Bitcoin (BTC) price tests $116,420 intraday highs today (Tuesday, 1 October 2025), surging over 3% during the last 24 hours as the cryptocurrency capitalizes on dollar weakness resulting from the temporary U.S. government shutdown. The leading digital asset trades at $116,261 with a 1.92% gain, demonstrating renewed momentum as investors position for October's historically bullish performance.

In this article, I answer the question of why the Bitcoin price is going up, how the BTC/USDT chart looks from a technical analysis perspective, and what the latest BTC price predictions are for October 2025.

Bitcoin Price Today Test $116K

Bitcoin’s price has climbed back above $116,000, reflecting strong bullish sentiment in the market as the U.S. dollar weakens.

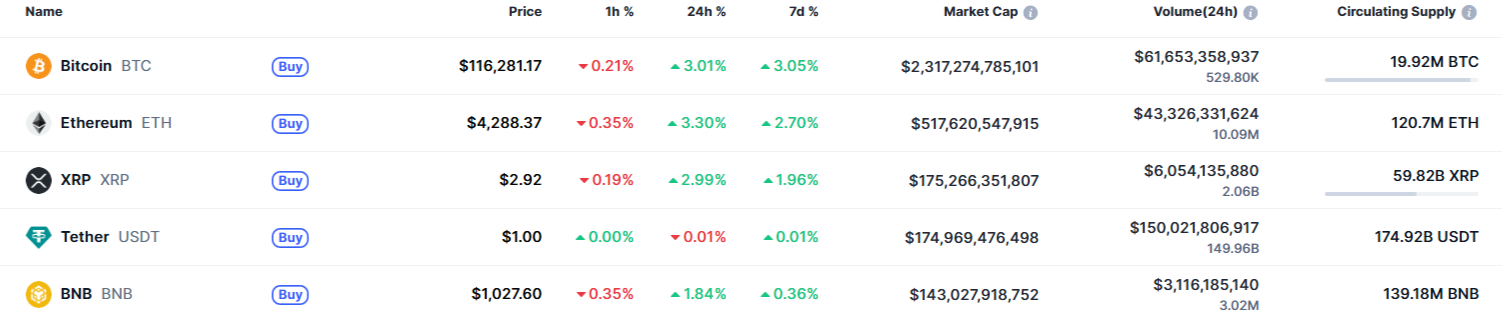

Following Bitcoin's lead, the broader altcoin market shows strength with Ethereum (ETH) rising 3.7% to test $4,300 levels while XRP increases 3.1% toward $2.93. Market cap stands at $2.29 trillion with $438 million in 24-hour volume as institutional demand returns.

Bitcoin Technical Analysis: Breakout Confirmation

According to my technical analysis, the observed strengthening since Sunday allowed Bitcoin to recover from September lows and the lowest levels since late August, which coincided with July lows.

This week, we clearly returned above the local support zone of $112,000 and simultaneously above the 50-period exponential moving average (EMA), positioning ourselves again in a narrow consolidation range just below historical highs tested in mid-July and mid-August near $124,000.

Today's strengthening reopens Bitcoin 's path to test local resistance at September highs coinciding with the $117,000 level. The next resistance stands near $120,000, representing recent peaks excluding the narrow consolidation zone.

Critical Technical Levels

Support Zones | Resistance Targets | Key Indicators |

$112,000 (50 EMA) | $117,000 (Sept highs) | Price above 50-day MA |

$108,000 (Aug-Sept lows) | $120,000 (Local peaks) | RSI recovering to neutral |

$106,000 (200 EMA) | $124,000 (ATH zone) | Golden MACD cross forming |

$100,000 (Psychological) | $128,000 (Breakout target) | Volume confirmation strong |

Bitcoin moves within a broader sideways channel established since early May, with the lower boundary at the psychological round level of $100,000, coinciding with 50% Fibonacci retracement. Only breaking below this level would be a clear signal that bulls have lost control of Bitcoin, bears are gaining, and we should expect increased downside pressure.

Why Bitcoin Price Is Surging?

October "Uptober" Seasonal Strength

Bitcoin enters October with significant tailwinds as historical data reveals the month as cryptocurrency's strongest performing period. Every year when Bitcoin finishes September in the green, October has gained at least 10%, with previous gains of 10.76%, 28.52%, 14.71%, and 33.49%.

Based on Bitcoin's current 6.5% September return, it's on track for its second-best September historically, creating a promising outlook for this month. As one analyst notes: "BTC is going to finish September green. Every other time that has happened October has also been green".

You can also review my latest prediction for the XRP price in October 2025 here.

Historical October Performance:

- Average October gains: +22.9% across all years

- Minimum gain after green September: 10.76%

- Maximum October rally: 33.49%

- Current setup: Second-best September performance

Analyst Crypto Busy mentions that "BTC is testing a critical level as Buy/Sell Pressure Delta hits the 'opportunity zone' and U.S. demand increases," suggesting institutional accumulation patterns support continued momentum.

Dollar Weakness Catalyst

LMAX analyst Joel Kruger previously observed that "the U.S. dollar has shown signs of recovery due to resilient economic data and the Federal Reserve's cautious approach to further rate cuts, but its broader downward trend persists, with technical indicators suggesting limited upward momentum". Today's government shutdown accelerates dollar weakness, creating favorable conditions for Bitcoin appreciation as investors seek alternative stores of value.

The temporary government shutdown increases uncertainty around fiscal policy and dollar stability, historically driving capital flows into decentralized assets like Bitcoin. This macro catalyst combines with technical breakout patterns to support the current 3% surge.

Expert Bitcoin Price Predictions Target $120K-$160K

AI-based forecasting models predict Bitcoin reaching $118,167 by October 1, 2025, representing a 2.7% gain from previous levels. The analysis incorporated momentum indicators including MACD, RSI, stochastic oscillator, and 50-day and 200-day simple moving averages, with Grok 3 offering the most bullish view at 2.99% gain.

Changelly's October 2025 forecast projects maximum levels reaching $126,599 with average trading values near $122,848, representing 11.6% potential ROI. The technical analysis suggests Bitcoin could test resistance near $116,405 before attempting continued upside toward $120,000.

October 2025 Price Targets:

- Conservative: $120,000 (analyst consensus)

- Moderate: $128,000 (ATH breakout scenario)

- Aggressive: $140,000-$160,000 (cycle top projection)

Popular trader BitBull targets a price range between $140,000 and $160,000 in 2025, stating: "The cycle top will be somewhere $140K-$160K before BTC enters the distribution phase". This aligns with broader analyst expectations that Bitcoin could surpass current all-time highs and enter price discovery phase.

Institutional Demand Returns

According to my technical analysis, before any downside scenario materializes, all corrections downward should be treated as technical and opportunities to buy at lower prices. Even the 200-day exponential moving average (200 EMA) will not be a determinant of trend change to bearish for me - it currently stands around $106,000, supporting the support zone together with the $108,000 level covering lows from the turn of August and September where I would also expect significant accumulation of pending buy orders.

Institutional traders appear to be supporting BTC above $110,000, with recent price action suggesting renewed accumulation phases. The combination of seasonal strength, technical breakout confirmation, and dollar weakness creates ideal conditions for sustained October rally.

Medium and Long-Term Outlook

What direction should Bitcoin take in the medium and long term? I personally predict that this year we will see a test of the current ATH and entry into the price discovery phase. Until that happens, all technical corrections provide strategic accumulation opportunities rather than signs of trend reversal.

Before this occurs, support levels remain robust at $108,000 (August-September lows), $106,000 (200 EMA zone), and ultimately $100,000 (psychological support with 50% Fibonacci). These levels represent where significant buy order accumulation likely exists, providing strong downside protection.

Bullish Catalysts for Q4:

- Two additional Fed rate cuts expected in 2025

- Ongoing corporate Bitcoin treasury adoption

- Potential return of sustained ETF inflows

- Nation-state adoption discussions accelerating

- Q4 institutional capital rotation into risk assets

The outlook becomes even brighter considering upcoming catalysts including anticipation of two more interest rate cuts this year, ongoing corporate demand for BTC, the potential return of ETF inflows, and discussions about increased nation-state adoption.

Read my previous cryptocurrency analyses:

- Bitcoin Price Prediction 2025: Why BTC Price Is Going Up Today

- Michael Saylor’s Bitcoin Price Prediction Suggests BTC Will “Move Up” to a New All-Time High by End of 2025

- Why Crypto Is Going Down? XRP, Bitcoin, Ethereum and Dogecoin Prices Lead Selloff Today

Bitcoin Price Prediction FAQ

Why is Bitcoin surging?

Bitcoin surges today due to a confluence of factors including U.S. dollar weakness from the temporary government shutdown, technical breakout above $112,000 support, and seasonal "Uptober" momentum. The cryptocurrency trades at $116,314 with 1.97% gains as institutional buying pressure returns and market structure improves following September's 6.5% positive performance.

What if I invested $1,000 in Bitcoin 10 years ago?

If you invested $1,000 in Bitcoin in October 2015 when prices ranged between $230-$270, you would have purchased approximately 3.7-4.3 BTC. At today's Bitcoin price of $116,314, that investment would now be worth approximately $430,000-$500,000, representing a return of 43,000%-50,000% over the decade.

Who paid 10,000 Bitcoin for pizza?

Laszlo Hanyecz, a Florida-based programmer, made history on May 22, 2010, by paying 10,000 Bitcoin for two Papa John's pizzas in what became the first documented real-world Bitcoin transaction. At the time, Bitcoin traded for fractions of a cent, making the 10,000 BTC worth approximately $41 in 2010.

At today's Bitcoin price of $116,314, those 10,000 Bitcoin would be worth approximately $1.16 billion. This transaction is commemorated annually on May 22 as "Bitcoin Pizza Day" by the cryptocurrency community, celebrating Bitcoin's evolution from experimental digital money to a trillion-dollar asset class.

How much will $1 Bitcoin be worth in 2025?

Bitcoin currently trades at $116,314 in October 2025, representing a 97.6% gain year-to-date from its January 2025 opening price near $58,863. Expert predictions for the remainder of 2025 suggest Bitcoin could reach between $120,000 and $160,000 by year-end, depending on institutional adoption rates and macroeconomic conditions.