Britain’s Financial Conduct Authority (FCA), the recently instigated regulator which took over the oversight of financial markets from the outgoing FSA, has released a consultation paper with relation to client assets (CASS) and how they should be dealt with by firms under the regulator’s auspices.

The FCA’s client assets regime applies to around 1,500 regulated firms, included among that is Britain’s retail and institutional FX industry, that safeguard and administer assets and hold Client Money .

Financial services firms in Britain collectively hold more than £10 trillion of custody assets and more than £100 billion of client money.

Customer Protection Paramount

As far as the FCA is concerned, its viewpoint is aligned with many other regulators in that protecting client assets is fundamental to consumers’ rights and the trust they place with firms that are often acting as their agents, fiduciaries and/or counterparties.

FCA Headquarters,

25 North Collonade,

Canary Wharf,

London

For the market to function correctly, it must be robust and garner the trust of the investors.

On the other side of the Atlantic, the entire year has so far been peppered with government level meetings relating to the implementation of the Dodd-Frank Act, with senate panels convening to devise means of ensuring better consumer protection following the financial crisis of 2008, and firm failures such as in the cases of MF Global and PFG more recently.

Whilst Australia’s ASIC announced last year that it planned to increase the net capital adequacy significantly for all FX firms, thus helping to safeguard client assets in the event of the firm taking a downturn in income, as well as having taken action against firms for negligence relating to client funds, the State of Israel’s Committee is also now busily engaged in discussion with the Israel Securities Authority about putting in place a series of regulatory reforms, one of which is the increase of capital requirement for FX firms in order to achieve the same stability for customers.

Worldwide, this is a dynamic that is inevitable and currently the FCA, although one of the first regulators to impose CASS rulings, is ensuring that it doesn’t drop the baton and therefore participates in consulting on this matter on an ongoing basis.

All participants will likely be interested in observing the points brought to light in the consultation paper, including:

• Firms that carry out investment business that are subject to the client assets sourcebook (CASS)

• Auditors and compliance officers that provide client assets audit reports and reports on different or alternative approaches/methods permitted by CASS

• Third party providers who provide back office functions that firms use for their client assets operations.

• Market infrastructure firms, including Central Counterparties, exchanges and other intermediaries with whom firms may place client assets.

• FX firms with whom firms place client money for the purposes of funding their trading accounts.

OTC Firms Subject To Extension of CASS Rules

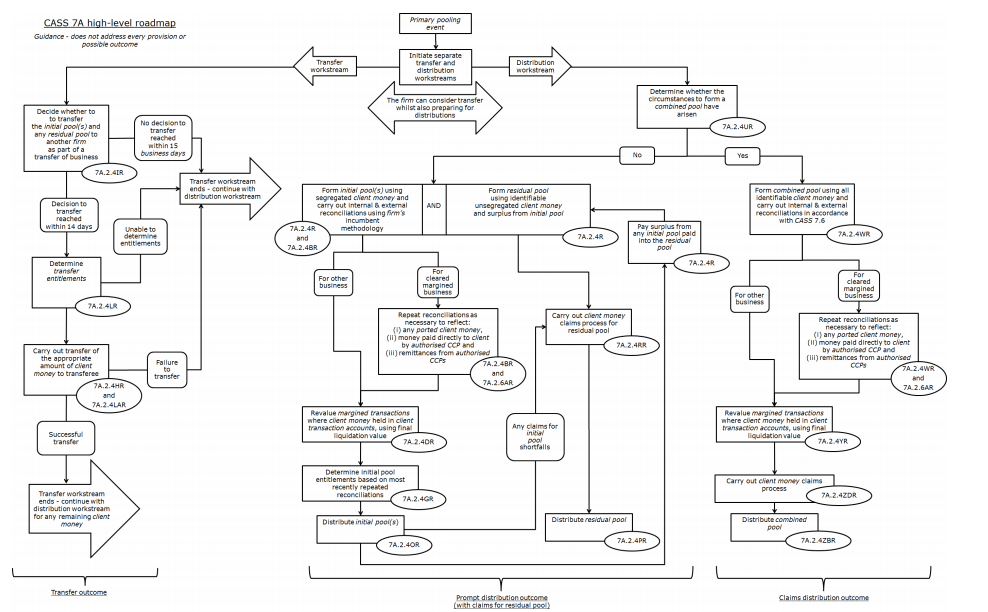

The consultation paper asserts that as far as extensions of CASS rulings to exchanges and clearing houses are concerned, the present situation is that the secondary pooling event rules only apply in the event of the failure of certain types of third parties: a bank, an intermediate broker, a settlement agent or OTC counterparty.

The FCA proposes to extend the rules to also apply if an exchange or central counterparty fails. Although the failure of a central counterparty in particular may not be considered likely, possibility and this proposal means that the CASS rulings should contemplate this eventuality.

Furthermore, the FCA has proposed that the client money in certain transaction accounts should not be pooled with other client money of the firm for a secondary pooling event.

What If A CCP Fails?

Also within this consultation, the FCA has put forward that if a CCP fails, any firms (usually clearing member firms) for which this constitutes a secondary pooling event will not be required to nationally pool money from individual client accounts (or omnibus client accounts that relate to a sub-pool that that firm operates) with other client money the firm holds.

If the firm were to pool monies in such accounts, all clients of the firm would share in any potential shortfalls that may result.

Given that in other circumstances, such as the failure of the firm itself, all other clients of the firm do not share in any benefits of these types of accounts such as porting or the direct return of client money to the client, as far as the FCA is concerned, only the clients these accounts relate to should share in these shortfalls.

Segregation of Client Funds – Rules Getting Tougher

As part of the constantly evolving rulings on segregation of client funds from the operating capital of firms, the FCA proposes to make amendments to its existing procedures.

Although very small changes, the amendments are intended to ensure no ambiguity is present in the rulings, and that the CASS handbook is thoroughly understood in order that transgressors cannot imply that they did not understand or that the laws referred to are obsolete.

The paper therefore recommends changes to be made to definitions and terminology relating to CASS, and what exactly constitutes ‘segregated funds’, ‘designated client bank account’, ‘designated client fund account’, ‘general client bank account’ and the appropriate action to be carried out according to each type.

Margined Transactions

A firm's equity balance, whether with an exchange, Clearing House , intermediate broker or OTC counterparty, is the amount which the firm would be liable to pay to the exchange, clearing house, intermediate broker or OTC counterparty (or vice-versa) for the firm's margined transactions if each of the open positions of the firm's clients were liquidated at the closing or settlement prices published by the relevant exchange or other appropriate pricing source and the firm's client transaction accounts with the exchange, clearing house, intermediate broker or OTC counterparty were closed.

In this consultation paper, the FCA reminds firms that the 'client’s equity balance' and 'firm's equity balance' refer to cash values and do not include non-cash collateral or other designated investments(including approved collateral) the firm holds for a margined transaction.

The margined transaction requirement should represent the total amount of client money a firm is required under the client money rules to segregate in client bank accounts for margined transactions.

On this basis, the calculation in CASS rule 7.6A.30R is designed to ensure that an amount of client money is held in client bank accounts which is equal to at least the difference between the equity held at exchanges, clearing houses, intermediate brokers and OTC counterparties for margined transactions and the amount due to clients for those same margined transactions.

With this calculation, a firm’s margined transaction requirement should be sufficient, if positions were unwound, to meet the firm’s gross liabilities to clients for margined transactions.

Previously, the CASS ruling set out a procedure relating to bank failures and the appropriate means of handling client money should a bank go out of business. The proposed changes to this are to make a complete removal of any reference to banks, instead widening the responsibility to ‘failed third parties’, thus ensuring that the procedure avoids cases such as MF Global and PFG’s ability to make off with client funds on their demise.

In recent times, attitudes to risk have become considerably more conservative among regulators and clients alike.

These proposals are intended to address the CASS reforms and assist in the EMIR and MiFID final rulings alongside the Dodd-Frank Act, as the working group in the US consults with European leaders to create a unified regulatory structure.