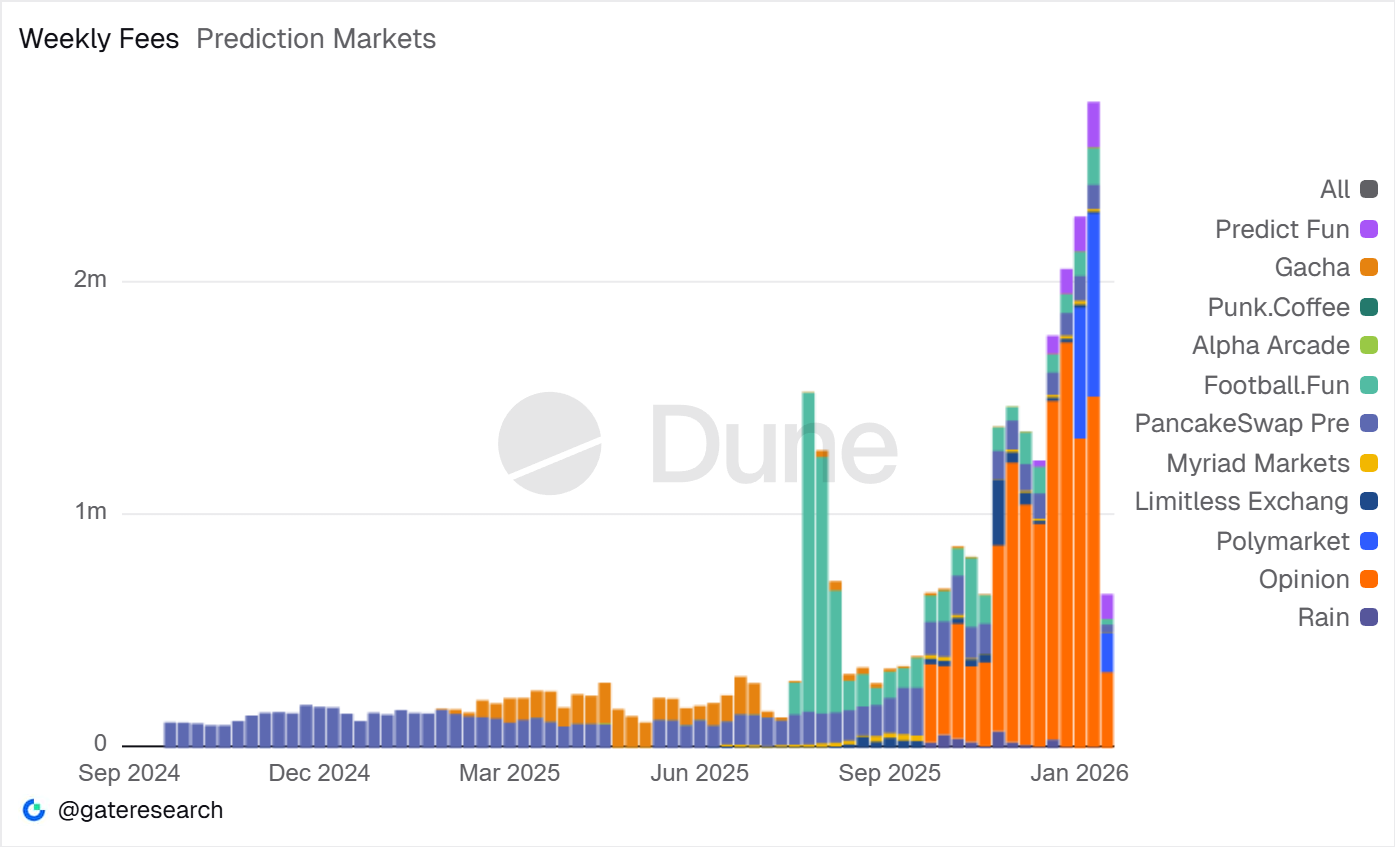

Prediction markets collected more than $2.7 million in fees last week, marking the highest weekly total the sector has recorded, even as the largest US-regulated platform faces a court-ordered shutdown in Massachusetts.

Prediction Markets Generate Record $2.7 Million in Weekly Fees as Kalshi Faces Massachusetts Ban

Suffolk County Superior Court Judge Christopher Barry-Smith ruled yesterday (Tuesday) that he will issue a preliminary injunction blocking Kalshi from accepting sports-related contracts from Massachusetts residents without a state gaming license.

The judge gave state Attorney General Andrea Joy Campbell's office until Wednesday to submit the proposed ban, with Kalshi having until Friday morning to respond before the order takes effect.

- Unusual Whales Extends Insider Radar to Prediction Markets With “Unusual Predictions”

- Wall Street Quants Move Into Prediction Markets to Hunt for Arbitrage, Not to Bet

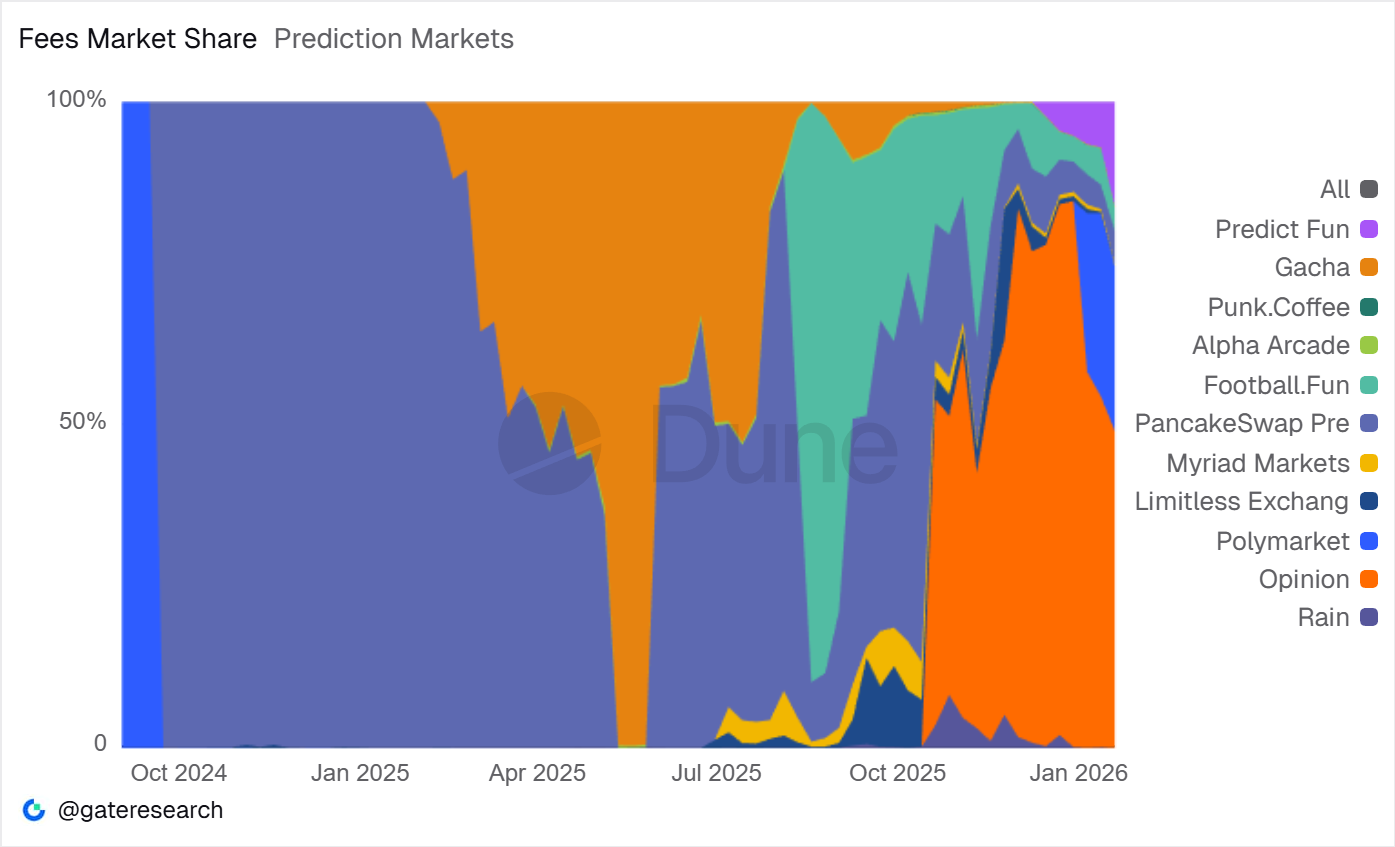

The timing creates an unusual backdrop for the sector's fee milestone. Opinion, a prediction platform operating on BNB Chain, generated over $1.5 million in fees during the record week, accounting for 54.3% of the total.

The platform averaged $115.6 million in seven-day trading volume, up 2.5% week-over-week and more than 33% compared to the previous month.

Volume Concentrates Among Three Platforms

Polymarket posted strong numbers through its 15-minute price direction contracts, which alone produced $787,000 in fees and represented 28.4% of total weekly fees across all platforms.

Seven-day trading volumes on Polymarket reached $112.4 million, climbing more than 15% from the prior week and nearly 200% quarter-over-quarter. Open interest on the platform hit $335.7 million, the highest among prediction protocols.

Kalshi maintained the largest overall market share at 52.6% of seven-day volume despite mounting regulatory challenges across multiple states. The New York-based company averaged $307.6 million in weekly volume, with growth of 7% week-over-week and nearly 177% quarter-over-quarter. Open interest reached $334.6 million, closely matching Polymarket.

The platform began offering sports event contracts nationally in January 2025, and they quickly became a majority of Kalshi's trading volume, according to Barry-Smith's ruling. The company warned in November that an injunction could force the halting or liquidation of $650 million in contracts.

Legal Pressure Builds in Multiple States

Barry-Smith's decision marks the strongest judicial rejection yet of Kalshi's claim that its federal registration with the Commodity Futures Trading Commission preempts state gambling laws. The judge wrote that the company “well understood that its business model, especially once it began offering bets on sporting events, came into direct conflict” with state enforcement bodies.

Campbell called the ruling “a major step toward fortifying Massachusetts' gambling laws and mitigating the significant public health consequences that come with unregulated gambling.” The injunction will apply on a forward-looking basis, requiring no unwinding of existing contracts in an effort to "minimize disruption,” Barry-Smith said.

Tennessee regulators issued cease-and-desist orders to Kalshi, Polymarket, and Crypto.com earlier this month over sports betting concerns. While Kalshi faces litigation with several other states, Massachusetts was the first to seek an injunction to halt operations.

Smaller Platforms Show Rapid Growth

Probable recorded the fastest expansion among tracked platforms, with weekly volume jumping more than 93% and quarter-over-quarter growth exceeding 2,300%, though from a smaller base. Predict Fun averaged $14.6 million in weekly volume, while Football.Fun held just over $5 million in open interest.

Opinion's open interest stood at $151.6 million, with a volume-to-open-interest ratio of 76%, pointing to active turnover rather than passive positioning. The platform has benefited from aggressive marketing efforts and integration within the Binance ecosystem, with weekly trading volumes reaching $1.6 billion at certain points in January.

Kalshi's lower volume-to-open-interest ratio suggests a greater share of longer-dated positions compared to competitors focused on short-term price direction bets. The data points to a sector where liquidity , fees, and open interest are rising together, with short-term trading formats and opinion-driven markets playing a larger role in driving engagement and revenue.

Analysis of Polymarket addresses showed that 70% of prediction market traders lose money, mirroring loss patterns seen in retail CFD trading. The regulatory pressure comes as platforms compete for market share in a space increasingly attracting Wall Street and Silicon Valley attention, with Kalshi reportedly raising $1 billion at an $11 billion valuation in November.