A key gateway to Asia, the Singapore Exchange (SGX), has today announced that its derivatives trading reached new highs in 2013, while certain reported metrics in the same segments declined during the same period, across its product lines and in other asset classes such as securities and bonds.

According to its December totals which summed last years trading results for Singapore's largest bourse, the final month of the year saw drops of as much as 56% year-on-year (YoY) for exchange traded funds (ETF) turnover, whereas FX Futures along with other futures and options business grew by 20% YoY.

However, on a yearly basis (for the 12 months ending December 31,2013), SGX's ETF turnover tripled to $3.2 billion, when compared to the previous full-year total, using this product segment as a contrasting example. The volume of Nikkei 225 futures trading also hit a record year high of 39 million contracts, on the SGX, as the underlying index had its largest annual gain since 1972.

In addition to the mixed results on both a month-over-month (MoM) basis, and YoY, growth was noted in its clearing business as the SGX wrapped up the year squeezing in an approval by the CFTC for its cross-border activities into the US, announced at the end of December when it became the first Asian Derivatives Clearing Organization (DCO) approved in the US.

SGX Stock Trading Volumes Down in December

- Securities daily average value (SDAV) declined 20% YoY to S$951 million in December, and securities turnover was down 16% to $20 billion also compared to December 2012.

- ETF turnover in December 2013 of $199 million was down 56% YoY, as mentioned above.

- There was only one IPO that raised $62 million, noted as 9 times higher than funds raised from initial public offerings in 2012.

- There were 39 new bond listings, raising S$6.1 billion, an increase of 9% YoY.

Derivatives trading in December at SGX Higher

- Derivatives daily average volume (DDAV) increased 6% YoY to 426,582 contracts respectively, and derivatives total volume grew 12% to 8.9 million contracts in December 2013.

- China A50 futures trading increased 23% to 2.1 million contracts YoY, and Nikkei 225 futures volume was up 9% YoY at 2.9 million contracts, as the Nikkei Index closed at a six-year high. MSCI Taiwan futures activity increased 39% to 1.4 million contracts from a year earlier.

- Nifty futures trading increased 12% to 1.3 million contracts year-on-year. MSCI Indonesia Index futures more than doubled to 21,210 contracts.

- Total open interest for all equity index, Forex and interest-rate futures, and equity index options grew 20% to 3 million contracts at the end of December from a year earlier.

OTC Clearing in December

- Volume of new OTC financial derivatives transactions cleared was S$3.7 billion, up 61% YoY.

- Volume of OTC commodities cleared grew 77% YoY to 39,112 contracts.

- Volume of iron ore swaps cleared almost doubled to 36,130 contracts from a year earlier.

SGX had several key months, with exceptional growth, as previously covered by Forex Magnates, such as in July. Shares of Singapore Exchange Ltd, traded on the SGX, under the symbol SP, closed up 1.11% on Monday in Asia.

An excerpt of items summarized highlights in the official press release can be seen below.

SGX Full-Year 2013 Highlights:

- Stock market capitalisation declined 0.6% to S$940 billion. On a total return basis, including dividends, the Straits Times Index was up 3.26%.

- Total equity fund-raising grew 40% to S$6.3 billion. There were 27 and 26 IPOs in 2013 and 2012 respectively.

- Total bond fund-raising decreased 4% to S$176 billion. There were 465 and 390 new bonds listed in 2013 and 2012 respectively.

- Securities daily average value (SDAV) increased 10% to S$1.4 billion.

- ETF turnover tripled to S$3.2 billion.

- Derivatives total volume and daily average volume (DDAV) increased 40% to 112 million and 459,362 contracts respectively.

- Volume of SGX AsiaClear commodities almost doubled to 660,372 contracts and volume of iron ore swaps, futures and options cleared more than doubled to 590,648 contracts.

- Trading in China A50 and India Nifty futures reached a record year volume of 21 million and 16 million contracts respectively. Volume of Nikkei 225 futures trading also hit a record year high of 39 million contracts.

Mixed Across Derivatives, Securities, and Clearing

The exchange reported mixed results for the prior month which despite tapering off from November's figures - reached record levels for some of its product lines, including FX futures - among other asset classes offered via SGX, as it had recently launched several new offerings in Foreign Exchange related products.

Its FX business, still in its infancy, has room for development if can be justified by volumes , and client demand, and for now remains entirely Asian-FX futures for deliverable and non-deliverable Asian currencies in the following six currency pairs including the AUD/USD, AUD/JPY, USD/SGD, INR/USD, KRW/USD and KRW/JPY, as per the latest SGX product fact-sheet.

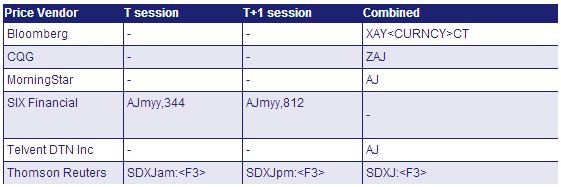

The following price vendors are listed as contributing to SGX's FX Futures products:

Source: SGX FX Futures specifications regarding Price vendors

The modernized infrastructure in Singapore supports the Monetary Authority of Singapore (MAS), and provides the framework for cross-border cooperation between businesses as evidenced by the SGX's many collaborations with international providers, including strong-ties with regional countries such as Malaysia, where nearly 1 in 5 company's listed on SGX are Malaysian based, as per a recent SGX announcement that noted IMF research.

For example, in the lastest post about SGX by Forex Magnates, it was noted that SGX mentioned how it's working with ESMA to have its clearing unit approved by European regulators to act as a “third country central counterparties" under the European Market Infrastructure Regulation (EMIR) in order to continue providing clearing services to European Union customers.

Globalization or Technologicalization? Or Both?

The SGX is well-poised to take advantage of its ability to regulate itself also as a result of the structure, similar to how a Self Designated Regulatory Organizations (SDROs) like the CME in the US, must oversee its members and under applicable NFA/CFTC rules, or any US exchange for that matter under applicable (such as NYSE with SEC).

Aspects of a harmonized and efficient international market-place (or market-places), whether venue specific, or decentralized like in OTC foreign exchange, shares parallels of globalization when governments agree on and take positions on major issues and rules -which provide certain benefits to participants.

This harmony can also occur due to ease of technology integration, or be a result of both. Meanwhile, when sovereign bodies take opposite stances, on something like Bitcoin, then regulatory arbitrage allows the market to evolve along with future rulings, and is often a needed step in its early development.

However, even for mature or modernizations countries or venue, such steps can be repeated during cycles of tightening rules - followed by a more freely operated market-place that would lead to differences based on technology and company's own-choices of how to operates and not necessarily based on external authority.

The graphic below, excerpted from the SGX website regarding its regulatory responsibilities - pinpoints the importance of synergies between Corporate Laws, Financial Regulations and Exchange Rules , in order to harmonize internal market efficiency within a country (domestically).

While no guarantee of success, this is something every country must strive for in order to easily engage in foreign trade cooperation, MOUs, and cross-border related collaborations, permissions, licensing, exemptions, etc..

Source: SGX