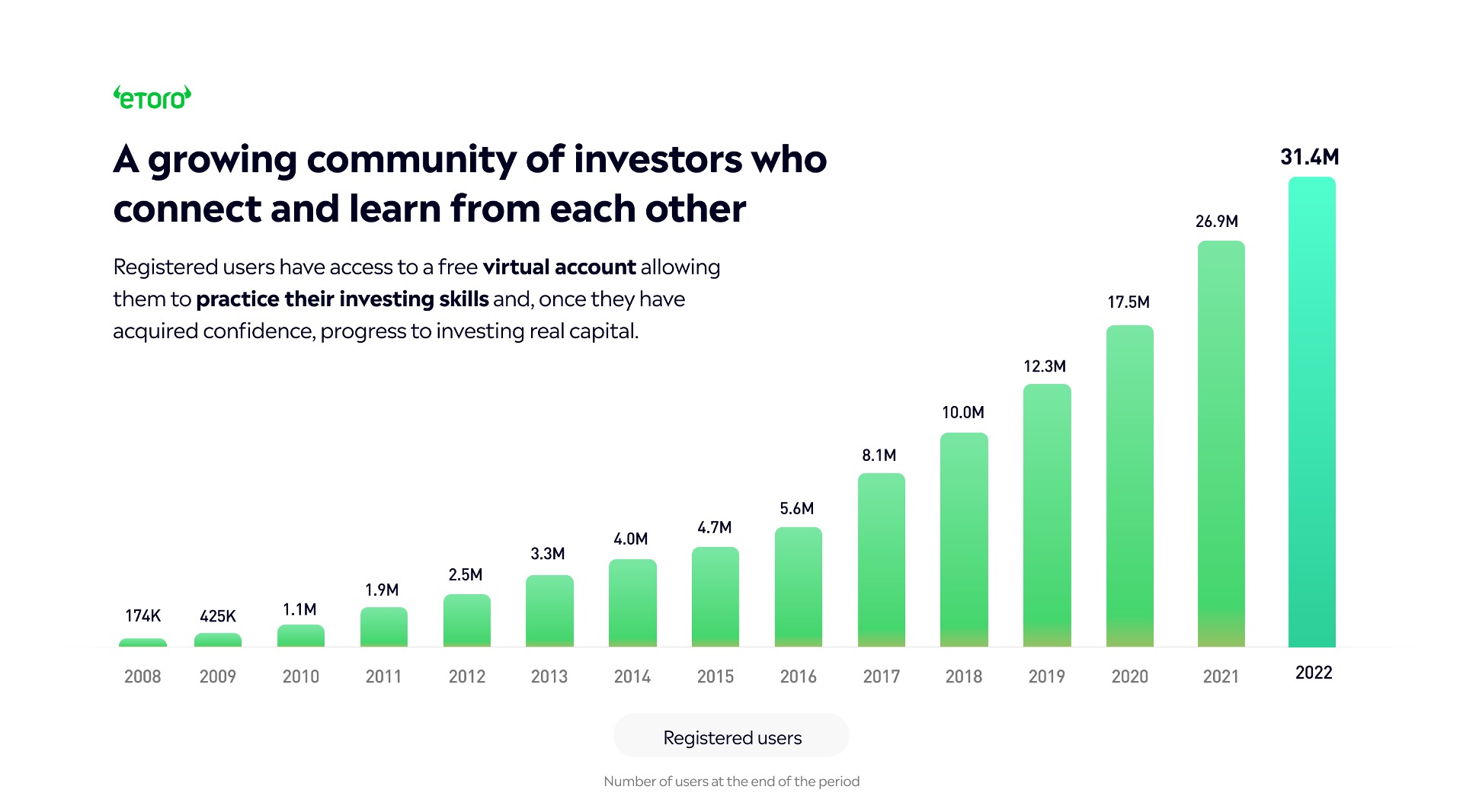

“I can't think of another broker that has that social spin on it. And even if it does, it doesn't have the liquidity that we have, with 31 million users.”

Crypto Regulation in Europe and the UK

Mr Moczulski supports clearer and more robust crypto regulation, recognizing that any regulation must “support the individual, but allow them to engage in capital markets.”

Regarding the regulatory mood in Europe and the UK, he explained that:

“Even from a political position, I think the UK wants to be at the table for the crypto industry, it wants to be involved, it wants to be engaged, and I think that’s true for the EU too. I'm sure we'll get there, I’m just not quite sure how long it'll take us.”

Regarding the broader direction of movement, which appears to be towards greater acceptance of crypto, Mr Moczulski stated:

“From the political process, the Treasury, even from the FCA, there's an acceptance that this is where we're going, and we have to bring it in-house, and we have to regulate it correctly and strongly.”

Freeing Up Information

Mr Moczulski also described how attitudes towards finance and investment have changed in the UK:

“If I look back ten or fifteen years, you have this cliche that the only financial conversation that people would have with friends at a dinner party was about the value of their houses.

"Now in society we’re very happy to talk about the investments we have, to talk about the stocks we’ve got that have done well, to talk about the coins that have done badly.

"So I think as a society, within finance, we're much happier sharing information, and I think that’s a good thing.”

Discussing possible wider industry effects resulting from the partnership between eToro and Twitter, Mr Moczulski suggested:

“Financial investing is most definitely a mainstream activity. I think this tie-in recognizes that actually the number of people that are interested in financial markets, and interested in engaging in financial markets, is far higher than you might assume.

"And in terms of what fintwit is, and how successful it is, well, it's definitely there, and people are using it as a mechanism to share information, and to talk to others.”

With regard to concerns voiced by some observers about social media’s capacity to spark or exacerbate extreme crowd behavior (such as, for example, the kind of bank run that affected Silicon Valley Bank), Mr Moczulski views the power of social media from a wider and more optimistic perspective:

“I can't get away from the idea that sharing information, and giving people access to more information, quickly, have to be good things. It has to be qualified, and I think maybe this eToro tie-up helps to do that as well, it helps people to qualify information.”

That outlook does, though, come with some important caveats.

“There's a level of education that we generally have to have, regardless. Just because you've seen something on a Facebook feed or a Twitter post, you've got to do your own research on the back of it, and there's a level of risk attached to any kind of investment. But I think information should be out there for people to engage with, and we should have a framework that encourages people to get engaged with information and knowledge responsibly.”