Poland’s main bourse, the Warsaw Stock Exchange (WSE) has today reported trading metrics for the month of March, completing its 1st Quarter (Q1) for 2014, and comparing the figures to its most recent periods which showed mixed results from a year-over-year (YoY) perspective when compared to last March, as well as for YoY for Q1 2014, across its products.

From a month-over-month (MoM) perspective, indicating the most recent trend, Currency Futures total trading volumes fell nearly 23% from 257,411 contracts in February 2014, to 198, 370 contracts in March 2014, according to the press release.

The reported trading volumes included totals across several main asset classes such as equities, derivatives, commodities and debt and energy markets, according to the release, with the largest percentage gain seen YoY for Q1 in the commodity Gas – Pol PX forward contract (measured in MegaWatts –MWh) which increased 608% from 132,289 MWh in Q1 2013, to 937,199 MWh in Q1 of this year.

The total volume of trading in gas was 426.2 GWh (GigaWatts) in March 2014, an increase of 79.8% YoY. The WSE acquired a majority stake in the Polish Power Exchange in 2012, as it continued on an expansion path, with the latest stakes described below.

Currency Volumes Fell in March Despite Extra Trading Days, YoY and MoM

The second largest gainer in terms of line-item reported figures was Currency Futures, in the category of the number of open interest (NOI) which increased 187.4% from 36,732 in Q1 2013, to 105,550 for Q1 2014, (from a YoY perspective) however, the total volume of trades during this period saw a decrease of 2.7% over Q1 2013 from 676,089 to 657, 755, despite the increase in open positions held (i.e. amount of open interest during that time).

As noted above, March was lower than February for the Currency Futures totals, whereas in February total volumes had grown 15.4% from a YoY perspective at that time, accompanied with a high percentage increase in the amount of open interest YoY (for February).

The exchange offers currency futures on the USD/PLN, EUR/PLN and CHF/PLN, and despite the extra trading day this March when compared to March of last year, as well as the greater number of trading days over the prior month, trading volumes managed to dip for the WSE's currency futures in March.

Advisor to CEO for Public Affairs and International Communication Opines

Forex Magnates' reporters inquired as for a possible reason for the decline in the exchange's Currency Futures segment for March and obtained a quote around time of publication from Maciej Wewior, Advisor to the CEO for Public Affairs and International Communication at WSE, he said, “Warsaw Stock Exchange is not an active participant but a platform for trading in currency futures on USD/PLN, EUR/PLN, and CHF/PLN, therefore we cannot answer your question definitively. But given that there were no policy changes on the market and on our side concerning currency trading we can assume that the main reason for a decrease in currency futures volumes in March 2014 YoY and in Q1 2014 to Q1 2013 was low Volatility of USD/PLN since the beginning of 2014. The USD/PLN future is the most traded currency future on WSE.”

The following chart was also provided as part of the comments we received from WSE:

![Chart that show the USD/PLN volatility since Feb 2013 to April 2014 [Source WSE]](https://www.financemagnates.com/wp-content/uploads/fxmag/2014/04/PLN.png)

Chart that shows the USD/PLN volatility since Feb 2013 to April 2014 [Source WSE]

50% of Futures Trading Volumes in 2013 Were from Individual Clients

The volume of trading in index futures increased by 14.7% year-on-year to 1.0 million in March 2014. The total value of trading in structured products on WSE was PLN 75.9 million in March 2014, an increase of 323.7% year-on-year. The total volume of transactions on the electricity market stood at 17.7 TWh (TeraWatts) in March 2014, an increase of 41.5% year-on-year.

In the groups' 2013 performance results, 50% of the share of futures trading on WSE came from individual clients, with 33% from institutional and the remaining 17% from foreign clients.

The monthly volume of trading in derivative contracts was 1.3 million in March 2014, an increase of 6.5% year-on-year. The volume of trading in index futures was 1.0 million in March 2014, an increase of 14.7% year-on-year compared to 900 thousand in March 2013. The number of open interest in derivatives increased by 25.7% year-on-year to 266 thousand at the end March 2014, according to the update.

Increases in the Exchanges Market Share

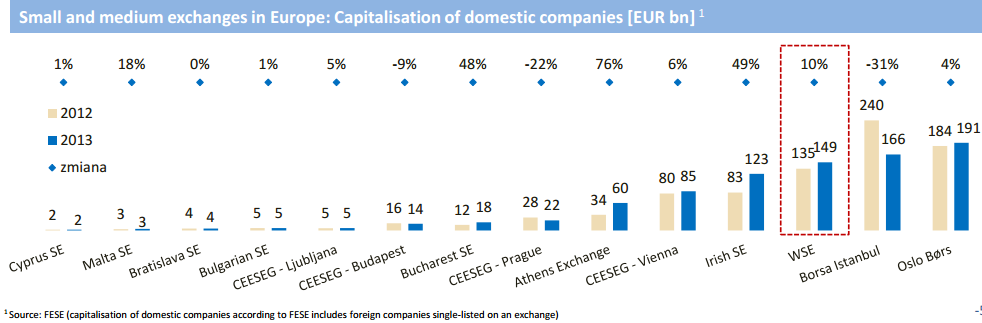

As described further below, WSE has been on the rise in terms of its acquisition of market share and in comparison to other exchanges around the world, especially in the category of new IPOs launching.

Two companies were newly listed on the WSE Main Market in March 2014: Comperia.pl and DTP. They were, respectively, the 27th and the 28th company in the history of WSE to transfer from NewConnect to the WSE Main Market.

![Highlights from the WSE Group 2013 Results [Source WSE]](https://www.financemagnates.com/wp-content/uploads/fxmag/2014/04/share-of-exchanges-CCE.png)

Highlights from the WSE Group 2013 Results [Source WSE]

Three companies were newly listed on NewConnect in March 2014: Mega Sonic, 2Intellect.com and Hollywood. The value of session trading on NewConnect was PLN 91.1 million in March 2014, an increase of 11.2% year-on- year (PLN 81.9 million in March 2013).

Five new issuers were newly listed on Catalyst in March 2014: Giełda Praw Majątkowych Vindexus, Skoczowska Fabryka Kapeluszy Polkap, the Municipality of Barcin, Polski Gaz and Europejski Fundusz Medyczny. The total value of issues of these issuers was PLN 42.4 million.

Public Company Listings and Capitalisation

The capitalisation of 404 domestic companies listed on the Main Market was PLN 613.4 billion (EUR 147.0 billion) at the end of March 2014. The value of session trading in equities on the Main Market was PLN 22.6 billion (EUR 5.4 billion) in March 2014, an increase of 20.6% year-on-year and the highest value since August 2011 when session trading stood at PLN 26.8 billion.

In its 2013 performance report, the WSE Group listed how it considered its WSE business ranked as follows:

- # 7 world exchange by the growth rate of the number of companies in 2013

- # 2 by the number and #5 by the value of IPOs in Europe in 2013

- # 15 world exchange by the number of listed companies

Compared to March 2013, session trading on the WSE increased by 20.6% YoY in March 2014. This stronger activity of investors over the same period last year is also reflected in a high increase in the number of transactions per session (by 43.7% YoY) to 1.5 million, according to the press release.

The total capitalisation of 450 domestic and foreign companies listed on the WSE Main Market was PLN 892.0 billion (EUR 213.8 billion) at the end of March 2014, as per the released figures today for March.

Poland has been an attractive destination for companies seeking to go public, indicated by the number of IPOs launched, in comparison to other global exchanges in 2013. In its report for 2013, WSE Group said that its 2014 targets included, among other goals, the launching of new products including stock options, binary and monthly options and power futures settled in cash.

Poland's Economy Supported by Strong Banking Sector

Forex Magnates' reporters spoke to a senior government official in Poland at the end of 2013, who attributed efficient financial market regulations in Poland as a reason for the strong banking sector, and said how vital this was as part of Poland's economy and financial services industry.

An article run by the International New York Times edition on March 20th, written by Ginanne Brownell, said Poland currently has one of the lowest crime rates in the EU, which Forex Magnates opines could be reflective of its positive economic conditions as high crime rates can be linked to poverty in certain instances.

![Highlights from the WSE Group 2013 Results [Source WSE]](https://www.financemagnates.com/wp-content/uploads/fxmag/2014/04/WSE2013.png)

Highlights from the WSE Group 2013 Results [Source WSE]

In mid-February the WSE acquired more shares in Aquis Exchange Limited - based out of London, in a deal worth 3 Million GBP, and as of February 18th, 2014 WSE reported it held 384,025 shares of Aquis, representing just over 32% of voting rights, or nearly a third of the company. After this process WSE will own 36.23% shares of Aquis with entitlment to 30% voting rights, described in its previous press release regarding the deal. This will allow the WSE to appoint directors to Aquis, as well as leverage its FCA-regulated MTF, among other perks from the synergy.

WSE reported a historically high volume of trading in structured certificates at 1,843,730 instruments on the 28th of March, 2014. The previous record of 1,116,339 certificates was reported on the 14th of March, 2014. The volume of trading in structured products was also a record high on that day at 1,843,900 instruments. The previous record of 1,116,339 products was also reported on the 14th of March, 2014. A full copy of the press release can be found on the exchange's website along with the reported volume totals.