Source: White House

During a press conference in the State Dining Room at the White House yesterday, U.S. President Barack Obama, announced that he has chosen senior treasury department official Timothy Massad to take the helm of the Commodity Futures Trading Commission (CFTC) and succeed current Chairman Gary Gensler who is set to step down January 3rd, 2014, following a wave of recent senior departures from the agency.

While the appointment will still require senate approval, the President in his speech urged the senate to confirm Mr. Massad as soon as possible, as he praised the CFTC for its successful combating of fraud and policing the commodity futures and derivatives markets following the recent economic crisis in the U.S.

He attributed the recent markets' record highs as a result of a more stable financial system and how a big reason for that stability is the work of what he called, "a small but mighty independent agency: the Commodity Futures Trading Commission."

Chairman Gensler was seen giving a subtle 'first-pump' (which elicited laughter from the audience- according to both the transcript and as can be heard on the White House video broadcast), in response to this praise from President Obama, of the effectiveness of the CFTC in recent years under Mr. Gensler's watch.

After having originally appointed Mr. Gensler to the role of Chairman, before taking office as President, Obama can be seen thanking Mr. Gensler on his way out during yesterday's speech, in preparation of the new appointment of his replacement.

Thank you Gary Gensler, Hello Timothy Massad

As a Senior Treasury Department official, Mr. Massad was in charge of the Troubled Asset Relief Program (TARP) after succeeding the late Herb Allison who passed away in early 2013. TARP was started by former President George W. Bush in 2008 to stop the downward spiral of the sub-prime crisis, and its success was also attributed to the key role that Mr. Massad played in the carrying out of that program.

During his remarks at the state dining room yesterday, regarding the new appointment, President Obama said,"Tim is a guy who doesn’t seek the spotlight, but he consistently delivers. He gets a high return for American taxpayers without a lot of fanfare. I have every confidence that he is the right man to lead an agency designed to prevent future crises - because I think it’s safe to say that he never wants to have to manage something like TARP again."

If Mr. Massad is approved by the senate and confirmed by congress, then he will commence his new role as Chairman of the CFTC in early 2014.

Source: CFTC

President Obama, during his speech yesterday at the state dining room also urged Congress regarding the bolstering of funding for the CFTC, and said, "I would urge Congress to give Tim and the CFTC the resources it needs to do the job. Ever since we passed Wall Street reform, its opponents have tried to starve funding for the agencies responsible for carrying it out."

The men and women of the CFTC are charged with protecting us from financial harm, but they are undermanned. They are outgunned. They are working overtime. The sequester cuts have made it even harder for them to do their job. They’ve lost 5 percent of their team this year," concluded the President, in some of his comments yesterday. The President had asked for $315 million for the CFTC, while in 2013 the CFTC was operating with only $195 million. A full copy of yesterday's transcript, regarding the new appointment, can be found on the press room section of the White House website.

CFTC Efficiency on Current Budget Reaching its Limits

President Obama further added regarding the effects of sequester cuts on the CFTC's operation, "Recently, Gary announced that some have to drop -- that they have to drop some open enforcement cases because Congress won’t allow them the resources required to do their jobs and complete these cases. This is like not having enough cops on the beat, not having enough prosecutors to prosecute crimes. This makes us safer. It makes our financial system work better, and it’s foolish for us not to adequately resource it."

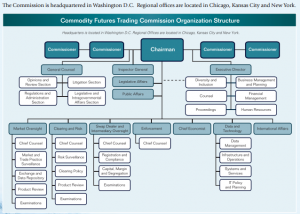

CFTC Organizational Structure [Source: CFTC]

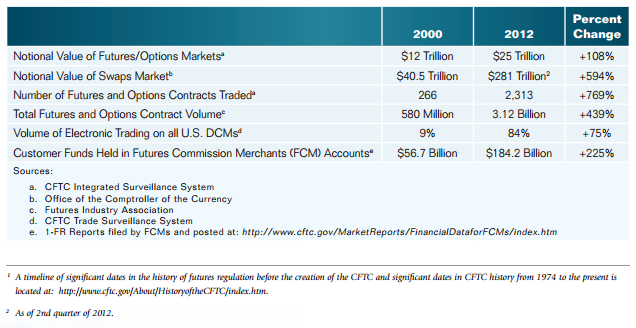

According to a transcript of Chairman Gensler's speech in late October during a lecture at the 2013 Annual Glauber Lecture at Harvard University, he emphasized the strains the agency is facing as market volumes have grown disproportionately to the agency's relative capacities, and he said, "At 675 people, we are only slightly larger than we were 20 years ago. Since then though, Congress gave us the job of overseeing the $400 trillion Swaps market, which is more than 10 times the market we oversaw just four years ago. Further, the futures market itself has grown fivefold since the 1990s."

As per the above mentioned transcript regarding the lecture at Harvard, Mr. Gensler used an analogy of a recent baseball game to compare the dilemma, "You might not have liked the umpire’s call in the game this week on obstruction, but would you want Major League Baseball to expand tenfold and not add to its corps of umpires?"

The Chairman added during the lecture regarding the need for more resources, "We’ve basically completed the task of writing all the reforms and are past the initial market implementation dates. We’ve brought the largest and most significant enforcement cases in the Commission’s history. These successes, however, should not be confused with the agency having sufficient people and technology to oversee these markets."

Source CFTC

Regulatory Tightening or Loosening, What's next?

Mr. Gensler further emphasized his belief in the need for more staff in order to maintain stringent oversight by the CFTC, during the Harvard hosted lecture, "We need people to examine the clearinghouses, trading platforms and dealers. We need surveillance staff to actually swim in the new data pouring into the data repositories. We need lawyers and analysts to answer the many hundreds of questions that are coming in from market participants about implementation. We need sufficient funding to ensure this agency can closely monitor for the protection of customer funds. And we need more enforcement staff to ensure this vast market actually comes into compliance and goes after bad actors in the futures and swaps markets."

Gary Gensler, Chairman, CFTC.

In closing, Chairman Gensler acknowledged the challenges with regard to the U.S. federal budget, and reiterated his belief that CFTC is a good investment for the American public to ensure the country has transparent and well-functioning markets.

Clearly, there have been many benefits to the regulatory tightening that enabled the CFTC to combat fraud, and provide greater regulatory framework protection to the OTC derivative and exchange traded commodities markets, in recent years. However, there have been negative side effects as well - in particular for brokerages striving to maintain increasingly higher regulatory capital ratios, as well as placing strain and limitations on permissible behaviors by traders and investors, in markets such as OTC Foreign Exchange.

Regulatory Efficiencies Preclude Loosening

In Forex Magnates' opinion, such cycles of regulatory tightening may be followed by periods of more loose and flexible rules - that could be more conducive to new market entrants and growth by both local and international investment.

Source: CFTC

This appears to be the goal of many Republicans who have opposed the tsunami of regulations that have blanketed the US financial markets following the Dodd-Frank Act, which has resulted in a collective regulatory squeeze across various U.S. financial services industries, despite the positive aspects of enhancing respective market framework - affected by these changes.

Accordingly, the time may be approaching when as the U.S. regulators become more efficient, the needs of brokerages and customers may be better accommodated through ease of compliance implementation. The key question is - if and when - such changes occur. The coordination between the CFTC and self-designated regulatory organizations (SDRO) such as exchanges and the National Futures Association (NFA) will also be of paramount importance - so that members can efficiently adapt to change without any added inconvenience.

A full copy of CFTC Chairman Gensler's speech during the 2013 Annual Glauber Lecture can be found on the Commission's website.