Institutional CFD offerings continue to expand as portfolio managers recognise their hedging capabilities, and retail brokers look to use existing infrastructure to broaden their client base.

CFDs Are a Hedging Tool

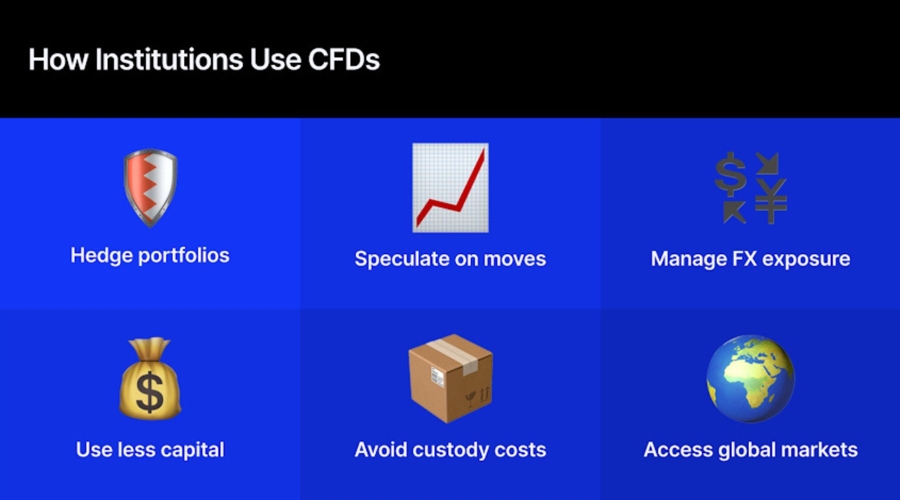

There are two main benefits to using CFDs for institutional investors, the first of which is to hedge existing positions. If a portfolio manager is concerned that stock market volatility could be about to rise, they can protect themselves by selling CFDs in individual equities or a stock index, such as the S&P 500. In this way, they can keep their portfolio intact and avoid the cost of closing out and then reopening positions – along with any capital gains tax that may arise – while the CFD offsets any losses from a falling market.

“CFDs can also be used as a leveraged speculation on price movements,” explains David Morrison, senior market analyst at Trade Nation. “They are traded on margin, so can be an efficient use of investment capital. A wide range of CFDs can usually be accessed from a single account, and there can be tax advantages depending on the jurisdiction.”

Read more: Why Are CFD Brokers Going “Insti”?

The appeal lies in their ability to provide fast, efficient exposure across asset classes with minimal operational overhead, adds Kourosh Khanloo, director of corporate strategy at Tradu.com.

“In addition to hedging specific positions and exploiting short-term opportunities, you will often see them used for managing currency exposure in global portfolios,” he says. “CFDs offer low capital requirements, easy leverage and no custody headaches. For institutions, the flexibility to take long or short positions with minimal friction is invaluable. CFDs also remove the need to move assets between custodians, making them operationally cleaner than physical holdings.”

For hedge funds, there is value in single stock CFDs, either as a geared instrument or in the form of synthetic cash where it is still a CFD but has no gearing and behaves as though it were a cash instrument. This is likely to appeal mainly to smaller and early-stage hedge funds that are more likely to permit the use of CFDs, although there is arguably a comparable use case for index or commodity CFDs in place of futures.

For large clients, the key considerations are balance sheet strength, product range, competitive pricing and quality of service, suggests Dan Benton, head of sales and client services at London Capital Group.

“From our conversations with funds and family offices, the main attractions of CFDs are the flexibility of product, enhanced liquidity and broader market access under one account/umbrella,” he says. “Larger CFD providers are fast becoming fierce competitors to the traditional prime brokers, who often set high minimum deposit or volume requirements before they will open an account or allocate resources.”

For many funds, CFDs can serve as an efficient tactical tool for short-term positioning, hedging or market access when physical settlement is not required, without the capital intensity of physical products or exchange-traded futures. “Over time, some clients may outgrow a CFD provider and move towards a full prime brokerage relationship, which is a natural part of the client lifecycle,” adds Benton.

An Alternative to Stocks and ETFs

An Interactive Brokers spokesperson notes that EU-regulated funds (AIFs and UCITSs) trade CFDs as an alternative to stocks and ETFs because equities typically need to be held at a depositary bank unless there are delegation arrangements in place, which can bring additional costs.

Gold has been particularly popular over the past 18 months, and demand continues to grow, suggests Nicholas Serff, executive VP trading at Alpari. “A key benefit from an institutional perspective is the broad range of markets that CFD providers make available, often on more competitive terms than those offered by banks or traditional funds,” he adds.

Adoption ultimately comes down to product understanding and flexibility. Some institutional mandates restrict activity to cash equities, fixed income or dealings with Tier 1 banks – but where permitted, CFDs do appear to offer genuine advantages.

For example, trading UK equities via CFDs saves the client 0.5% stamp duty since they do not have beneficial ownership of the underlying share, which can be meaningful for active strategies. Index and FX CFDs are also popular for tactical exposure, portfolio hedging and taking advantage of short-term dislocations at more competitive margins than exchanges.

“Most buy-side institutional clients would trade single name stocks where they perceive themselves to have an informational advantage,” says Benton. “Some sell-side institutional clients would simply be hedging their flow, which tends to reflect more of an aggregated retail flow in indices and FX.”

Retail Brokers Are Becoming 'Insti'

One of the most notable recent developments in the CFD space has been the entry of retail brokers such as Axi, CFI and Taurex. According to Benton, the main driver for retail brokers moving into institutional business is diversification. “The technology is there to make it straightforward,” he says. “Off-the-shelf LP hubs and bridges like Your Bourse and PrimeXM mean a retail broker can offer prime-of-prime liquidity, FIX/API access and low-latency execution to funds, prop desks and other brokers without having to build it.”

Damian Bunce, CEO of GTN Middle East, agrees that retail firms entering institutional markets are extending their reach and client growth through new revenue streams, while Serff observes that they may also benefit from natural offsetting flows on the retail side, which can be used to service institutional client flow.

As reported earlier this year, ESMA has proposed a new field in regulatory reporting that would require CFD brokers to tag retail and professional clients. “I imagine ESMA is concerned that retail clients may be at risk if bundled together with institutional investors,” says Morrison. “If so, tagging should be positive for both retail and institutional clients, as there are stricter compliance requirements for retail.”

Serff is more cautious, noting that the potential operational burden it would place on retail brokers remains unclear. “Transparency is good but it has to be practical,” agrees Khanloo. “The challenge will be creating a system that genuinely safeguards less experienced participants while allowing seasoned traders and institutions to operate without unnecessary red tape. If done right, it could help build trust without sacrificing efficiency.”