Over the years CRM (Customer Relationship Management) has evolved into one of the most valuable systems that a business can implement. It is now widely acknowledged that a carefully planned, effective CRM strategy can serve as the cornerstone of a company’s sales success.

Mike Muhney

CRM software hit the market in the late 1980s, keeping many interns busy for years inserting Leads from paper into the CRM systems that were created. This revolution of migrating leads and customer contacts from paper to PC was a natural progression which has now transcended from the PC to the Cloud . Traders and brokers everywhere now depend on meaningful engagements with their leads and effective CRM has become the key to their success.

In the first part of this article, we look back at the history of CRM and how it evolved into one of today’s must-have business tools. The discussion features an in-depth interview with Mike Muhney, co-founder and CEO of ACT!

The End Of The Road For The Rolodex

Back in the 1980s, when Apple was starting to make waves in the industry and RadioShack was selling computers instead of everything but computers, a new concept in software was about to hit the market – a concept that would revolutionize the way organizations, both large and small, would track sales, leads, and customer information.

The Rolodex

Until the early part of the 1980s, salespeople everywhere were still spinning through Rolodexes and making notes on pieces of paper to be stored in customer files and folders. The process was entirely disjointed and even the best sales people around would sometimes inadvertently let leads and opportunities slip through the net.

Around this time, two men from Dallas, Texas, spotted an opportunity. In 1986, Pat Sullivan and Mike Muhney founded Conductor Software and released a product that revolutionized the business as we know it today.

ACT!, originally meaning Activity Control Technology, which was later to become known as Automated Contact Tracking, was released in 1987 as the first piece of software designed to manage sales processes and customer engagements from a computer. This type of software would evolve into what we now know as CRM, or Customer Relationship Management.

In an interview conducted with Mike Muhney, co-founder and CEO of ACT!, Mike explained how the company started in 1986 and the events that led to what he referred to as his “napkin” moment:

The Beginnings Of CRM

“Back in the 1980s, there wasn’t a CRM market. When ACT! was conceived there were only three major software categories: spreadsheets (Lotus), word processing (Wordstar and WordPerfect) and general database products (Ashton-Tate’s dBase and Paradox). None of these provided a focus on relationships so with ACT! we not only created an entirely new product but a new category as well.

Pat Sullivan, my business partner, and I both came from sales backgrounds. We knew selling, and we knew it was about the quality of relationships that provided the edge. We had always wanted to work together and have our own company.

Our first venture which we started with $100,000 raised from an angel investor was originally known as QuotePro but later changed to MarginMaker. It was designed especially for computer store salespeople to configure a quote, provide the ability for a salesperson to back solve a margin and/or line-item a discount, and print it out to give to the prospect. We thought it would be a big winner but, to cut a long story short, it failed after spending $85,000 of the investor’s money to build the business.

So, we had some options. First, close down the business and return the $15,000 left to the investor, or second, come up with some other option. As it happened, I had been trying to sell MarginMaker to a computer chain called CompuShop. My IBM training had taught me to always sell at the top, to the CEO, and that’s what I had been trying to do with the CEO of CompuShop. Although he never bought MarginMaker for the chain, he took a liking to me. He had also just been identified as one of the twenty-five most influential people in the reseller industry by Computer Reseller News, and I knew the guy!

So, Pat and I went to see him to tell him that MarginMaker had failed, that we were almost out of money and with the investor coming down in 3 weeks, we didn’t know what to do. His advice was to go have a 4-hour breakfast and brainstorm. Needless to say we took his advice as we just didn’t want to give up."

A Napkin Moment

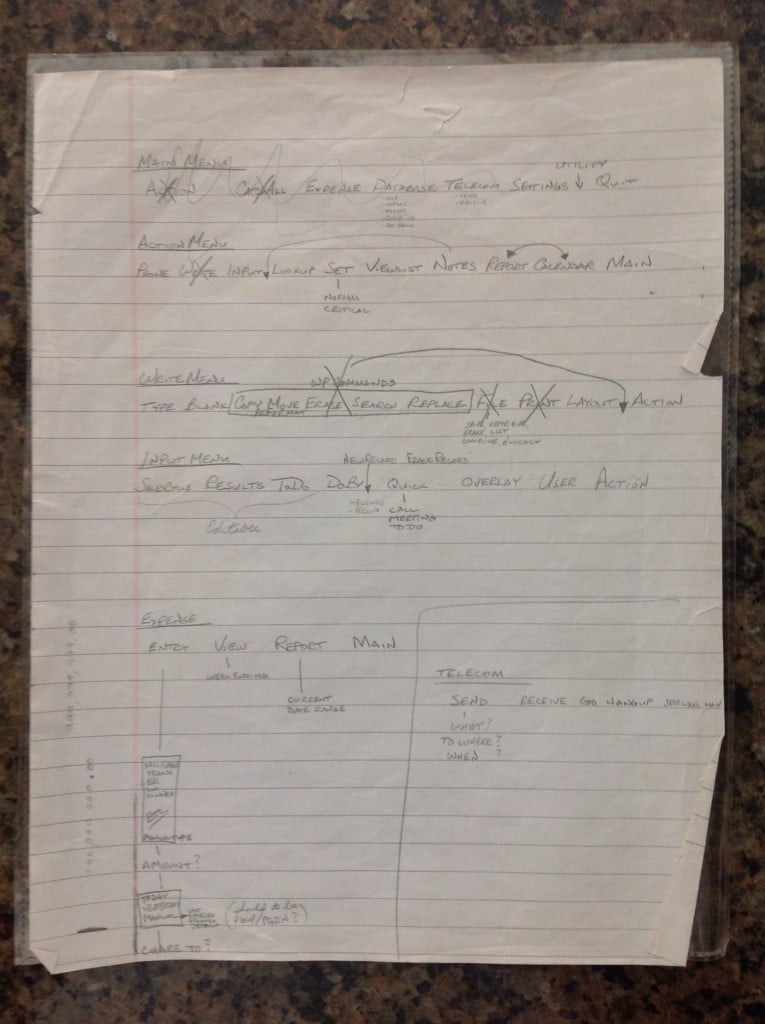

“On July 4th, 1986 with pencil and paper in hand we sat down at a nearby restaurant and asked each other “what do we personally need that would help us?” As was the case with virtually the whole world at that time, we all kept some kind of paper system to be organized with, calendars for activities and Rolodexes for contacts. The question was “if we could take what we use on paper in various formats and be able to do that on a computer what should it do and how?" I still have the proverbial napkin of our initial menu system that we wrote down at that breakfast identifying functional elements which was code-named YES, an acronym for Yes, Everybody Sells. That’s how ACT! was conceived that morning.

The investor arrived and we admitted that our original idea was a failure but that we had another idea that we had been working on and unfolded it all to him. His response, having shown him paper diagrams of the design and the purpose of YES was “I didn’t invest in MarginMaker, I invested in the two of you, and it’s obvious you feel you are really on to something better.” He then asked us if we needed any more money and how much? We asked for $50,000 and he pulled out his check book and wrote a check. I then went back to the CEO from CompuShop who was so impressed with everything that he said he too was interested in investing and that he had a couple of other friends who might also be interested. He set up a meeting and within weeks we had another $400,000 in the bank. We were on our way, and ACT! was released nearly nine months later to the day."

Mike also went on to recall his favourite technology from the 1980s and how it shaped his career path and led to his decision to get involved in CRM:

“What I fondly remember was the introduction of the laptop. After the establishment of the IBM PC and the Compaq luggables the laptop was really cool. They weren’t especially powerful at first with lousy screens and poor resolution, no hard drives, cheap plastic casings, and not much RAM, but what they had in mobility trumped them all. ACT! justified the reason to own a computer, especially a laptop. We also saw the power of mobility using technology before mobile was cool and that it was only going to keep imbedding itself more and more culturally. The evidence? What person doesn’t have a smartphone today?”

ACT! was released nine months later on April 1st, 1987 and, in the words of Mike Muhney, “the rest is history”.

The second part of this article will be published next week.