Prop trading platform Level Up Society abruptly went dark late last month. A message displayed on its website states that its break up with the management of Easton Consulting Technologies is the reason behind the stutter.

“As you may or may not know, Leveled Up and Easton Management have both parted ways,” a message on its website by Raul, an FX influencer on social media promoting Leveled Up Society, wrote.

Easton Consulting Technologies is the shadow company running more than 13 prop trading platforms, according to a press release by Leveled Up Trading. It is a limited liability company registered in Florida in 2021, and is run by Angelo Ciaramello as CEO (also a Co-Founder) and Carlos Rico-Ospina as a Managing partner. They are also the CEO and CFO, respectively, of The Funded Trader, another prop trading firm. Ciaramello also controls Skilled Funded Traders, according to one of his Twitter posts.

“While we may have chosen different paths to follow, we believe it is important to acknowledge and respect the differing perspectives we bring to the table,” Raul added in his message on Leveled Up Society’s website. “These diverse viewpoints are what enable progress and innovation within the business landscape. But, in this instance, we at Leveled Up and Easton Technologies were no longer aligned and decided it was best to part ways.”

“As of right now, all of our services are temporarily paused as we are working hard into a new transition.”

Complaints from Customers

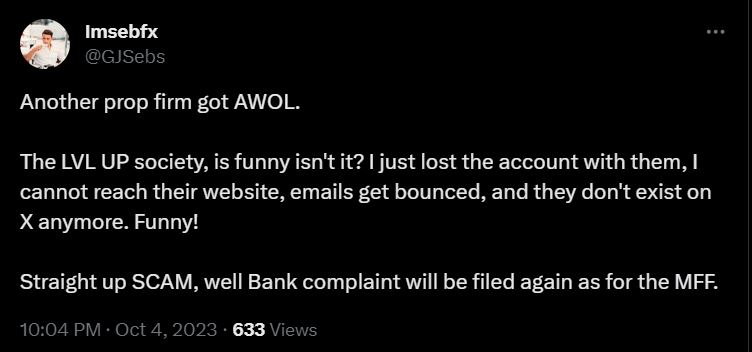

However, things are not so straightforward. On social media, especially on Twitter, Leveled Up Society is facing some claims.

The platform has been accused of informing its users that it suspended the services for updating its server and publicly announced the suspension of operations. The X handle DezziFinance revealed the messages Leveled Up’s customer support team sent to the customers.

RIP @leveledups

— DezziFinance (@dezzifinance) October 4, 2023

Internally, they inform their traders that server updates are in progress and operations will resume as usual. However, publicly, they permanently suspend operations. will they be transferred to a new prop firm or will they be scammed? pic.twitter.com/TS92NIiGKU

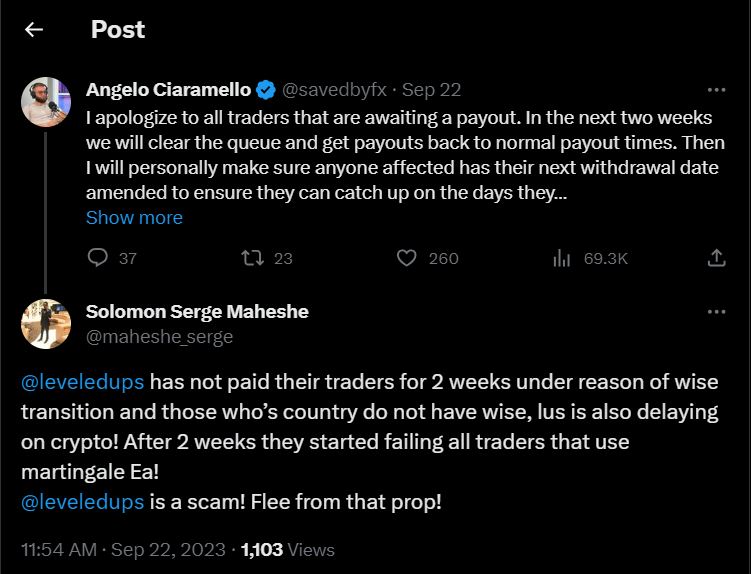

Although Leveled Up suspended payouts for its services, it said it had resumed the payouts in a public message.

“For all of our traders currently pending payouts, they have been resumed, and we will contact you in a timely manner to deliver your payout if you have not yet received it,” the message on its website stated. Raul, who signed this message, also reiterated the same on a Telegram channel of Level Up.

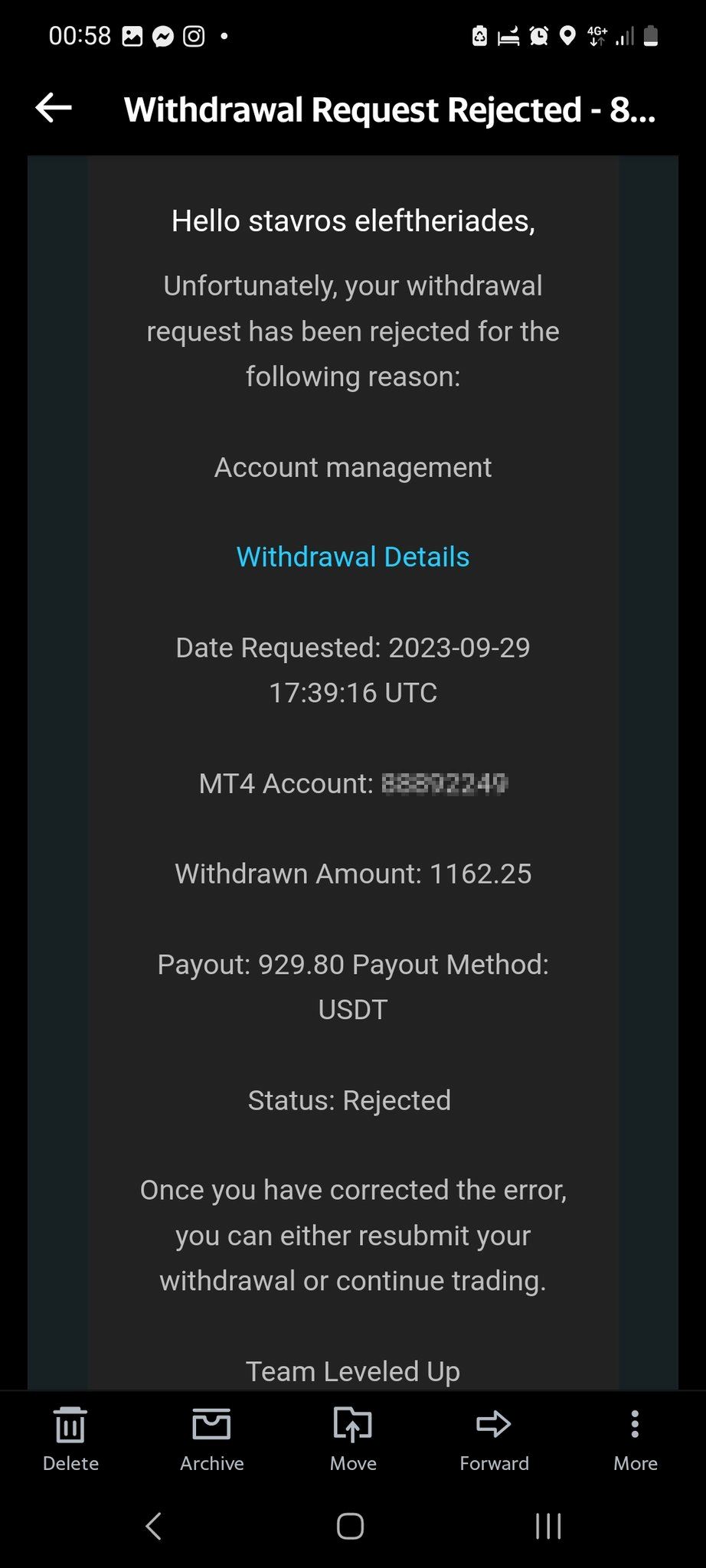

Some traders are alleging that the platform has been rejecting the payout claims.

"I requested my payout at 29 of september from @leveledups and i today i got an email from them saying my account is breached and that my payout is rejected The reason was account management. These bloody scammers will take your money and give nothing back," wrote a twitter handle thewolf (@Stevetradingfx_).

However, the platform promised to resume its business after "a series of changes to better the trading experience." It also dropped eight Cap as a partner broker without citing any reason.

Curious what the public perception on who’s responsible for the leveled up society rug pull.

— MattL CEO MyFundedFX (@MattLCEO) October 4, 2023

What are your thoughts?

The Prop Trading Model

Leveled Up Society operated as a prop trading platform, the popularity of which has been booming lately. It promised to fund the traders with up to $200,000 who can pass its trading ‘challenge’, offered in two phases. It charged the traders between $109 and $1,069 for taking the ‘challenges’. It offered the traders a profit share of up to 80 to 85 percent.

According to an archived version of the Leveled Up Society website from August, it had 76,403 members and paid $1.9 million in payouts, with an average payout of $7,000. However, the authenticity of these numbers can be questioned as they did not change for months.

Archived versions of its website from August 2022 and April 2023 also show the same number of “Leveled Up members.” which is 46,383.

The popularity of prop trading platforms has exploded in recent years. While some reputed brands offer prop trading services, many smaller brands are pumped by the influencers and applying aggressive marketing strategies.

The US and Canadian regulators recently charged My Forex Funds and its CEO for fraud. The prop firm generated $310 million in revenue in merely two years, but its assets are now frozen.

Enters GoldenOwl Bot

In the middle of Leveled Up Society story, another name popped up: GoldenOwl. It is a trading bot, a MetaTrader 4 Expert Advisor, to be specific, which came with a guarantee to pass prop trading challenges on Leveled Up Society and Rocket 21, another prop trading platform, for the traders.

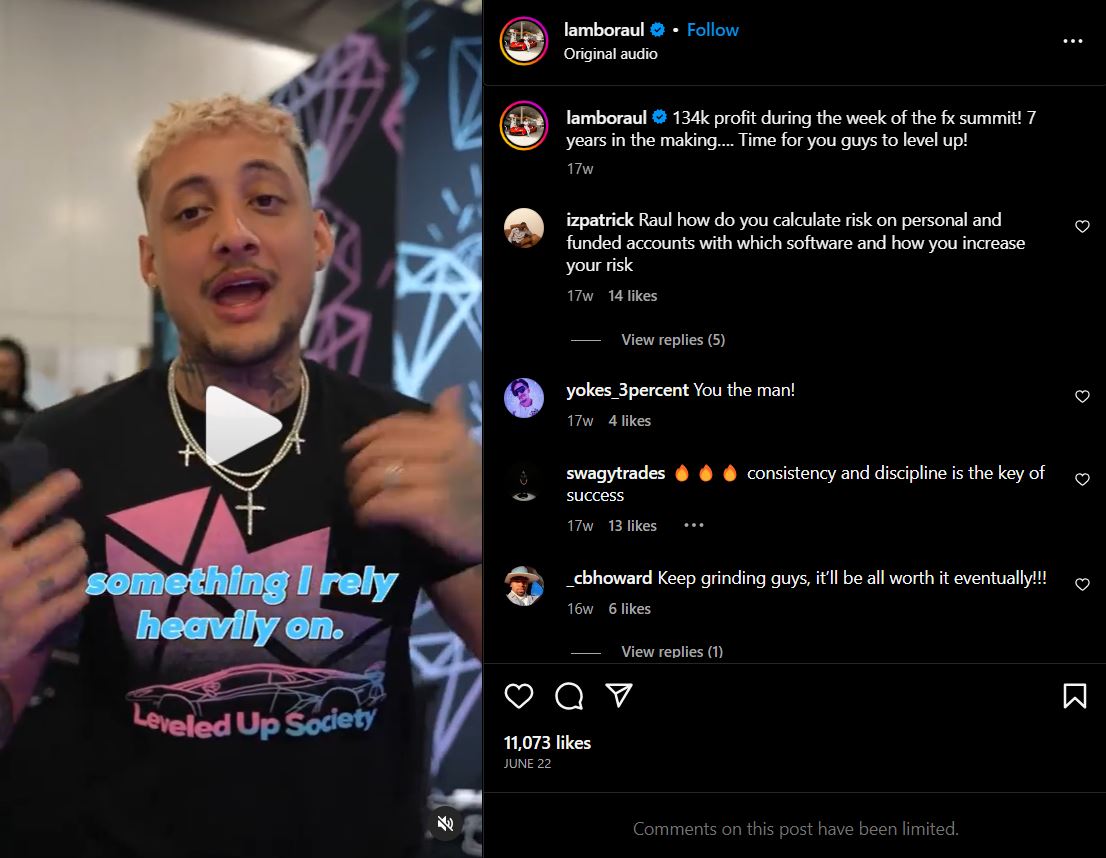

The bot was promoted by many FX trader influencers on social media. These names include Raul, the promoter of Leveled Up, who has 622K followers on Instagram, and Alex Gonzalez, who has 293K followers on Instagram. Both of them are showing off their luxurious lifestyle with expensive cars and private jets.

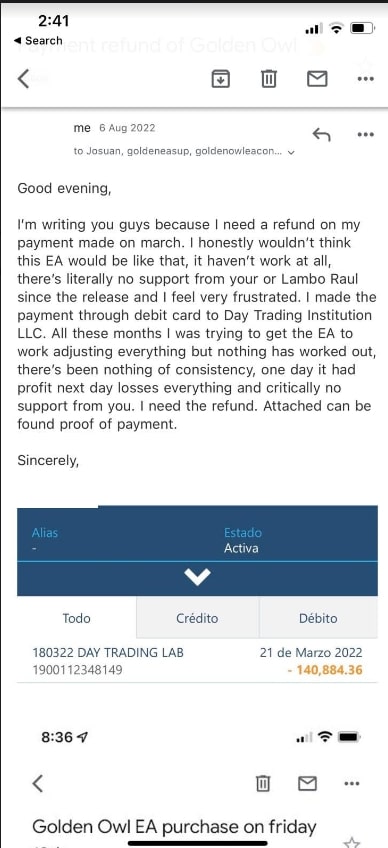

Some complaints from customers who bought the GoldenOwl bot claim that it never worked. Many said the bot turned a profit in one day and then went on a losing streak the next day. The users could not fix the bot’s performance even after adjustments and did not even receive any support from the developers, according to complaints.

Several buyers of the bot are now claiming a refund. However, many of them seem to have not received any refund, according to the number of complaints on social media.

Meanwhile, Gonzalez is trying to come out clean from the fraud allegations of selling the GoldenOwl bot. He is a brand ambassador of Rocket 21, a platform that blocked user accounts who tried to use the GoldenOwn bot for violation of rules.

On a Zoom conference call, many users accused him of owning the company behind Rocket 21 and Leveled Up Society. However, he became defensive and clarified that he was not the owner. He also shifted the blame to “tiny influencers” who promoted the platforms and the GoldenOwl bot.

A representative from Leveled Up Society told Finance Magnates: "Thank you for the interest but for the moment we cannot make the interview." Ciaramello, the CEO of Easton Consulting Technologies, declined to comment to the questions shared by Finance Magnates and Raul did not respond as of press time.

We will update the story accordingly with further developments.

Damian Chmiel has contributed to this story.