Financial markets faced several overlapping developments this year that shaped trading activity, asset prices, and operational stability. These ranged from sharp moves in gold and major equities to cloud and internet outages affecting trading access, alongside episodes of politically driven volatility in digital assets.

Together, these trends reflected markets’ continued sensitivity to technology reliability, policy direction, and shifts in investor risk perception.

1. Gold’s Explosive 2025 Sets Up a Pivotal Year Ahead

Gold has rarely dominated market conversations the way it has in 2025, with a rally of about 59.5% and multiple fresh record highs, forcing investors to rethink how they use the metal in portfolios.

- UK in Hardcore Crackdown on Online Content

- CME’s March FX Report Sees Volumes Trending Slightly Upwards

- Retail Investors in France Get Access to Crypto ETNs Amid Tokenized SME Trading

After such an exceptional year, the pressing question is whether the same mix of geopolitical tension, easier monetary policy, and robust central bank buying can keep pushing prices higher in 2026, or whether some of those supports will fade.

Unlike past cycles that hinged on a single catalyst, this year’s advance rests on several overlapping forces that reinforced each other. Persistent geopolitical friction and elevated trade uncertainty pushed investors into defensive positions, boosting demand for assets perceived as resilient in crises.

Forecasts for 2026 are now split into two broad camps: those who see more room to run, and those who warn that such strong gains set up a more fragile starting point.

2. Cloud and Data Failures Disrupt Global Trading Platforms

Internet and infrastructure outages remained a key operational risk for financial markets and online trading platforms, reflecting the industry’s dependence on a small group of cloud providers. Early disruptions at Amazon Web Services affected Binance and KuCoin, temporarily halting withdrawals, while Rabby and DeBank also reported brief outages.

Following the recent AWS disruption, our services have been fully restored.

— BC Wong (@BC_KuCoin) April 15, 2025

All user funds remain 100% safe, and platform data is fully intact. Deposits, withdrawals, and trading are now operating smoothly.

We’re taking steps to further strengthen system resilience and minimize… https://t.co/dwV4UzbSC8

A later AWS incident impacted Robinhood and Coinbase, along with platforms such as Venmo, Amazon, Prime Video, Snapchat, Canva, and Roblox.

Brokerage platforms also faced internal failures. European broker XTB suffered a multi-hour outage that restricted client trading and briefly suspended CFDs. Cloudflare outages affected brokers including Monaxa, Skilling, Xtrade, and FXPro.

We're aware many users are currently unable to access Coinbase due to an AWS outage.

— Coinbase Support (@CoinbaseSupport) October 20, 2025

Our team is working on the issue and we'll provide updates here. All funds are safe.

Finance Magnates Intelligence estimated that such disruptions may have cost an average CFD broker about $1.58 billion in lost trading volume, or roughly 1% of monthly revenue. Within three weeks, scheduled Cloudflare maintenance in Chicago and Detroit caused brief interruptions for firms including The5ers and Topstep.

The most market-wide disruption occurred when CME Group halted trading after a cooling-system failure at a CyrusOne data center, freezing prices across several futures markets. Overall, the incidents highlighted continued exposure to concentrated technology risks affecting access, pricing, and execution.

Due to a cooling issue at CyrusOne data centers, our markets are currently halted. Support is working to resolve the issue in the near term and will advise clients of Pre-Open details as soon as they are available.

— CME Group (@CMEGroup) November 28, 2025

3. Trump’s Inauguration and Market Volatility

Donald Trump was sworn in as US president, coinciding with notable market movements in digital assets. On the day of the inauguration, Bitcoin reached a new all-time high near $110,000, with a market capitalization above $2.1 trillion. The surge was linked to expectations regarding Trump’s support for digital assets and regulatory reconsideration.

Speculative tokens associated with Trump and the first lady also moved sharply. The TRUMP token climbed to $74 before falling to $38, later recovering toward $63. The MELANIA token debuted near $12.

Heavy speculative trading triggered more than $1.2 billion in liquidations affecting over 400,000 traders. Major altcoins, including SOL, DOGE, and ADA, fell between 6% and 8%. Bitcoin remained relatively stable.

Does the US impact Europe's policy making? “I wouldn’t say so," said CySEC Chair.

4. Investors Watch Closely as US Stocks Adjust to New Tariff Measures

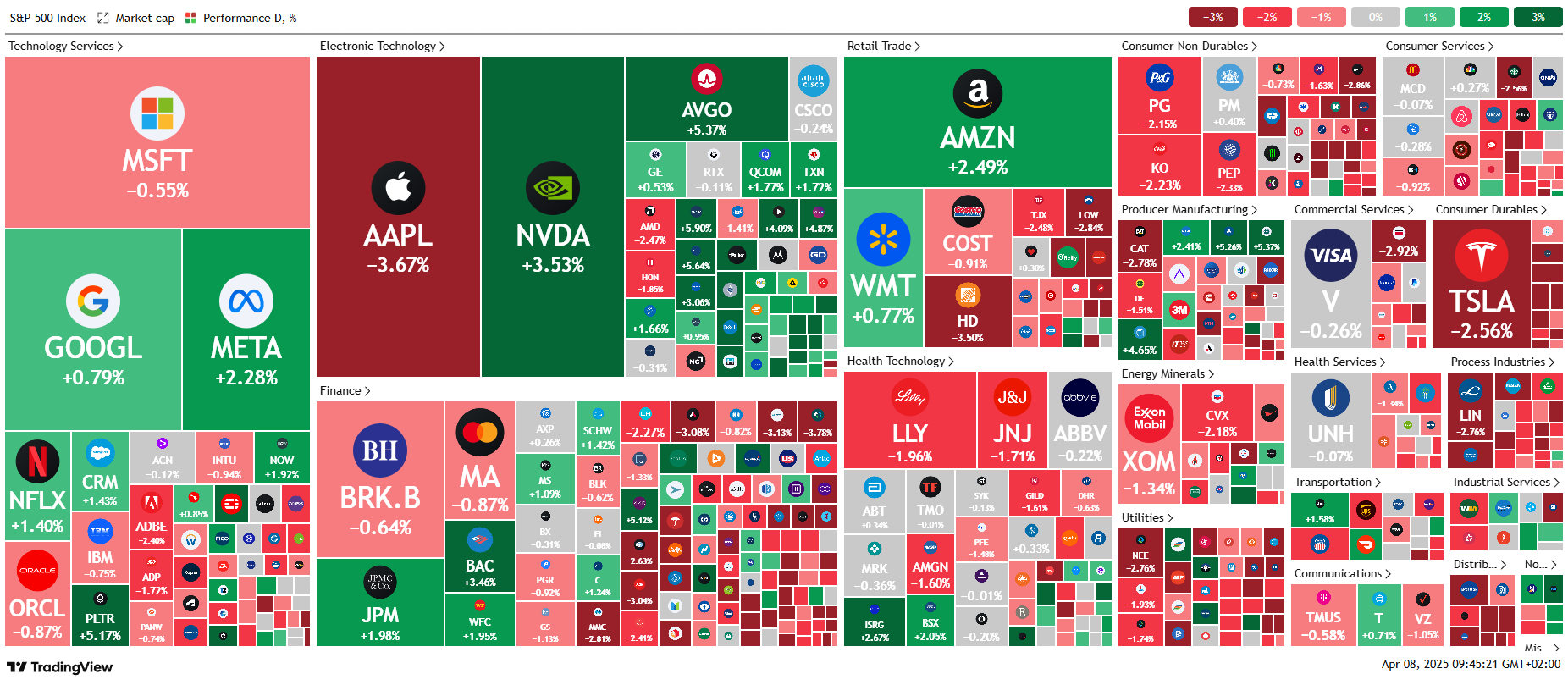

US equities showed tentative stabilization after a period of volatility tied to new tariff measures. The administration introduced steep duties on several trading partners, including China, India, and Vietnam.

The tariffs targeted technology and automotive sectors, raising concerns over higher production costs and supply chain pressure. Potential retaliation from China, the EU, and Canada added to market uncertainty.

Major indices closed mostly lower. The Dow Jones Industrial Average and S&P 500 fell, while the Nasdaq was largely unchanged, supported by select technology shares. Apple extended losses, Microsoft declined slightly, and Tesla fell amid concerns over tariffs and demand.

5. The Year Nvidia Ruled Wall Street

Also, this year, Nvidia dominated equity markets, transforming from an AI beneficiary into the world’s most valuable listed company for much of the year.

At various points, Nvidia leapfrogged Microsoft and Apple to sit alone at the top of the global league table, helped by a market cap that climbed into the 4 trillion to 5 trillion-dollar range by late 2025. Real-time data on Google Finance showed Nvidia valued at about 4.5 trillion dollars, cementing its status as the benchmark AI stock.

Additionally, Nvidia’s third quarter of fiscal 2026 saw a record $57 billion in revenue, up 22% from the previous quarter and 62% from the year-ago quarter, Finance Magnates reported. This came amid intense demand for AI accelerators from hyperscalers such as Microsoft, Amazon, Google, and xAI.

WATCH: Nvidia, the world's first $5 trillion semiconductor company, will report earnings results next week, with investors watching for AI forecasts that could sway global tech markets and ease bubble concerns. Here is the top business news for next week https://t.co/RGzin6AMK9 pic.twitter.com/YidJoitx53

— Reuters Business (@ReutersBiz) November 15, 2025

By late October, it went further, becoming the first firm in history to reach around a 5 trillion-dollar market value. Next year’s outlook shows that the debate around Nvidia will shift from whether AI demand is real to how long it can stay ahead of rivals amid supply constraints.

What Could Shape Markets in the Coming Months: Trade to Technology

Looking ahead to 2026, markets are expected to remain influenced by a mix of policy, technology, and asset-specific dynamics. Gold enters the year with a divided outlook following its strong 2025 performance. Nvidia’s trajectory will increasingly be judged on its ability to sustain growth amid intensifying competition and supply constraints.

Trade policy may also remain a source of volatility, with new tariff measures and potential retaliation adding pressure to supply chains and equity valuations. At the same time, persistent infrastructure vulnerabilities across cloud and data providers suggest that operational resilience will remain a continuing area of risk for trading platforms and exchanges.